The Average Selling Price (ASP) of Ultrabooks and tablets declined by 7.8% in 2014, as the market matured and commoditized, allowing these devices to become more affordable in all markets. According to market intelligence firm ABI Research, the average weeks of household income needed to buy a tablet or Ultrabook both declined by approximately 30% YoY; making these devices more affordable to a wider range of consumers.

“Across 22 different countries between 2013 and 2014, there was an 8.5% decline for the ASP of tablets and 7.1% for Ultrabooks,” says Research Analyst Stephanie Van Vactor. “This decline is allowing these devices to reach a larger audience in a wider range of countries.” Although growth is slowing for both these types of devices, affordability could help prevent a drastic decline in sales.

The affordability of personal technology devices is strongest in many mature markets, such as the United States, Japan, and Germany, primarily due to the higher household income. However, ABI Research highlights that Chile experienced the largest decline in ASP, 56% for both tablets and Ultrabooks combined; tablets experienced the largest decline at 70.3%, due to the increase in selection and competition caused by lower-end devices entering the market between 2013 and 2014. In contrast, India experienced the largest increase in ASP between 2013 and 2014, at an average of 22% for both tablets and Ultrabooks; tablets alone experienced an increase of 34.5%, due to the surge of an e-commerce presence, Apple products, and mid-tiered devices.

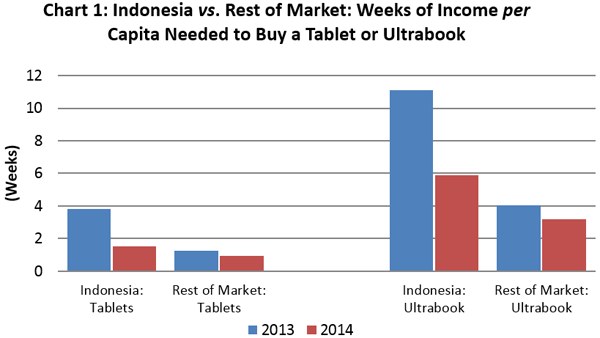

As shown in Chart 1, the most noticeable change in affordability for weeks to buy for Ultrabooks and tablets occurred in Indonesia. In 2013, ABI Research’s data shows that 11 weeks of income were needed to purchase an Ultrabook and nearly four weeks for tablets. In 2014, the weeks of income needed to purchase an Ultrabook declined by 47%, dropping to 5.9 weeks, and for tablets weeks of income declined by 60%, dropping to 1.5 weeks. “Partly due to the increase in models and price points in e-commerce, Indonesia, like many other developing markets, is a good example of the commoditizing of these devices,” continues Van Vactor. “Market maturation will continue this effect through the next year, especially as competition increases and affordability continues to prosper as a result.” Over the next year, competition will continue to surge and ASPs will continue to decline.

These findings are part of ABI Research’s Media Tablets, Ultrabooks and eReaders Market Research.

ABI Research provides in-depth analysis and quantitative forecasting of trends in global connectivity and other emerging technologies. From offices in North America, Europe and Asia, ABI Research’s worldwide team of experts advises thousands of decision makers through 70+ research and advisory services. Est. 1990. For more information visit www.abiresearch.com, or call +1.516.624.2500.

About ABI Research

ABI Research is a global technology intelligence firm uniquely positioned at the intersection of technology solution providers and end-market companies. We serve as the bridge that seamlessly connects these two segments by providing exclusive research and expert guidance to drive successful technology implementations and deliver strategies proven to attract and retain customers.

ABI Research 是一家全球性的技术情报公司,拥有得天独厚的优势,充当终端市场公司和技术解决方案提供商之间的桥梁,通过提供独家研究和专业性指导,推动成功的技术实施和提供经证明可吸引和留住客户的战略,无缝连接这两大主体。

For more information about ABI Research’s services, contact us at +1.516.624.2500 in the Americas, +44.203.326.0140 in Europe, +65.6592.0290 in Asia-Pacific, or visit www.abiresearch.com.

Contact ABI Research

Media Contacts

Americas: +1.516.624.2542

Europe: +44.(0).203.326.0142

Asia: +65 6950.5670