Industrial digital twins, once rarely discussed among C-level executives, are firmly in the mainstream. This transformative technology is being used to test the waters with new operational approaches and collect real-time data on asset performance. The opportunities of digital twins for manufacturers are exciting.

Growing at a Compound Annual Growth Rate (CAGR) of 29%, the industrial digital twin market is forecasted to increase from US$3.5 billion in 2021 to US$33.9 billion in 2030.

Even more, the value of goods manufactured using digital twins will grow from US$1.1 trillion in 2021 to more than US$4 trillion by 2026 (see chart below).

What Is a Digital Twin?

A digital twin is defined as a digital representation of real-world sensors, devices, machines, facilities, processes, complex systems, people, and other entities. This deployment is aimed at driving critical business outcomes, such as utilizing resources in a more efficient and sustainable manner. Digital twins provide connectivity, metadata management, data management, increasingly advanced analytics, and often integration with business applications and process systems. Digital twins can be organized and structured in different ways, such as hierarchies, topologies, etc.

Learn the difference between a digital thread and a digital twin in the blog post, Digital Thread vs Digital Twin.

Latest Developments

ABI Research has identified the following trends in the industrial digital twin market:

- Manufacturers require many capabilities to use digital twins. This necessitates Computer- Aided Design (CAD) modeling, connectivity, cloud computing, Industrial Internet of Things (IIoT) software platforms, remote monitoring, hardware for shop floor workers (tablets, Augmented Reality (AR) glasses), physics-based simulation, Machine Learning (ML), and systems integration. It’s important to understand that digital twins are not really a technology per se. Instead, digital twins can be considered a combination of various solutions that connect the physical and digital worlds—from design through simulation, manufacturing, assembly, and after-sales service and support.

- There are multiple types of digital twins, ranging from those that encompass basic metadata about a respective entity/asset with a means to monitor it in near real-time to advanced high-fidelity analytic models that enable prediction and simulation for comparison of expected versus real behavior. ABI Research designates the levels of maturity as 1) basic twins, 2) intelligent twins, 3) simulations twins, and 4) executable twins.

- Budget traditionally comes from the engineering and Research and Development (R&D) organizations. Vendors increasingly see budgets from Information Technology (IT), finance, and sales teams. However, such projects remain discretionary spending and therefore face headwinds unless pursued on a case-by-case basis.

- The most noteworthy changes in the next 12 to 24 months include the development of data and model-based standards; integration of real-time data from new sources such as virtual sensors, video cameras, and front-line workers; emergence of new business models such as throughput over time; and the use of simulation alongside metrics like Overall Equipment Effectiveness (OEE).

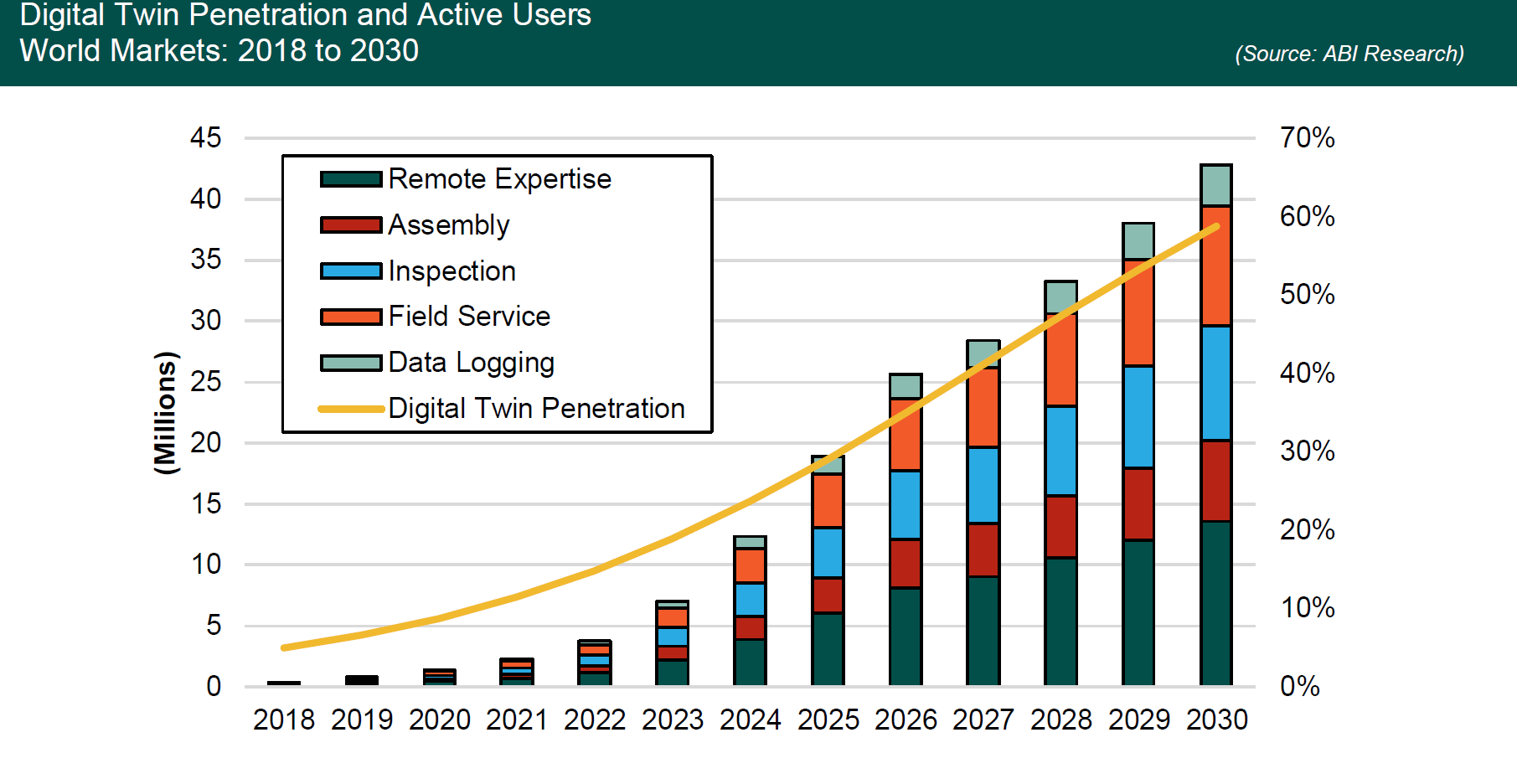

- The United States currently leads in both the adoption of digital twins and in products manufactured using digital twins. However, China has the potential to overtake the United States in terms of products manufactured using digital twins by 2024 under current conditions. ABI Research estimates average global adoption of digital twins is about 11.4% in 2021. By 2026, 34.9% of all new condition-based monitoring connections will feed digital twins, supporting more than 10 million frontline workers in manufacturing.

- There are three main implementation strategies: 1) greenfield, 2) side-by-side, and 3) gradual evolution. End customers are either manufacturers/operators or product manufacturers. The most successful digital twin initiatives start small. This helps manage expectations and costs.

- A large number of vendors solidly provide some of the core products and services for digital twins, but few offer a custom end-to-end solution. Some of the most robust digital twin solutions come from companies like Dassault Systèmes, Hitachi Vantara, PTC, and Siemens. Meanwhile, other companies become well-known through their standardization work through organizations like the Digital Twin Consortium (DTC).

The chart below forecasts the digital twin penetration rate and active users between 2018 and 2030.

You May Also Like

Digital Twins in Quick-Service Restaurants: Industrial Solutions for Industrial-Grade Food Service

Digital Twin Applications In Manufacturing

Many opportunities await manufacturers with the use of digital twins. Those opportunities can be realized with the following digital twin applications and use cases:

Design

Many manufacturing companies create CAD models of products before building prototypes. These models do not really fit the definition of a digital twin because their physical twin has yet to be built. So, in this case, they fill the role of a “digital definition,” but will continue to be called a digital twin or a digital prototype for the purpose of this report. Companies use these digital prototypes for engineering and testing purposes, such as using simulation and visualization during the design phase to verify and inspect the overall 3D design and make sure all parts fit together. Simulations include mechanical, thermal, and electrical in addition to their interdependencies.

Simulate and Test

Once the engineering team has a basic design, team members can run as many physics-based simulations on the digital prototype as needed to test performance under varying realistic conditions to perfect the design. This allows engineers to understand the limits of products in a field environment and make design adjustments without wasting physical resources. Once the physical prototype is built, the actual digital twin can verify the performance of the physical prototype in near real-time to validate the simulations. These simulations can continue when the physical twin is in operation using predictive analytics for failing parts. This analysis provides insight for engineers on how to improve the design.

Instruct and Build

Descriptive analytics and condition-based monitoring are among the most common baseline IIoT applications where it is logical to link and overlay real-world data. For instance, using tablets or Augmented Reality (AR)/Virtual Reality (VR) glasses to provide field technicians with an overlay of information on real equipment to visualize certain parameters (such as temperatures of non-accessible parts or material stress). These technologies—digital twins combined with an AR/visual frontend—can extend complex tasks to junior staff with greater confidence in the result. Not only does this mean more meaningful work for less experienced workers, but also the prospect of on-the-job training with less error and better allocation of resources. This use case increases productivity and improves quality by minimizing errors and is regarded as one of the quickest to adopt.

System Configuration and Integration

System-level twins can verify constraints such as spatial footprint and physical connections. By connecting to the twins of other components, interactions can be simulated, including data transfer and control functionality, as well as mechanical and electrical behavior and what-if scenarios. More advanced implementations can go a step further and virtually commission machinery for faster time-to-market.

Monitor and Maintain (Diagnostics)

Monitoring and maintaining industrial equipment formerly meant routine inspections and tests based on historical and physically observed operating performance. Now, more manufacturing companies have sensors monitoring performance and health in real-time, making it possible to assess equipment, measure status, and perform troubleshooting in a virtual environment, which alleviates the need to staff in-person inspections. When this data is combined with and continually analyzed alongside historical, fleet, environmental, and situational data, plant operators can optimize operations and procure replacement parts to arrive precisely when needed. Combining these insights with AR technology can overlay a digital twin on the physical twin to ensure proper maintenance and repair

Update and Improve (Prognostics)

As more data are collected and analyzed, digital twins can provide a lens for macro analysis of performance, as well as manufacturing/industrial processes that can be improved through software updates or workflow enhancements. This combination of remote monitoring, analytics, and remote control holds high-value potential for applications that leverage digital twins.

Who Benefits from Industrial Digital Twins?

The following stakeholders benefit from deploying industrial digital twins:

- Manufacturers: Digital twins provide critical data feeds across the entire value chain, from design to manufacturing to shipment and operations.

- Frontline Workers: Digital twins serve the necessary information at the time and place it is needed.

- Business Executives: Plant and asset managers benefit from digital twins because the technology allows rapid data-driven insights. These insights relate to the health and performance of assets and processes, with continuously updated sensor values and states.

- Sellers of Physical Assets: Digital twins enable improved customer service, new revenue streams, and entirely new business models (e.g., Outcome-as-a-Service).

- Software Engineers: Digital twins allow more rapid deployment of new applications without having to go back to the physical environment. The latter can be difficult, especially in mission-critical environments or situations where the entity/asset resides in an inaccessible/remote location.

Market Drivers

The following four market factors have given rise to the growing adoption of digital twins:

- Digital Continuity: Before digital twins, users could not be informed beyond the data managed within their departments. A service/maintenance organization could only see publications, sensors, and service order history. Engineering could only see manufacturing recipes. Manufacturing could only see work instructions and Manufacturing Execution Systems (MES) activity. With digital twins, there is not only enterprise data collaboration, but lenses that make this data highly consumable for valuable tasks. Data continuity also leads to better trust in data, despite emanating from other departments.

- Improving OEE: OEE is all about optimizing availability, performance, and quality. Digital twins benefit this metric by providing better visibility into the real-time health of assets and operations, minimizing downtime, closing the loop on quality, and extending the useful life of equipment.

- Frontline Worker Enablement: Frontline workers represent 75% of the global workforce, or 2.7 billion people. These professionals need a way to receive data where they work. Digital twins allied with AR are essentially the frontline equivalent of the tools that desk workers rely on so heavily (such as Microsoft Office, Teams, Salesforce, DocuSign, and Zoom), but for the purpose of remote monitoring, maintenance, knowledge sharing, guided workflows, collaboration, and accelerated on-the-job learning. By 2026, there will be more than 10 million active users of AR for expertise and training applications in manufacturing.

- Product Differentiation: The pace of New Product Introduction (NPI), change, and competition has never been greater. The automotive industry is undergoing a monumental shift to electrification, additive manufacturing is starting to take hold, and new Consumer Packaged Goods (CPG) products are being launched on the market every 3 months instead of the previous average of 12 months. At the same time, companies are looking to add intelligence to their products and allow end users to integrate that intelligence into their workflows. Digital twins and AR continue to be viewed as important differentiators that can enable benefits like better lifecycle management, training, and support, in addition to a clearer divide between competitors old and new.

Companies Using Digital Twins

This section outlines several companies putting digital twins to good use in their manufacturing operations.

Cummins

Cummins, an American multinational firm that manufactures engines, filtration, and power generation products, uses physics-based digital twins to improve product health management decisions. This reduces the cost and risk of unplanned downtime and improves product development processes.

Honeywell

Honeywell is using digital twins to improve product testing. One example is a valve in a Honeywell aircraft engine that regulates pressure in a pipe or duct. With digital modeling, engineers can vary the pressure and temperature of the valve to gauge its strength and discover failure points more quickly than they could by building and physically testing multiple valve configurations.

See how agricultural and heavy equipment manufacturer John Deere is leveraging digital twins in its facilities in this Analyst Insight: Digital Twins Are No Longer an Interesting Concept for John Deere, They Are Essential to Optimizing Facilities

Kaeser Kompressoren SE

Kaeser Kompressoren SE is one of the world’s leading manufacturers and providers of compressed air products and services. The company uses simulation-based digital twins to bolster the efficiency of its configuration, price, and quote processes by automating simulation tasks for technical verification of customer configurations. Benefits include:

- Reduced administrative overhead by removing manual interfaces between lines of business.

- Automated feasibility and applicability studies.

- The simulation of multiple “what-if” scenarios that compare costs with customer requirements.

With the digital twin deployment, Kaeser has shortened its sales cycle from weeks to hours.

VinFast

Vietnamese automotive manufacturer VinFast designed, built, and commissioned a plant in 21 months, a feat that takes other companies more than 5 years. VinFast leveraged a comprehensive digital twin across multiple domains—from mechanical and electrical software design through production, planning, and virtual commissioning of both the plant and the production lines within the factory. It is a state-of-the-art factory designed for expansion.

The automotive company uses digital twins not only to monitor and maintain all aspects of existing operations but perform scenario planning and simulations as it grows. Forthcoming technologies that will enable a true executable twin will come with the containerization of edge applications, use of additional contextual sensors (e.g., cameras with machine vision), and convergence of wireless connectivity and computing (e.g., 5G, Multi-Access Edge Computing (MEC), Time- Sensitive Networking (TSN)).

In January 2022, it was announced that VinFast vehicles will be cloud-connected via the Cerence Connected Vehicle Digital Twin (CCVDT) platform. Cerence’s AI-enabled digital twin solution allows the carmaker to develop a virtual replica of an entire car, which includes software, mechanics, electrics, and physical behavior.

To learn more about the use of digital twins in manufacturing download ABI Research’s Industrial Digital Twins: What’s New and What’s Next application analysis report.

This content is part of the company’s Industrial and Manufacturing research service, which includes research, data, and ABI Insights. Based on extensive primary interviews, Application Analysis reports present in-depth analysis on key market trends and factors for a specific technology.

Related Content:

- Creating a Digital Twin of Entire Facilities Enables Mars Inc.’s Staff to Meet Operational Challenges Head-on

- Manufacturing Platforms Underpinning Digital Twin Introductions

- Siemens’ Media and Analyst Conference Highlights and Key Takeaways: Digital Twin, SaaS, and Sustainability

- Digital Twins Take on the Supply Chain

![Heavy Industry Trends and the Key Role of Satellite Communications [Infographic and Webinar]](https://cdn2.abiresearch.com/static/blogs/trucks-at-mining-site.webp)