Generative Artificial Intelligence (Gen AI) is perhaps the biggest technology trend of our time, with business leaders and investors rapidly seizing the opportunities it can present. ABI Research's latest report, Gen AI Telco Strategies, discusses the case for Gen AI in telecommunications.

It’s still early days for Gen AI in telecom, but its potential to revolutionize the industry through AI-driven network optimization and customer engagement is impossible to ignore. In these early days, it’s clear that telcos are still hesitant toward company-wide implementation of Gen AI. The technology is almost exclusively being used by Communication Service Providers (CSPs) for low-hanging fruit use cases, notably customer service, marketing, and sales.

To a lesser degree, Gen AI is gaining ground in telecom networks, being leveraged for 5G management to enhance efficiency. However, there are several challenges that must still be addressed before wider implementation.

ABI Research forecasts that telcos will spend US$47 billion on Gen AI solutions by 2029. This is an enormous leap compared to just US$268 million in spending expected in 2025.

Current State of Gen AI in Telecom

So far, most deployments of Gen AI in telecom have focused on business operations, using Large Language Models (LLMs) hosted in the public cloud. But as telcos start exploring Gen AI for more critical tasks—like managing network performance, spotting security threats, and handling customer interactions—concerns around data privacy and control are growing.

As a result, many organizations will turn to sovereign cloud for Gen AI usage, ensuring sensitive sensitive data remains local and secure. Sovereign cloud will be particularly prominent in regions where geopolitical tensions complicate cloud ownership and regulation.

While business operations are currently the main drivers for Gen AI adoption in the telecom industry, it also supports telcos’ ambitions to automate 5G network management. The streamlining benefits of contextualized LLMs are especially welcomed by telcos because they operate in one of the most complex and data-driven industries there is. Network automation with LLMs enables Gen AI to serve as a step toward greater autonomy by performing analytical tasks like guiding network planning through natural language, summarizing incidents, and recommending solutions.

Gen AI-driven solutions support network management through synthetic data generation, improving data quality for network modeling and enabling broader personnel involvement in operations while maintaining data security. Overall, Gen AI's potential for the mobile network is increasingly acknowledged as telcos initiate Research and Development (R&D) in these areas.

How Gen AI Improves the Mobile Customer Experience

As a prominent industry example, Deutsche Telekom (DT) launched its Ask Magenta chatbot in 2016 to assist customers. However, the AI-powered application could only accept limited information regarding service malfunctions. DT has since invested in Gen AI chatbots powered by Anthropic Claude and Meta LLaMa to expand the use cases of Ask Magenta. These LLMs allow the chatbot to resolve billing and service issues, such as service requests, while handling sensitive customer data.

Of the many public LLMs available to the telecom industry, Anthropic Claude is especially well-suited for customer care. This is because Claude AI models are trained to detect a user’s intent and emotions. In this way, the chatbot can respond more appropriately and resonantly to network service requests. DT recently partnered with Anthropic (Claude 2) and Meta (LLaMa2) to develop a multi-lingual, telecom-specific LLM through the “Global Telco AI Alliance” alongside e&, Singtel, and SK Telecom. This platform, driven by contextualized large language models, will ensure telco chatbots are tailored to the specific needs of a CSP’s customers and potential customers.

The superiority of Gen AI-based chatbots plays a key role in telco companies providing timely, context-based, and personalized responses to customers. This is all done with a human touch. Moreover, a good customer experience will keep the consumer on your website longer and increase stickiness. Ultimately, this will lead to more sales, as much as 67% more, according to Intercom's recent survey of 500 business leaders. Lastly, these chatbots reduce the workload for live human support agents.

Read Analyst Insights:

Telecom AI: Achieving Energy Efficiency in the 5G Era

The Role of Gen AI in Telco: Handle with Care

Using AI to Transform Cloud RAN from Stepping Stone to Revenue Engine

Telco to “AI-co”—a Look at SK Telecom’s Aggressive Approach to Capitalize on AI Demand

How Telcos Are Using Gen AI in Marketing and Sales

In terms of telecom business operations, some of the top use cases of Gen AI are employee guidance, sales support, and content production for marketing. Gen AI-powered chatbots used for customer service can be extended to internal employee support. Service providers like Vodafone and Orange deploy dual customer and Business Support System (BSS) chatbots powered by Gen AI LLMs. For example, Vodafone used the same Bard LLM to build both a customer service chatbot (TOBi) and a chatbot for employees (ASKHR). Meanwhile, Orange’s Google Cloud-powered LLM chatbot provides sales agents with a transcription/summarization of a call and offers follow-up recommendations. From customer journey mapping to lead identification, Gen AI-based content has many benefits on the sales front.

As we’ve recently pointed out, Gen AI excels at creating fresh content, such as text, images, and videos. This allows marketing teams at telco companies to streamline the process of prototyping new branding and advertising ideas. Besides content production, Gen AI can also provide recommendations based on past marketing campaigns.

ABI Research forecasts as much as a 40% productivity increase for telecom companies using Gen AI in customer care and BSS applications.

Gen AI Streamlines Telco Network Management

Telcos can also use Gen AI technology to enhance network operations, which is unique to the industry. While the potential for Gen AI automating cellular networks is undeniable, its application remains in the Proof of Concept (PoC) stage. Network operations are far more complex and prone to risks than customer service or business operations use cases.

Instead of fully autonomous network management, which will be supported by AI copilots, telco network operators are primarily using Gen AI for telecom business process automation. This could be anything from producing summaries and recommendations to network orchestration and coding. Gen AI can identify network anomalies, provide intent-based development or code assistance, automate incident response, and provide step-by-step support for field maintenance workers. LLMs that excel in mathematical and logical reasoning, such as Palm, are the best options for automating network operations.

However, it should be noted that network operations outputs are based on exceptionally complicated datasets and non transparent procedures. For these reasons, telcos refrain from fully automated network management and instead must oversee the guidance provided by LLMs. In other words, telco network operators cannot take everything the Gen AI suggests at face value. Outputs must be scrutinized and verified for assurance.

For now, network operations is a more nascent area for Gen AI in telecom. Once LLMs become more trustworthy, the technology has immense potential to automate network optimization and predictive maintenance (e.g., anomaly detection). Gen AI currently sits between manual operations and fully automated networks. According to ABI Research forecasts, telcos that leverage Gen AI for network design, optimization, and testing can increase productivity by 15% to 25%.

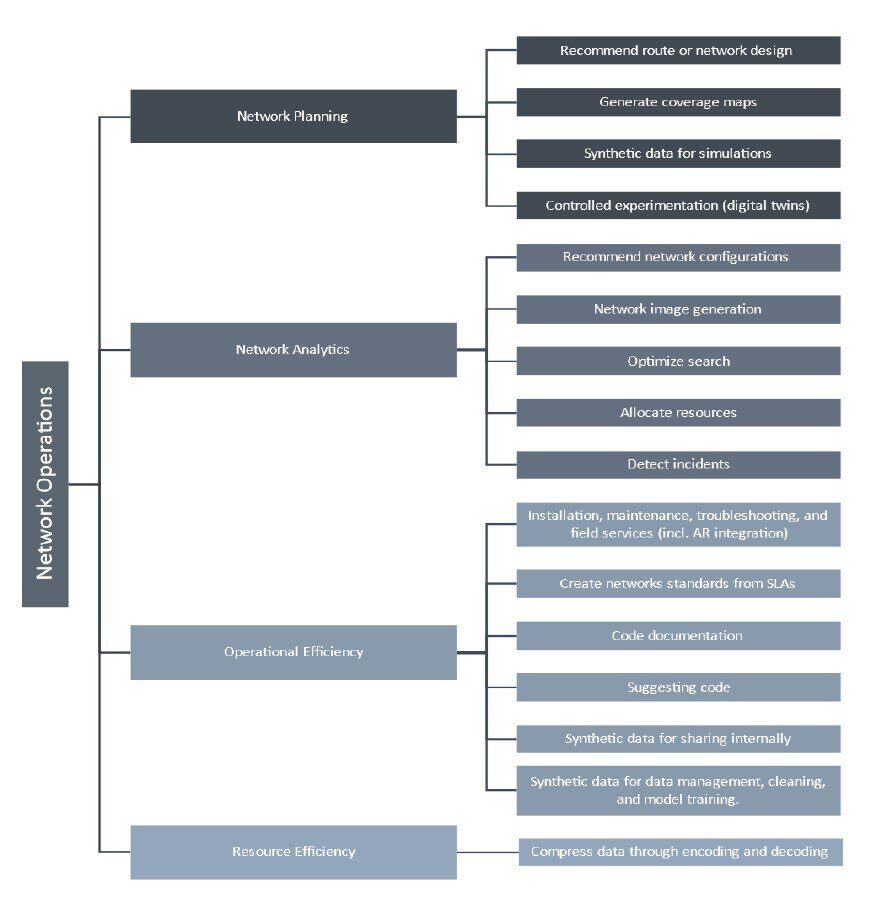

Figure 1: Generative AI Use Cases for the Telco Network

(Source: ABI Research)

Gen AI's Industry-Disrupting Potential

From the telecom perspective, Gen AI has strong potential to be an industry disruptor. As CSPs deploy AI-based workloads in the cloud, other companies like hyperscalers, network vendors, and open-source contributors will play a more prominent role in network management. These companies will service assets that telcos require for Gen AI enablement. More network assets will be controlled by non-CSP entities, such as cloud infrastructure providers. Moreover, the CSP monetization models and business strategies will inevitably veer toward AI-driven, intelligence-based offerings and services (e.g., network slicing).

Applying Gen AI to business is a convoluted process, with most projects failing to deliver a Return on Investment (ROI) across industries. Telcos may face an even lower success rate, considering the complexity of cellular networks. There are many challenges that service providers must be aware of as they aim to adopt Gen AI, such as the risk of business strategy misalignment, building “explainable” LLMs, and regulatory compliance.

For further guidance on the latest AI advancements in the telecom industry, download ABI Research’s Gen AI Telco Strategies report.