By Dimitris Mavrakis | 4Q 2020 | IN-5966

Registered users can unlock up to five pieces of premium content each month.

The Open RAN Market is Rapidly Expanding |

NEWS |

Open Radio Access Network (RAN) is not a new technology, but an innovative implementation approach promoting more open, transparent, and modular cellular networks and ecosystems. It invites various stakeholders to bring their best-in-class technologies and contribute to building the next-generation telecommunications networks, including 5G. These very same principles have shaped many industries that have now become the growth engine of our economy, including the Internet, the Personal Computer (PC) business, and the smartphone market. The ABI Research white paper Open RAN: Market Reality and Misconceptions discusses the importance of both hardware and software to allow this leap in terms of performance and efficiency in Open RAN network implementations.

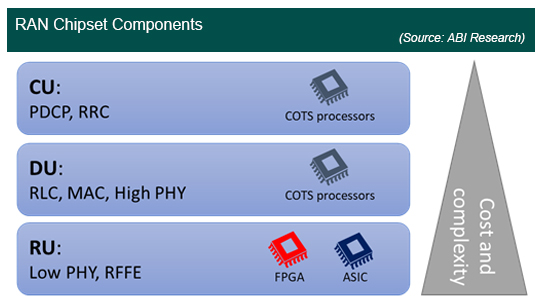

Current Open RAN market developments have largely focused on the Centralized Unit (CU) and Distributed Unit (DU), which take advantage of existing processing platforms and new software to process what was traditionally processed in baseband units. This is Layer 2 and Layer 3 functionality, complemented by what is called high-PHY, which is processing some parts of the physical layer. DU and CU units use common off-the-shelf processors, virtualization or containers, and, most recently, acceleration cards that perform the most demanding processes. Radio Units (RUs) are implemented in two different types of configurations:

- For consumer networks and high-performance configurations, RUs are implemented in custom Application-Specific Integrated Circuit (ASIC) platforms that are vendor-specific and proprietary. These are high upfront cost and low unit-price chipsets that require economies of scale to break even. In addition, developing custom ASICs is time consuming, as it may require up to 36 months from initial concept to commercial deployment. The lengthy development of custom/proprietary ASIC has been, so far, a major barrier to entry for new radio equipment suppliers.

- Lower performance units are implemented through flexible processing platforms, such as Field-Programmable Gate Arrays (FPGAs), that are equally powerful, reconfigurable, but higher cost.

The gap between these two areas is clear: reconfigurable processing platforms that are cost-effective also allow new entrants, startups, and smaller vendors to create innovative products. These vendors need to focus on software, rather than hardware for all CU, DU, and certain RU domains. For this to happen, especially in the radio domain, the following processing capabilities are necessary:

- Flexibility and reconfigurability in the processing domain for physical layer functions that can be adapted for both macro and small cell networks.

- Software reconfigurable modems and Radio Frequency Front Ends (RFFEs) that can be used in a variety of frequencies and global networks. This will allow new entrants to create products that can reach a critical mass.

- System-level design of the entire RFFE to maximize performance, while enhancing power efficiency.

Chipsets Are the Foundation of Innovative Products |

IMPACT |

The emergence of flexible chipsets and development tools is crucial to allow a new breed of vendors to enter the market, irrespective of the technology domain. In the PC market, x86 processors commoditized processing, and hundreds of manufacturers created affordable home computers. The same needs to happen in the Open RAN domain, but now, commercial Open RAN deployments are largely focused in two domains:

- In the greenfield domain, the supply chain has provided new entrants with new types of products, often developed and integrated by new types of companies. For example, Rakuten has partnered with Altiostar, NEC, Quanta, and other small vendors to create its 4G and 5G radio networks. These networks are small scale for the time being and do require significant development and integration efforts to reach commercial scale. This is indicative of the current status of the Open RAN market.

- In the brownfield domain, where mobile operators have existing networks to maintain, the focus of Open RAN has been limited to niche areas (e.g., rural networks) or small cells, where these innovation areas can be adequately tested and understood without potential disruptions to the existing network.

However, in order for Open RAN to reach the mainstream, it is important to address specific pain points and operator requirements:

- Massive Multiple Input, Multiple Output (MIMO) Units: Current physical layer processing for massive MIMO units consists of massively parallel signal processing units in the form of ASICs. These are typically developed by large incumbent vendors and can be a make-or-break factor in terms of market success for these vendors. Now, processing for these functions can only take place using these proprietary chipsets that smaller vendors cannot afford to develop due to the insurmountable upfront cost, but also the lengthy development and design time these platforms require.

- Macrocell Networks for Consumers: This network domain is driving 5G deployments currently and is expected to be the focus for mobile operators in the next 2 to 3 years. Open RAN developments also need to focus on this area to create a critical mass of products, expertise, and innovation to help mobile operators reduce costs and deploy new types of products.

A new breed of vendors needs to focus on these areas, both of which have high entry barriers to entry. Massive MIMO units, for example, are a very high-tech area to address, which requires advanced expertise in both software and hardware. The first step to allow this innovation and new types of developments is to create the much-needed chipset platforms, development kits, and software tools to help new vendors create these products. In addition, delegating the development of RAN ASICs to specialized chipset suppliers could lower the barriers to market entry for new radio equipment suppliers. These chipset suppliers have accumulated years of extensive expertise in computing and system-level radio design, which could help both new entrants and incumbent radio equipment suppliers accelerate time to innovation and offer cost-effective equipment without compromising power efficiency.

Chipset Development of Open RAN |

RECOMMENDATIONS |

The RU has recently become the development focus in the mobile supply chain and for good reason. While the implementation aspects of CUs and DUs are very well understood, because when borrowing technologies from the IT domain, RU design and implementation still consists of ASICs and FPGAs, both have their advantages and disadvantages and currently have a high barrier to entry for new companies. The following diagram is a summary of functions performed by these units.

|

It is unlikely that Commercial Off-the-Shelf (COTS) processors will replace ASICs and FPGAs in the short term. This is especially the case with high-power base stations, including Massive MIMO where COTS processors would translate into a very high cost and energy footprint. The Open RAN market needs specific processing platforms in the form of either ASICs that can be tuned within the range of 5G New Radio (NR) deployment frequencies and options, or FPGAs that can scale in a cost-effective manner. Both will likely be developed by companies that are already developing similar products and have released chipsets for adjacent areas.

For example, Qualcomm has already released the Femtocell Station Modem (FSM) platform for 5G small cells and is now expanding it to include macrocells and more powerful units than before. Qualcomm’s latest 5G RAN platform for small cells and macrocells is an important milestone in the development of Open RAN technology, in that it will offer vendors a flexible, scalable, and cost-effective platform to bring new types of innovation with a very aggressive product time-to-market. ABI Research expects that this announcement will be the first of many and that these types of developments will be key to accelerating the Open RAN market, particularly RU developments, and will create a critical mass of expertise to push Open RAN to the mass market.