On December 9, 2025, I had the pleasure of participating in the GlobalPlatform Cybersecurity Vehicle Forum. During this virtual event (which you can watch here), I discussed the growing role of Secure Elements (SEs) and Authenticated Integrated Circuits (Auth ICs) in automotive security.

To date, the key accelerator for adopting SEs and authenticated ICs in the global automotive space has been the development of application-specific standards and specifications. Most notable are the International Organization for Standardization (ISO) 15118 Plug and Charge for Electric Vehicles (EV) standard, the Wireless Power Consortium’s (WPC) Qi wireless specification, and the Connected Car Consortium’s (CCC) Digital Car Key specification.

In this blog, we will uncover these use cases and discuss China’s pioneering role in automotive cybersecurity.

Key Takeaways:

- Secure elements are becoming essential across connected cars. They secure EV charging, wireless charging pads, digital keys, and in-car payments.

- Standards are pushing adoption forward. ISO 15118, Qi 1.3+, and the CCC Digital Key give automakers clear paths to deploy SEs.

- China is moving even faster with proprietary solutions. Local automakers use SEs widely for digital keys and vehicle-as-wallet features.

- SEs are expanding into deeper vehicle systems. They now support Electronic Control Units (ECUs), domain controllers, Advanced Driver-Assistance Systems (ADAS), and secure in-vehicle communication.

- Artificial Intelligence (AI)-driven cockpits will accelerate SE demand. Generative Artificial Intelligence (Gen AI) features need secure hardware to protect identity, apps, and payment services.

WATCH THE VIRTUAL EVENT REPLAY: CYBERSECURITY VEHICLE FORUM

What Is Driving Adoption of Secure Elements for Automotive?

The top use cases for automotive SEs are outlined below:

Electric Vehicles

The EV is the most popular application, to date, for SE adoption. Both EVs and charging ports feature some sort of SE that stores the cryptographic credentials for the driver’s payment information and the vehicle ID for authentication, private key generation, and digital signing.

The ISO 15118 Plug and Charge standard includes provisions on enabling automatic authentication (using Transport Layer Security (TLS)), authorization and payment; SEs are ideally suited to enable these.

Other standards are being developed in the EV space that will further drive SE demand, notably the Open Charge Point Protocol (OCPP) that aims to facilitate interoperability between different charging networks.

Qi-Certified Wireless Charging

Beyond EVs, another popular use case for automotive SEs and Auth ICs is for Qi-certified wireless charging pads (standardized by the WPC). They provide charger authentication to smartphones, and SEs are actually a core requirement in the latest specification iteration, Qi 1.3+.

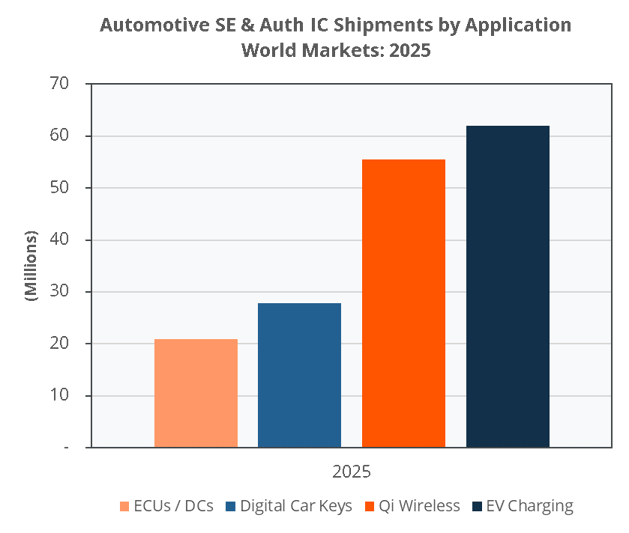

ABI Research estimates a 53% penetration rate of Qi wireless chargers in new cars shipped globally in 2025. Largely, this is driven by strong consumer demand for convenience and is a direct result of high smartphone usage. The specification is particularly popular in North America.

Digital Car Keys

SEs are also the primary secure hardware form factor being leveraged for digital car keys. This is driven, in large part, by the CCC Digital Key specification for secure vehicle access (with keyless entry), which offers a standardized protocol over Near Field Communication (NFC) and Bluetooth® Low Energy (LE) in combination with Ultra-Wideband (UWB); in the latest version, 3.0., SEs are used to host the digital key applet, alongside a separate connectivity chipset.

In this space specifically, Original Equipment Manufacturers (OEMs) offer a range of key complements for the user: NFC card, key fob, or as a digital key embedded into a smartphone wallet. Collaboration between almost all major smartphone (e.g., Apple, Google, Samsung) and automotive OEMs is driving widespread adoption.

ABI Research estimates an average 26% penetration rate of digital car key functionality in new cars globally in 2025 (and 30% in commercial vehicles). Strong adoption in commercial vehicles specifically is a direct result of fleet management demands for operational efficiency and access control.

Critical Functions

The smallest segment, but with the fastest adoption rate, for automotive SEs (but not Auth ICs) is critical functions, notably in ECUs and Domain Controllers (DCs).

Typical target applications for use include ADAS, Battery Management Systems (BMS), in-vehicle communication (e.g., Controller Area Network (CAN) message authentication, sensor management), and Vehicle-to-Everything (V2X) communications. Future applications include more extensive usage in ECUs and DCs for centralizing security services.

Currently, however, the focus is on vehicle monetization. Think of paid upgrades for in-car features and services (including infotainment), as well as in-car payment systems to enable fuel purchases, toll payments, parking fee payments, etc.

Today, there are a number of very interesting pilot projects currently ongoing with the European Union (EU) Digital Wallet Consortium (EWC) and cars. For example, digital car keys could offer a use case for EU Digital Identity (EUDI) wallets.

Beyond that, SEs could be used in supply chain integrity (authenticating new car parts). This is a long envisioned, but little realized evolution of the authentication IC market.

China Leads the Automotive SE Adoption Wave

China is seeing similar trends as the rest of the global market. In fact, China is at the forefront of the digital car key movement, with an estimated penetration rate of 40% for new cars shipped in 2025.

In large part, this is due to much more open consumer attitudes toward new technologies, resulting in higher adoption compared to other markets. Current deployments focus on security-critical, but non-driving-safety functions (e.g., Internet of Vehicles (IoV) authentication, communications security).

The Chinese market is more mature than in North America and Europe, with most Chinese automotive SE providers already having mass production capacity. Right now, the main Chinese players are focusing their SE R&D on higher safety and performance applications for driving functions.

One of the main differences, however, is that there is little focus on complying with standards or specifications such as ISO 15118, WPC Qi, and CCC Digital Car Key. In part, this is due to Chinese preference for proprietary solutions for high-volume, low-cost, and faster Research and Development (R&D), which accelerates time to market.

Nonetheless, there are two digital car key consortia in China:

- The Intelligent Car Connectivity Industry Ecosystem Alliance (ICCE), led by Huawei, unifying digital key practices

- The Intelligent Car Connectivity Open Alliance (ICCOA), with founding members including FAW, Bosch, and GAC, among others.

We are certainly seeing the most advances in the payment space. Chinese OEMs have already started treating the vehicle as a mobile wallet, with SEs providing the hardware root of trust. These can hold payment tokens or wallet credentials, but can also host isolated applets for different payment providers like Alipay, WeChat, and others.

Europe is catching on though. EMVCo and CharIN recently announced they are exploring Europay, Mastercard, Visa (EMV) card-based payments for the Plug and Charge standard.

Looking forward, some of the most interesting developments this year have been around Gen AI-assisted cockpits. A wave of announcements were made in China this year, with many integrating DeepSeek, and others integrating AI-assisted companions for driving functions, as well as for infotainment.

SEs will not be the only hardware form factor in use here, but they are, to date, the preferred form factor for some of these applications (notably payments), which are likely to evolve significantly going forward with the integration of AI in digital cockpits.

With rather successful integration in China, and a growing focus on multi-application enablement that can quickly capture emerging demand in other functions, the market is ripe for SEs to thrive in China today, and the rest of the world tomorrow.

Get access to over five hours of discussion on automotive cybersecurity from myself and other security experts by watching the on-demand virtual event by GlobalPlatform, Cybersecurity Vehicle Forum.

For further analyst insight into the evolution of cybersecurity in automotive and other end verticals,, subscribe to ABI Research's Quantum Safe Technologies Research Service.