All market forecast figures have been updated in September 2025.

Demand for Electric Vehicles (EVs) continues to grow every year, and will account for more than 50% of vehicle sales volume by the end of the decade. Governments worldwide and several U.S. states have set bans on Internal Combustion Engine (ICE)/diesel vehicle sales, causing a spike in EV production.

However, a lack of charging infrastructure is the elephant in the room. For example, a recent survey from AAA reports that 56% of U.S. consumers say a lack of charging stations is a primary barrier to purchasing an EV.

Significant investment in installing public EV charging points is essential if consumer demand for EVs and government mandates can be met. Home chargers alone will not be adequate for the sustained mass use of EVs, especially in developing markets lacking access to home charging equipment.

From the number of available public charge points to revenue generation, ABI Research has released a new market data report that identifies forecasts and key trends for EV charging infrastructure. Our report findings will help the industry better understand the path to electrification and the market opportunities it presents.

Key Takeaways

- EV sales are skyrocketing. According to ABI Research, more than 68 million EVs will be sold worldwide each year by 2035. EVs will make up nearly 70% of all passenger vehicle sales.

- Public charging is critical. Home chargers won’t be enough for electrification, especially in regions like the Asia-Pacific. To accommodate widespread EV usage, nearly 41 million public charging points will be installed globally by 2035.

- Fast chargers drive most revenue. Although AC chargers will outnumber DC, the latter will generate about three-quarters of public charging revenue.

- Massive market opportunity ahead. Public charging revenue is forecast to grow from US$16.4B in 2025 to over US$152B by 2035, creating big opportunities for charge point operators.

How Many Electric Vehicles (EVs) Are Being Sold?

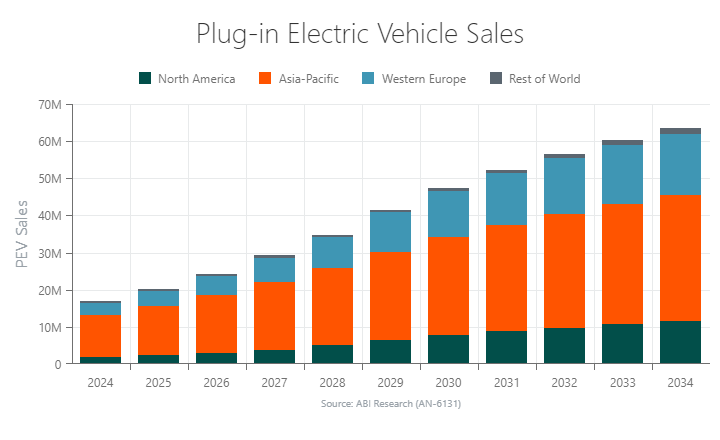

As the number of EVs on the road increases, so will the number of public charge points required to power them. ABI Research forecasts EV sales (including Battery EVs and Plug-in Hybrid Electric Vehicles (PHEVs) sales to increase from 18.68 million in 2025 to 68.5 million by 2035 (around 68% of total passenger vehicle sales). More than half of all these EV sales will originate from the Asia-Pacific market. This is a region that especially relies on public charging infrastructure, given the lack of home charging options in China.

EV Charge Point Forecasts

Public EV charging infrastructure can be based on Alternating Current (AC) technology or Direct Current (DC) technology. While AC chargers support sub-30 Kilowatts (kW), DC chargers typically achieve 50 kW or higher (although some support <50 kW). The use cases for each type of EV charging differ.

For example, an AC charge point is appropriate at a supermarket where the driver will park the car while shopping for an hour. However, someone driving long distances on the highway would require a DC fast charge solution at the station.

ABI Research forecasts more than 33 million public EV charging points to be installed between 2025 and 2035, reaching 40.7 million total. That’s a nearly 7X increase from the 6 million charge points in 2024, signaling significant charging infrastructure efforts worldwide.

Broken down by charging technology, about 2 out of 3 EV charging points installed are of the AC variety, with the remaining being DC. EV charging infrastructure providers like ABB, Tesla, Kempower, and EVBox offer Direct Current Fast Chargers (DCFCs) in the 51–349 kW range, with only a handful exceeding 200 kW.

Despite there being far more AC charging points than DC ones, the latter still generates greater energy demand. ABI Research reports that AC chargers will require a little more than 11 TWh in 2024, compared to more than 38 TWh for DC chargers. By 2034, EV charging infrastructure will require about 448 TWh to satisfy energy demand, with DC chargers accounting for 333 TWh alone.

Table 1: Public EV Charging Point Stock by Type, 2025 to 2035

(Source: ABI Research)

| Type | Units | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | CAGR 25-35 |

| AC | (000s) | 4,658.66 | 6,090.56 | 7,902.57 | 10,079.81 | 12,684.47 | 15,471.96 | 18,275.65 | 20,965.62 | 23,472.63 | 25,768.46 | 27,850.79 | 19.58% |

| DC | (000s) | 2,658.62 | 3,389.76 | 4,228.94 | 5,165.03 | 6,199.69 | 7,281.51 | 8,397.90 | 9,524.10 | 10,651.24 | 11,770.06 | 12,867.35 | 17.08% |

| Total | (000s) | 7,317.28 | 9,480.32 | 12,131.52 | 15,244.84 | 18,884.16 | 22,753.47 | 26,673.55 | 30,489.72 | 34,123.87 | 37,538.52 | 40,718.14 | 18.73% |

Charging Infrastructure Revenue Forecasts

Another key forecast that ABI Research reported on was public EV charging revenue. In 2025, charging infrastructure suppliers are looking at a US$16. 4billion market opportunity, with DC charge points accounting for 78% of total revenue.

As a testament to the sweeping charging infrastructure projects to come, public EV charging revenue will balloon tenfold to US$151 billion by 2035. Still, the more advanced DC charge points will account for 74% of the revenue generated from public EV charging.

Table 2: Public EV Charging Market Growth, 2025 to 2035

(Source: ABI Research)

| Type | Revenue | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | CAGR 25-35 |

| AC | (US$ Billions) | 3.60 | 4.81 | 6.46 | 8.62 | 11.47 | 14.96 | 19.04 | 23.64 | 28.67 | 33.93 | 39.40 | 27.02% |

| DC | (US$ Billions) | 12.80 | 17.17 | 22.73 | 29.65 | 38.29 | 48.51 | 59.48 | 71.52 | 84.42 | 97.83 | 111.66 | 24.18% |

| Total | (US$ Billions) | 16.41 | 21.98 | 29.18 | 38.28 | 49.76 | 63.47 | 78.52 | 95.16 | 113.09 | 131.76 | 151.06 | 24.86% |

How Charge Point Operators Make Their Money

EV charging infrastructure revenue is calculated as a function of energy consumption and Average Selling Price (ASP). However, some charging networks offer free electricity and generate revenue through advertising on the Electric Vehicle Supply Equipment (EVSE). Other Charge Point Operators (CPOs) provide free electricity and make a profit through added sales due to consumers being incentivized to visit their businesses (hotels, supermarkets, leisure attractions, etc.).

Figure 1: Digital Advertisement Displayed on Volta Charging Station

However, the “standard” business model for charge stations is kWh pricing. In other words, drivers pay for the electricity they consume per kWh. Other charging infrastructure operators may charge per minute. In these business models, the price of electricity may be lower during off-peak times and higher during times of increased demand or for DC charging. Regardless of the pricing strategy used, our market forecasts focus on the value of the charge to the CPO, not the amount paid directly by the consumer.

Other Considerations about EV Charging Improvement

Charging infrastructure is the lifeblood of the transition to electrification worldwide. Mass adoption of EVs will be impossible without the rapid expansion of public charging stations. Other factors, such as power grid readiness, smart charging technologies, and battery advancements, should also be considered. ABI Research’s Automotive Research Service covers the latest technological advancements and trends that can address the challenges blocking the road to EV mass adoption. Check out the service page to review some of our latest research products.

Forecast Methodology

- Forecasts are based on the stock of consumer Light-Duty Vehicles (LDVs), not Heavy Goods Vehicles (HGVs) or Light Commercial Vehicles (LCVs). These latter vehicles are more likely to use non-public charging infrastructure, such as depot charging.

- Alternating Current (AC) charging is generally Level 1 or Level 2.

- Only public chargers are considered, including along highways, in parking spaces, at retail sites, or anywhere else where members of the public can use them.