Enterprise connectivity used to be simple. Companies could get the job done with point-to-point connections or the consumption of cloud applications across the public Internet. But today, enterprises need connectivity services with greater network agility, flexibility, security, performance, and redundancy in their cloud operations. Cloud hyperscalers, interconnection providers, and telcos play a prominent role in meeting these new connectivity demands and unlocking the next-generation enterprise.

What Is Enterprise Connectivity?

Enterprise connectivity is defined as the physical or virtual network and protocols that “connect” enterprise endpoints (devices, systems, etc.) with the resources they need to function. It also serves as a framework that connects various enterprise branches (or Local Area Networks (LANs), across fundamental networks, to other branches, offices, facilities, data centers, or cloud-based software applications within the Wide Area Network (WAN).

Enterprise Connectivity Applications

Each enterprise vertical has specific connectivity requirements, but some common applications and use cases across verticals exist. These applications and use cases are listed in the following three sections.

Video Monitoring

5G connectivity in the enterprise domain can be used for enhanced remote video monitoring of enterprise production assets. This application could also be used for video capabilities to remotely operate vehicles like Rubber Tire Gantries (RTGs) or remotely-guided production vehicles on the factory floor.

As another example, healthcare and social workers can use video monitoring to check on patient conditions and deliver remote care to them. As video footage is data-intensive, this requires exceptionally high bandwidth for transmitting these files in a timely manner.

Non-cellular connectivity technologies like Wi-Fi (especially Wi-Fi 6) could cater to stationary video monitoring applications in the enterprise. However, the absence of robust handovers between Wi-Fi Access Points (APs) poses significant limitations for video monitoring and remote operations of mobile assets, such as Automated Guided Vehicles (AGVs). As a result, AGVs using 5G connectivity can be operated at a 30% higher speed, as latency remains constant when signals are handed over.

Exemplifying the market opportunity to be had, ABI Research forecasts that there will be 300,000 video surveillance connections using 5G by 2026 (see Chart 1).

Sensing

Another primary application of enterprise connectivity is sensing capabilities. Unlike video monitoring, sensing applications do not have exceptionally high bandwidth needs or particularly low latencies. Instead, they usually refer to massive wireless sensor networks, necessitating the connectivity of many devices. That means sensing applications will benefit from the Massive Machine-Type Communications (mMTC) capabilities of 5G.

Sensing use cases can be applied to many enterprise verticals. For example, in mines or oil & gas fields, a massive wireless sensor network can be deployed to monitor safety conditions and detect potential hazards. Likewise, in manufacturing, operators can apply sensors to production machines to enable predictive and preventative maintenance. As these use cases are either highly mission-critical or even life-critical, enterprises prefer to retain the maximum possible control in their own hands, rather than involving Communication Service Providers (CSPs).

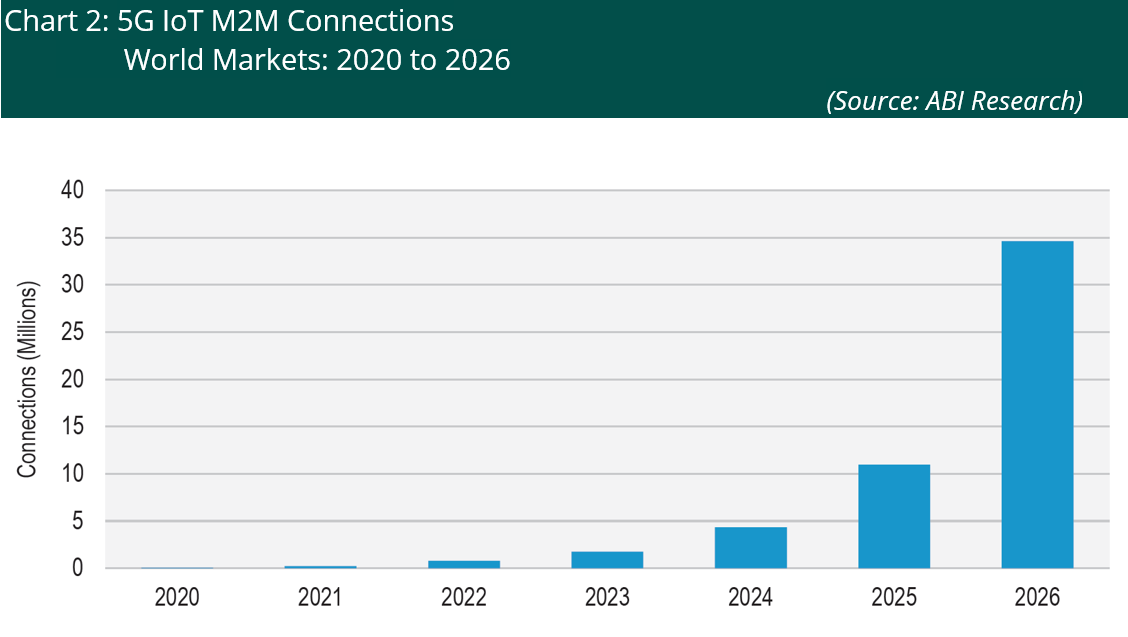

As Chart 2 quantifies, we project that there will be roughly 35 million true Machine-to-Machine (M2M) Internet of Things (IoT) connections powered by 5G connectivity in 2026 (excluding mMTC and Ultra-Reliable Low Latency Communication (URLLC) applications).

Augmented Reality/Virtual Reality

5G enterprise connectivity can be used for Augmented Reality (AR) and Virtual Reality (VR) use cases because they require transmitting large amounts of data. Regarding the enterprise context, 5G connectivity can be used to create digital twins of production assets or for enhanced training capabilities for medical personnel, for example.

Furthermore, a range of use cases for AR and VR exists in the so-called carpeted verticals. In retail, AR and VR can be used to create new and immersive shopping experiences for customers. Similarly, for hospitality and smart event locations (including stadiums), AR can be used to portray additional spectator information to complement what they are seeing.

When stacked up against video monitoring use cases (as previously discussed), AR and VR footage is more complex, driving up bandwidth requirements.

Meanwhile, consumer applications will leverage AR and VR applications mainly for entertainment (gaming) applications.

To understand the weight of the AR/VR enterprise opportunity, ABI Research expects just over 30 million smart glasses to ship annually by 2026 for enterprise applications. Part of this forecast, articulated in Chart 3, is all devices that use pass-through displays (or micro-display outside of the field of view) in a head-worn form factor, regardless of the connectivity technology used.

Get more insight in our Wireless Trends In Enterprise Connectivity whitepaper.

Tech Trends Redefining Enterprise Connectivity

Better access to digital resources is the name of the game for enterprise connectivity. To improve end-user performance and simplify managerial processes, telcos must first latch onto technological creativity. The following three sections explain some of the key technology trends shaping the connectivity market.

Embedded Automation & Intelligence

Embedded Intent-Based Networking (IBN) helps enterprises match their business/operational objectives with network connectivity policies through automation. Artificial Intelligence (AI) and Machine Learning (ML) are huge factors for IBN, automating routine tasks, setting policies, and responding to critical events that ensure alignment with broader business goals.

IBN can transpose manual, hardware-centric networks into a software-defined controller-oriented network. Consequently, enterprise connectivity is monitored unceasingly and given performance adjustments consistent with desired business outcomes.

Network Edge Integration

Enterprise connectivity providers see great value in integrating network edge resources. This gives customers access to high-value digital applications. For example, Network-as-a-Service (NaaS) connectivity provider Megaport recently extended its strategic alliance with Amazon Web Services (AWS) to add Outpost.

If you’re unfamiliar with AWS Outpost, it’s an on-premises private cloud deployment that provides enterprises with virtualized edge computing resources in local AWS regions.

Expect more of these types of cloud network deployments to be used in enterprise connectivity applications as the market advances.

Network-as-Code

Developers can lose much productivity through manual coding processes. For example, a global survey revealed that 64% of developers spend at least a quarter of their time dealing with software bugs. Network-as-code can alleviate this enterprise connectivity challenge by allowing developers to deploy, provision, and manage network services with code.

The benefits of network-as-code include the following:

- Improved consistency

- Drives ease of use

- Lowers provisioning time

- More agile and stable processes

What Enterprise Connectivity Customers Are Looking For

Effective enterprise connectivity is central to the modern company. As firms digitally transform, they require agile networks to keep pace with the latest technological developments. To elaborate, the following bullet list offers insight into what enterprises need in a connectivity solution.

- Enhanced End-User Experience: Holistic single platform access to all resources; ongoing lifecycle post-deployment support/optimization/refresh services; visibility across all major cloud applications; improved DevOps experience to support app ecosystem.

- Access to All Digital Services: Edge continuum (network, metro, on-premises) is becoming vital to emerging technology-supported use cases. Enterprises need access to applications across the edge to the cloud.

- Operational Simplicity: Oversight/management of thousands of network connections is challenging; single plane of glass, network analytics, DevOps support, sustainability metrics, multi/hybrid cloud support, and edge-to-cloud integration.

- Cost & Performance Optimizations: End-to-end automation to support connection deployment, management, billing, etc. Intent-Based Networking (IBN) will be a tremendous value driver to align business goals with performance. Automation can support application time to market.

- Strategic Alignment: Deeper alignment between enterprise growth ambitions and connectivity infrastructure (e.g., regional growth ambitions). Strategic alignment also includes alignment between Software-Defined Networking (SDN) services (e.g., a Software-Defined Wide Area Network (SD-WAN) lowers barriers to connectivity adoption).

How Vendors Should Act

Enterprise connectivity is a battleground, with cloud hyperscalers, neutral host providers, and other telco vendors fighting over clients. Stating the obvious, connectivity vendors must integrate enterprise pain points into their go-to-market, investment, innovation, and operating strategies. You only have so much time and money, so latching onto the most lucrative opportunities is crucial. To help hyperscalers and telco providers align their connectivity solutions with enterprises’ expectations, ABI Research recommends taking the following three steps:

- Improve Performance and User Experience: Enterprise connectivity experiences can be improved through solid investment and innovation in layers 4 (network) and 7 (application) within the Open Systems Interconnection (OSI) model. This will translate into a higher quality of experience for end users, application developers, and network managers. Moreover, enterprise connectivity vendors should invest in automation and management platforms, notably IBN and hyper-automation.

- Pursue Deeper Strategic Alignment and Partnerships: Regional presence through Points of Presence (POPs), SDN partners, and ecosystem applications must align with telco ecosystem partners. Vendors can better harmonize their business strategy with the customer base by improving cooperation with industry players. And remember not to neglect enterprise relationships struck in the post-deployment phase. Higher customer retention rates and an enhanced service value proposition can be realized by establishing an active, ongoing relationship with new partners.

- Expand Infrastructure, Service, Application, and Domain: Enterprise connectivity providers should extend the application ecosystem to connect enterprises with more digital resources. The key focus areas are edge computing, public cloud services, and private clouds.

This content comes from ABI Research’s Hyperscaler Strategies for Enterprise Connectivity report. This report breaks down the entire enterprise connectivity ecosystem, from enabling technologies to vendor profiles.