Energy market intelligence provides the insight needed for companies to fend off competitive threats and adapt to the latest industry trends. The energy market is navigating turbulent waters, contending with rising costs, increased demand for renewables, and the urgent need to digitally transform. Adding to this, Artificial Intelligence (AI) data centers are consuming unprecedented amounts of electricity.

To cut carbon footprints and reduce energy costs, utilities, facility managers, oil & gas providers, and other energy stakeholders are turning to a variety of innovative solutions. Not only is there an opportunity for the energy sector to turn challenges into new profits, but also for technology vendors to acquire new customers.

But which technologies are dominating conversations? Are there any regional differences in renewable capacity? What strategies and solutions will bridge the energy sector from fossil fuels to net zero?

To demystify the biggest trends, ABI Research’s Smart Energy team shares its latest energy market intelligence offerings. We also explain how key decision makers across the industry can use market intelligence to achieve their strategic goals.

Table of Contents:

- Closing the Gap Between Data Center Expansion and Electricity Grid Limitations

- Energy Grid Digitalization

- Small Modular Reactors (SMRs) – Technologies, Applications, and Use Cases

- Energy Flexibility Trading for Utilities, Industries, and Enterprises

- Energy Management Software for Buildings and Industrials

- Smart Energy Metadata

- Analyst Insights

Closing the Gap Between Data Center Expansion and Electricity Grid Limitations

What is it?

A long-form assessment on the mounting disconnect between expanding data center energy demand and aging grid infrastructure. Hyperscalers and AI end users are consuming never-before-seen levels of energy. This poses a huge challenge both in terms of business continuity and sustainability.

Potential solutions include, but are not limited to:

- Distributed data centers

- Grid digitalization and automation to unlock existing grid capacity

- On-site nuclear energy in the form of Small Modular Reactors (SMRs)

- Improved grid planning and accelerated infrastructure implementation via digital, energy-efficient liquid cooling

- Repurposing heat generated by data centers for district heating

The efforts of companies like Schneider Electric, GE Vernova, and Siemens are discussed in the report.

Key insight: The main challenge is that AI moves quickly, while the energy sector is slow to upgrade its infrastructure. Data center operators and utilities must cooperate with each other to meet rapidly growing energy demands.

How does this market intelligence help the energy sector?

The report identifies which technologies and strategies can ease grid congestion, how to align planning cycles with data center expansion, and where investment should be prioritized. Energy tech companies, in particular, can leverage this market intelligence to learn how to position themselves as key enablers of future-proof grid planning.

Energy Grid Digitalization

What is it?

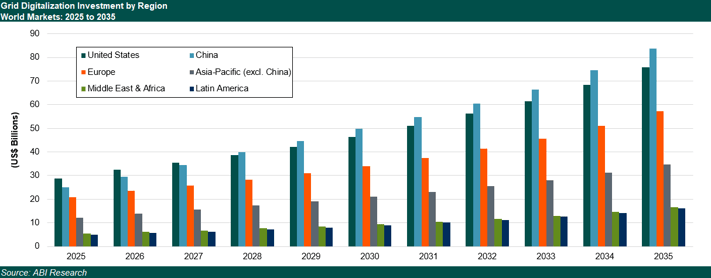

A market data sheet providing a regional, 10-year outlook on global investment in digital energy infrastructure. Readers get an analysis of how utilities are upgrading legacy grids with intelligent systems and software. Grid technology investments include Advanced Distribution Management Systems (ADMS), Energy Management Systems (EMS), digital substations, etc.

The dataset highlights where and how much investment is accelerating across segments like transmission networks, substation modernization, and Distributed Energy Resource (DER) management.

Key Insight: According to ABI Research, total grid digitalization investment is forecast to increase from US$97.4 billion in 2025 to US$284.3 billion by 2035. China is projected to surpass the United States and Europe in total digital grid spending by 2028.

How does this market intelligence help the energy sector?

This data-driven study helps utilities and energy vendors track investment trends, prioritize product development, and align with regional grid transformation goals. Forward-looking investment projections also support strategic planning by uncovering where and when digital transformation is happening across the grid.

Small Modular Reactors (SMRs) – Technologies, Applications, and Use Cases

What is it?

This report provides a detailed market outlook on Small Modular Reactors (SMRs), including technology roadmaps, deployment forecasts, and the evolving vendor landscape. SMRs are becoming a viable nuclear option for grid and private use cases because they are cheaper and more scalable than traditional Gigawatt (GW) nuclear sites.

Key insight: ABI Research expects SMR deployments to gain meaningful traction at the turn of the decade. Analysts forecast roughly 100 SMRs in operation by 2035, and 250 by 2040.

How does this market intelligence help the energy sector?

The market intelligence guides energy providers, tech vendors, grid operators, and data center planners on how to incorporate SMRs into their energy portfolios. It also supports decision-making around partnerships, siting, and investment strategies.

Moreover, case studies from Aalo Atomics, GE Vernova Hitachi Nuclear Energy, and Oklo offer a glimpse into early market activity.

Energy Flexibility Trading for Utilities, Industries, and Enterprises

What is it?

In this report, ABI Research explores the growing opportunity in energy flexibility trading markets. Energy analysts examine how utilities, grid operators, vendors, and Distributed Energy Resource (DER) owners can monetize flexible capacity to stabilize the grid.

Included within the report are original market forecasts, ecosystem profiles, and actionable recommendations for engaging in these emerging trading models.

Key insight: Without effective flexibility markets, solar and wind curtailment could reach over 1,400 GW by 2030. This equates to more than US$400 billion in annual losses at 2024 energy prices.

How does this market intelligence help the energy sector?

The energy sector can better anticipate how flexibility markets will reshape grid operations. Additionally, executive-level planning is enhanced by identifying monetization paths, emerging partnerships, regulatory considerations, and technology requirements.

Energy Management Software for Buildings and Industrials

What is it?

This market intelligence tracks how Energy Management Systems (EMS) are being deployed across buildings and industrial sites worldwide. Data encompasses revenue, user bases, and technology spend across software, hardware, and services through 2035.

The research also differentiates between Building Energy Management Systems (BEMS) revenue projections across building types in each region:

- Industrial buildings (factories, warehouses)

- Data centers

- Government buildings

- Leisure and retail

- Multi-Dwelling Units (MDUs)

- Office buildings

Key Insight: ABI Research expects the global EMS market to grow from US$36.8 billion in 2025 to US$98.4 billion by 2035. EMS software is the fastest-growing segment (12.2% Compound Annual Growth Rate (CAGR)) and is expected to overtake hardware by 2028.

Table 1: Energy Management System Revenue by Segment: 2025 to 2035

(Source: ABI Research)

|

Segment |

Revenue |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

CAGR |

|

Hardware |

(US$ Millions) |

15,581.03 |

17,294.94 |

19,110.91 |

21,022.00 |

22,913.98 |

24,747.10 |

26,726.87 |

28,731.38 |

30,742.58 |

32,740.85 |

34,705.30 |

8.3% |

|

Services |

(US$ Millions) |

6,790.58 |

7,537.54 |

8,442.05 |

9,455.09 |

10,589.70 |

11,860.47 |

13,046.51 |

14,351.16 |

15,642.77 |

16,894.19 |

18,076.78 |

10.3% |

|

Software |

(US$ Millions) |

14,401.03 |

16,417.17 |

18,879.75 |

21,711.71 |

24,751.35 |

27,969.03 |

31,325.31 |

34,771.10 |

38,248.21 |

41,881.78 |

45,651.15 |

12.2% |

|

Total |

(US$ Millions) |

36,772.64 |

41,249.66 |

46,432.71 |

52,188.81 |

58,255.04 |

64,576.59 |

71,098.69 |

77,853.64 |

84,633.55 |

91,516.82 |

98,433.23 |

10.3% |

How does this market intelligence help the energy sector?

It enables enterprises and facility operators to understand where EMS drives the greatest energy efficiency returns. For energy technology vendors, 10-year revenue forecasts pinpoint the regions and verticals driving demand.

Smart Energy Metadata

What is it?

A market snapshot of global renewable energy infrastructure as of 2026. It breaks down the number of sites and installed capacity of energy assets by region and country. Everything from wind and solar farms to nuclear stations and Liquified Natural Gas (LNG) terminals is covered.

Clients also get a look at detailed infrastructure data for national energy markets, such as the United States, China, India, Brazil, France, the United Kingdom, and Germany.

Key Insight: Wind farms in Asia-Pacific generate more renewable energy than any other region, despite Europe having the most wind farms installed worldwide. This reflects the fact that wind farms in Asia are operating closer to a utility scale than European energy providers.

Table 2: Installed Capacity (Gigawatts (GW)) of Renewable Energy Sources by Region in 2026

(Source: ABI Research)

| Region |

Wind |

Solar |

Hydro |

Nuclear |

Bio Energy |

Geothermal |

Region Total |

|

North America |

173 |

169 |

176 |

112 |

19 |

5 |

653 |

|

Latin America |

42 |

33 |

288 |

2 |

15 |

0 |

380 |

|

Europe |

212 |

180 |

225 |

158 |

31 |

2 |

808 |

|

Middle East & Africa |

8 |

41 |

42 |

9 |

4 |

1 |

105 |

|

Asia-Pacific |

647 |

330 |

558 |

114 |

10 |

5 |

1,664 |

|

Total by Energy Source |

1,081 |

754 |

1,289 |

395 |

79 |

13 |

3,610 |

How does this market intelligence help the energy sector?

Granular infrastructure data facilitates smarter decisions across renewable energy sourcing, investment, and policy alignment. Utilities, vendors, and energy buyers can identify regional strengths, plan new deployments, and prioritize partnerships based on technology mix and installed capacity.

Analyst Insights

Nuclear Energy Coming to Data Centers: Equinix Taps into Rolls-Royce-Powered SMRs

What is it?

Nuclear energy is gaining significant traction as a long-term power source for data centers. This article highlights how companies like Equinix and Microsoft are turning to Small Modular Reactors (SMRs) to meet rising electricity demands.

ABI Research VP, Verticals & End Markets Dominique Bonte, explores key partnerships with SMR developers, including Rolls-Royce, Oklo, Stellaria, and Radiant. His analysis also connects this shift to broader energy constraints caused by AI data center growth and aging grid infrastructure.

Key Insight: Wind and solar are constrained by land and intermittency, but nuclear offers unparalleled energy density and long-term reliability. Equinix alone is preparing to source over 1 GW of nuclear energy through multiple SMR agreements. These partnerships epitomize the sense of urgency the energy market is feeling to seek clean alternatives.

How does this market intelligence help the energy sector?

This industry update assists energy technology vendors and users in anticipating increased demand for co-located nuclear solutions. Moreover, the article reveals how major data center operators are shifting from passive grid users to active participants in next-generation power ecosystems.

Energy market stakeholders can use this knowledge to align product development, investment timing, and partnership strategies with the evolving role of nuclear in digital infrastructure.

The smarter E Europe 2025: As European Energy Markets Prioritize Grid Resilience, Energy Storage and Flexibility Solutions Are Seizing the Limelight

What is it?

This analyst insight covers the key developments observed by ABI Research from The smarter E Europe 2025, Europe’s largest renewable energy event. While solar Photovoltaics (PV) dominated floor space, Battery Energy Storage Systems (BESS) and flexibility services generated the greatest buzz. Our attendance confirmed that the focus for the energy market has clearly shifted from generation to grid stability.

Key Insight

Solar installations have reached a level of maturity in Europe at which energy players can now concentrate on solutions that stabilize the grid. Europe is set to become a top export market for Chinese battery storage manufacturers going forward.

How does this market intelligence help the energy sector?

BESS and flexibility are now central to European energy strategies. This research pinpoints how vendors and developers can support grid operators and governments under pressure to prevent outages like the Iberian blackout. With grid resilience becoming a top priority, energy stakeholders can leverage this insight to optimize smart grid deployments in line with best practices.

Oil Majors’ Retreat from Renewables: Prudent Policy or Commercial Miscalculation?

What is it?

This ABI Insight analyzes the commercial implications of major oil providers pivoting away from renewable energy. BP, Shell, and Equinor have dialed back their clean energy commitments in favor of increased investment in fossil fuels. BP alone plans to invest US$10 billion annually in oil & gas, while cutting renewable spending by over US$5 billion. The shift is driven by investor pressure, near-term profitability goals, and the belief that green energy cannot match hydrocarbon returns.

Key Insight:

Renewables are expected to make up 50% of the global energy mix by 2030. China and the European Union (EU) are forecast to install over 3,750 Gigawatts (GW) of new renewable capacity between 2024 and 2030. By downsizing renewables production, oil companies risk diminishing market share as the world transitions to clean energy.

How does this market intelligence help the energy sector?

This energy market intelligence offers a timely reality check for petroleum industry stakeholders. The data show that renewables are no longer niche or subsidy-dependent. Instead, they are economically competitive and entrenched in long-term global energy plans.

Oil & gas juggernauts must recognize that fossil fuel resurgence is not a sustainable growth path—both in terms of commercial viability and environmental impact. Aligning with the accelerating net-zero transition will be key to securing market relevance and investment.

Partner with ABI Research

ABI Research’s Smart Energy Research Service equips stakeholders with the insights needed to lead through energy disruption. By tracking regulatory shifts, grid modernization, and emerging technologies, our market intelligence enables smarter investments and more resilient energy strategies.

Technology providers use this intelligence to refine product development and align internal teams, while end users benefit from implementation guidance and peer comparisons. As the energy transition accelerates, partner with ABI Research to convert change into a commercial opportunity.

Meet the Authors

Dominique Bonte, VP, Verticals & End Markets

Research Focus: Dominique Bonte, Vice President, Verticals & End Markets, leads ABI Research's end markets research team, which covers industrial and manufacturing, supply chain and logistics, fleet management and commercial telematics, automotive and smart mobility, electric vehicles, smart homes and buildings, and smart urban infrastructure. His personal focus areas include smart cities solutions such as digital twins, urban IoT platforms and connectivity, Intelligent Transportation Systems (ITS), smart roadside infrastructure and V2I, electrification and sustainability, smart rail, and cooperative mobility.

Michael Larner, Distinguished Analyst

Michael Larner, Distinguished Analyst, is part of ABI Research’s End Markets team. His research examines how technologies such as data analytics, robotics, Artificial Intelligence (AI), the Internet of Things (IoT), and connectivity solutions are enabling discrete and process manufacturers, building managers, and facilities managers to address both external and operational challenges. He also examines the cutting-edge technologies driving transformation across the value chain.

Frequently Asked Questions

What is energy market intelligence?

Energy market intelligence is the analysis of technologies, investments, policies, and competitive dynamics shaping global energy markets. It helps companies understand where demand, regulation, and innovation are headed so they can make informed strategic decisions.

Why is energy market intelligence important today?

Energy markets are under pressure from increasing electricity demand, grid constraints, decarbonization targets, and AI-driven data center growth. Energy market intelligence helps organizations anticipate risk, prioritize investments, and adapt to rapid structural change.

Which technologies are driving the energy transition?

Key technologies include renewable energy systems, grid digitalization platforms, energy management software, battery energy storage, flexibility trading markets, and nuclear solutions such as Small Modular Reactors (SMRs). These technologies improve efficiency, reliability, and grid resilience.

How are data centers impacting energy markets?

AI-driven data centers are significantly increasing electricity demand, creating a growing gap between compute expansion and grid capacity. This is accelerating interest in alternative energy sources, grid upgrades, flexibility markets, and co-located power generation.

How can companies use energy market intelligence to support net-zero goals?

Companies use energy market intelligence to identify the most effective technologies, regions, and investment strategies for reducing emissions while maintaining reliability. Forecasts and infrastructure data support decisions around renewable sourcing, grid modernization, and energy efficiency initiatives.