Key Takeaways:

- SMRs are reshaping the clean energy landscape. Their modular design allows faster, lower-cost construction, and flexible deployment across sectors. In other words, SMRs offer a more realistic path toward global net-zero goals than traditional nuclear plants and renewables.

- Safety and sustainability improvements drive confidence. Passive safety systems, long operating cycles, and fuel recycling are helping position SMRs as a safer and more circular power source.

- SMR adoption will take time. High initial costs, strict regulations, and public skepticism remain major hindrances for SMR projects. Broad commercial rollout is unlikely before the 2030s.

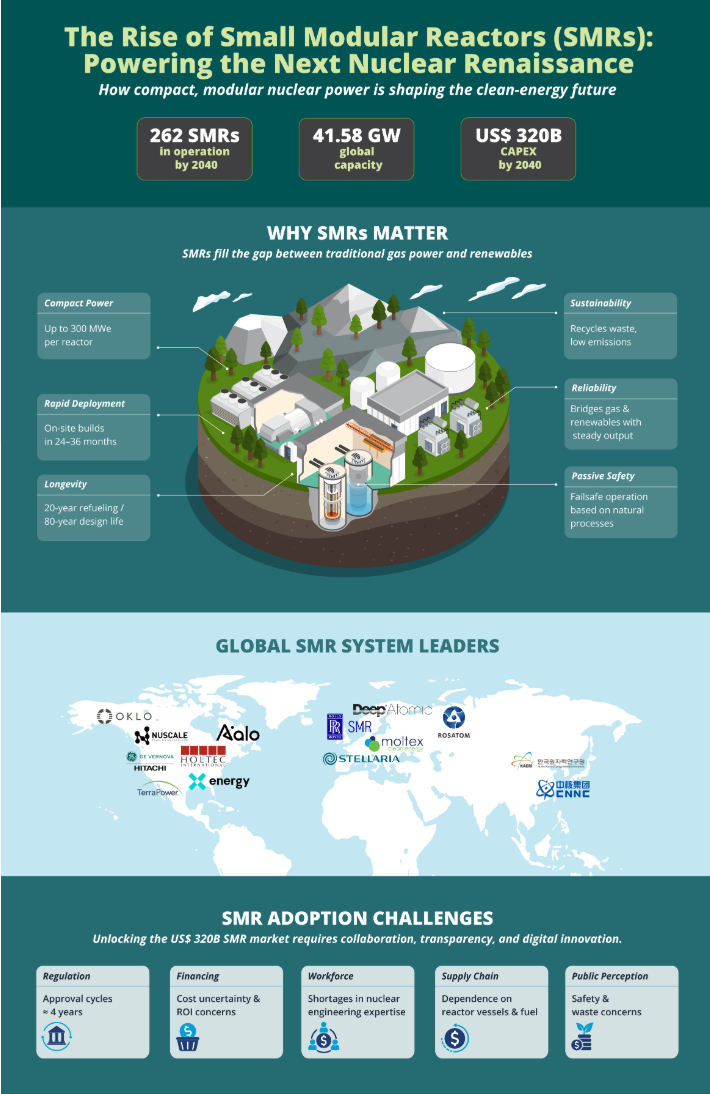

Despite lingering skepticism of nuclear power, there is a growing consensus that SMRs are a viable option for meeting net-zero emissions. Vendors like GE Vernova Hitachi Energy, NuScale, Rolls-Royce, Holtec, Oklo, and X-energy are sinking billions of dollars into constructing SMRs across North America and Europe over the next decade. According to ABI Research, the accumulated Capital Expenditure (CAPEX) spent on SMR construction is projected to eclipse US$320 billion between 2025 and 2040.

Our Small Modular Reactors (SMRs) – Technologies, Applications, and Use Cases report sets out to disassemble the emerging hype surrounding SMRs into realistic opportunities and feasible timelines.

In this post, we break down the pros and cons of small modular reactors to help inform strategic plans for vendors, businesses, government entities, and investors.

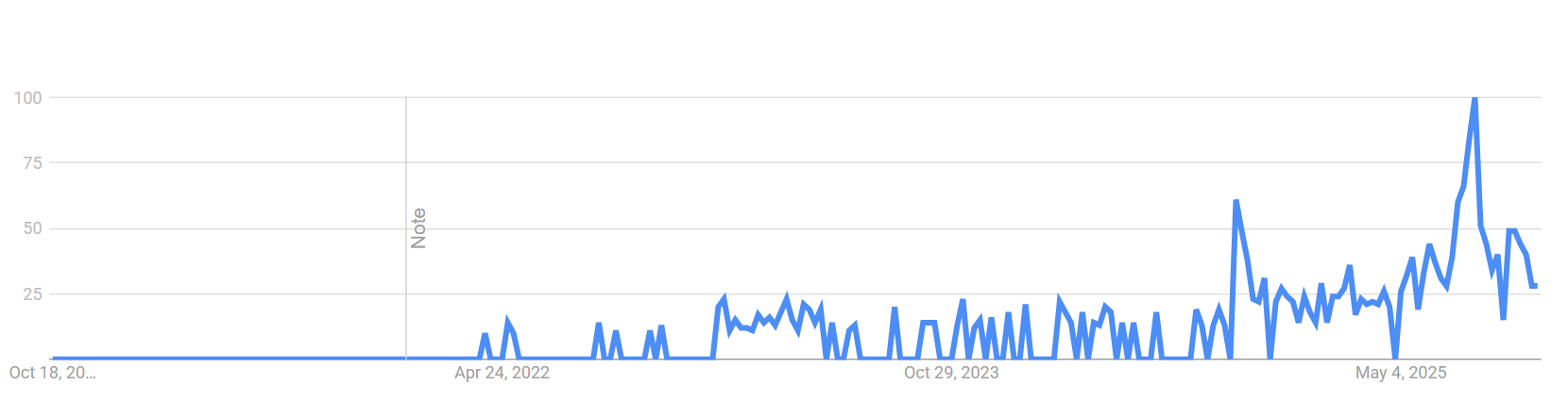

Chart 1: Search Interest for the Keyword “Small Modular Reactor” Over the Last 5 Years

(Source: Google Trends)

What Is a Small Modular Reactor?

A Small Modular Reactor (SMR) is a compact nuclear reactor that provides up to 300 MWe of on-site clean energy. They can be constructed more quickly and at a lower cost than traditional Gigawatt (GW) nuclear reactors.

SMRs not only benefit public grid operators seeking a zero-emissions power source, but also private companies that want to bring nuclear energy closer to operations. Some of the key sectors expected to invest in SMRs include data centers, green hydrogen plants, desalination operations, and industrial sites.

An SMR is usually fueled by enriched uranium, with mixed oxide fuels, thorium-based fuels, liquid salt fuels, and other fuel types occasionally used as well. The modular design of SMRs provides deployment flexibility and customization for specific energy needs.

For these reasons, SMRs are gaining wider support across governments, enterprises, and utilities. However, there are several downsides to SMR deployment, such as regulatory hurdles, high upfront costs, and public opinion.

Should SMR Companies Worry About Recent Stock Market Volatilities?

No, small modular reactor companies are still in a good position, reaching personal-best valuations in 2025. That’s not to say there haven’t been bumps along the road.

Stock prices for some SMR companies have been on a downward trend recently. NuScale’s valuation dropped 14.7% in the week of October 20 to October 24 after a market surge in mid-2025.

There is a similar story with Oklo, with its stock prices taking a 16.2% hit the same week.

Much of these recent woes reflect increasing concerns about SMR project delays and what are sometimes perceived as overvaluations. Although financial analysts have recently downgraded these companies, SMR technology providers still find themselves in a favorable investment climate. Overall, the year 2025 has been very good to them, experiencing skyrocketing valuations on the New York Stock Exchange (NYSE).

Disclaimer: ABI Research does not provide investment or financial advice. The information in this article is intended for informational purposes only and should not be construed as a recommendation to buy, sell, or hold any securities.

Pros of Small Modular Reactors

1. Flexible Deployment

One of the biggest advantages of SMRs is the ability to deploy them in diverse settings. An SMR can be used anywhere from a public electric grid to an isolated island.

Their modularity enables organizations to tailor the reactor to various energy needs. For example, the 50 MW Aalo Pod Extra Modular Reactor (XMR) was designed specifically for powering modern data centers. Similarly, colocation data center operator Equinix has partnered with SMR companies Rolls-Royce and Oklo for nuclear energy generation (learn more in my ABI Insight, “Nuclear Energy Coming to Data Centers: Equinix Taps into Rolls-Royce-powered SMRs”).

SMRs are also being customized for industrial environments. Case in point, there are multiple discussions across Russia and Poland to construct SMRs at remote mining sites. These fine-tuned deployments reflect the versatility provided by small modular reactors.

2. Rapid and Cost-Effective Construction

SMRs can be built within 2 to 3 years due to being factory-built, offering simplified on-site assembly. Compared to traditional Gigawatt (GW)-scale plants, which can take up to a decade to build, SMRs yield a much quicker time-to-value.

Organizations also save money both in terms of Capital Expenditure (CAPEX) and Operational Expenditure (OPEX). Building an SMR on-site costs about US$1 billion for up to 300 MWe capacity, while a 1 GW nuclear reactor costs 10X that figure. Ongoing maintenance costs (OPEX) are also less significant with SMR plants.

3. Passive Safety

Passive safety is a core pillar of SMR design, providing a more proactive approach toward protecting workers and the surrounding environment. Passive safety will also be crucial for acquiring public support. SMRs rely on the following physical phenomena to automatically mitigate emergencies:

- Gravity-driven cooling

- Natural convection

- Water circulation

- Passive containment cooling

- Buoyancy

Passive safety bolsters worker protection at SMR sites while minimizing the need for human intervention. Oklo is one of the most notable champions of nuclear safety, with accident-proof safety features being the key differentiation for the company’s Aurora Powerhouse reactor. Self-regulation, self-stabilization, and similar features automate safety enforcement at reactor plants.

Passive safety features alone cannot eliminate all risks associated with SMRs; they typically complement fuel safety technologies (e.g., X-energy’s TRISO-X encapsulated fuel pebble technology and active safety systems (e.g., emergency cooling, power backup, etc.).

4. Sustainability

SMRs are sustainable because they enable nuclear waste recycling and long operating cycles without refueling (up to 20 years). Some nuclear energy companies are building large-scale fuel recycling facilities, highlighting how next-gen reactors aim to close the fuel loop. What was once considered an environmental liability can be converted into a viable energy resource.

Furthermore, small modular reactors are designed to be used for roughly 80 years. Because construction projects are infrequent, it uses fewer resources and minimizes waste.

Cons of Small Modular Reactors

1. Lengthy Regulatory Approval Timelines

A notable drawback of SMRs is that they face significant regulatory hurdles. New nuclear energy designs often take up to 4 years for certification. Moreover, SMR deployment stipulates site permitting and environmental impact assessment.

These time-consuming regulatory processes inevitably prolong SMR deployments, especially for startups and technology innovators. Despite strong government advocacy, the stringent regulatory landscape remains a major bottleneck for SMR development. For these reasons, commercial scalability of SMRs won’t materialize until after 2030.

2. High Upfront Capital Expenditure

Although cheaper than full-scale nuclear plants, SMRs still require significant capital investment. A single SMR unit can cost up to US$1 billion, and combined/multi-modal configurations will drive costs up further.

The high initial costs are a clear disadvantage for early-stage energy tech firms aiming to develop SMRs. Most market pioneers already have well-established revenue streams and a solid repertoire of deep-pocketed investors.

3. Uncertainty from Unproven Technologies

Another con of small modular reactors is technological uncertainty. Many nuclear energy vendors are embracing novel technologies like molten salt, liquid metal cooling, and Light Water Reactors (LWRs) for SMR design. These technologies, while holding immense safety and cooling potential, are largely unvetted. The risk is that investors and regulators will remain skeptical, further delaying the wider adoption of SMRs.

The SMR ecosystem must demonstrate the reliability of forward-looking tech solutions to gain trust from venture capitalists, regulators, utilities, and other stakeholders.

4. Public Perception and Waste Concerns Persist

While public opinion of nuclear energy has significantly improved over the decades, people naturally have safety/health concerns. Common opposition words include “radiation,” “dangerous,” and “meltdown.” Incidents such as Chernobyl (1986) and Fukushima-Daiichi (2011) continue to be haunting reminders of the severe outcomes caused by nuclear disasters.

Developing an SMR plant will typically require buy-in from the local community. The fact that SMRs still produce nuclear waste will certainly put energy vendors at a disadvantage when pursuing contracts. Research-backed educational campaigns and operational transparency will be key to overcoming nuclear fears.

Survey results from Bisconti Research show that the public trusts information sourced from nuclear scientists and scientific organizations the most. Communicating scientifically backed benefits of nuclear power will be essential in building advocacy.

SMRs Are Driving the Next Wave of Energy Transformation

We are on the cusp of energy transformation, and small modular reactors are at the center of the story. Data centers and industrial firms are consuming more energy than ever, with no signs of slowing down. As governments vow to reach net-zero, a reliable source of clean energy is essential to ensure the electric grid remains stable. Solar and wind cannot meet this demand due to their intermittent nature.

Nuclear energy, on the other hand, is regarded as one of the most reliable sources of clean energy. It’s clear that traditional GW nuclear plants are not a viable option for most organizations, as they are cost-prohibitive and take a very long time to build. SMRs, while offering less total capacity, push on-site nuclear energy closer toward democratization.

ABI Research’s Smart Energy team will continue to track the latest on small modular reactors and provide advisory services for energy tech vendors, building managers, sustainability officers, and investors.

Frequently Asked Questions

What are small modular reactors?

Small Modular Reactors (SMRs) are compact nuclear power plants that generate up to 300 Megawatts (MW) of clean energy. They are factory-built, easier to transport, and can be deployed faster and at lower cost than traditional large-scale nuclear reactors.

What are the pros of small modular reactors?

Key advantages of small modular reactors include:

- Flexible Deployment: Can be installed on electric grids, industrial sites, and remote areas.

- Faster and Cheaper Construction: Built in factories and assembled on-site in 2 to 3 years.

- Enhanced Safety: Uses passive safety systems that automatically cool and stabilize the reactor.

- Sustainability: Supports nuclear fuel recycling and long operating cycles with minimal waste.

What are the cons of small modular reactors?

Notable disadvantages of small modular reactors include:

- Regulatory Delays: New designs require lengthy certification and permitting processes.

- High Upfront Costs: Each unit can cost up to US$1 billion, limiting access for smaller developers.

- Unproven Technologies: Many designs use new cooling and fuel systems that lack large-scale validation.

- Public Concern: Ongoing fears about nuclear safety and waste disposal affect acceptance.

When will small modular reactors be available?

Small modular reactors are expected to gain momentum between 2030 and 2035 as regulations mature and designs are approved. According to ABI Research, 262 SMRs are forecast to be in operation worldwide by 2030, providing a total capacity of 41.6 Gigawatts (GW).

Who makes small modular reactors?

Leading small modular reactor developers include GE Vernova Hitachi Energy, Rolls-Royce, Holtec, Oklo, and X-energy. Other notable contributors are Westinghouse, TerraPower, Rosatom, and the China National Nuclear Corporation (CNNC).