By David McQueen | 1Q 2020 | IN-5732

Registered users can unlock up to five pieces of premium content each month.

Encouraging 5G Smartphone Sales for 2019 Revealed by the Major Vendors |

NEWS |

Over the past couple of weeks, lead global smartphone vendors Samsung and Huawei revealed the number of 5G smartphone units shipped in 2019, which were released as 6.7 million and 6.9 million respectively. While this is a healthy start to the anticipated explosion in volume of 5G devices, it is more impressive when considering that the majority emanated from premium, high-priced models. For the time being, these volumes have been mostly confined to the United States, South Korea, parts of Europe, and China for the tail end of the year. With a plethora of cheaper 5G smartphone models expected to arrive in 2020, room at the top will quickly evaporate.

Fast Growing 5G Smartphone Sales to Outstrip 4G |

IMPACT |

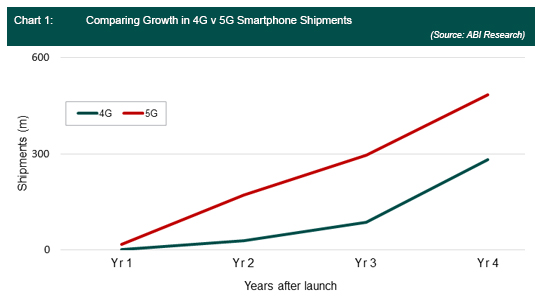

Adding together the 5G volumes of Samsung and Huawei with an estimate for the remainder of the 5G smartphones market, which will emanate from the likes of LG, Xiaomi, Huawei, vivo, OPPO, and ZTE, ABI Research believes there were a total of 16.4 million sold in 2019, which accounts for just over 1% of global smartphones sales in 2019. It is expected that 5G smartphone sales will increase more aggressively compared to 4G and, in comparison to the growth of 4G at launch, 5G is expected to outperform its predecessor on nearly every metric. Excluding the obvious gains in an increase in data throughput and improved latency, 5G wins hands-down on the number of mobile devices, subscribers, and networks available at launch and volume sales will outstrip 4G for a number of years thereafter, becoming the most accelerated mobile technology generation ever launched.

|

It is notable that Samsung and Huawei’s shipments came from a combined total of 13 5G models in 2019, including mostly high-end Samsung flagship Galaxy S10 and Note 10 ranges and Huawei Mate 30 5G variants and the Mate X. Both companies have leveraged their early commitment to 5G, catalyzing its market development in 2019 as they have sought market leadership in sectors from mobile devices and semiconductors to networking equipment.

This vendor landscape is due to change rapidly into 2020. Despite these high-end models currently commanding the majority of 5G smartphone volume, the market is set to expand exponentially in 2020, led by a sizeable number of new models set to arrive from all major vendors (including those from 5G laggard Apple). The availability of models during the year will become more diverse, bringing 5G to the market at a wide variety of price points and democratizing the 5G experience. This means that 5G at the high-end will be squeezed, witnessing rapid saturation, particularly in the final quarter of 2020 as Apple is expected to add three (possibly four) new 5G iPhone models to the mix, joining expected high-end 5G upgrades from Samsung and Huawei.

With new entrants and a plethora of cheaper 5G models expected to hit the market, mid-range smartphones will be the main driver for accelerating adoption throughout the year, helped by increased 5G network coverage and improved User Experience (UX). With many vendors on the roster expected to push deeper into the lower-priced 5G smartphone segment, led by models from Xiaomi, OPPO, Motorola and Vivo, as well as lower tiered offerings from Samsung and Huawei, shipments of 5G smartphones will grow globally by over 1,200% in 2020 to reach more than 170 million units worldwide, accounting for 12% of total smartphones sales. To aid this growth, the low- and mid-range sectors will also be underpinned by the continuing availability of more affordable 5G chipsets, notably those from Qualcomm, MediaTek, and UNISOC.

The charge to 5G is currently being led by the key markets of the United States and South Korea, reflecting the market’s high-end profile. However, it is the latter introduction of the China market at the end of 2019 that will be predominate in 2020, boosting demand further for smartphones, with Japan and parts of Western Europe also making significant gains throughout the year. Indeed, most regions will be far more aggressive regarding 5G in 2020 and the likely addition of large emerging markets, including India, will help create even greater demand for devices in the low-to-mid range that will accelerate 5G affordability and adoption.

Mid-Range 5G Smartphones Race to the Front in 2020 |

RECOMMENDATIONS |

While consumers are eager to embrace new mobile experiences after years of tolerating stagnation and lack of innovation, many smartphone vendors are looking to quickly expand their 5G portfolios in 2020. They will help serve this pent-up demand by introducing new advancements that will improve speed, performance, and security, with 5G promising enhanced broadband speed connectivity and services, offering innovative ways to interact with their devices. However, the high prices of 5G smartphones are currently suppressing sales, and so a seismic shift in 2020 to lower price tiers will help fulfil this promise and put them in more hands. This will undoubtedly be good news for smartphone replacement cycles and technology migration in the short term, but this rapid change, particularly when compared to previous generations, could potentially be detrimental to the market in the mid- to long-term. With such a relatively shortened time for those across the value chain to extract decent margins from the market, it is expected that many will start to follow an aggressive pricing strategy to avoid possible declines in overall profits.

Furthermore, with the expected frantic pace of plunging 5G smartphone prices, it would be of little surprise if 2021 saw 5G smartphones fall below the US$100 mark, driven by the availability of cheaper components and pricing policies of chipset vendors. With such a potentially small window of opportunity open until 5G smartphones become mass market, the industry is perhaps unwittingly damaging its own market potential. With the high end becoming quickly saturated and relying on the replacement market, vendors that are better equipped to adjust their portfolios to target the low- and mid-priced sectors, as well as the price-competitive and fast-growing emerging markets, will carve out viable revenues and profit margins. This drive, however, notably excludes Apple, which is not only late to 5G smartphones but also does not currently have a class of model that fits the profile for this growth target market (omitting any older models it may offer at reduced prices). Apple is going to suffer if it does not create new market opportunities or provide some uniquely created interfaces and features in its 5G offerings. If rumors are true, however, Apple is expected to launch a new low-cost iPhone in 1Q 2020 that will probably be 4G only but will lead the company to finally move into the 5G mid-range sector by 1Q 2021.

In the year ahead, vendors and component suppliers will need to work closely with global carrier partners to expand 5G networks and create differentiated offerings. However, an overriding problem they are currently facing is the implementation of 5G by carriers, which are seemingly falling into the trap of marketing it as just another “G,” positioning it as an enhanced Mobile Broadband (eMBB) overlay. If the industry is not careful, this approach will fall well short of fulfilling the massive market potential of 5G. Therefore, those across the value chain need to encourage operators to push past eMBB, accelerating their plans beyond smartphones and consumers. Instead of slowly milking 5G for the consumer market as carriers have done in previous technology migrations, and with the long-term viability of eMBB called into question, they need to quickly flood the consumer market and then focus their attentions on serving the enterprise as well as other use cases, devices, and applications to better unleash the full capabilities that 5G brings to the industry.