AT&T-EchoStar Deal: Bad for Open RAN Ecosystem, but Good for FWA

By Larbi Belkhit |

23 Sep 2025 |

IN-7922

By Larbi Belkhit |

23 Sep 2025 |

IN-7922

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

By Larbi Belkhit |

23 Sep 2025 |

IN-7922

By Larbi Belkhit |

23 Sep 2025 |

IN-7922

US$23 Billion Spectrum Deal |

NEWS |

In August 2025, AT&T agreed to purchase certain spectrum licenses from EchoStar, the parent company for Boost Mobile (formerly known as DISH Wireless), for approximately US$23 billion, subject to regulatory approval. This deal consists of EchoStar’s 3.45 Gigahertz (GHz) (30 Megahertz (MHz) of spectrum) and 600 MHz (20 MHz of spectrum) and includes an agreement between the two operators to allow EchoStar to leverage AT&T’s cell sites to become a “hybrid” Mobile Network Operator (MNO), leveraging EchoStar’s existing cloud-native 5G core and will result in the steady decommissioning of its own Radio Access Network (RAN) sites, opting to leverage AT&T’s cell sites moving forward.

The sale of these spectrum assets was a step toward resolving the ongoing concerns that the Federal Communications Commission (FCC) has raised with EchoStar, according to EchoStar’s chairman Charlie Ergen. AT&T intends to deploy the mid-band spectrum it has acquired as soon as it possibly can. The FCC subsequently ended its investigation into EchoStar in September 2025.

Bad News for Open RAN, Good News for FWA |

IMPACT |

From a 5G RAN perspective, this news has major implications on the Open RAN ecosystem. EchoStar’s Boost Mobile is one of the largest, if not the largest, Open RAN deployments that is multi-vendor, using a range of suppliers such as Samsung and Mavenir. According to U.S. Securities and Exchange Commission (SEC) filings, EchoStar had an obligation to have deployed at least 24,000 5G cell sites by June 2024, and it had surpassed 15,000 cell sites back in 2023 according to the FCC. The U.S. Open RAN market will now be dominated by AT&T’s ongoing Ericsson refresh and will be mostly single vendor outside of some small cell radios. Furthermore, AT&T only recently performed the first data call using 1Finity radios in a lab trial, and this is yet to be proven in a commercial setting. Given that the initial press release from AT&T suggested that it planned to have 70% of wireless traffic running over Open RAN infrastructure by late 2026, it is unlikely that we will see a large-scale multi-vendor presence by then. Ultimately, this coupled with the EchoStar deal will greatly strengthen Ericsson’s position in the U.S. market.

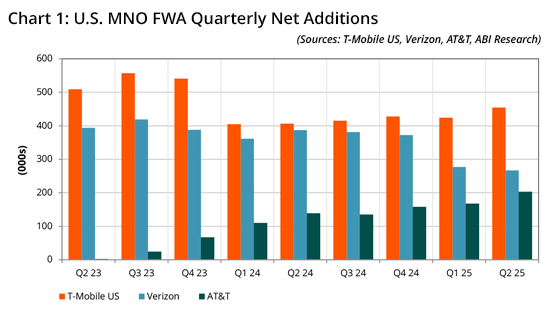

From a 5G Fixed Wireless Access (FWA) perspective, the impact is much more positive. AT&T has been the most pragmatic in its approach to FWA compared to its competitors Verizon and T-Mobile US. However, its stance regarding the technology has softened over the last 12 months. This spectrum transaction means that AT&T expects to accelerate and expand the availability of its FWA service. As of 2Q 2025, AT&T’s FWA customer base has surpassed 1 million connections with quarterly net adds between 150,000 and 200,000 for the last 3 quarters, which is less than both T-Mobile US and Verizon, as Chart 1 shows. ABI Research expects that AT&T will likely reach parity with and even surpass Verizon in terms of quarterly net adds due to having a smaller existing customer base and, in turn, larger growth opportunities. This will be driven not just by the addition of EchoStar’s spectrum assets, but by the ongoing RAN upgrades increasing capacity in sectors that opens up FWA opportunities alongside the ongoing copper network retirement initiative that AT&T is undertaking.

FWA Competition to Heat up in the United States |

RECOMMENDATIONS |

For the FWA market, AT&T’s deviation from its FWA pessimism creates a unique opportunity. Currently, AT&T provides Original Design Manufacturer (ODM)-supplied hybrid 5G Passive Optical Network (PON) Customer Premises Equipment (CPE) to easily upgrade its FWA customers to fiber once it is rolled out in their area, but also has included Askey and Cisco in its portfolio mix, although ABI Research understands that these suppliers are used selectively as they are not converged 5G-PON solutions. The acceleration in AT&T’s strategy may result in the need to diversify this hybrid supply chain; therefore, FWA vendors that are capable of creating customized, hybrid designs should proactively engage with AT&T to see if they can be selected in their portfolio mix moving forward.

For the Open RAN ecosystem, the decommissioning of Boost Mobile’s Open RAN sites is a major blow. We are likely to see EchoStar beginning to quietly sell the radios and other components of its network to other operators in an effort to recoup some of that investment alongside its US$40 billion of spectrum asset sales, after it sold more of its spectrum to SpaceX in September (for more information, please see ABI Insight “EchoStar Inks Deal to Usher in Era of (More) SpaceX Dominance in NTN IoT and NR”). For the larger market, while Boost Mobile was a champion of multi-vendor Open RAN, its success alone would not have spurred significant growth in Open RAN investment. Only the success of a large, brownfield operator that opts for a truly multi-vendor Open RAN approach has that capability, and we are not seeing this in the market due to the complexity involved.

Written by Larbi Belkhit

Related Service

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions