US$1.3B MARKET WILL HELP ENTERPRISES CUT COSTS WHILE CREATING NEW REVENUE STREAMS FOR TELCOS

Neutral host networks have existed for decades, but the solutions have never generated as much attention as they do today. As enterprises experience rising energy costs, high inflation, and labor shortages, they are accelerating their digitization projects to increase productivity. However, rapid digitization also requires reliable wireeless connectivity.

When budgets are tight and the appetite to manage a network in-house is low, the high deployment costs of a traditional, exclusive private cellular network are not desirable. Neutral hosts fill a crucial role here, “renting out” the telco infrastructure needed for Mobile Network Operators (MNOs) to sell connectivity services to numerous enterprises simultaneously. Neutral host solutions and managed services go hand-in-hand, as enterprises want to avoid high upfront costs and offload network management to another entity.

For enterprises and MNOs, choosing a neutral host means they do not need to invest in and build out their own telco infrastructure or lease spectrum. This yields many benefits, including:

- Significantly reducing costs (up to 47% more cost-effective) and accelerating the time for MNOs to deploy new service

- Neutral hosts provide the Distributed Antenna Systems (DASs), small cells, fiber, and other infrastructure required for 4G/5G coverage.

- Neutral hosts provide access to spectrum they already possess, such as the Citizens Broadband Radio Service (CBRS) shared spectrum in the United States.

- A shared infrastructure basis supports sustainability goals due to less hardware being

installed and transported along the supply chain, reducing carbon emissions

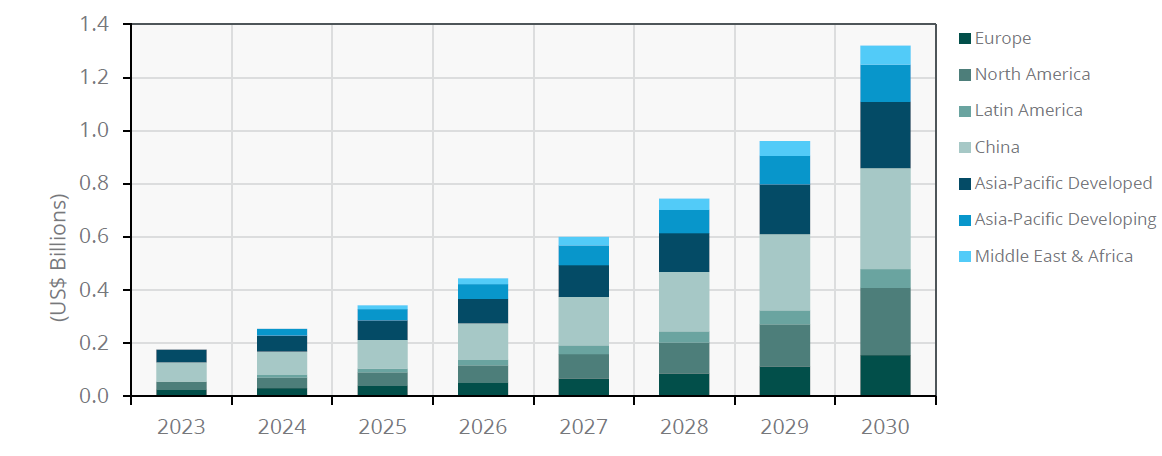

As a result, ABI Research forecasts the neutral host in enterprise cellular market opportunity to equate to US$254.4 million in 2024. By 2030, that number will soar more than fivefold to US$1.3 billion, with businesses in Asia-Pacific and North America adopting neutral host solutions the most.

Much of the current interest in neutral hosts stems from so-called “carpeted verticals,” such as financial services, public venues, and commercial real estate. For these firms, network ownership is not considered essential, and they are more interested in the cost savings generated from shared connectivity infrastructure.

However, mission-critical and life-critical verticals will also be a robust revenue opportunity. Organizations within these sectors, such as manufacturers, logistics firms, and utilities, are motivated to partner with neutral hosts because they find it beneficial to have a Managed Service Provider (MSP) handle network operations.

Chart 1: Neutral Host in Enterprise Cellular Revenue by Region (World Markets: 2023 to 2030)

WHAT ARE NEUTAL HOSTS, AND WHAT TYPES EXIST?

Neutral hosts are third-party connectivity providers renting or leasing their wireless infrastructure (cell towers, small cells, fiber-optic networks, etc.) to multiple MNOs/Mobile Service Providers (MSPs) on a shared-tenant basis. Of course, the concept of neutral hosts itself is nothing new, as they have been present in the telco industry for several decades, renting access to their infrastructure out to different Mobile Network Operators (MNOs).

Fueled by increased demands for enterprise connectivity and spectrum, liberalization initiatives—like CBRS in the United States or setting aside licensed spectrum for enterprise use cases in parts of Europe and the Asia-Pacific region—also emerge as powerful providers for enterprise cellular.

Neutral hosts are in an advantageous position for enterprise connectivity, due to their strong expertise in providing access to their infrastructure in a service-based business model, as well as pre-existing enterprise Distributed Antenna Systems (DASs).

At the same time, enterprises that are looking to deploy cellular connectivity to improve their operations are no telco experts. And they do not want to become telco experts, as they have their own strategic priorities. In this context, enterprises can hand over network management and operation to the neutral host provider, rather than dealing with it themselves.

As an example, one of the top neutral host providers that ABI Research recently assessed (see the Neutral Host Providers’ Enterprise 5G Solutions competitive assessment to learn more), Boingo, offers DASs, small cells, and wireless connectivity to its target markets of airports, sports/entertainment venues, military/public sector, commercial real estate, healthcare, manufacturing, and logistics. Boingo’s monetization strategy centers around managed services, with pricing based on professional services like planning, design, construction, and certification.

Enterprises and MNOs can collaborate with one of two types of neutral hosts: in-building wireless service provider neutral hosts or Small Cell-as-a-Service (SCaaS)/tower companies. It’s important to understand the underlying differences between these two types of providers, as these differences will affect private network capabilities.

- In-building service provider neutral hosts are companies or organizations that specialize in providing various services and solutions within indoor environments. As these services are often related to telecommunications, wireless connectivity, and infrastructure within buildings, they can act as a neutral host and rent out their deployed connectivity infrastructure to different MNOs or enterprise tenants.

- SCaaS companies, also referred to as tower companies, lack their own spectrum resources. However, these providers leverage small cell clustering, backhaul sharing, and virtualization capabilities (radio support for multiple MNOs) to accommodate clients.

HOW THE NEUTRAL HOST MARKET IS TAKING SHAPE

Many telco players—from MNOs to infrastructure vendors—have responded to the increased demand for neutral hosts.

PARTNERSHIPS & ACQUISITIONS PORTEND CONSOLIDATION

Between 2022 and today, scores of partnerships and acquisitions have been made to support neutral host deployment models and expand cellular coverage. These partnerships and acquisitions foreshadow an imminent consolidation of the historically disparate market. Recent examples include:

- Ericsson and Nokia Partnership: As cited in ABI Research’s Neutral Host in Enterprise Cellular: Best Practice Case Studies technology analysis report, Nordic infrastructure vendors Ericsson and Nokia struck new partnerships in 2022 to support their respective neutral host ambitions. Ericsson collaborated with property management company Proptivity to build the first neutral host-led indoor 5G deployment for a Stockholm mall and offices property. Meanwhile, Nokia teamed up with American Tower to implement a Software-Defined Networking (SDN) virtualization tool that enhances its neutral host deployment model.

- Boldyn Networks’ acquisition of Cellnex: Late in 2023, Boldyn Networks announced it was taking over Cellnex’s private networks business unit, including industrial specialist Edzcom. Considering that Cellnex only acquired Edzcom itself three years ago, it could be insinuated that the former’s investment in in-building wireless was a difficult journey. This may serve as a warning sign to other telcos that patience and the ability to accept short-term losses are essential before long-term revenue gains materialize.

NEW INITIATIVES & COLLABORATIONS

There were several noteworthy neutral host announcements and collaborations in 2023, as discussed in our Neutral Hosts in Enterprise Cellular: Business Models and Market Activities report:

- Celona: Announced the first End-to-End (E2E) neutral host platform operating over the CBRS shared spectrum. The solution, certified for T-Mobile’s 4G LTE network, runs on the cloud-based, multi-site, and multi-tenant software technology called the Multiple-Operator Exchange Network (MOXN).

- Federated Wireless: The Virginia-based company announced its new Neutral Host 2.0 offering in May 2023, mostly targeting the CBRS spectrum in the United States. Customers can expect Federated Wireless to source hardware, leverage its as-a-Service software platform, manage shareable CBRS spectrum, and collaborate with the cellular operator for commercial offering integration.

- Kajeet: Wireless and IoT connectivity provider Kajeet announced its Private Smart Private 5G Neutral Host Network Platform in November 2023 to expand cellular coverage and fill capacity gaps for in-building sectors. The primary target bases are college campuses, office buildings, retail areas, event venues, and hospitals.

- InfiniG: Designed to accommodate the indoor coverage capabilities of AT&T, T-Mobile, and Verizon, the California-based startup announced its Neutral Host-as-a-Service (NHaaS) platform in September 2023. Small cells for InfiniG are provided by U.S. infrastructure vendor Airspan. While AT&T and T-Mobile have committed to working with InfiniG, Verizon has yet to commit, although the company is confident about an eventual agreement.

WHAT ENTERPRISES NEED TO KNOW ABOUT NEUTRAL HOSTS

Neutral hosts are third-party connectivity providers renting or leasing their wireless infrastructure (cell towers, small cells, fiber-optic networks, etc.) to multiple MNOs/MSPs on a shared-tenant basis.

Enterprises that are looking to deploy cellular connectivity to improve their operations are no telco experts, and they do not want to become telco experts, as they have their own strategic priorities. In this context, enterprises can hand over network management and operation to the neutral host provider, rather than dealing with it themselves.

Enterprises and MNOs can collaborate with one of two types of neutral hosts: in-building wireless service provider neutral hosts or Small Cell-as-a-Service (SCaaS)/tower companies. It’s important to understand the underlying differences between these two types of providers, as these differences will affect private network capabilities.

- In-building wireless service provider neutral hosts: Companies or organizations that specialize in providing services and solutions within indoor environments. They act as a neutral host and rent out their deployed connectivity infrastructure to different MNOs or enterprise tenants.

- SCaaS (Small Cell-as-a-Service) companies/tower companies: Providers that lack their own spectrum resources. They leverage small cell clustering, backhaul sharing, and virtualization capabilities to accommodate clients.

KEY TRENDS DRIVING THE NEUTRAL HOST MARKET

To anyone working in the telecommunications industry, the idea of a neutral host is familiar. However, several reasons explain why neutral host providers are an increasingly attractive concept for enterprise connectivity today.

Table 1: Neutral Host Market Drivers

|

Driver |

Explanation |

Neutral Hosts’ Role |

|

Coverage and Capacity |

As enterprises further digitize, demand for connectivity solutions with high capacity and coverage range will soar. |

Neutral hosts possess numerous towers, cells, and other telco infrastructure, which can be leveraged by multiple enterprises concurrently. |

|

Costs and Macroeconomic Conditions

|

Operating/production costs have risen due to current macroeconomic/geopolitical challenges, as well as lingering COVID-19 pandemic effects. Therefore, enterprises’ budgets have dwindled, necessitating more cost-efficient connectivity solutions. |

“Renting” telco infrastructure from neutral hosts is more economical than building out new dedicated infrastructure. This arrangement allows MNOs to cater to many customers at once using the same towers. |

|

Minimize Complexity |

A murky economic outlook means enterprises want to simplify operations to reduce risks. |

Neutral hosts act as Managed Service Providers (MSPs), which frees up time and resources for enterprises. |

|

Spectrum Liberalization Efforts |

Shared spectrum projects have ramped up recently, which is crucial for enterprises and System Integrators (SIs) deploying private cellular networks due to their cost advantages. |

In the United States, the CBRS shared spectrum initiative has paved the way for several neutral host deployments. Spectrum liberalization has made the United States a petri dish for neutral host innovation. |

|

Resource Efficiency |

Resource efficiency is a key focal point for the modern enterprise aiming to curb its carbon footprint and deflate infrastructure costs. |

Less energy (38% greeneis required for operation when cellular networking is shared. Moreover, reusing infrastructure reduces emissions originating from its production and device use. |

HOW NEUTRAL HOSTS CAN STAND OUT FROM THE CROWD

Through countless conversations and interviews, ABI Research learned that neutral host providers share a similar vision. Providers have become dynamic, with additional services being a common theme in market offerings. Neutral hosts typically avoid charging significant upfront costs (CAPEX) and choose to deploy a managed services model. That translates to an OPEX model, which is attractive to enterprises with tight budgets.

Neutral hosts primarily generate revenue from

- Expanded SIM card connections

- Providing KPIs

- Broader network consumption/coverage

- Supporting multiple technologies (4G/5G, DAS, Wi-Fi, fiber)

- Security provisioning, which is a top concern for enterprises

WHAT'S YOUR VISION?

These aforementioned neutral host solution characteristics are widespread in the market. Therefore, what really sets a neutral host apart from the competition is the execution of its vision.

- How many regions does the neutral host have customers in? For example, Boingo has enterprise customers in nearly every corner of the Earth. Its primary target markets are the United States, Latin America, Europe, and Asia-Pacific.

- Which verticals are being targeted? Some verticals are more inclined to adopt traditional neutral host architecture than others (more on this later). Leading providers ensure they cater to the public venues, hospitality, commercial real estate, and retail sectors. Other verticals require robust Service-Level Agreements (SLAs) for mission and life-critical use cases, and therefore, control over at least part of the cellular network infrastructure. For these verticals, neutral hosts are considered Managed Service Providers (MSPs). This, however, requires neutral hosts to develop new delivery architecture, which takes time to develop and to manifest.

- How many partnerships have been struck? In creating the E2E connectivity solutions that enterprises seek, neutral hosts typically need support from other telco players. American Towers is a shining example of an influential neutral host, having ties with numerous telco companies through its Channel Partner program. This program anchors MSPs, enterprises, and data center operators.

- Does the neutral host have a proven track record? Enterprises prefer to choose a connectivity provider with a history of successful 4G/5G private cellular network deployments. The more publicly disclosed deployments and Proof of Concept (PoC) projects, the better. Cellnex has performed well in this context through its acquisition of Edzcom (in 2020), which reported more than 50 private cellular deployments as of July 2023. With the acquisition by Boldyn Networks, these assets will move over to Boldyn Networks once the acquisition is finalized in early 2024.

- What’s the number of DASs actively deployed? Enterprises prefer to work together with established partners when deploying a private cellular network. Therefore, deployed DASs can serve as important incumbent advantages for neutral hosts and their enterprise cellular ambitions. A neutral host provider’s private cellular network capabilities are inherently tied to its DAS infrastructure. Enterprises will want to partner with a provider that has already deployed many DASs for indoor cellular connectivity, providing wider coverage. For example, Kajeet reports an impressive 3,000+ DAS deployments. As another example, Boingo has deployed a three-digit number of DASs across the United States, in addition to 32,500 access nodes.

WHERE IS MARKET POTENTIAL FOR NEUTRAL HOSTS THE GREATEST?

By 2030, ABI Research forecasts the revenue opportunity for enterprise neutral hosts to reach US$1.3 billion and grow at a Compound Annual Growth Rate (CAGR) of 33.4% between 2023 and 2030. Throughout the forecast period, the manufacturing, logistics, and energy generation verticals will account for between 62% and 67% of the market opportunity. These verticals find neutral hosts’ experience as Managed Service Providers (MSPs) an alluring trait, as they rely on robust 5G connectivity for digital transformation and the introduction of mission- and life-critical technologies (robotics, digital twins, etc.).

A neutral host can be more affordable than a dedicated private cellular network because multiple customers use the same infrastructure concurrently. In a traditional private network deployment, new cellular infrastructure must be built for the enterprise, increasing costs significantly. While the neutral host is economical for many enterprises, it’s important to understand that it comes with less control over the network, negatively affecting network integrity.

While this may challenge mission-critical and life-critical verticals, so-called “carpeted” verticals such as financial services, retail, transportation, stadiums and event venues, and commercial real estate are less concerned about network autonomy. Carpeted verticals choose neutral host partners based on their infrastructure capabilities, making Multi-Operator Radio Access Network (MORAN) and Multi-Operator Core Network (MOCN) attractive features.

For these reasons, carpeted verticals will also present significant opportunities for neutral hosts as they aim to digitize in the most convenient and cost-effective way possible. For example, retailers are expected to spend US$106.3 million on neutral host solutions annually by 2030. Moreover, the financial services (including commercial real estate) sector will be a US$69.7 million opportunity by the decade’s end.

Table 2 below distinguishes the connectivity requirements between various verticals. Those with a higher score are more mission-critical and life-critical, necessitating full ownership of their telco infrastructure. For those verticals, neutral hosts are considered because of their capabilities as MSPs, rather than just the owners of connectivity infrastructure.

Table 2: Wireless Networking Requirements by Vertical

|

Network Consideration |

Agriculture |

Energy Generation |

Financial Services |

Healthcare |

Logistics |

Manufacturing |

Retail & Commercial Real Estate |

Stadiums & Event Locations |

Transportation |

|

Network Integrity |

Important |

critical |

important |

critical |

very important |

critical |

no specific requirements |

no specific requirements |

critical |

|

Data Security |

no specific requirements |

critical |

important |

critical |

very important |

critical |

no specific requirements |

no specific requirements |

critical |

|

Full ownership of the infrastructure |

no specific requirements |

critical |

no specific requirements |

no specific requirements |

very important |

critical |

no specific requirements |

no specific requirements |

very important |

|

Wide coverage area |

critical |

critical |

no specific requirements |

important |

important |

important |

no specific requirements |

no specific requirements |

important |

|

High bandwidth |

important |

very important |

important |

very important |

very important |

very important |

very important |

critical |

important |

|

High density of connected devices |

very important |

very important |

important |

no specific requirements |

very important |

very important |

critical |

critical |

very important |

|

Availability and reliability |

very important |

critical |

important |

critical |

very important |

critical |

very important |

very important |

critical |

|

Low latency |

no specific requirements |

very important |

no specific requirements |

very important |

very important |

very important |

no specific requirements |

important |

very important |

|

SUM |

8 |

21 |

5 |

17 |

15 |

19 |

8 |

9 |

20 |

NEUTRAL HOST USE CASES

As mentioned in ABI Research’s The Role of Neutral Hosts in Private Cellular Networks report, some of the immediate opportunities for neutral hosts come from non-mission- and life-critical verticals with limited digitization budgets. Among them, organizations within the education, public events, commercial real estate, and first responder spaces are prime customer bases. This section explores why neutral hosts should target these verticals and how these networks are used.

![]()

COLLEGE CAMPUSES AND PUBLIC EDUCATION

Schools and universities are prime targets for neutral hosts, considering these institutions do not require ownership of infrastructure and their digitization budgets are strained. The idea of “renting” connectivity from a neutral host at a reasonable price is highly attractive to educational institutions.

Therefore, it is no surprise that the education sector is the main enterprise customer base for neutral hosts in the United States, especially considering the affordable access to the CBRS spectrum. San Jose University is a prominent example, recently partnering with Celona to connect up to 24,000 devices simultaneously using 3,000 Access Points (APs). The 4G/LTE network provides more reliable connectivity than the previous Wi-Fi network for such a dense environment.

U.S.-based neutral host providers Internet2 and Kajeet are other telcos primarily targeting educational environments. The former teamed up with Duke University, DISH, and Cisco in 2022 to pilot a private neutral host-based network that converges 5G with Wi-Fi. This pilot demonstrates the ability of neutral host providers to improve wireless connectivity, thereby supporting new educational technologies. Meanwhile, Kajeet mostly provides wireless connectivity for public education and smart campuses, fueled by its 2022 partnership with RAN supplier Samsung.

![]()

PUBLIC EVENT VENUES

Some industry players say that over 75% of all mobile traffic originates from highly dense areas, such as concert halls, hospitality environments, and other event locations. Existing public networks may not be enough to sustain traffic demand, necessitating new connectivity means. Neutral hosts are an excellent connectivity choice for public event organizers, as various commercial entities typically use stadiums and event locations. This way, the event organizer can rent out the neutral hosts’ infrastructure and wireless connectivity to the individual entity when they host an event at a stadium or other venue.

For example, Celona provides the wireless infrastructure needed for Haslam Sports Group to build a cellular/Wi-Fi converged private network at two of its largest stadiums in Ohio, the FirstEnergy Stadium (home of the Cleveland Browns) and Lower.com Field (home of the Columbus Crew). The cellular solution, which runs on the CBRS spectrum, is more resource-efficient, requiring just two outdoor-based APs (as opposed to several dozen Wi-Fi APs).

It’s also important to point out that the promise of improved connectivity alone is not compelling enough to convince venue owners to invest in their own dedicated private network. A more reasonable approach, in their eyes, would be to partner with a neutral host that provides wireless connectivity services to multiple enterprises simultaneously using the same infrastructure.

![]()

COMMERCIAL REAL ESTATE

For building owners or building management companies, the appeal of neutral hosts stems from their cost savings and rapid service provision. These companies picture the neutral host solution supporting Virtual Private Networks (VPNs) for dedicated connectivity. With VPNs, real estate tenants can securely execute business-sensitive and critical use cases.

In most cases, these building managers own commercial real estate with multiple retailers or offices requiring similar connectivity requirements. Thankfully, for neutral hosts, this means you only have to tailor the network for one single entity, which then offers services to all real estate tenants concurrently.

![]()

FIRST RESPONDER NETWORKS

Vehicle-to-Everything (V2X) capabilities are of immense interest to smart city operators, but applications require reliable and ubiquitous connectivity. Neutral host deployments make V2X applications a reality for cities as it’s a far more affordable way to achieve connectivity than using a public network.

For example, a connected ambulance can communicate with surrounding vehicles to inform them to maneuver to the side of the road during a trip to and from the hospital. Or a “green wave” can be made for a fire truck when responding to a fire via communication between the connected fire trucks and traffic light infrastructure. These use cases ensure that traffic flow is optimized and emergency services personnel can reach their destination as quickly as possible.

KEY TAKEAWAYS FOR TELCO PLAYERS

MNOs, infrastructure vendors, and System Integrators (SIs) should all have a vested interest in capturing enterprise value in the neutral host market; the revenue potential is expected to grow robustly throughout the rest of the decade. ABI Research provides the following key takeaways for these telcos to help map future business strategies.

Table 3: Key Takeaways for Telcos Approaching the Neutral Host Market

(Source: ABI Research)

|

MNOs and Neutral Hosts |

Infrastructure Vendors |

System Integrators |

|

Pivot from the traditional Connectivity-as-a-Service model to a managed services model to attract enterprises facing macroeconomic and labor challenges. |

Ensure infrastructure is interoperable across different vendors. Neutral hosts will prioritize interoperability because it allows them to offer customers a wider range of services. |

Acquire neutral host capabilities to provide E2E services to customers. The liberalization of spectrum will help facilitate cellular connectivity for enterprises. |

|

MNOs that partner with neutral hosts will be better positioned to offer a Network-as-a-Service (NaaS) model that enterprises currently seek with tight budgets. This will ensure that MNOs extend or differentiate their service offerings and remain relevant to enterprises. |

Expanding product portfolios, such as small cells, in-building network solutions, etc., is essential. Innovative design and manufacturing are required to reduce hardware costs, which is appealing to neutral hosts. |

Cellular SIs can tap into new markets accustomed to Wi-Fi by embracing neutral host solutions. The cost-effectiveness of shared infrastructure appeals to retail, real estate, financial services, sports & venues, and other carpeted verticals. |

|

Refrain from a “one-size-fits-all” approach to private cellular networks, as certain verticals are better suited for neutral host deployment than others. It’s key to offer solutions tailored to each vertical. |

Establish partnerships with neutral hosts for sustained business growth and to stay informed on customer pain points. |

Diversify services to cater to neutral hosts, including network planning, design, installation, and post-deployment support. Integrated, modularized designs ensure solutions can easily be molded to specific enterprise environments. |

NEXT STEPS

As our market forecast precipitates, demand for neutral hosts is growing with every passing year. It will represent a significant revenue opportunity for telcos as enterprises seek a more cost-effective wireless connectivity solution. To help telcos optimize their products and services, ABI Research offers the Neutral Hosts for Enterprise 5G Research Spotlight, which helps you:

- Assess the competitive market

- Identify opportunities

- Evaluate innovations

- Conceptualize business models