By Jake Saunders | 1Q 2024 | IN-7206

Registered users can unlock up to five pieces of premium content each month.

Apple Primes a Market |

NEWS |

In November 2022, Apple announced that its soon to be launched Apple 14 smartphone would provide “Emergency SOS via satellite service” in collaboration with Globalstar. At the time, this was a game-changer, as this was the first satellite/cellular hybrid end-user smartphone. The Satellite Communications (SatCom) service was integrated into the iPhone’s Crash Detection service and could detect a severe car crash and automatically dial emergency services when the user is incapacitated. That SatCom development triggered a groundswell of interest from other semiconductor and smartphone manufacturers.

In February 2023, Qualcomm announced “Snapdragon Satellite.” Satellite connectivity capability would be integrated into its flagship Snapdragon 8 Gen 2 Mobile Platform and the chipset vendor declared that a number of end-user smartphone manufacturers were keen to integrate satellite connectivity into their handsets. Motorola was very proactive with its Defy line-up. Huawei launched its satellite-capable Mate P60 smartphone in 2Q 2023 to great fanfare, especially in China. One of the latest smartphone manufacturers to get on the satellite connectivity bandwagon is OPPO. Significantly, OPPO and Huawei have stated that their Non-Terrestrial Network (NTN)-capable smartphones can provide more than just an emergency messaging service. Indeed, they state that their devices can provide voice communications in a more conversational manner, rather than being like a “walkie-talkie.”

Chinese Satellite and Smartphone Sector Positioned for Takeoff |

IMPACT |

Chinese smartphone manufacturers are embracing SatCom with great enthusiasm. Samsung announced a joint venture with Skylo, but it has yet to launch a flagship satellite-enabled smartphone. In addition to Huawei, OPPO, ZTE, HONOR, and even China Telecom (with its Tianyi Bodun S9) have come out with their own NTN-capable devices. However, the satellite service provider is not the one Qualcomm had lined up—Iridium. Instead, these device manufacturers are using China Telecom’s satellite service, “Mobile Direct Satellite.” It uses the Tiantong-1 Geosynchronous Earth Orbit (GEO) satellite constellation, which covers all of China’s territory and territorial waters. The service is available to all China Telecom customers and does not require users to switch to a new Subscriber Identity Module (SIM) card.

In November 2023, Qualcomm announced publicly that it was terminating its relationship with Iridium, as there had been pushback and concern about Snapdragon Satellite’s need for proprietary satellite connectivity based on Iridium’s solution, as well as the cost structure. We will have to see what future announcements Qualcomm makes to secure one or more satellite service providers for its Snapdragon Satellite platform.

Certainly, satellite connectivity is seen as an essential feature in the highly competitive Chinese smartphone market. OPPO, in a late December 2023 announcement, highlighted several innovations and features in its satellite-capable smartphone, the Find X7. OPPO’s handset uses the low-frequency n28 band (700 Megahertz (MHz)) and the n8 band (900 MHz), and has integrated quadruple low-frequency antennas in the handset body, effectively doubling the number of receiver channels for the low-frequency Multiple Input, Multiple Output (MIMO) antennas in the handset. OPPO also claims it has been able to achieve a 7 Decibel (dB) increase in the received signal by mitigating the person’s hands and body from attenuating the satellite signal. Novel antenna design and smartphone design materials are cited, but ABI Research has yet to verify their characteristics. OPPO believes the net result of these innovations transforms voice communication over the NTN satellite link from a “walkie-talkie” to a more regular two-way conversation.

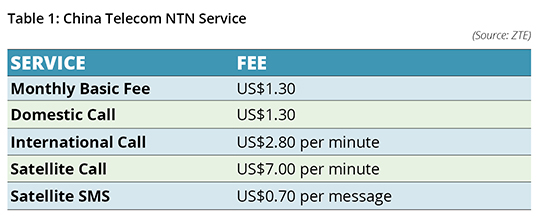

Furthermore, the presumption that SatCom is “expensive” is also changing. NTN users in China can access the service with the following fees:

Compared to unlimited calls and 1,000+ Short-Message Service (SMS) bucket plans that most mobile operators offer in most developed domestic markets, these NTN services are not cheap, but for guaranteed, “anywhere on the planet-type communications,” it is competitively priced and competition is likely to push down fees over the next 3 to 5 years. Several satellite Internet and Internet of Things (IoT) service providers will be ramping up their services for the Chinese market and indeed the wider regional and global market. Contenders include Guowang, a mega constellation with 13,000 satellites in Low Earth Orbit (LEO), and the Shanghai government has announced support for a broadband mega-constellation consisting of an initial 1,296 satellites, called G60 Starlink. Elon Musk cannot be happy that a Chinese constellation is intending to use the same brand name as its SpaceX Starlink satellite broadband service. Other contenders are waiting in the wings.

Diversifying Satellite Business Models |

RECOMMENDATIONS |

The satellite NTN marketplace is moving rapidly. There was a time when the cellular communications industry, in the form of “GSM,” busted the nascent mobile satellite service industry in the late 1990s/early 2000s. Iridium came within days of shutting down its 66 LEO satellite constellation, as a universal communications technology, the GSM handset, and international roaming plans coordinated and supported by the GSM Association undermined the international business traveler model from the likes of Iridium, Globalstar, ICO, and Spaceway in the late 1990s. The latter two satellite service providers faded away. Iridium and Globalstar survived by plugging into the needs of national agencies (military, police, and rescue services), exploration, and mining companies. Later, they targeted the intrepid explorer and wealthy leisure cruise market segments.

The convergence of miniaturization, the mass market adoption of wireless connectivity, and competition now provide the opportunity to merge the satellite and terrestrial cellular ecosystems. The legacy Mobile Satellite Services (MSS) LEO providers such as Iridium and Globalstar will need to ensure their satellite operations become fully compliant with The 3rd Generation Partnership Project (3GPP) NTN mobile services. This will require additional investment and a number of satellite launches. GEO satellite communications providers such as Viasat and Hughes NS will need to demonstrate LEO hybrid capabilities. The GEO satellite is a very reliable communications platform, but latencies of 600 Milliseconds (ms) to 800 ms will impact some applications. SpaceX’s Starlink has launched more than 5,000 satellites (and counting). Amazon’s Project Kuiper will start launching its mega constellation in 2024. These more recent LEO systems will have comparatively low latency and substantial capacity, but will need to demonstrate that several thousand strong satellite constellations can remain commercially viable in the long term. LEO satellites only last 5 to 7 years before they fall out of orbit. All these aforementioned satellite providers could face significant competition from the Chinese satellite sector, which has a track record for rapid innovation, iteration, and competitive pricing.