As enterprises and consumers increasingly embrace automation, robotics research provides the intelligence that leaders need to make smarter, faster decisions. It bridges innovation with strategy, revealing where to invest and how to stay competitive.

Robotics research provides clarity into a rapidly evolving technology landscape. From the integration of Artificial Intelligence (AI) to the commercialization of humanoids, the robotics industry is rapidly evolving.

Without timely insight into these trends, there is a risk of missing out on the next big opportunity. Robotics Original Equipment Manufacturers (OEMs), System Integrators (SIs), investors, technology vendors, and end users must accurately anticipate how the industry is innovating. Gathering market intelligence positively impacts product portfolios, deployment tactics, and financial planning.

Robotics is still in the genesis stage, with just 28% of manufacturing firms having deployed robotics within their facilities. Therefore, there are still many unknowns that must be addressed before the mass adoption of robots.

ABI Research studies a broad range of topics in robotics, spanning safety, revenue forecasts, emerging use cases, vendor profiles, simulation tools, Physical AI, customer sentiment, and more. This article reviews our recent body of research into robotics.

Key Takeaways:

- Robotics research is redefining how organizations innovate, automate, and compete.

- Reliable data turns uncertainty into a clear, strategic direction.

- Stronger collaboration across the robotics ecosystem accelerates growth and adoption.

- Balancing innovation with safety, compliance, and responsible AI is critical for long-term success.

- Leaders who stay informed and act on emerging insights will set the pace for the next wave of automation.

Table of Contents

- Robotics Research Reports

- Robotics Research Presentations

- Robotics Market Data

- Robotics Competitive Benchmarks

What Is Robotics Research?

Robotics research is the study of robotics technologies, markets, and deployment practices. The way robotics are created and how customers use it is changing as advanced technologies become available and preferences evolve. Research plays a vital role in tracking robot form factors, enabling technologies, and assessing their impact on the commercial and industrial sectors.

Research also covers the companies involved in developing and implementing solutions. For example, ABI Research’s competitive rankings assess vendors’ product features, partner ecosystems, Go-to-Market (GTM) strategies, and other factors that determine their market positioning. These competitive assessments help robotics industry players identify threats, opportunities, and potential partnerships.

Data represent another core pillar for researching robotics technologies. They quantify the market opportunity for specific robotics form factors across specific regions, industries, and applications. Put simply, data-driven research helps predict where the robotics landscape is headed.

By researching the evolution of robotics, organizations can enhance their capabilities in:

- Product design

- Competitive intelligence

- Marketing

- Commercialization roadmaps

- Investment priorities

- Implementation

Robotics Research Reports

Open-Source Framework Robot Operating Systems (ROS)

What Is It?

A comprehensive research report exploring the widespread use of the Robot Operating System (ROS). ROS is the open-source middleware powering nearly half of today’s Autonomous Mobile Robots (AMRs). The ABI Research analyst team unpacks the core value of the ROS in robotics product development, outlines the differences across ROS versions, and discusses standardization progress.

Adoption hindrances are analyzed, too. Senior Analyst George Chowdhury says, "Internally, the main barriers to ROS adoption are its non-standardized and volunteer-dependent nature. Manufacturing and warehousing robots are the two biggest robot-adopting market verticals today.”

The report also examines notable vendors like NVIDIA, Amazon Web Services (AWS), AMD, Qualcomm, and others.

How Does This Research Support the Robotics Industry?

This research gives robotics developers and product managers the clarity needed to optimize their product strategy. Original Equipment Manufacturers (OEMs) use professional perspectives to compare different types of ROSs, gauge commercial readiness, and measure the impact of open-source models.

Finally, the study’s company profiling reveals the vendors and alliances pushing ROSs toward enterprise-grade adoption. That way, industry stakeholders can monitor the competition and explore potential partnership opportunities.

Robotics Software: Simulation, Virtual Commissioning, and Emerging Innovation

What Is It?

This market research report explores the growing role of simulation software in robotics. It covers key areas like virtual commissioning, synthetic data generation, and digital twins. Furthermore, readers learn how cloud, on-premises, and offline simulation methods are being used to improve robot design, training, and deployment.

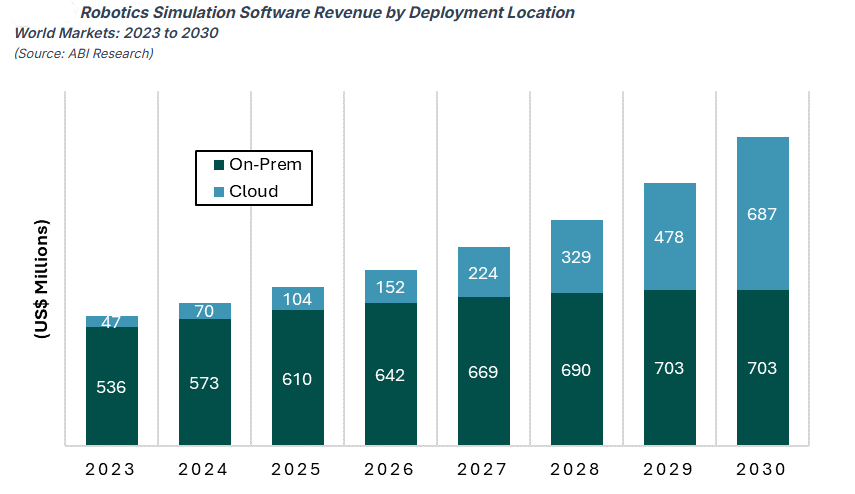

Market forecasts are shared in this report as well. ABI Research forecasts robotics simulation software spending to more than double from US$714 million in 2025 to US$1.4 billion by 2030.

How Does This Research Support the Robotics Industry?

By providing robotics vendors and SIs with a practical guide to choosing and using advanced simulation tools. The report highlights which features matter most, where AI fits in, which solutions are currently available, and how virtual commissioning can reduce rollout delays.

Robotics developers and implementers can use this research to make smarter investments in simulation and build better robots, faster. On the supply side, simulation vendors come away with revenue projections and identify adoption drivers.

One notable trend revealed from this report is the rapid shift toward cloud-based robotics simulation tools. Therefore, customers increasingly prefer scalable, software-based solutions.

Robotics Functional Safety

What Is It?

This report analyzes the changing landscape of robotics functional safety, including updates to ISO 10218 and shifts in software and hardware expectations. Key themes include the role of Real-Time Operating Systems (RTOSs), collaborative robot safety, and the growing importance of cybersecurity. Additionally, startup and leading vendor profiles are included in the report to identify innovators in robotics safety.

How Does This Research Support the Robotics Industry?

Safety regulations are evolving, and this research helps robotics vendors and integrators prepare. Analyst findings illustrate how changes in standards affect robot design, what software features customers expect, and which companies are shaping the future of safe automation.

Robotics Research Presentations

Industrial and Manufacturing Survey 2H 2024/1H 2025: Robotics

What Is It?

This PowerPoint slide deck summarizes ABI Research’s most recent Industrial and Manufacturing Survey, with a special focus on robotics adoption in the manufacturing sector. Deploying industrial robots was the second-biggest investment priority for manufacturers, as organizations realize the competitive edge gained by automation.

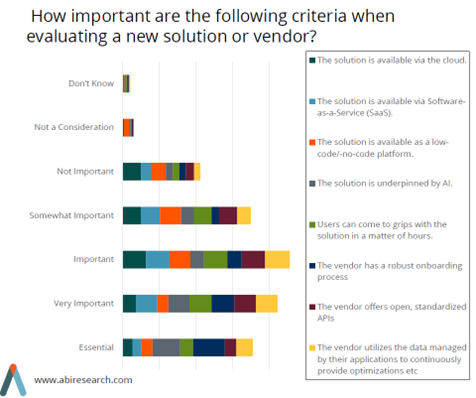

Readers can expect findings on robotics investment timelines, productivity expectations, top challenges, and which features manufacturers value most.

Beyond the actual survey responses, the presentation includes Senior Analyst George Chowdhury’s interpretation of the findings.

How Does This Research Support the Robotics Industry?

It provides robotics vendors and partners with the customer feedback required to optimize product development. This data-backed revelation of adoption patterns, deployment roadblocks, and investment priorities helps vendors guide messaging, improve features, and align GTM timing. For example, the survey found that manufacturers increasingly prefer Software-as-a-Service (SaaS)-based, low/no-code products with AI integrations.

Robotics Market Trends

What Is It?

A trend analysis delivering clarity into the current robotics market and its near-term outlook. It covers multiple areas, including drones, humanoids, simulation software, collaborative robots, and AI integration. With this research, key decision makers obtain expert foresight on product trends, funding levels, and popular form factors.

In the report, Chowdhury cautions about the risk to incumbent vendors in the manufacturing sector. “Manufacturing verticals (automotive and other heavy industries) are dominated by legacy players ABB, FANUC, KUKA, etc. “ He continues, “A lack of focus on AI and innovation may jeopardize the incumbents’ competitive advantages as new robotics markets materialize.”

How Does This Research Support the Robotics Industry?

It helps ensure that vendors, investors, and product teams stay in tune with the broader robotics landscape. The presentation informs them of where market growth is happening, what risks need attention, and which enabling technologies are gaining traction.

Product development leaders can use this trend analysis to align robotic solutions with industry trajectory. Meanwhile, senior-level executives can assess forward-looking startups ripe for collaboration and understand robotics adoption hurdles.

The Landscape of Physical AI in Industrial and Collaborative Robotics

What Is It?

This research presentation evaluates the impact of Physical AI on industrial and collaborative robotics. The analyst team covers everything from emerging Agentic AI and world models to the evolving role of vision hardware and digital twins.

The presentation maps AI-powered robotics maturity across industrial environments. As a result, companies pinpoint which features are enterprise-ready and which remain in the Research and Development (R&D) phase.

How Does This Research Support the Robotics Industry?

Because robotics companies can benchmark their AI maturity against the broader industry. Robotics stakeholders such as executives, strategists, and venture capitalists can see what AI innovation looks like and identify the models and vendors driving solution development.

For instance, there are underlying differences between NVIDIA’s GR00T foundation model, Google DeepMind (RT-2), and models offered by startups like Physical Intelligence and Skild. These differences must be carefully considered when integrating Physical AI into robotic products.

Robotics Market Data

Commercial and Industrial Robotics

What Is It?

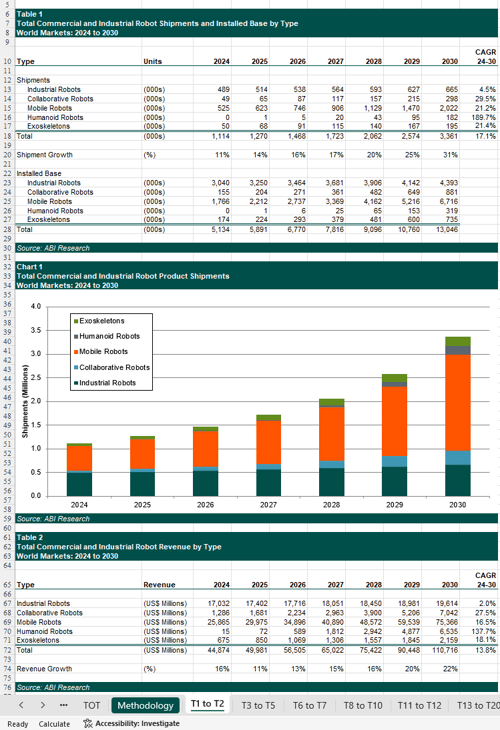

This market data (MD) gives a detailed look at the global commercial and industrial robotics market. Revenue, shipment, Average Selling Price (ASP), and installed base forecasts are provided across five robot types: industrial, mobile, collaborative, humanoid, and exoskeleton.

The data are segmented by market vertical, use case, and region. They also include key insights on industrial robot market share leaders such as FANUC, ABB, Yaskawa, and KUKA.

On a more granular level, the MD includes the outlook for specific robotic components such as mechanical arms, sensors, cellular connectivity, and processors.

Below is a high-level sample of the forecasts contained within this research.

Table 1: Total Commercial and Industrial Robot Shipments by Type, 2024 to 2031

(Source: ABI Research)

| Robotic Type | Shipment Units | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 |

| Industrial Robots | (000s) | 489.2 | 514.2 | 538.5 | 564.2 | 592.7 | 626.6 | 665.2 | 4% |

| Collaborative Robots | (000s) | 48.7 | 64.6 | 87.2 | 117.2 | 156.8 | 214.9 | 297.8 | 30% |

| Mobile Robots | (000s) | 525.3 | 622.8 | 746.2 | 906.1 | 1,129.5 | 1,470.1 | 2,022.1 | 21% |

| Humanoid Robots | (000s) | 0.1 | 0.6 | 5.2 | 19.9 | 42.6 | 94.6 | 181.5 | 190% |

| Exoskeletons | (000s) | 50.2 | 67.9 | 91.2 | 115.2 | 140.2 | 167.4 | 194.8 | 21% |

| Total | (000s) | 1,113.5 | 1,270.0 | 1,468.2 | 1,722.6 | 2,061.8 | 2,573.7 | 3,361.5 | 17% |

And a sample of what the excel file looks like in the screenshot below.

How Does This Research Support the Robotics Industry?

Granular market forecasts assist the industry with planning its next moves more effectively. By revealing where robotics market growth is coming from, what segments drive demand, and which regions lead adoption, decision-makers can allocate resources to the right places.

The broader robotics industry can use these data to shape marketing outreach and align the GTM strategy with high-growth segments. In other words, it empowers organizations to take business action based on evidence.

The Small Unmanned Aerial System Ecosystem

What Is It?

A market breakdown of small drone shipments and revenue across military/defense, civil, commercial, and prosumer segments. Forecasts span from 2023 to 2030, with deep granularity by application, region, and hardware type.

According to ABI Research, the global small Unmanned Aerial System (sUAS) market will more than double in size between 2025 and 2030, reaching US$123 billion. There is a stark contrast between segments, with military accounting for more than 70% of market revenue at the top level and prosumer accounting for about 4% to 7% on the bottom level. However, the cheaper prosumer and commercial-grade drones make up most of the shipments.

The datasets also contain attach rates for enabling technologies like sensors and processors, connectivity trends, and vendor market share across flight and controller types.

How Does This Research Support the Robotics Industry?

By advising drone makers and their partners on which segments generate the most revenue. Vertical-level analyses and shipment data fuel the direction that the drone industry will take.

For software vendors and drone service providers, this quantitative assessment is key to aligning product roadmaps with key use cases and regional growth. For example, China and Japan are the key opportunities in Asia-Pacific.

Table 2: Total Cumulative sUAS Revenue by Region/Country, 2023 to 2030

(Source: ABI Research)

|

Region/Country |

Revenue |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

CAGR |

|

North America |

(US$ Millions) |

50,567 |

67,826 |

89,051 |

115,698 |

147,911 |

186,964 |

232,697 |

285,070 |

21.2% |

|

United States |

(US$ Millions) |

46,741 |

62,851 |

82,608 |

107,445 |

137,201 |

173,229 |

215,033 |

262,901 |

21.2% |

|

- |

||||||||||

|

Europe |

(US$ Millions) |

23,665 |

28,398 |

34,024 |

41,215 |

50,310 |

62,005 |

75,778 |

91,388 |

16.2% |

|

- |

||||||||||

|

Asia-Pacific |

(US$ Millions) |

32,630 |

45,399 |

60,896 |

80,780 |

105,304 |

135,447 |

170,871 |

211,278 |

23.1% |

|

China |

(US$ Millions) |

19,915 |

28,998 |

40,121 |

54,389 |

71,757 |

93,083 |

118,135 |

146,709 |

24.8% |

|

Japan |

(US$ Millions) |

8,254 |

9,476 |

10,947 |

12,992 |

15,487 |

18,521 |

22,048 |

26,065 |

13.6% |

|

Others |

(US$ Millions) |

4,461 |

6,924 |

9,829 |

13,400 |

18,059 |

23,843 |

30,688 |

38,504 |

27.1% |

|

- |

||||||||||

|

Rest of the World |

(US$ Millions) |

12,561 |

17,890 |

24,358 |

31,767 |

40,832 |

51,838 |

64,790 |

79,571 |

22.8% |

|

Total |

(US$ Millions) |

119,424 |

159,512 |

208,330 |

269,460 |

344,357 |

436,254 |

544,136 |

667,306 |

21.1% |

Robotics Functional Safety Forecasts

What Is It?

A market projection for the robotics functional safety landscape from 2025 to 2030. It distills revenue and shipment forecasts across key components, including safety Programmable Logic Controllers (PLCs), safety controllers, and Light Detection and Ranging (LiDAR) safety fences. A key finding is that North America and the Middle East & Africa outpace the global growth rate for LiDAR safety fences.

Vendor shares for the emerging Real-Time Operating System (RTOS) market are also found in this research.

How Does This Research Support the Robotics Industry?

It gives industry players a window into where the robotics safety market is heading and how standards like ISO 10218-1:2025 are impacting adoption. Regional breakdowns and product-level forecasts support vendors in meeting anticipated demand across the hardware and software domains.

The ABI Research Robotics analyst team identifies hardware manufacturers, system integrators, automation specialists, semiconductors, and sensor vendors as the companies that benefit from this research.

Robotics Competitive Benchmarks

Offline Programming for Robotics Software in Industrial Manufacturing

What Is It?

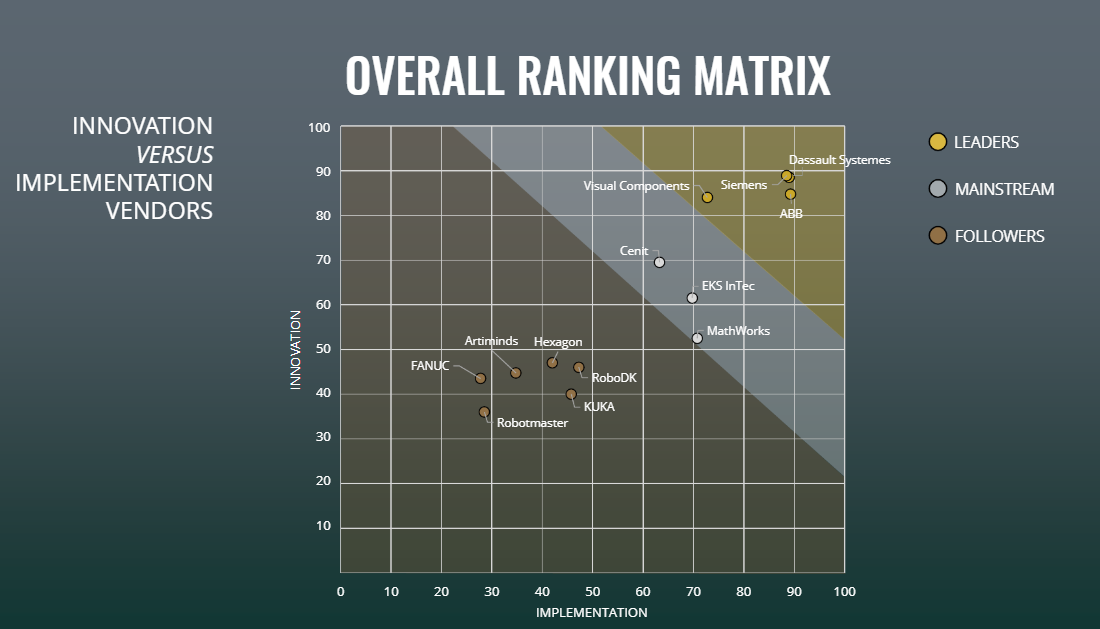

A competitive assessment that ranks 13 vendors developing Offline Programming (OLP) software for robots in manufacturing. Companies are assessed on both innovation and implementation strengths, such as flexibility, customization, simulation capabilities, ease of use, post-sale support, and advanced features.

Dassault Systèmes led the way, solidified by its robust DELMIA and 3DEXPERIENCE offerings. Siemens, ABB, and Visual Components emerged as other leaders in the benchmark.

How Does This Research Support the Robotics Industry?

This research product is tailor-made for robotics integrators and OEMs looking to evaluate the simulation tools that improve programming efficiency and reduce robot downtime. The benchmark shows product teams how their peers are evolving and reveals important features to focus on.

This study is also useful for manufacturing firms interested in deploying robotics simulation software. In-depth vendor profiles enable Chief Technology Officers (CTOs) to discern between the various solutions available to them.

Autonomous Forklift System Vendors

What Is It?

It’s a competitive ranking that critiques 16 autonomous forklift vendors. Each company is scored on criteria such as vehicle form factors, navigation, fleet management, integration, maintenance, revenue, customer references, and regional presence.

There is a detailed analysis of vendors’ distributor networks and GTM execution. According to the benchmark, French company Baylo is the top autonomous forklift system developer. Other leaders include Teradyne, Seegrid, and SEER.

How Does This Research Support the Robotics Industry?

This research permits SIs, end users, and robotics vendors to compare self-driving forklift solutions and identify those that are truly scalable. It offers a deep look at each vendor’s forklift technology and market approach, making it easier for organizations to choose the right partner and invest wisely.

The report also highlights where each vendor excels. For example, SEER stands out for its hardware innovation, such as its Arm-based controller. Meanwhile, Vecna Robotics gains an edge through its strong software capabilities.

Connect With ABI Research’s Robotics Experts

Robotics development is accelerating at lightning speed. Comprehensive research ensures that stakeholders stay in step with the latest trends across safety, ecosystem evolution, and innovative technologies.

ABI Research’s latest findings highlight the leading vendors, customer pain points, and digital tools defining the robotics landscape. By incorporating this intelligence into organizational decision-making, companies can quickly adapt to the biggest shifts.

In addition to research studies, our Industrial, Collaborative & Commercial Robotics analyst team provides advisory services to drive successful business outcomes. Our research also fuels thought leadership marketing campaigns through whitepapers, webinars, executive briefs, and third-party validation. Reach out to a member of our team today to learn how we can help your organization and get a glimpse into our upcoming robotics research.

Meet the ABI Research Robotics Analyst Team

Malik Saadi, Vice President of Strategic Technologies

Research Focus: Malik Kamal-Saadi is head of the Strategic Technology Group at ABI Research focusing on transformative technologies and innovation across Telecommunications and Connectivity Technologies, Enterprise IT and OT Technologies, Cloud, Edge, and Distributed Computing, Artificial Intelligence, Data Warehouses, Robotics and Automation, and other adjacent technologies. In his role, Malik leads ABI Research’s thought leadership, consultancy services, syndicated services, strategic positioning, market forecasts, competitive assessments, and market analysis.

George Chowdhury, Senior Analyst, Robotics

Research Focus: George Chowdhury is a Senior Analyst on the Strategic Technologies team at ABI Research. George provides research, analysis, and insight into industrial, collaborative, and commercial robotics, focusing on robotic technologies that interact with and augment the human workforce in line with industrial transformation.

Frequently Asked Questions

What is robotics research?

Robotics research is the study of robotics technologies, markets, and deployment practices. It examines how robots are designed, how they’re used across industries, and how trends like AI, safety standards, and new form factors shape commercial and industrial adoption. This research helps organizations improve product design, strengthen competitive intelligence, guide commercialization, and make smarter investment decisions.

Which robotics research topics does ABI Research cover?

ABI Research covers a wide range of robotics topics, including safety standards, simulation software, ROS adoption, AI-powered robotics, Physical AI, vendor benchmarking, market sizing, use-case evolution, and customer sentiment. The research spans industrial robots, collaborative robots, mobile robots, humanoids, exoskeletons, drones, and the enabling technologies that support them.

What are the biggest trends in the industrial robotics market?

The industrial robotics market is being shaped by rising automation demand, the rapid integration of AI, and growing interest in humanoids and simulation tools. Manufacturers increasingly want SaaS-based, low/no-code robot software with AI features, while legacy vendors face pressure to innovate or risk losing ground. Safety, compliance, and cloud-based simulation are also becoming major priorities as organizations scale robotics deployments.