4Q 2021 | IN-6322

Registered users can unlock up to five pieces of premium content each month.

From Interdependent to Modular Design |

NEWS |

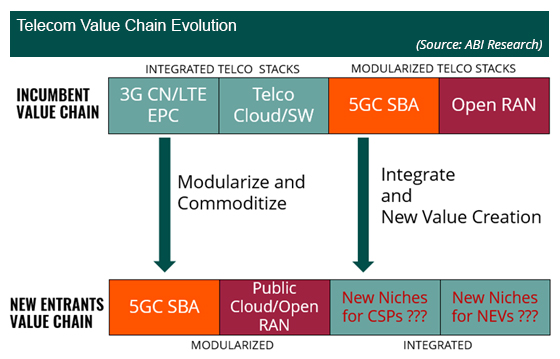

Ecosystem disaggregation upends existing business models that are predicated by specialized technology, control, and a tight integration of the cellular domain. Open and disaggregated ecosystems point toward a gradual evolution in product architecture from integrated designs toward modular stacks. This enhances flexibility but it changes the industry structure from vertically integrated to horizontally stratified. For example, an ‘all-in-one’ approach championed by integrated vendors is eventually complemented by ‘best-of-breed’ modular solutions provided by new suppliers. In other words, the modular nature advocated in a number of key industry trends (e.g., cloud innovation, 5G core, Open RAN) which alters the industry structure. Modularity opens new opportunities for independent, non-integrated vendors to sell, buy, and assemble plug-compatible components and subsystems.

Broadly speaking, modularity enables the disaggregation of the industry. This, in turn, gives rise to a diluted degree of differentiation because a population of non-integrated vendors start to compete with integrated suppliers that occupy a dominant position in the ecosystem. If integration in the past was a competitive necessity, in the future it may become a competitive disadvantage if not approached with prudence. To that end, this ABI Research Insight is an attempt to elucidate the merits of interdependent and modular designs: when does integration makes sense, and when does modularity? There is no hard-and-fast rule; everything is context specific, which means understanding the strengths and weaknesses of both approaches is valuable.

Interdependence vis-à-vis Modularity |

IMPACT |

An architecture is interdependent if one component cannot be created independently of another. The way one component is designed and integrated depends on the way other components are designed and integrated. Network Equipment Vendors (NEVs), such as Nokia, Huawei, Ericsson, and ZTE, excel at commercializing interdependent—or vertically integrated—product architectures. NEVs, with their vertically integrated stacks, enjoy a dominant competitive advantage for product performance and scale. NEVs’ integrated model has resulted in healthy margins for years. Further, these vertically integrated stacks are associated with continuous (a.k.a., sustaining) innovation. This refers to the normal upgrading of products that does not require consumers to change behavior but, importantly, may not necessarily create new markets.

By contrast, a modular architecture and/or interface is a clean one. There are no unpredictable interdependencies across value chain components or subsystems. Modular interfaces/components fit and work together in clearly understood and well-defined ways. Modularity disrupts and redefines the industry structure by introducing solutions that may not be as good as currently available products in terms of performance. That is because the standardization inherent in product modularity takes too many degrees of design freedom away from product engineers. Consequently, they cannot optimize performance. But modular architectures offer other benefits; typically, they are simpler, offer convenience and flexibility, and potentially offer better economics. Modular components are designed and built by different vendors working at arm’s length.

Most new products that come to market will fall somewhere between these two extremes. Flexibility and agility that come from modular (software) design is bound to complement the optimum performance provided by interdependent stacks. Modularity stands to be the core building block of new value creation for Communication Service Providers (CSPs). But modularity, particularly in the core network, alters the industry structure not just for vendors but also for CSPs. For example, it opens up new opportunities for new entities to acquire spectrum and build their own network assets. Furthermore, plugging into open core network platforms can be restrictive in terms of building (sustainable) core competencies. The broader takeaway here is that the industry should find the right integration points for what are arguably two key determinants of innovation and success: focus and quality.

Integration for Focus and Quality |

RECOMMENDATIONS |

Broadly speaking, the value of integration is that it provides a sustainable point of differentiation that can drive outsized profits. It also lays the foundation for a better user experience. It is critical to note, though, that the point of differentiation has to be in the right place. Apple, for example, has long predicated its business model on integration between hardware and software. What makes Apple’s integrated model so commercially feasible is that the company has differentiated its otherwise commodifiable hardware with software. Hardware requires physical assets and supply chains to manufacture. Software, by contrast, is both infinitely differentiable yet infinitely reproducible. This means that software, unlike most other commercial goods, is both unique yet has unlimited supply. Apple charges a premium for its products because it can combine the differentiable qualities of software with hardware while staying focused and providing superior user experience and quality.

Similarly, what is critical in telecoms is integration in the right places of the ecosystem. In addition to cellular, that integration must extend to cloud and Artificial Intelligence (AI)/Machine Learning (ML), and it needs to span both product innovation and service innovation. These two strands must become an integrated, single paradigm that doesn’t just produce differentiated services, but also has an entire business model and cohesive approach to match. So, integration can be incredibly profitable for the industry because it is, from a commercial perspective, a monopoly. CSPs already have exclusive access and control to the cellular core network. That control, however, is being diluted somewhat, as discussed in ABI Research’s Insight: How Does AT&T’s Public Cloud Strategy Fare against that of Verizon? (IN-6296). The broader lesson here, however, is not that integration is better than modularity, or vice versa.

The key takeaway is that the ability to create (new) integration points in existing or new value chain(s) is essential for growth. It is yet to be determined where those points of integration are, as ABI Research posits with the above graphic. The industry should accept this new reality at its core. Whether it is the supply side (Huawei, Nokia, Samsung, and ZTE), or the demand side (AT&T and Verizon), they must build their strategy, their organizational capabilities, and their product designs to prioritize, integrate, and differentiate around not just cellular, but also cloud, AI/ML, and cybersecurity. To accomplish this successfully, senior executives may need to re-think their solutions, their go-to-market decisions, and potentially even some parts of the existing skill set. In the end, it has the prospect to be a truly winning model to explore new niches based on innovation that solves “problems” and creates “value”. Success for the industry will be about delivering superior quality in those niches.