Author: Mark Lydon, Senior Content Marketing Manager

Startups succeed when they deeply understand their customers, competitors, and market opportunities. This guide shares a clear seven-step approach to conducting market research for startups. With examples and actionable insights, it shows how research can strengthen strategy, product development, and investor pitches.

Startups are inherently vulnerable, with most going out of business between 2 and 5 years. From securing seed money to educating new audiences, founders navigate a delicate path. Market research can help drive early-stage growth by uncovering what customers truly want and identifying the most promising opportunities.

Without research, startups risk experiencing a product-market misfit. Competitive benchmarking, trend analysis, and demand forecasting are the pillars of entrepreneurial success. Not only does market research enable startups to resonate with customers, but it also helps make more confident pitches to much-needed investors.

But how do you conduct market research as a startup? This guide walks you through seven key steps in the process, accompanied by relevant examples.

Key Takeaways:

- Market research helps startups avoid product-market misfit. It reveals customer needs, market gaps, and competitive pressures so founders can make smarter product and go-to-market decisions.

- Early-stage research strengthens investor pitches. Data on market size, customer pain points, and competitive dynamics gives founders the evidence required to win funding.

- Effective startup research blends secondary data with direct customer input. This mix validates market trends, uncovers unmet needs, and guides positioning, pricing, and product design.

- Research should guide ongoing strategy, not just early decisions. Insights from pilots, ecosystem mapping, and market forecasts help startups refine messaging, secure partners, and scale with confidence.

Learn how ABI Research's technology experts help catapult startups from unknowns to industry thought leaders.

Why Do Startups Need Market Research?

Most early-stage startups face an uphill battle out of the gate. Market incumbents have established dominance, and other companies may have a head start on product innovation. Some of the most common challenges that entrepreneurs relay to ABI Research include:

- Market Validation Uncertainty: Difficulty confirming market fit and demand for a new business idea.

- Credibility Challenges: Hard to establish trust and thought leadership as a new market entrant.

- Limited Strategic Bandwidth: Founders need fast, expert input, but lack internal resources or time for deep research.

- Funding Pressure: Need to demonstrate market opportunity and competitive advantage to investors quickly.

- Lack of Ecosystem Access: Difficulty connecting with relevant partners, customers, or strategic collaborators.

- Go-to-Market Clarity Gaps: Uncertainty about positioning, timing, and optimal routes to market.

Market research is important for startups because it identifies niche gaps to target, shifts in customer preferences, key competitors, and future revenue projections. This information can be used to optimize product strategy and allocate marketing/sales resources to the right areas.

The top reason why startups fail is a poor product-market fit. Research confirms there is a need for a specific solution. Moreover, evidence-based assessments enable startup founders to make a more compelling pitch to investors.

(Source: Exploding Topics)

How to Conduct Market Research for a Startup: 7 Key Steps

Step 1: Define What You Need to Learn

Start with the decisions you need to make in the near term. Good market research begins with identifying specific internal knowledge gaps tied to executive strategy, marketing, product, or fundraising.

Frame your research around goals such as:

- Determining if there is a product-market fit

- Understanding your target customers' unmet needs

- Identifying your Total Addressable Market (TAM)

- Pinpointing key differentiation areas

- Validating your Go-to-Market (GTM) strategy

- Assessing your competitors’ strengths and weaknesses

Example

An Internet of Things (IoT) startup wants to target supply chain stakeholders, but it lacks in-depth knowledge of the industry. Before conducting market research, the company should devise questions such as:

- Which supply chain challenges can be solved by IoT technology?

- Where do we currently lack credibility in the market?

- Which megatrends are currently impacting supply chain leaders?

- How big is the opportunity with the food & beverage segment?

- When should we launch our next product?

- Are there any government regulations that affect us?

Step 2: Size the Market and Study the Competitive Landscape

Next, startups should use secondary research to answer big-picture questions. Analyst reports, investor briefings, regulatory filings, and media coverage can help you:

- Quantify your target market size

- Identify which players are leading

- Reveal where market gaps exist

Startups are often resource-strained, making it difficult to capture comprehensive market intelligence alone. There is a plethora of data out there published by third parties. Entrepreneurs must be as resourceful as possible, so secondary research cannot be ignored.

While publicly available data, such as government data banks, is a good starting point, it only goes so deep. The granular analyses required for startup growth come from research firms that study niche markets in great detail.

Taking things a step further, some advisory firms like ABI Research regularly publish competitive rankings. These long-form reports compare the top market players in terms of innovation and implementation. Using these findings, startup founders can learn which tactics transfer to business success and the product features customers want.

Example

For instance, a robotics startup might need to quantify the future outlook for the humanoid segment. Organizational leaders can view global robotics market data to learn that humanoids are the fastest-growing robotic segment through 2030 (a 137% Compound Annual Growth Rate (CAGR)). Moreover, they will realize that entertainment-based applications are the top use case in the near term, before the market broadens.

This research validates that there is, indeed, a growing appetite for humanoids. From there, the startup has a better perception of where humanoid demand is being driven and when market growth will accelerate.

Step 3: Map the Ecosystem Around You

Startups rarely grow in isolation. To succeed, you will likely need the support or cooperation of a wider ecosystem.

It’s easy to focus too much on the customer. Of course, the customer is the main priority, but in many cases, other entities hold the keys to accessing those customers. Regulatory groups, standardization bodies, system integrators, resellers, and supply chain channels are all vital ecosystem players for startups to consider.

Ecosystem mapping should include:

- Potential strategic partners or integration pathways

- Industry groups or events where your customers and partners meet

- Technology platforms you may need to build on or alongside

- Regulatory and standardization bodies at the local and national level

By identifying the broader ecosystem early on, a startup can avoid any growth-inhibiting surprises later. Mapping the ecosystem can also help founders prioritize certain segments based on regulatory pressures and technical standards.

Example

The GSMA’s SGP.32 standard will have a major impact across the Embedded Subscriber Identity Module (eSIM) landscape. If you’re a startup in the connectivity space, you might wonder how you can use SGP.32 to your advantage. The market research report, Understanding the eSIM SGP.32 Timeline and Opportunity, has the answers. It provides forecasts for SGP.32 eSIM downloads, lists the top applications, and shares the benefits for service providers.

This research analysis empowers the connectivity startup to pivot its product strategy and helps it gain an early-mover advantage.

Step 4: Talk to Your Target Market

No amount of desktop research can replace direct feedback from your target audience. Interviews, discovery calls, and surveys allow startups to pressure-test their assumptions. AI tools can quickly summarize respondent feedback and identify recurring themes.

By talking to your target audience, you can discover which challenges customers face. You can also pinpoint the product features they prioritize. These research findings are essential to tailoring products to market demands. Moreover, content marketing teams can start focusing on the topics that matter the most.

When talking to your target market and/or conducting surveys, focus on learning rather than pitching. This phase of market research is not designed to convince customers about your product. Instead, the goal is to peel the layers back on how prospects see the problem and what they have already tried.

Example

For instance, if a cloud computing startup were formed in 2025, it would need to scope out a rapidly evolving industry. From hybrid cloud infrastructure to Artificial Intelligence (AI)-accelerated platforms, the market is undergoing a seismic shift in how enterprise Information Technology (IT) teams are responding.

The company could either interview IT leaders about their challenges and priorities or leverage third-party survey results.

For the latter, ABI Research surveyed 25 enterprise IT professionals in its whitepaper, Enterprise IT Leadership Insights: AI and Data Center Infrastructure Investment Priorities. The survey found that technology concerns like legacy infrastructure, data hygiene, security, and integration complexity are key concerns. This research tells the startup that its target audience has a growing preference for flexible, AI-ready cloud solutions that can protect against modern cyberthreats. These topics should be emphasized during sales calls and solution development.

Step 5: Shape and Test Your Market Positioning

Now that you understand the landscape and your customer’s mindset, you need to position your startup in a way that clearly explains what makes your brand different and why that matters.

At this stage, your goal is to distill a clear, compelling message that differentiates your product from competitors while resonating with customers. After conducting competitive analysis, identify the white space you want to own.

Once you have a working draft of your positioning, test it. See if your core value proposition sticks with customers. This can be done at trade shows, industry events, and through marketing. You may find that your company is focusing too heavily on one feature while overlooking the one that customers value most.

Positioning should never be static. It evolves as you gain more insight into your market and your buyer. By shaping and testing early, you avoid wasting precious time and resources on messaging that misses the mark. In other words, this research phase helps startups build traction around what truly matters to their audience.

Example

A building management software startup may build its market positioning around sustainability regulation compliance. While Environmental, Social, and Governance (ESG) goals are increasingly important to enterprises, that’s more of a “nice-to-have” for many. The startup founders learn that customers care more about the energy savings benefits.

Upon discovering this insight, the company highlights cost savings within blogs, whitepapers, email outreach, webinars, and other marketing assets. Moreover, it begins allocating more development time and resources toward power conservation. This way, the startup aligns its messaging with what motivates building managers to make a purchase.

Step 6: Validate Demand Through Pilots or Early Access

Once your positioning is clear, the next step is to observe how the market actually responds. This can happen through early pilots, limited beta programs, or even one-off customer projects.

Use this research phase to refine both your product and your messaging.

How do customers feel about your pricing model? Is your product easy to use? Does it seamlessly integrate with existing systems?

Be sure to take note of what early users like and dislike.

You should document outcomes to gauge market success. These revelations will fuel meaningful conversations with investors, partners, and future customer bases.

Example

Did you know that Instagram was originally a location-based social networking app called Burbn? It allowed users to do check-ins, make plans, and earn “points.” But after analyzing early user data and feedback, co-founders Kevin Systrom and Mike Krieger quickly realized that people overwhelmingly cared more about photo sharing. Other features were mostly untouched. In fact, users found the interface too cluttered, resulting in a messy experience.

This was when Systrom and Krieger made the pivot to the simplistic, photo-sharing app we have today. Without researching what early users thought about the product, Instagram would not have 2 billion monthly active users.

Step 7: Use Research to Guide Funding and Strategic Decisions

As an entrepreneur, I’m sure you’re familiar with the show Shark Tank. I can’t count how many times I’ve watched a founder lose a deal because they didn’t come prepared with the numbers. Market research ensures you are always prepared going into a pitch.

Proving there is demand for your product is essential to securing Venture Capital (VC) funds. Investors demand confidence that your startup is making decisions based on hard data and future-readiness. Your market research helps tell a compelling story, backed by revenue forecasts, expert quotes, and strategic logic.

You might reference a specific gap in the market that came up repeatedly in interviews with research analysts. Or you can share a chart that projects the market outlook for your product over the next decade.

To sum up, startup founders cannot hiccup when asked the tough questions. By presenting a business idea that is aligned with market trends, they can expand their investor network.

Example

Neocloud companies are disrupting the entire AI and data center value chain. Most of these companies are startups relying on VC funding. ABI Research has published several reports analyzing this emerging technology landscape.

A neocloud could leverage our research studies to show investors what the Graphics Processing Unit-as-a-Service (GPUaaS) opportunity is for the market. They can emphasize the enterprise shift from hyperscalers to smaller, more niche neoclouds. Reasons include transparent pricing, regional compliance, and flexibility.

Furthermore, research analysts evaluate how each neocloud differentiates itself from the competition. Together, this market intelligence supports neocloud startups’ efforts in generating new sources of cash flow.

Bonus: Publish Research-Driven Marketing Content

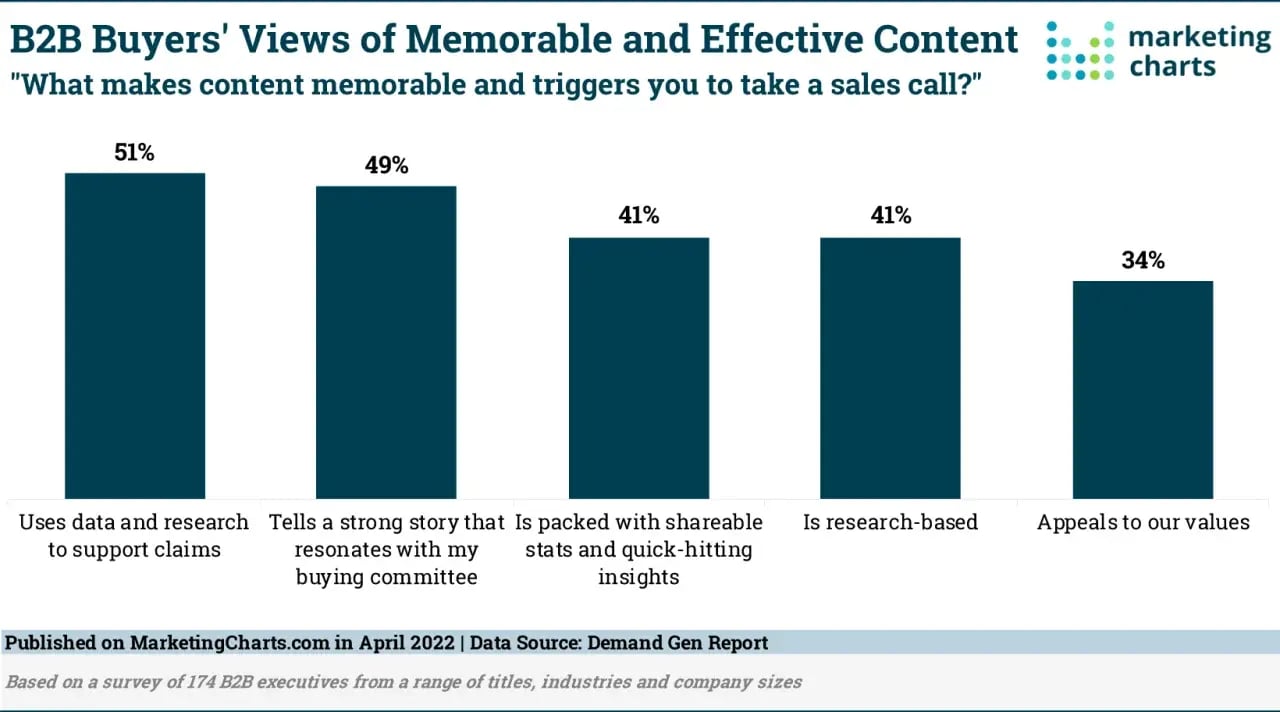

Finally, startups should leverage research to fuel their content marketing strategy. Business-to-Business (B2B) buyers want to read content that is expert-based and data-driven. Case in point, a Demand Gen report finds that B2B buyers view data and research-driven content as the most memorable.

Market research findings, such as shipment figures or analyst commentary, can be injected directly into whitepapers, articles, infographics, slide decks, and other marketing assets. Visualizing key stats boosts the likelihood that buyers will share content with colleagues.

Example

To address the post & parcel market, IoT startup Wiliot sponsored a comprehensive whitepaper from ABI Research supply chain tech analysts Adhish Luitel and Ryan Wiggin. The paper delves deep into the broader market using charts and trend analysis. It identifies challenges such as declining carrier parcel volume, regulatory pressure, and lost assets.

International Trade Administration (ITA) data on e-commerce revenue visualizes the rapid growth in online sales. This research is directly tied to the growing need for end-to-end supply chain tracking solutions. Another stat on estimated losses in missing containers is cited within the whitepaper.

These research-backed findings help educate Wiliot’s target firmographic with facts, not conjecture. From there, the company’s ambient IoT technology is presented as the solution to the problem.

Conclusion

Conducting market research empowers startups to act based on data. It provides a window into customer sentiment and competitor activities, driving sound business decisions.

Many entrepreneurs believed they had the perfect business idea, only to find out they were wrong. In some cases, there is simply no demand for the product. In other cases, a startup quickly runs into issues around messaging, competitive dynamics, or regulations. To avoid early-stage growth roadblocks, founders must possess a comprehensive study of their entire target market. This can be challenging with limited headcount and a lack of accessible data.

Some of the biggest global brands had to make early pivots to reach the heights at which they find themselves today. A technology market research firm like ABI Research provides the intelligence that startups need to build agility into their executive DNA. In addition to research reports and technology advisory, we build thought leadership content to educate your customer personas.

Talk to a member of our team today to learn how our research can fuel your technology startup’s GTM strategy and amplify your presence in the right channels.

Frequently Asked Questions

How do you do market research for a startup?

Startups conduct market research by following a clear process: defining what they need to learn, sizing the market, mapping the ecosystem, talking to customers, shaping positioning, running pilots, and using insights to guide funding decisions. This mix of secondary research and direct customer feedback helps founders validate demand, avoid product-market misfit, and make smarter strategic decisions.

What are examples of startup market research?

Examples include market sizing using analyst reports, competitive benchmarking, customer interviews, surveys, early pilot programs, and ecosystem mapping. Startups may also test messaging at trade shows, run beta programs, or use research-driven content to educate customers and support investor pitches.

What questions should you ask when conducting market research for a startup?

Startups should ask questions such as the following when doing market research:

- Who are our target customers and what problems do they face?

- How big is our Total Addressable Market (TAM)?

- Who are the key competitors to monitor?

- What features do users value most?

- What gaps exist in the market?

- How should we position and price our product?