Author: Mark Lydon, Content Manager

Page updated on 9/30/2025

The telecom industry’s future is being defined by a wave of innovation that transforms today’s challenges into tomorrow’s business growth. Operators can achieve success by embracing cutting-edge technologies, adapting business models, and overcoming barriers in security, sustainability, and scale.

The telecommunications (telecoms) industry is in the midst of a transformational phase. Technologies like Artificial Intelligence (AI), network slicing, ISAC, satellite communications, and network security tools are setting the stage for a digital revolution.

Innovation not only drives network efficiencies but also redefines the role of telcos. Their data center developments are positioning them as cloud service providers and opening the door to new revenue opportunities.

Telecom business models are rapidly evolving, with an emphasis on next-gen network technologies and improved customer experiences. Despite the progress, there are still challenges to overcome before the industry reaches its full potential in digital transformation.

To provide a global telecom outlook, ABI Research shares seven key trends the analyst team is tracking.

Table of Contents

- Integrated Sensing and Communications

- Enterprise Fixed Wireless Access

- 5G Network Security

- Smartphone eSIM in China

- Telco GPUaaS

- Sustainable Passive Cellular Antennas

- Direct-to-Cell (D2C) and Non-Terrestrial Network (NTN) Services Become Mainstream

Key Takeaways:

- ISAC is telecom’s next big innovation. Integrated Sensing and Communications (ISAC) will let networks both connect and sense their surroundings, opening new use cases like Extended Reality (XR) streaming and drone delivery. Chinese Mobile Network Operators (MNOs) and technology vendors lead in terms of early ISAC deployments.

- Enterprise FWA demand is set to soar. ABI Research forecasts show that subscriptions are forecast to jump fivefold by 2030, reaching more than 28 million connections and generating US$17.7 billion annually. North America drives enterprise Fixed Wireless Access (FWA) growth and MNO competition, with U.S. carriers filling in connectivity gaps for hard-to-reach, rural regions.

- 5G network security is an urgent priority. With more connected devices facing Artificial Intelligence (AI)-driven threats, telcos are ramping up security spending. ABI Research forecasts that 5G security revenue will climb from US$4 billion in 2025 to over US$11 billion in 2030. Signaling firewalls, Extended Detection and Response (XDR) platforms, AI, and entitlement servers are just a few solutions being used to thwart network attacks.

- China prepares for a consumer eSIM boom. China Unicom will launch a smartphone embedded Subscriber Identity Module (eSIM) in late 2025, paving the way for 125 million shipments by 2030 from Apple and local brands like OPPO and Xiaomi.

- Telcos eye GPUaaS for AI growth. Graphics Processing Unit-as-a-Service (GPUaaS) will surge from half a million dollars in 2025 to US$21 billion by 2030. The year 2027 will be a turning point for large-scale deployments as telco data center infrastructure matures.

- Sustainability pushes green antenna design. Operators are focusing on energy efficiency, reducing embodied carbon, and promoting circularity in antenna production and recycling programs.

- Direct-to-Cell and NTN are going mainstream. Satellite-to-smartphone services already reach 585 million users, and this will grow to 2.6 billion by 2035. North America and Asia-Pacific lead the charge, and telcos are quickly forming partnerships with satellite operators despite several ambiguities.

Integrated Sensing and Communications

The next big thing in the telecom industry is Integrated Sensing and Communications (ISAC). ISAC enables cellular networks to sense their environment, enabling them to identify moving objects. The use cases for ISAC are diverse, ranging from animal intrusion detection to Extended Reality (XR) streaming.

Although ISAC likely won’t commercially launch until 2030 for mature 6G systems, tests will continue to be critical for maturing the technology. Telcos like Ericsson, Huawei, and Nokia are actively developing ISAC systems and engaging in Research and Development (R&D). Moreover, they contribute to much-needed projects from The 3rd Generation Partnership Project (3GPP).

Most of the early ISAC deployment activity has taken place in China. Local MNOs and vendors have already deployed pre-standard ISAC systems for commercial applications in the low-altitude economy vertical. For example, China Unicom Henan, Yunhuan Connected Technology, and ZTE launched the first 5G-Advanced ISAC base station for blood delivery drones.

The early pilot studies that occur in China will serve as guidance for ISAC launches in other regions. The telecom industry will look closely to identify use cases, best practices, and common challenges.

Senior Research Director Dimitris Mavrakis has been closely monitoring the latest trends in ISAC development. He notes that most academic activity takes place in Europe, while industry stakeholders in the Americas have been less proactive.

“Most of the [ISAC] academic activity takes place in Europe, where the European Commission (EC) has funded several projects taking place around the continent. Regional activity is lowest in the Americas, where Qualcomm, Interdigital, and others are conducting Research and Development (R&D).” – Dimitris Mavrakis, Senior Research Director

Dimitris posits that there are key challenges that must be addressed before ISAC goes mainstream. These issues fall under the technical, architecture, privacy, and monetization lenses.

- Technical: Channel modeling, integration and complexity, latency and accuracy, signal processing algorithms, and effect on communication.

- Architecture: Multi-source data integration complexity, coordination of sensing nodes, balance sensing & communication, and potential new site requirements.

- Privacy: User consent & data protection, data trustworthiness, higher security guardrails, and leaking, spoofing, jamming, injection, etc.

- Monetization: Lack of clear business models, potential Application Programming Interface (API) exposure concerns, uncertain customer demand, and deployment costs.

Enterprise Fixed Wireless Access

Consumers constitute the overwhelming majority of the Fixed Wireless Access (FWA) market, with 140 million global subscriptions projected in 2026. This dominance will be sustainable, but a notable trend is the growing traction for enterprise FWA.

According to ABI Research forecasts, enterprise FWA subscriptions will surge by 5X, from roughly 10.5 million in 2025 to 28.2 million by 2030. Our revenue projections indicate more than US$17.7 billion annually by the decade’s end.

Demand for enterprise FWA comes from the need for:

- Rapid 4G/5G deployment in rural, underserved areas

- Backup broadband for business continuity

- Connectivity for mobility applications without trenching

Table 1: Enterprise Fixed Wireless Access (FWA) Service Revenue, 2023 to 2030

|

Region |

Service Revenue |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

CAGR |

|

North America |

(US$ Billions) |

1.2 |

2.2 |

3.6 |

5.0 |

6.5 |

8.1 |

9.6 |

11.1 |

37.5% |

|

Asia-Pacific |

(US$ Billions) |

0.7 |

0.9 |

1.2 |

1.4 |

1.7 |

2.0 |

2.2 |

2.5 |

19.4% |

|

Western Europe |

(US$ Billions) |

0.2 |

0.3 |

0.4 |

0.5 |

0.7 |

0.8 |

1.0 |

1.1 |

24.6% |

|

Eastern Europe |

(US$ Billions) |

0.1 |

0.1 |

0.1 |

0.1 |

0.2 |

0.2 |

0.3 |

0.3 |

23.4% |

|

Latin America |

(US$ Billions) |

0.1 |

0.1 |

0.2 |

0.2 |

0.3 |

0.4 |

0.5 |

0.5 |

26.6% |

|

Middle East & Africa |

(US$ Billions) |

0.5 |

0.6 |

0.8 |

1.0 |

1.2 |

1.5 |

1.8 |

2.1 |

23.0% |

|

Total |

(US$ Billions) |

2.8 |

4.3 |

6.3 |

8.4 |

10.7 |

12.9 |

15.3 |

17.7 |

30.0% |

(Source: ABI Research)

For national carriers, the enterprise segment should be a core focus to break out of the profit flatline. The consumer market is already very competitive, and profits are low. To expand revenue, they must focus on enterprise use cases. They tried, and so far have failed, to successfully monetize private cellular networks. FWA might be one of their last options to generate revenue from the enterprise segment.

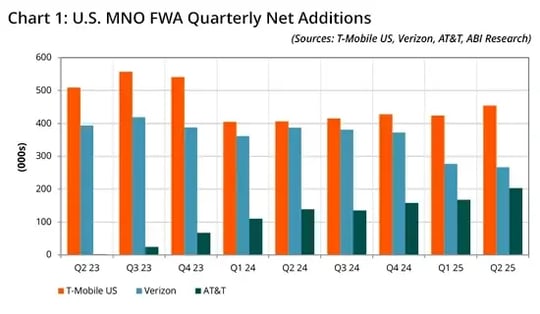

North America is the most mature market for enterprise FWA, and that will remain through the decade. T-Mobile and Verizon have far surpassed AT&T for U.S. FWA quarterly net additional subscriptions, but that is beginning to see a shakeup.

A recent ABI Insight from Industry Analyst Larbi Belkhit explains how AT&T’s recent deal with EchoStar will ramp up competition in the United States. The roughly US$23 billion deal will boost AT&T’s FWA aspirations going forward by providing the spectrum needed to expand.

Beyond the competitive space for enterprise FWA, we have been analyzing the technical opportunities afforded by it.

ABI Research Principal Analyst Leo Gergs is a key contributor to our technology intelligence on FWA. He shares an optimistic view of the potential for network slicing with FWA deployments:

“Enterprise FWA has the chance to revitalize the interest in network slicing: while many slicing applications are still emerging, reserving a dedicated slice for FWA has proven to be both technically feasible and commercially relevant. It aligns with real enterprise requirements and is relatively easy to integrate with existing Information and Communication Technology (ICT) infrastructure. Operators like Telefónica and T-Mobile US are already trialing this approach, reinforcing its near-term viability.” – Leo Gergs, Principal Analyst

Key industry verticals for enterprise FWA include:

- Retail: FWA provides rapid uptime for 5G connectivity, which is essential for retailers operating many stores and opening new doors. FWA has proven valuable for seamless, company-wide connectivity and across device types. For example, Tractor Supply Co teamed up with Inseego to install 5G FWA Customer Premises Equipment (CPE) across 2,000+ rural and semi-rural retail sites.

- Construction & Commercial Real Estate: The construction and commercial real estate vertical is a major growth area, where FWA enables temporary broadband at job sites, supports mobile offices, and powers real-time Internet of Things (IoT)-enabled monitoring for security, worker safety, and asset tracking.

- Hospitality: In hospitality and event venues, FWA is used to provide high-capacity, short-term connectivity for seasonal operations, conferences, or entertainment events where traditional fixed lines are either unavailable or impractical.

- Agriculture: The farming and agriculture industry is emerging as a strategic vertical, with FWA powering smart irrigation, livestock tracking, and remote field sensors. FWA will be a key facilitator of digital agriculture operations across large, geographically-dispersed sites.

5G Network Security

5G network security is top-of-mind for the telecom industry. Enterprises continue to adopt new devices, creating more network entry points. At the same time, threat actors have evolved their tactics with AI-driven methodologies.

Compounding matters, most telcos lack the expertise needed to combat threats. The telecom industry is short of telco security experts by about 70%.

While 5G networks are more secure than 4G by design, most businesses continue to blend both 5G and legacy technologies. This means that legacy cyberthreats persist despite cellular upgrades.

Table 2: 5G Network Security Revenue Across MNOs and Enterprises

|

Type |

Revenue |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

|

Hardware |

(US$ Millions) |

192.77 |

207.51 |

208.32 |

211.79 |

219.62 |

236.42 |

249.97 |

|

Services |

(US$ Millions) |

1,235.47 |

1,551.40 |

2,078.90 |

2,833.20 |

3,660.39 |

4,666.23 |

6,157.64 |

|

Software |

(US$ Millions) |

1,112.06 |

1,382.00 |

1,797.10 |

2,297.10 |

2,904.36 |

3,670.84 |

4,640.00 |

|

Grand Total |

(US$ Millions) |

2,540.30 |

3,140.91 |

4,084.32 |

5,342.08 |

6,784.38 |

8,573.50 |

11,047.62 |

(Source: ABI Research)

A key tech trend shaping the telecom industry is the increased investment in 5G network security. According to ABI Research, 5G network security revenue will more than double from US$4 billion in 2025 to more than US$11 billion by 2030. Software and services dominate spending.

Additionally, network operators are turning to forward-looking technology solutions to keep cyberthreats at bay. These solutions include:

- 5G Signaling Firewalls: Creates a walled garden between signaling messages and the network. Signaling firewalls prevent network access from users who lack authentication and compliance.

- XDR Platforms: Takes a three-thronged approach to network security. Extended Detection and Response (XDR) platforms centralize threat detection, streamline response, and enhance network visibility.

- AI & Gen AI Tools: AI and Generative Artificial Intelligence (Gen AI) may be used by threat actors, but these tools play a vital role in securing 5G networks, too. Network operators use AI to automate network monitoring and quickly identify anomalies.

- Security APIs: Without security APIs, networks are vulnerable to social engineering attacks, data leakage, Denial of Service (DoS) attacks, and more. ABI Research forecasts that security APIs will be the largest revenue generator among API types through 2028.

- Entitlement Servers: Operators integrating Rich Communication Services (RCS) support will greatly benefit from an entitlement server. These platforms equip operators with real-time insight across large device volumes, bulk updates, and rule-based templates.

Smartphone eSIM in China

After years of stalled progress due to security regulations, the Chinese consumer market is ready to kickstart its smartphone eSIM market in late 2025. ABI Research Digital Security Analyst Georgia Cooke wrote about this development in her blog post, “China’s MNOs Hit Redial on eSIM.”

The cliff notes:

- China Unicom paves the way for consumer eSIM in China. China Unicom is leading these efforts, with a planned smartphone eSIM launch expected in late 2025.

- 2025 will only be the beginning. Other Chinese MNOs are expected to watch closely as China Unicom rolls out smartphone eSIM. This presents huge revenue potential for international tech vendors that provide Remote SIM Provisioning (RSP) and other eSIM platforms.

- A diversity of device manufacturers exists. While Apple will lead shipments of smartphone eSIM shipments in China, it’s not as dominant as in the United States and Europe. Chinese smartphone makers HONOR, OPPO, Xiaomi, vivo, and others will eat away at market share.

- Chipset makers must prepare now. Mass volumes of eSIM-enabled smartphones are imminent in China. Chipset suppliers must accommodate enhanced security (stacked chips, Secure Elements (SEs)) and hardware innovations (e.g., integrated SIM (iSIM), processing speeds, etc.).

A recent Proximus Global survey makes it clear that interest in consumer eSIM is greatest in China.

And ABI Research forecasts confirm that. Our market data shows that forecasts that eSIM-enabled smartphone shipments will skyrocket from 17 million units in 2026 to 125 million in 2030.

Telco GPUaaS

The relentless investment in AI infrastructure worldwide has not escaped the telecom industry, which is either exploring the feasibility of building new AI-ready data centers or upgrading its existing infrastructure. While this infrastructure will provide benefits to a telco’s internal workloads, GPU-as-a-Service (GPUaaS) for unutilized capacity is a significant opportunity.

Table 3: Telco GPUaaS Revenue, 2024 to 2030

|

Workload Type |

Revenue |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

|

Inference |

(US$ Billions) |

0.02 |

0.51 |

1.82 |

4.46 |

8.18 |

13.35 |

20.41 |

|

Training |

(US$ Billions) |

0 |

0.01 |

0.04 |

0.14 |

0.28 |

0.48 |

0.71 |

|

Total |

US$ Billions) |

0.02 |

0.52 |

1.86 |

4.6 |

8.46 |

13.83 |

21.12 |

(Source: ABI Research)

According to ABI Research, GPUaaS spending will increase from about US$0.5 billion in 2025 to more than US$21 billion by 2030. We published a report indicating that 2027 will be a big inflection point for GPUaaS. Telco AI data centers and GPU capacity will be built out over the next 12 to 24 months, where 2027 fits in. Spending will jump from around US$1.9 billion in 2026 to US$4.6 billion in 2027.

SK Telecom, TELUS, SoftBank, Verizon, and Telenor are just some of the companies active in the GPUaaS space. However, they have not all taken the same approach, with three distinct business models being adopted in the industry:

- Facilitating GPUaaS for external cloud providers (i.e., leasing data center capacity)

- Aggregating owned and external GPU clusters to customers

- Becoming sovereign AI hyperscalers with a full-stack AI cloud strategy.

There are variations in the key verticals driving the growth of the telco GPUaaS opportunity on a regional basis. In Asia-Pacific, government partnerships for national Large Language Model (LLM) training and hosting are the major drivers thus far, whereas in Europe, the manufacturing and supply chain industries are driving the momentum early on. This is epitomized by the Deutsche Telekom AI Gigafactory plans, featuring 10,000 NVIDIA GPUs in Germany for European manufacturers.

Sustainable Passive Cellular Antennas

Sustainability is a key topic in telco boardrooms as Communications Service Providers (CSPs) aim to reduce energy costs, while complying with climate regulations and Next Generation Mobile Networks Alliance (NGMN) guidance. Passive cellular antennas are a popular starting point.

ABI Research defines a green antenna as an antenna that is committed to environmental sustainability through energy-efficient design, technologies that minimize footprint, and sustainable, climate-friendly manufacturing processes.

As outlined in our recent blog post from Mavrakis, CSPs must focus on three main areas to achieve antenna sustainability:

- Energy Efficiency: Data sheets and basic radiation patterns fail to reflect true sustainability performance. CSPs must track advanced metrics like Three-Dimensional (3D) beam efficiency. This directly impacts Signal-to-Interference-plus-Noise Ratio (SINR), throughput, and overall energy use.

- Embodied Carbon Emissions: CSPs must address their Scope 1 (direct), Scope 2 (indirect), and Scope 3 (Upstream) emissions. Achieving emissions reduction across these three Scopes requires telcos to use sustainable materials, reduce product weight, minimize waste via virtual prototyping, and hold supply chain partners accountable for climate agreements.

- Circularity: Circularity means designing antennas and packaging with easily recyclable, low-diversity materials. Offering take-back programs is also a best practice. For example, Ericsson’s E-Waste Management program allows customers to securely dispose of their equipment, thus avoiding landfill pileup.

ABI Research’s Passive Cellular Antenna Competitive Analysis and Passive Antenna Vendors Hot Tech Innovators presentation analyze various telcos’ sustainability efforts.

Direct-to-Cell (D2C) and Non-Terrestrial Network (NTN) Services Become Mainstream

Direct-to-Cell (D2C) connectivity is on the rise, as satellite services directly for smartphone users become available around the world. The number of users with access to satellite services from their smartphones reached 585 million in 2024, and ABI Research forecasts that number to increase to 2.6 billion by 2035.

As Senior Analyst of Space Technologies, Andrew Caviler, points out in his recent ABI Insight, many NTN milestones have been reached in 2025. The New Radio (NR) for NTNs 3GPP standard facilitates connectivity between a device and a 5G core via satellite. For telcos, NTN expands 5G coverage, providing new opportunities to reach smartphone and IoT customers.

North American operators lead the charge for satellite D2C/NTN revenue, driven by:

- The proliferation of Satellite Communications (SatCom) networks

- A supportive regulatory framework

- An increasing number of devices supporting Non-Terrestrial Networks (NTNs)

- A strong ecosystem of top D2C operators (Starlink, Skylo, Globalstar, etc.)

Asia-Pacific holds the lion’s share of D2C user opportunity, given its 3 billion+ cellular subscribers. Not only will U.S.-based operators provide D2C services, but global networks operated from China like Guo Wang and Qianfan will provide Low Earth Orbit (LEO) connectivity services.

We have observed strong NTN momentum in Asia-Pacific countries where the government is heavily involved in adoption.

“Interestingly, some of the most significant progress in telco–satellite collaboration for NTN is happening in regions with strong government involvement—particularly in Asia-Pacific—where state-backed mandates, funding, and manpower are driving testing and deployment. In addition, the region’s manufacturing base and supply chain strengths are accelerating the adaptation of network equipment, chipsets, and hardware for NTN.” – Andrew Cavalier, Senior Research Analyst

D2C and NTN present uncertainty for telcos. Is this a threat or an opportunity? What are the chipset requirements? Do satellite gateway base stations need to be upgraded? The reality of adoption is more complicated as standards remain incomplete.

Despite these uncertainties, telcos appear to be on board with D2C and NTN services. Case in point, Starlink is collaborating with T-Mobile (United States), One NZ (New Zealand), Optus (Australia), Rogers Communications (Canada), Salt (Switzerland), Entel (Chile), KDDI (Japan), and Kyivstar (Ukraine).

The industry is clearly marching forward with D2C and NTN. Telcos that fail to strike partnerships with satellite operators now risk revenue shares falling in the future.

Conclusion

The telecoms sector is on the cusp of significant transformation. With AI, cloud computing, sustainability, and automation driving the next phase of digital evolution, operators must continue to innovate to meet the rising demand for connectivity services. In many cases, this requires a shift in business models and striking strategic alliances to stay competitive.

As the industry moves toward a more customer-centric approach, operators must prioritize enhancing the user experience while embracing new technologies to drive operational efficiency.

Learn more about how our forward-looking insights support the telecom sector in the services below:

Meet the ABI Research Analyst Team

Malik Saadi, Vice President of Strategic Technologies

Research Focus: Malik Kamal-Saadi is head of the Strategic Technology Group at ABI Research focusing on transformative technologies and innovation across Telecommunications and Connectivity Technologies, Enterprise IT and OT Technologies, Cloud, Edge, and Distributed Computing, Artificial Intelligence, Data Warehouses, Robotics and Automation, and other adjacent technologies. In his role, Malik leads ABI Research’s thought leadership, consultancy services, syndicated services, strategic positioning, market forecasts, competitive assessments, and market analysis.

Jake Saunders, Vice President, Asia-Pacific & Advisory Services

Research Focus: Jake Saunders, Vice President, Asia-Pacific & Advisory Services, heads ABI Research’s Space Technologies & innovation research division. Jake brings highly developed analytical skills to the company, combined with years of expertise in the telecom technology market research business and a proven track record of operations management. He devotes particular attention to the Asia-Pacific market in relation to its mobile operator strategic positioning, satellite communications, infrastructure vendors, mobile device vendors, and chipset manufacturers.

Dimitris Mavrakis, Senior Research Director

Research Focus: Dimitris Mavrakis, Senior Research Director, manages ABI Research’s telco network and cloud computing coverage, including hybrid cloud platforms, digital transformation, and mobile network infrastructure. Research topics include AI and machine learning in telco networks, hybrid cloud deployments and technologies, telco software and applications, 5G, 6G, cloud-native networks, and both telco and cloud ecosystems.

Leo Gergs, Principal Analyst

Research Focus: Principal Analyst Leo Gergs leads the enterprise connectivity and cloud research at ABI Research. Together with his team, Leo's research focuses on enterprise drivers, use cases, and providers for connectivity solutions, including private cellular, network slicing, Software-Defined Wide Area Networks (SD-WANs), and Fixed Wireless Access (FWA).

Andrew Cavalier, Senior Analyst

Research Focus: Andrew Cavalier, Senior Analyst at ABI Research, focuses on satellite communications (SatCom) and space technologies. As part of the custom research team, Andrew also focuses on wireless networks, infrastructure, and other emerging technology industry sectors such as Internet of Things (IoT), cloud, cybersecurity, 5G, and Artificial Intelligence (AI).

Larbi Belkhit, Industry Analyst

Research Focus: Industry Analyst Larbi Belkhit is part of ABI Research's Strategic Technologies research group focused on 5G, 6G, and RAN automation research. He is responsible for producing qualitative analysis and market forecasts on indoor and outdoor network infrastructure, Fixed Wireless Access (FWA), Massive MIMO, and other trends impacting network technologies.

Sam Bowling, Research Analyst

Research Focus: Sam Bowling is a Research Analyst within ABI Research's Strategic Technologies team, focused on 5G, 6G, and Open Radio Access Network (RAN). Coverage includes passive antennas, Distributed Antenna Systems (DASs), Massive Multiple Input, Multiple Output (mMIMO), and other trends impacting network technologies.

Frequently Asked Questions

What are some examples of telecom industry innovation?

Some of the most important telecom innovations today include:

- Integrated Sensing and Communications (ISAC): Combines connectivity with environmental sensing to enable applications like drone delivery, smart cities, and animal detection.

- Enterprise Fixed Wireless Access (FWA): Provides fast broadband without trenching fiber, providing connectivity for businesses operating in rural, underserved areas.

- 5G Network Security Solutions: Tools like signaling firewalls, Extended Detection and Response (XDR), entitlement servers, and AI monitoring help telcos defend against increasingly sophisticated cyberthreats.

- Consumer eSIM Adoption in China: Enables flexible, Remote SIM Provisioning (RSP) for smartphones. Rapid growth expected from 2025 onward, led by China Unicom.

- GPU-as-a-Service (GPUaaS): Enables telcos to support AI workloads without building costly infrastructure. GPUaaS revenue is set to accelerate in 2027.

- Sustainable Passive Antennas: Focuses on energy efficiency, recyclable materials, and reduced carbon emissions to meet climate goals.

Why is Integrated Sensing and Communications (ISAC) important for the future of telcos?

ISAC allows networks to both transmit data and sense their surroundings. This enables telcos to support applications such as drone delivery, smart city services, and XR gaming. Commercial adoption is expected around 2030, but early pilots in China and academic testing in Europe are already shaping global direction.

How is enterprise Fixed Wireless Access (FWA) changing the connectivity market?

Enterprise FWA delivers high-speed broadband without trenching fiber, making it a rapid and cost-effective choice for businesses. Industries that sometimes work in remote regions, such as retail, construction, agriculture, and hospitality, are using it for IoT, mobility, and business continuity. ABI Research projects the enterprise FWA market size to reach nearly US$18 billion by 2030.

What are the biggest challenges and solutions in 5G network security?

Enterprises are connecting more devices, and threat actors are using more advanced attack methods, elevating cyber risks. The telecom industry is addressing these challenges by deploying forward-looking solutions like 5G signaling firewalls, Extended Detection and Response (XDR) platforms, AI-based monitoring, and security APIs.

Why is consumer eSIM adoption in China significant for telcos?

China Unicom is preparing to launch smartphone eSIM in late 2025, with other Chinese MNOs to follow in the proceeding years. China has an enormous smartphone user base, positioning it as a ripe revenue opportunity for local carriers, Remote SIM Provisioning (RSP) providers, and other technology vendors. The rollout of smartphone eSIM will impact chipset suppliers, requiring them to enhance device security and support hardware innovation.

How will GPU-as-a-Service (GPUaaS) impact telco operators?

GPUaaS enables telcos to support AI workloads like training and inference. They can essentially “rent out” their data center infrastructure to neocloud providers, creating new revenue opportunities. Spending on GPUaaS is forecast to reach US$21 billion by 2030, with business models ranging from facilitator roles to vertically integrated sovereign hyperscalers.

How are telcos making passive antennas more sustainable?

The telecom industry is motivated to reduce energy consumption and save costs. Equipment vendors are developing passive cellular antennas that focus on energy efficiency, lower embodied carbon emissions, and champion circular design principles. This includes using recyclable materials, lighter products, and offering take-back programs that reduce waste and align with climate regulations.