Although Network-as-a-Service (NaaS) is far from being well-established, Communication Service Providers (CSPs), such as telco and infrastructure providers, need to plan their next moves now if they want a slice of the potential US$75 billion market. NaaS is the logical evolution of enterprise networking in a world that shows a preference for dematerialization and enhanced user experiences. In this post, we define what NaaS is, explain how it's changing the telecommunications industry, and list 6 of the top NaaS providers that are targeting enterprise customers.

Defining Network-as-a-Service (NaaS)

A NaaS is a cloud-native network service model offered by CSPs, whereby enterprises keep hardware costs to a minimum as virtualization and software replace traditional network infrastructure. In a NaaS service model, enterprises are presented with a much more flexible platform that can be customized to a reasonable degree. Although a lot of CSPs market their services under the umbrella of NaaS, many simply provide managed network services like a Software-Defined Wide Area Network (SD-WAN), data transfer connectivity, security services, etc.

Network-as-a-Service (NaaS) delivers virtualized, Software-Defined Networking (SDN), and Application Programming Interface (API)-based operations to Wide Area Network (WAN) infrastructure, enabling enterprises or "clients" to "rent" network services from a cloud-native marketplace or ecosystem within an Operational Expenditure (OPEX)-based and flexible consumption model.

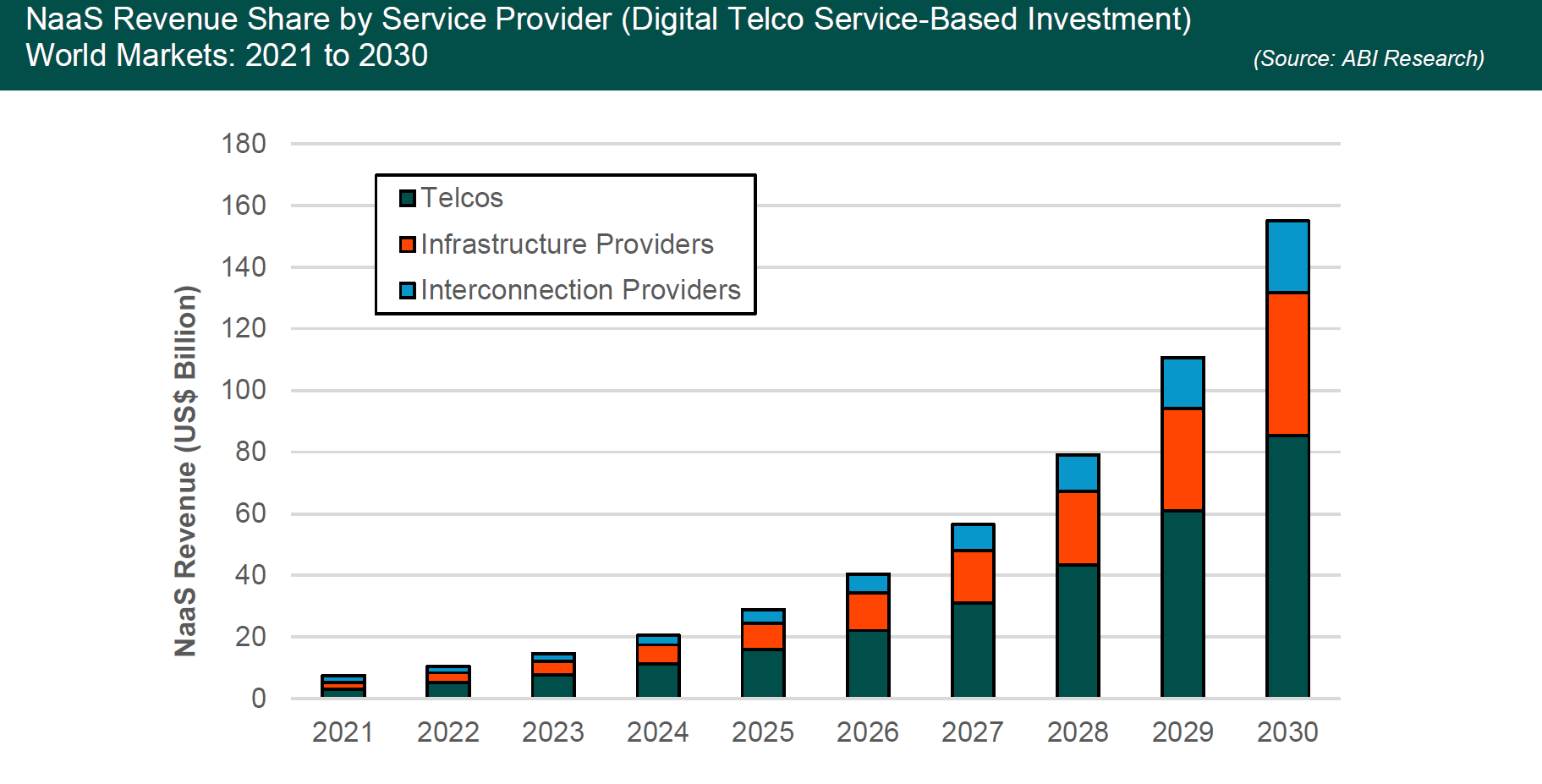

Telcos, interconnection providers, and infrastructure providers are the three main NaaS providers. Telcos already have the edge because of their dominance in the network market, brand awareness, and software know-how. Assuming that telcos get fully onboard with the NaaS model, they will account for more than half of all NaaS revenue (see the chart below to learn more).

But if telcos go the “dumb pipe” route, interconnection and infrastructure providers will fill the void.

Among startups, Small and Medium Enterprises (SMEs), and Multinational Corporations (MNCs), SMEs will adopt NaaS the most frequently, by a long shot. Although SMEs and startups will be close to parity in adoption rates until 2027, SMEs will separate from the other segments significantly by 2028. By 2030, SMEs will account for more than 6 out of 10 enterprise NaaS deployments, while startups and MNCs will account for 15% and 14%, respectively.

Reference the chart below for more insight into enterprise adoption of NaaS.

Why Capital-Strained Companies Will Cherish NaaS

Enterprises, especially startups and SMEs, are cautious about static network contracts given the volatility of world markets. That means network flexibility will be like gold to decision makers, as it gives them the ability to scale as demand fluctuates. Furthermore, cloud nativity and multi-cloud access, which are cornerstones of NaaS, reduce infrastructure costs and scalability.

As numerous software and tech startups come to the market, it creates a huge challenge for enterprises already struggling to acquire skilled IT workers. But a NaaS service model provides financial relief because it’s up to the CSP to manage network services. Because enterprises are essentially “renting” network infrastructure, Total Cost of Ownership (TCO) and Information Technology (IT) costs shift to the provider.

How Providers Can Build a NaaS

The transition from a traditional network to a NaaS is not an easy endeavor, as CSPs need to completely change old thinking habits and make technological leaps to get there. Here are the main ingredients that create a NaaS:

Network Virtualization

Network virtualization means replacing hardware with software and network features. With a fully virtualized network, services are software-defined—making it unnecessary for enterprises to invest heavily in on-premises hardware. Not only does a virtualized network bring greater agility and scalability, but it also introduces individual workloads to colocation data centers.

Software Delivery Network

In an SDN, managers control all of the company’s network intelligence in a central location by disconnecting the data plane from the control plane. Once the network is virtualized and focused on software, the SDN serves as a means of control.

Network Function Virtualization (NFV)

NFV takes on the role that traditional network hardware once had by using Virtual Machines (VMs). By separating services and hardware, CSPs can add new services dynamically and quickly, as well as automate network provisioning.

Open Application Programming Interfaces (APIs)

To develop the Flexible Consumption Model (FCM) that a NaaS needs, providers must sever Operations Support Systems/Business Support Systems (OSSs/BSSs) from what telco functions have historically entailed. To make this change, and gain greater control and visibility, providers should utilize Open APIs.

Artificial Intelligence Operations (AIOps)

Artificial Intelligence (AI) and related technologies (e.g., Machine Learning (ML) and Natural Language Processing (NLP)) can bring automation to a telco NaaS. In the services area, AIOps reduce manual operations, boost service availability, and reduce energy consumption, among other things. AIOps can also enable telcos to lessen their need to hire more IT and service employees.

Okay, now it’s time to take a look at some of the top NaaS providers on the market.

1. Verizon

The first NaaS provider on the list comes from a familiar name to everyone: Verizon. The New York-based telco company builds its NaaS solution on OpenStack, which allows the company to improve visibility and lessen network complexity for customers. Moreover, Verizon has the ability to upgrade network customizability. To promote connectivity openness and interoperability for customers in more than 120 countries, Verizon offers agnostic access from any carrier.

Verizon’s NaaS services involve Local Area Network (LAN) and Wide Area Network (WAN)-as-a-Service—utilizing SD-WAN, SASE, SDCampus, MEC, and digital service platforms within their SDN services. The company owns the underlying network framework, enabled by Azure and AWS cloud applications in a global private backbone. This provides them with greater autonomy over 5G networks with edge computing and LTE/broadband in a cost-effective way.

2. Telefónica

Virtual Private Networks (VPNs) are an integral piece of Telefónica’s network services. Through a global network of VPNs, the telco company facilitates connectivity between enterprises and public/private cloud networks under the WAN2Cloud product.

As pointed out in a recent ABI Insight, partnerships will be key to solving some enterprise network-as-a-service problems. And Telefónica is seemingly doing everything it can to win on this front.

At the forefront of Telefónica’s NaaS aspirations is its iFUSION project. In conjunction with intelligent automation software provider Blue Planet, Telefónica leverages SDN to transform networking and introduce automation. Other partnerships that signal the Spanish telco’s NaaS commitment include one with Pente and another with Equinix, and finally, an alliance with Vodaphone. The partnership with Pente will simplify 5G edge transformation, the Equinix partnership is aimed at delivering multi-cloud connectivity, and the alliance with Vodaphone is propelled by a desire to geographically expand 5G coverage.

3. Orange Business Services

The French NaaS provider Orange Business Services has been a pioneer in the NaaS market. The four key network services the telco company offers are bandwidth on demand, network on demand, managed SD-WAN, and flexible application access. Orange Business Services does a lot of work with TM Forum, highlighting the company’s standardization/openness ambitions.

But what business areas does Orange Business Services target?

Below are the three key focus areas for the company:

- Telco cloud infrastructure

- Expanding transition from legacy to next-generation Point of Presence (PoP)

- IT automation and APIs

Orange Business Services intends to use its telco cloud infrastructure for the rollout of AIOps and ML. These services can improve the customer experience through Quality of Service (QoS) and clearer network visibility.

4. Vodafone

Like Orange Business Services, Vodafone was one of the first telcos to breach the NaaS space. The UK-based telco provider’s NaaS genesis began in 2020, as an extension of its Technology 2025 program. As part of the shift to network-as-a-service, Vodafone has used 50 teams of network software providers.

Much of Vodafone’s NaaS efforts are focused on API standardization, which is one of its two major focuses (the other being IP monetization). Thus far, the company has 20 APIs cataloged, encompassing everything from roaming indicators to sophisticated fleet management suites.

Vodafone continues to widen its ecosystem partner network to create more standards and foster network flexibility. A recent partnership with Ericsson resulted in the UK’s very first on-demand 5G network slicing service. Considering that network slicing is key to further monetization, Vodafone is on the right path for improving NaaS solutions. In fact, ABI Research believes Vodafone is the most exciting NaaS provider given its commitment to enterprise solutions like API exposure and value-added services.

5. Deutsche Telekom

Using VMware’s Telco Cloud, Deutsche Telekom has been able to successfully build a cloud-native, flexible 5G network for customers. This managed network foundation, associated with Microsoft Azure, enables the telco to transform its network, simplify multi-cloud applications, and ensure that workloads can handle demand at scale.

Among Deutsche Telekom’s wide range of enterprise network solutions, cloud connectivity, software-defined networking, traditional enterprise networks, and network transport and backbone stand out. Moreover, the German telco company drives OSS/BSS innovation by taking advantage of the automation features of Netcracker.

Although Deutsche Telekom hasn’t arrived at a full-fledged NaaS solution quite yet, the telecommunications provider has sure put the necessary pieces together.

6. Tata Communications

Tata Communications, an India-based telco founded in 1986, is currently migrating to NaaS. For the time being, Tata Communications aims to push for NaaS by leveraging its existing network infrastructure competencies (including network engineering), as well as striking strategic partnerships. The company’s existing infrastructure includes WAN services End-to-End (E2E) Internet WAN in more than 120 countries and about 400 PoPs.

Currently, Tata Communication offers Tata NaaS, but the service is not as robust as it needs to be. From the point of view of ABI Research, Tata Communications will heavily depend on partnerships, including promising startups, to drive NaaS innovation. Ultimately, this business strategy is likely going to pay off for Tata Communications and the company’s golden child, the IZO product range, will reflect the need for OSSs/BSSs and automation.

Approaching NaaS the Right Way

Without a doubt, 5G network slicing is destined to be an influential factor in NaaS deployment given the low latency benefits that come with slicing. Providers need to start thinking about how to monetize network slicing and create a Slice-as-a-Service (SlaaS) model that provides slice/bandwidth-on-demand services to customers. But SlaaS is just one example of how enterprise demand will mold the network-as-a-service market. Telcos are used to being in charge and dictating where the industry goes, but now they need to put themselves in the shoes of enterprise leaders in order to conceptualize services and features.

Striking partnerships and possibly hiring new leadership are other actions that NaaS providers may want to explore. A more collaborative ecosystem—where telcos, network startups, and hyperscalers work toward common goals—will reduce the costs and risks associated with driving innovation in the NaaS market and reduce Time to Market (TTM). At the same time, filling leadership roles with people who have been in the enterprise space or SDN world will be a strategic advantage.

To learn more about the best approaches toward NaaS and formulating a long-run investment plan, download ABI Research’s Network-as-a-Service: Business, Operational, and Technological Strategies for Telco Digital Service Transformation research analysis. This report, which comes from the company’s Distributed & Edge Computing Research Service, also explores interconnection NaaS providers like Megaport, Packet Fabric, and Equinix.