By Andrew Cavalier | 3Q 2023 | IN-7052

Registered users can unlock up to five pieces of premium content each month.

KDDI and Starlink, China Telecom and Huawei, Motorola |

NEWS |

KDDI and Starlink recently announced a new partnership to bring satellite-to-cell services to Japan. These services are anticipated to start as early as 2024 and are initially slated to introduce Short Messaging Service (SMS) text services to KDDI mobile users. This will likely be in Long Term Evolution (LTE) Band 1, of which KDDI is allocated the 1,920 – 1,940 Megahertz (MHz) (Uplink (UL)) and 2115 – 2130 MHz (Downlink (DL)). This announcement follows Starlink’s trend of reusing partnering Mobile Network Operators' (MNOs) spectrum to bring services to mobile subscribers using unmodified Commercial Off-the-Shelf (COTS) mobile cellular devices, akin to competitors AST SpaceMobile and Lynk.

On other fronts, equipment vendors Motorola and Huawei have announced that their newest generation of satellite-to-cell services will be using Geosynchronous (GEO) satellite Tiontang-1, operated by China Telecom, for two-way messaging via satellite in the country. vivo also recently unveiled a smartphone using a new prototype Non-Terrestrial Network (NTN) System on Chip (SoC), which is based on The 3rd Generation Partnership Program (3GPP) Release 17 standards, supports n255/n256 dual frequency, and is compatible with the Viasat+Inmarsat and Tiantong-1 satellite systems. With Apple due to unveil the iPhone 15 in the coming weeks, which will likely continue to use their proprietary solution with Globalstar, it is likely that the NTN-mobile segment will continue to see different evolutionary paths for satellite-to-cell services.

NTN-Mobile Market Fragmentation |

IMPACT |

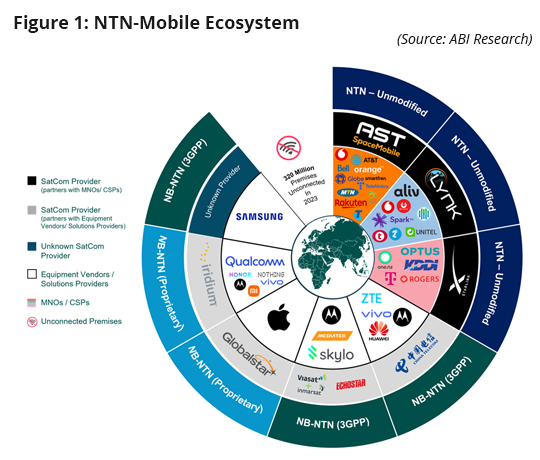

These announcements reveal a rapidly developing and fragmented market. On one hand, operators like Starlink, AST SpaceMobile, and Lynk focus on connecting unmodified COTS devices by reusing their partnering MNOs’ LTE spectrum to bring services to mobile subscribers. While these services aim to eventually bring broadband to their users, they will initially offer two-way messaging. ABI Research recognizes this as a distinct segment under the term NTN-unmodified.

On the other hand, mobile phone vendors like Apple, Motorola, Samsung, Huawei, ZTE, and others partner with satellite operators directly to provide satellite texting services to their devices with dedicated NTN-mobile processors and modems. These services primarily focus on low data rate applications, such as one-way and two-way messaging via satellites. These players can be further divided into those following the 3GPP standard (i.e., using Narrowband Internet of Things (NB-IoT)/LTE-M) and those using proprietary solutions via legacy Mobile-Satellite Service (MSS) solutions.

Those following 3GPP’s standard include the Motorola Defy 2 using MediaTek’s 3GPP IoT-NTN chipset and vivo’s prototype equipped with the V8821 SoC, while those following a proprietary design include the Apple iPhone 14 Pros (and likely the upcoming 15 series), as well as Android phones equipped with Qualcomm’s 5G processors and modems like the Snapdragon 8 Gen 2 processor and X70 5G modem. ABI Research collectively recognizes this as a distinct segment, under the term Narrowband-NTN (NB-NTN). It should be noted, however, that IoT-NTN chipsets (as the name suggests) can be used for embedded Internet of Things (IoT) applications, which ABI Research recognizes as a distinct category, also referred to by 3GPP’s standard as IoT-NTN. The fact that these chipsets are used in phones can be confusing.

The final segment is based on 3GPP’s standard known as New Radio NTN (NR-NTN), which adopts 5G NR for use over NTNs. This segment will include mobile broadband (5 – 20 MHz) communications, such as video, voice, and Internet applications. NR NTN User Equipment (UE) is anticipated to include NTN chipsets, software, and hardware, such as Global Navigation Satellite System (GNSS) modules, to compensate for the Doppler shift and execute Conditional Handover (CHO) between network cells based on timing and location triggers. It is anticipated that these solutions will begin to emerge in the later part of the decade.

With these separate evolutionary NTN tracks, it is apparent that 3GPP’s standard is not gaining traction in all corners of this NTN-mobile market. In this respect, ABI Research anticipates that the market will be driven by NTN-mobile device penetration and access to low-cost NTN services. With devices in the NB-NTN segment having built-in NTN services out of the box, this segment is anticipated to become the largest segment over the decade as users refresh their phones to the latest generation. While the NTN-Unmodified segment has the greatest starting potential by targeting all existing mobile devices, these NTN services need to reuse the local MNO’s spectrum and get local regulatory approval. Alongside this, these services will eventually have to compete with built-in NB-NTN services on devices and may face challenges in converting customers.

Establish Partnerships and Introduce Differentiated Products |

RECOMMENDATIONS |

Navigating this emerging market can be both challenging and full of opportunities. As the NTN-mobile market is still in its early stages, there is no dominant leader yet and potential remains to earn a share of the market. To do so, companies will need a strategic approach that considers some of the dynamics between MNOs, Satellite Communications (SatCom) operators, mobile phone vendors, and regulatory requirements within different regions. Here are some recommendations:

- Segmentation and Targeting: Clearly define and understand the various segments within the market, especially from a global and national perspective. Some countries like China only allow NTN services from Chinese networks like Tiantong-1 or Beidou, so they have more specific requirements than other European or American markets. Therefore, identify the specific needs, preferences, and pain points of each segment and market so that products, services, and marketing efforts are more effective and tailored for that market.

- Niche Focus: Instead of trying to serve the entire market, consider focusing on a specific niche where your products or services can excel. Providing an NTN software layer and services catered for a specific market, such as emergency services or low-cost texting in uncovered areas, are such examples. This can help establish one as an expert and leader in a service niche and build a reputation and loyalty among customers looking for specialized solutions, such as Apple SOS.

- Differentiation: Differentiation is another key area that can help set offerings apart from competitors. Identify what makes your products or services unique and valuable. This could be through quality, features, pricing, customer service, or any other aspect that sets you apart.

- Partnerships and Alliances: Form partnerships with complementary businesses in the market. This seems to be one of the primary tactics in the NTN-mobile space and helps companies pool resources, expand their reach, and leverage each other's strengths. In this way, satellite operators, solutions providers, equipment vendors, and MNOs can all get a slice of the market and find potential partners to generate revenue.