The modern manufacturer has a plethora of advanced technology options to choose from. For example, mobile robots can streamline assembly line processes and simulation software can shape the product or process design. Although the COVID-19 pandemic may have put a hold on heavy investment from some companies, the hiatus was just temporary. Whether it’s pressure from the competition, workplace safety, government regulation, or something else entirely, manufacturers have been and will continue to be one of the most significant market opportunities for technology vendors.

Over the last few years, ABI Research has compiled numerous market data reports in the manufacturing sector composed of deep insight into market share analysis and highly segmented, service-specific forecasts. In total, smart manufacturing spending will reach US$950 billion by 2030, which is nearly triple the spending in 2021. In this post, ABI Research shares 11 forward-looking technologies used in manufacturing and evaluates what kind of solutions the top verticals are spending their money on.

Table of Contents

- IoT

- Simulation Software

- Digital Twins

- SCADA/HMI Software

- Real-Time Location Systems

- Augmented Reality

- Robotics

- Manufacturing Execution Systems

- Machine Vision

- Private 5G Networks

- Smart Manufacturing Platforms

Manufacturing Technology #1: IoT Connections

Industrial IoT (IIoT) connections include technologies like sensors, trackers, video surveillance, wearables, and other connections that help manufacturers better understand the flow of operations. These connections reveal key data to operators, such as equipment condition, predictive analysis, product location, etc.

IIoT devices are used by manufacturers to gain operational visibility within the digital factory or the supply chain. Our analysts saw many additive manufacturing firms embracing the IIoT at the International Manufacturing Technology Show (IMTS) last year (see the best of IMTS 2024)

So what can this technology do?

IIoT devices can monitor anything from a machine's performance to the environmental data within the back of a truck used to transport temperature-sensitive goods.

For example, a chemical manufacturer could leverage an Internet of Things (IoT)-connected pressure sensor to ensure the optimal flow of gases or fluids in a tank (predictive maintenance). If there’s a buildup, the IoT solution will detect it and notify operators. As a result, it can prevent plant downtime, which costs the world’s largest industrial and manufacturing firms a cumulative US$864 billion per year.

Or, as another example, manufacturers can deploy massive IoT devices to geolocate Returnable Transport Assets (RTAs). These battery-powered IoT trackers can pinpoint the location of pallets, racks, roll cages, kegs, crates, totes, trays, containers, and other logistics assets. This can prevent theft and reduce costs associated with misplaced assets

ABI Research expects manufacturing IoT connections to increase from 259 million connections in 2024 to 935 million connections by 2030. China and the United States dominate this market, accounting for nearly half of global IoT deployments in manufacturing.

This will translate to manufacturing IoT revenue surging from US$13.2 billion in 2024 to US$44.5 billion by 2030. Our revenue forecasts span physical IoT connections, data analytics services, device/application platform services, network services, professional services, and security services.

Condition-Based Monitoring (CBM) is the key catalyst for IoT connection and revenue growth throughout the decade, In 2024, manufacturers will spend US$9.05 billion on condition-based monitoring. As seen in the chart below, that accounts for 68% of total IoT revenue among all applications. By 2030, that number will be over US$34 billion in revenue and 77% of total revenue. Data and analytics services are the biggest driver for CBM revenue, followed by device and application platform services.

Chart 1: Manufacturing IoT Revenue by Application in 2024

(Source: ABI Research)

Chart 2: Manufacturing IoT Revenue by Application in 2030

(Source: ABI Research)

Cold chain monitoring is another key application of the IoT. It enables supply chain stakeholders to adjust the temperatures of perishable goods in real time, avoiding product spoilage and increasing business profitability. ABI Research projects the food cold chain market to be worth US$5.5 billion by 2030, indicating a rising demand for reliable IoT solutions.

IoT is also a core aspect of remotely monitoring your assets. IoT remote monitoring platforms enable manufacturers to track the real-time condition of machines, equipment, infrastructure, and other assets. As a result, stakeholders can identify where bottlenecks exist and optimize maintenance schedules. .

New Survey Results Are In

ABI Research just published its The State of Technology in the Manufacturing Industry survey results to help technology suppliers and end users identify the attitudes and challenges that manufacturers have with technologies. View Today

Manufacturing Technology #2: Simulation Software

Simulation software can be used for manufacturers to see how a product/component or a production line will behave under carefully selected conditions. That way, operators know how to optimize their designs in a way that bolsters productivity and adheres to regulations.

Led by China, manufacturers will allocate US$3.7 billion to factory simulation software in 2034—a 2.5X increase compared to double the US$1.4 billion expected to be spent in 2024. That’s a Compound Annual Growth Rate (CAGR) of 10.2%.

The industries spending the most on factory simulation software include computers/electronics, automotive, machinery, and food.

As for vendor breakdown, the technology companies with the largest market shares in the factory simulation software market are Siemens (29.7%), Dassault Systèmes (26.6%), and Rockwell Automation (19.2%). The rest of the market is composed of smaller firms such as Anysys, Autodesk, and Hexagon, among others. These market shares are depicted in the pie chart below.

Learn More

Industrial & Manufacturing Simulation Software Research Spotlight

Manufacturing Technology #3. Digital Twins

Digital twins are the digital mirror of real-world objects like sensors, devices, machines, processes, systems, people, or even entire facilities. Manufacturers deploy digital twins to drive optimal business outcomes. They provide connectivity, metadata management, data management, increasingly advanced analytics, and often integration with business applications and process systems.

Digital twins can be organized and structured in different ways. This means they come in various hierarchies, topologies, etc. In its most basic form (low fidelity), a digital twin involves:

- Metadata about the respective entity/asset

- A means to monitor it in (near) real time

More advanced (high-fidelity) digital twin technologies contain analytic models (physics-based or increasingly machine/deep learning-based) that enable prediction and simulation. As a result, this allows manufacturers to compare expected versus actual behavior, "what-if" scenarios, and continuous improvement of models through feedback loops. All modern digital twins can interact with an IoT platform or an Application Enablement Platform (AEP).

To understand the benefits of a digital twin, consider the case of Consumer Packaged Goods (CPG) manufacturing giant Mars Inc. The company has leveraged the Azure Digital Twins IoT platform since 2020 at its 160 manufacturing facilities worldwide. Using the Azure digital twin, Mars staff are able to predict outcomes and run production line simulations accurately. Moreover, using digital twins has also benefited Mars in meeting its sustainability goals. The technology helps the firm improve water stewardship at plants and reduce waste and Greenhouse Gas (GHG) emissions.

Related Content

5 of the Top Digital Twin Companies.

Manufacturing Technology #4: Supervisory Control and Acquisition Data/Human-Machine Interface Software

Supervisory Control and Acquisition Data (SCADA) systems are the next digital manufacturing technology on the list. Industrial SCADA systems acquire and present data to the Human-Machine Interface (HMI) and central operating terminals. This, in tandem with Programmable Logic Controllers (PLCs), manages industrial equipment, while a historian stores time series, alarm, and event-based data.

SCADA allows operators to see what production is doing in real time, react to alarms, control processes, and change settings locally or from remote central command centers.

A related technology is Human-Machine Interface (HMI) software. HMI software provides and allows manufacturers to design graphical interfaces to monitor and control production processes and assets locally. HMI software can run independently from SCADA, simply as a local visualization and control tool for a single asset or process.

However, due to the symbiotic nature of industrial SCADA and HMI, HMI software is considered a component of SCADA. Indeed, vendors mesh the two tools to differing levels.

As manufacturers continue introducing more IIoT devices to their operations, SCADA and HMI software will be essential.

Manufacturing Technology #5: Real-Time Location Systems

The Real-Time Location System (RTLS) is a much-needed technology in the manufacturing industry. The manufacturing sector is losing hundreds of billions of dollars related to the loss of products and equipment. These financial losses are compounded by the subsequent operation downtime induced by the loss of products and equipment.

Using an RTLS, the manufacturing equipment can be tracked and traced, and discovered in real time whenever needed. Pallets at manufacturing sites often move between the site and the customer facilities. Tracking them often relies on physical tags and requires substantial labor and time to trace and manage them. Here again, RTLS technologies provide ample opportunity to automate the tracking of these assets.

This automation becomes even more essential and unavoidable with the ever-increasing size, complexity, and amount of assets contained in warehouses.

Manufacturing Technology #6: Augmented Reality

COVID-19 created an immediate need for remote worker enablement, and Augmented Reality (AR) has excelled at remote assistance and expertise for years. ABI Research has tracked the most active use cases for Extended Reality (XR) in the manufacturing sector, and remote expertise has consistently shown the most active users and active implementations in industrial markets.

By 2025, ABI Research estimates more than 8 million monthly active users of remote assistance in the manufacturing industry. Nearly half of those use smart glasses, and the others use mobile devices. XR enables instant access to experts, no matter the location, and reduces wasted time and travel costs. This is a game-changer in making customers happy via remote after-sales services.

Increased efficiency is perhaps the keystone of the XR Return on Investment (ROI) discussion for manufacturers interested in the technology. No matter the AR use case being examined by a manufacturer, efficiency plays a role. Delivering the right content to employees rapidly improves the employee’s efficiency. And for even more efficient workflows, industrial companies can add hands-free features, enabled via AR applications, to content access.

A manufacturing assembly line worker, for example, would see an AR-enabled overlay that provides workstation instructions. This way, the employee can continuously work without having to look down at physical instructions or receive support from a human co-worker.

ABI Research forecasts the number of XR shipments for after-sales to grow at a robust 74% CAGR between 2024 and 2030. This brings the total number of annual shipments to 7.4 million in 2030, a far cry from the 269,000 expected in 2024.

XR technologies are also useful for employee training. When using extended reality in the manufacturing sector, employee training is improved due to XR's ability to improve knowledge retention and content efficacy. This makes training more efficient both during and after sessions.

Emerson has given an ROI example for its Plantweb Optics platform in an AR training environment. The example included:

- Five field workers, three new workers hired per year, four months to train, and five subject matter experts available.

- One dispatch per month per field worker, one local expert visit per month, one remote expert visit per month, and 25% less training time.

Results for this relatively small-scale example were US$90,000 in annual savings, with an ROI seen in 6 months with the AR technology.

Learn how Tooling-U SME is helping manufacturers upskill staff with virtual reality by unlocking our Analyst Insight.

Manufacturing Technology #7: Robotics

Robotics is an integral aspect of modern manufacturing, especially in the face of labor shortages and increased product demand. In our 2023 trends paper, our analysts pointed out the fact that industrial robot deployment didn't slow down during COVID-19 and grew in 2023. Robots can automate tasks such as materials handling, product picking, assembly, parts unloading, and other critical processes. There are four main types of robotics that manufacturers can leverage: industrial robotics, Collaborative Robotics (cobots), mobile robotics, and exoskeletons.

Industrial Robots

The most common forms of industrial robots are as follows:

- Articulated Robots: Classic industrial robots with multiple rotary jointed “arms.” Articulated robots can range from a simple 2-joint robot to complex 10-joint robots.

- Selective Compliance Articulated Robot Arm (SCARA)Robots: Fast, highly precise six-axis robots typically mounted on a pedestal. Mainly used for handling small objects. Motors are parallel with each other and along a vertical axis.

- Parallel/DeltaRobots: Also called picker robots or spider robots. Most hang overhead, have three or four arms that extend or contract to position the manipulator, and are used for fast, precise movement of objects.

- Linear/CartesianRobots: Robotic systems used primarily to lift and carry heavy objects linearly over long distances along an x, y, or z axis.

- Other Robot Types: All other classes of robots, such as cylindrical and polar robots.

Collaborative Robots

Collaborative Robots (cobots) are articulated robots designed to interact with human workers in a shared workplace. While the industry has varying definitions for cobots, ABI Research defines a cobot as follows:

- 6 or 7 Degrees of Freedom (DoF) articulated arms

- Force sensing/force control

- No pinch points/sharp edges

- Programming by demonstration

- Lightweight construction/new materials

- Integrated sensors (torque, vision, sonar, etc.)

- Software intelligence

- Compliant/gravity-compensated/back-drivable arms

Mobile Robots

Manufacturers deploy mobile robots to transport goods between production cells or lines in factories and plants.

Within the category of mobile robots, there is an important distinction between Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs). While AGVs require external infrastructure to move, AMRs, in principle, can navigate an environment without needing external infrastructure.

There are also Remotely Operated Vehicles (ROVs) that are designed to be remotely operated or teleoperated by human operators. Many robots are remotely operated but have a high degree of autonomy and operate at least partially without fiducial markers or magnetic tape. Therefore, these technologies are classed as AMRs. With the increased adoption of AMRs, robotics manufacturers will have a greater reliance on robotics simulation software and the use of Visual SLAM (vSLAM) for perception.

Related Content

Exoskeletons

Exoskeletons are a relatively nascent robotics technology with immense promise in manufacturing. This wearable solution helps human workers perform industrial applications, such as lifting heavy loads or reaching products otherwise out of reach. Exoskeletons mitigate worker health risks like Work-Related Musculoskeletal Disorders (WMSDs). Moreover, exoskeletons are known to provide manufacturers with productivity gains.

Industrial exoskeletons can either be powered or passive.

- Powered exoskeletons have a power source and will have enhanced capability but require charging. If the goal is to augment human strength or endurance, there is a greater need for powered exosuits. Though more capable, powered (or active) exoskeletons are considerably more expensive.

- Passive (unpowered) exoskeletons don’t need any power source, batteries, motors, or mechatronics to operate. Unpowered exoskeletons can improve body posture, alleviate pain, and rehabilitate the injured.

To learn more about the role of exoskeleton technologies in Industry 4.0 applications and their revenue forecasts, read our blog post, An Exciting Future For Exoskeletons.

Manufacturing Technology #8: Manufacturing Execution Systems

Manufacturing Execution System (MES) software is a primary foundation for manufacturing plants in the Industry 4.0 space. The software tracks, documents, and guides the production process in real time to visualize and control the factory floor. These capabilities are essential to improve production and labor efficiency, support comprehensive digital threads, and enable new business models and best practices in the long run.

MES software is used to monitor the factory floor, track, document, and guide the production process in real time, and provide further support in optimizing the production process. Each unit is tracked uniquely, end-to-end, from raw material to final product. Holistically, the software supports Overall Equipment Effectiveness (OEE), a composite of availability, quality, and performance. Architecturally, MES software fits between ERP and process control systems. MES solutions cover a broad range of capabilities, so after implementation and customization by manufacturers, it is rare to find multiple MESs that work the same.

ABI Research identifies the following benefits for manufacturers when using MES software:

- Easier product standardization

- Automated and accurate resource management

- Better regulatory compliance

- Machine/system predictive maintenance

- Improved quality management processes

As pointed out in our MES software competitive ranking, the main trends shaping the development of MES software include:

- Low/No-Code Functionality: Democratizes application configuration, reducing deployment time, especially for recipe design.

- Out-of-the-Box (OOTB) Capabilities: Ready-to-use MES functionality with minimal customization, increasingly becoming a standard.

- Manufacturing Ecosystem Integration: MES is evolving to integrate more with other enterprise software, broadening its functionality.

- Cloud-Native/SaaS Architectures: Enables enterprise-wide data access and strategic planning, addressing supply chain fragility.

- AI Integration: AI-supported features, especially in data analytics and generative AI copilots, are gaining popularity in MES solutions.

- Discrete Manufacturing Adoption: Sectors like automotive and aerospace are updating older MES systems to newer, more advanced solutions.

Manufacturing Technology #9: Machine Vision

Machine Vision (MV) is a key enabling technology in automation and human-machine collaboration, especially when deployed at the edge. To date, this Artificial Intelligence (AI)/Machine Learning (ML)-enabled technology has been mainly deployed in quality inspection, defect detection, security, and surveillance. For example, MV is being

As more and more manufacturers embark on digital transformation, they begin to collect more data to optimize their internal processes. This has led to the emergence of data-driven Deep Learning (DL)-based MV technology. Many startups have introduced novel applications that are DL-based MV. Conventional MV companies have also started to invest in DL startups to develop in-house solutions to cater to this development.

Related Content

Manufacturing Technology #10: Private 5G Networks

All the aforementioned manufacturing technologies require a reliable connectivity solution.

Enter 5G.

The top industrial 5G private wireless use cases currently support automation, robotics, and AR. Below are a few examples:

- Quality Assurance: A 5G network can provide manufacturers with lower defect levels by supporting the capture and analysis of items as they are produced. For example, Chinese appliance manufacturer Haier leveraged 5G to significantly simplify its quality assurance process that uses 500-watt industrial cameras to inspect products.

- AR: A private 5G network is essential to support the latency requirements of AR in terms of getting real-time operating information to frontline workers. A remote expert can also support them as if the colleague is there in person.

- Robotics: Coverage offered by 5G networks means that AMRs can receive navigation algorithms, use Light Detection and Ranging (LiDAR) sensors, vision technology, and use mapping for optimal navigation. In addition, AGVs can operate by transporting components and products across the facility. This reduces delivery times and the risk of damage.

- Workplace Safety: Improved safety levels can be expected with a 5G deployment due to the sub-10 Millisecond (ms) reaction time that automatically stops machinery that would injure staff.

- Asset Tracking: 5G allied with the deployment of sensors throughout the facility or embedded on mobile assets provides opportunities to constantly track tools, equipment, and employees over a wide area.

Enhanced security is another big investment driver for manufacturers of private 5G. Organizations generate more data than ever and deploy numerous connected devices/systems throughout their facilities. This elevates cyber risk, as there are potential network entry points to leverage and more sensitive data to be stolen. 5G provides highly reliable, low-latency communication, enabling manufacturers to automate and digitize safety-critical and emergency applications more effectively than other wireless technologies. It supports real-time surveillance and monitoring across production lines, while secure remote access solutions can be implemented for Internet of Things (IoT) devices without compromising the manufacturing process. This is particularly important for operations requiring remote oversight. Additionally, 5G’s low latency allows for automated emergency alerts, ensuring swift dissemination to devices and personnel within facilities, facilitating rapid responses such as evacuations or lockdowns. Furthermore, private 5G networks allow the remote control of safety systems and maintain communication even during power outages, ensuring critical functions like ventilation or emergency shutdowns are activated without delay.

As shared in our recent whitepaper, Private 5G Drivers & Use Cases In Manufacturing, improved security is the top investment driver for 5G in OT and IT settings.

Although enhanced security is a huge focus for private 5G in manufacturing, it's not the only reason for investing in it. 5G also brings the benefits of increased capacity, achieving quality goals, network flexibility, and improved efficiency/operations.

Manufacturing Technology #11: Smart Manufacturing Platforms

Smart manufacturing platforms cover innovations like digital twin support, low-code app development, edge and cloud development, connectivity, and Augmented Reality (AR). Innovators like PTC and Siemens provide advanced platforms for manufacturers to leverage, and ABI Research identifies these two companies as the top innovators in the Smart Manufacturing Platforms Competitive Ranking report.

As depicted in the chart below, there will be more than US$66 billion in annual spending on Industrial Internet of Things (IIoT) platforms by 2030, up from roughly US$20 billion in 2021.

In the next sections, ABI Research takes a deeper look at three of the main manufacturing segments: mining, pharmaceutical, and consumer packaged goods.

Technology Investments In Mining

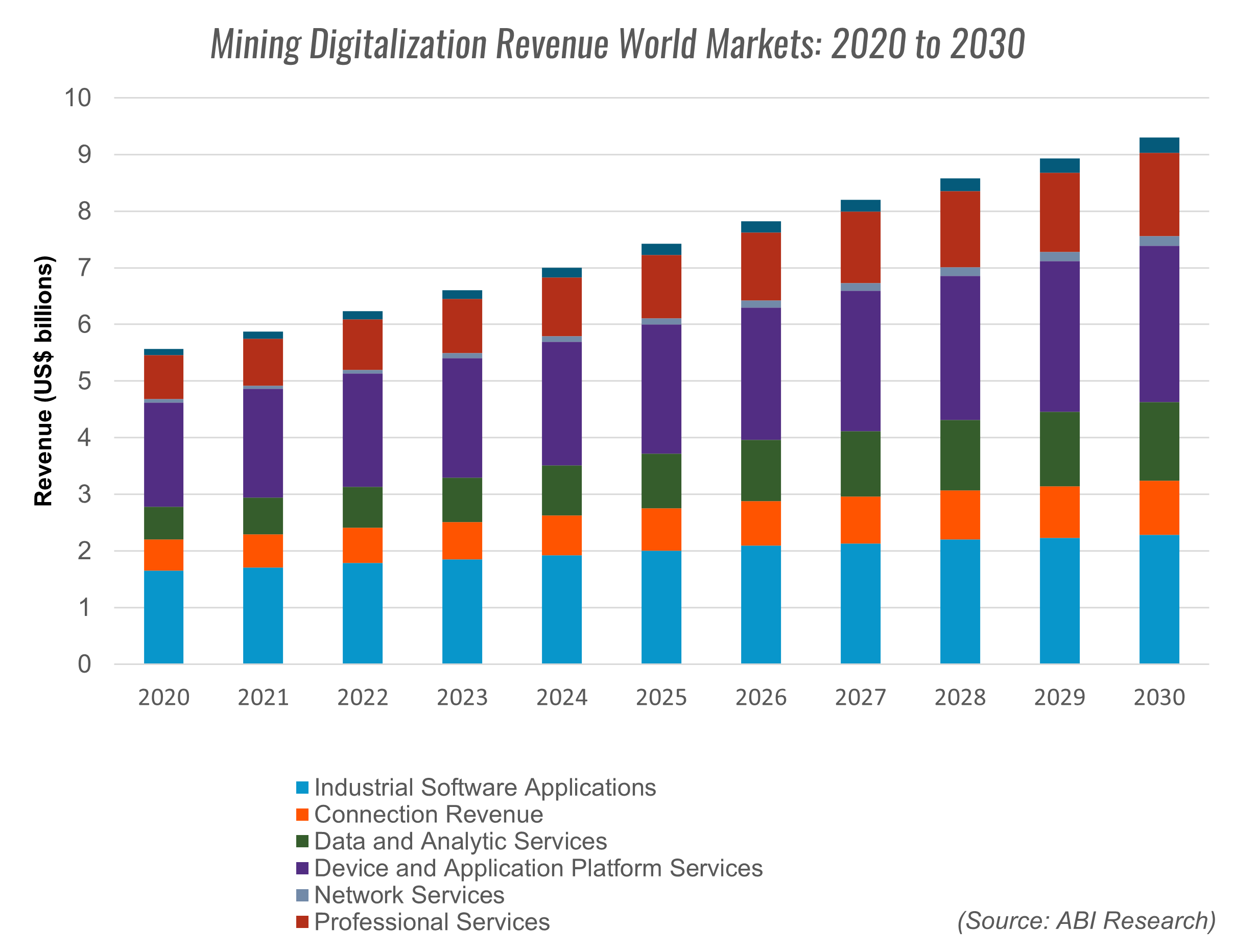

Spending on mining digitalization will be US$9.3 billion in 2030, up from US$5.6 billion in 2020—a CAGR of 5.2% for the forecast period. Digitalization in mining includes advanced analytics, assessing samples at the exploratory phase, calculating yields by simulating mining operations, and modeling drill/blast effects, among other applications. IoT sensors can collect data information on wastewater levels, vehicles, staff, and supply chain shipments.

Industrial software applications make up US$1.8 billion in revenue in 2022, and by 2030, that will be US$2.3 billion. Device/application platforms services will see similar, albeit slightly higher, forecast numbers.

Connectivity and network connections are other areas of digitalization because mining workers often work in dangerous and underground communications where safety requires good communication and reliable coverage. Connection revenue will reach nearly US$1 billion by 2030, while network services revenue will have the highest CAGR between 2020 and 2030 (11.1%).

Technology Investments In Pharmaceuticals

Pharmaceutical firms look to modernize their factories with investments in advanced manufacturing technologies like asset tracking, analytics, application enablement platforms, security, and services. Total digital factory revenue will be worth more than US$4.5 billion by 2030, growing at a 17.5% CAGR between 2018 and 2030.

Until 2028, device/application platform services will remain the most in-demand category. But data/analytic services will take over, accounting for US$857 million by 2028.

There’s also considerable interest in professional services, as pharmaceutical companies need assistance from third parties to shift and optimize processes, learn how to leverage data, and maintain operational security. ABI Research forecasts a 21% CAGR between 2018 and 2030 (US$850 million in 2030) in the professional services vertical within pharmaceutical digital factory revenue.

ABI Research sees the greatest spending on the following technologies:

- Asset tracking

- Human-Machine Interfaces (HMIs)

- Industrial Personal Computers (IPCs)

- Connected Programmable Logic Controllers (PLCs)

- Industrial smart glasses

- Industrial intelligent pumps

Technology Investments In Consumer Packaged Goods

Technology spending in the consumer packaged goods sector is going to be US$23.8 billion by 2030, a huge jump from the US$7.1 billion in 2021 spending. Device/application platform services revenue will reach US$6.8 billion in 2030, compared to US$2.4 billion in 2022.

Revenue in professional services is quite significant, reaching US$4.5 billion in the consumer packaged goods segment by 2030.

Collaborative robots see little momentum in consumer packaged goods—US$11.8 million in 2030 revenue and growing at a CAGR of 58% between 2018 and 2030.

Digging a little deeper, the biggest use cases for technological investment are:

- HMIs/PCs

- Asset tracking

- Connected PLCs

- Intelligent industrial pumps

To see how advanced manufacturing technologies are used in real-world scenarios, let's review three examples from solution providers.

Vendor Examples

Manufacturing Technology Vendor #1: MindSphere

Siemens offers a smart IoT platform called MindSphere that provides real-time analytical insight into operations like equipment maintenance and production lines. Using these insights, organizations make more timely decisions, prevent equipment failure, and improve the quality of assets.

Steelmaker HBIS partnered up with Siemens to integrate MindSphere with existing Operational Technology (OT) infrastructure. Before using MindSphere, factory asset and system process data were separated into different silos, making it challenging to optimize digitalization. After implementing MindSphere, HBIS gained fuller transparency into operational data like the health status of mills and temperature changes from coil motors.

The advanced analytics MindSphere provides also allows HBIS operators to detect product abnormalities and the reasons for degraded steel quality. For example, HBIS can use MindSphere to record every instance of steel coil surpassing the ±5 micrometer benchmark. From there, the company can dig into historical data and working conditions to help understand cause/effect relationships.

Manufacturing Technology Vendor Example #2: Zemax

The Zemax OpticsStudio and OpticsBuilder platforms offered by Ansys allow engineers to create, simulate, optimize, and then migrate their CAD designs to native CAD parts and assemblies. This saves CAD teams many hours recreating their lenses while also reducing the likelihood of errors manifesting in the real world.

Bulgarian optical device manufacturer OPTIX JSC turned to Ansys when the design team realized its existing platform couldn’t keep up with the greater workload demands. Leveraging Zemax products OpticsStudio and OpticsBuilder, OPTIX JSC can take their optical drawings and export them to manufacturing for the next stage of processing. With the Ansys product deployments, the company’s production flow runs more smoothly, and development times and costs are cut down. Finally, the prevalence of last minute design adjustments was reduced.

Manufacturing Technology Vendor Example #3: Roambee

During the height of the COVID-19 pandemic, Roambee provided IoT technologies to vaccine providers that promote supply chain transparency. Using sensors, accurate data on ETA and the condition of shipments could be gathered and accessed on one platform. Some of the conditional data captured include temperature, humidity, and vibration. The accuracy of the ETAs enabled logistics teams to dynamically allocate vaccine stock and confidently receive shipments without unexpected damages. Roambee’s IoT solutions bolstered inter-department collaboration and improved the company’s ability to meet its Key Performance Indicators (KPIs).

Concluding Remarks

As these examples show, technology is a manufacturer's best friend in the face of fierce competition. Key decision makers must turn to reliable technologies with advanced features to gain more visibility into operations, increase worker productivity, and keep their networks secure. Besides IoT hardware and software, many manufacturers are also spending a lot on professional services so they can learn how to better utilize their assets. As some manufacturing technologies will require a steep learning curve, system integrators and third-party services can enable a quicker and smoother digital transition.

To learn more about how companies can digitize themselves with manufacturing technologies, check out the following ABI Research reports:

- 74 Technology Trends To Expect in 2023

- Digital Transformation and the Mining Industry

- Industrial and Manufacturing Semiannual Update

- Industry 4.0 in the Consumer Packaged Goods Industry

- Industry 4.0 in the Pharmaceutical Industry

- Simulation Software in a Manufacturing Setting

- IoT Market Tracker: Manufacturing