In the pharmaceutical supply chain, the margin for error is razor-thin. If there’s a disruption to the delivery of critical drug products or medications, patients' lives, overall health, and well-being could be at stake. Unfortunately, operational vulnerabilities arise as the pharma industry grows tremendously and becomes more globalized. This article highlights five pharmaceutical supply chain challenges that could be remediated with Internet of Things (IoT) track and trace technologies.

Before reviewing these issues, it’s essential for a refresher on how the pharmaceutical supply chain works.

How the Pharmaceutical Supply Chain Works

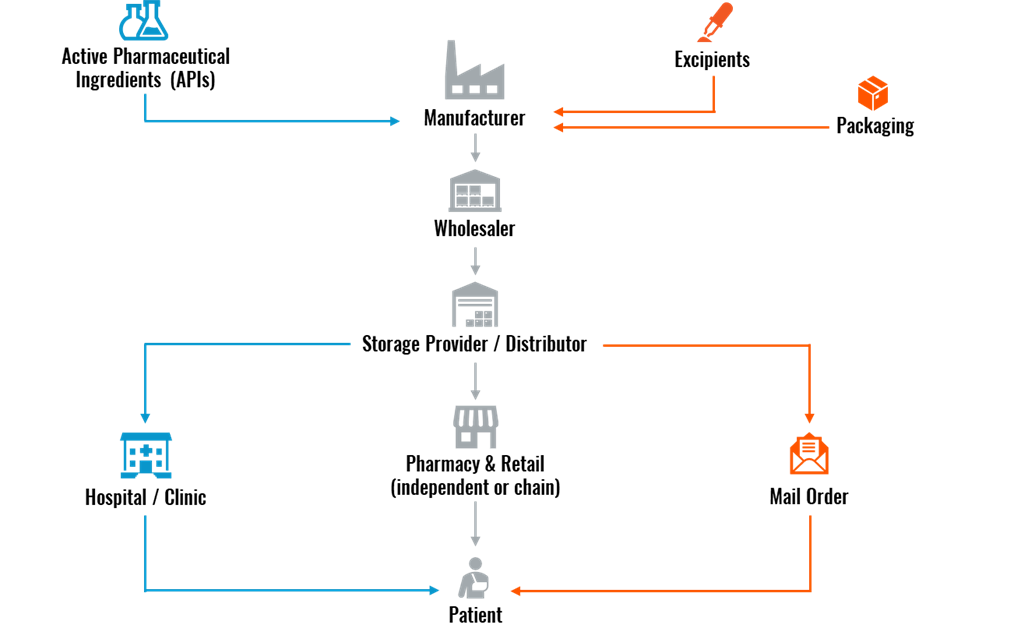

The first step in the pharma supply chain is for the pharmaceutical company to either develop or source the two building blocks of a drug product: Active Pharmaceutical Ingredients (APIs) and excipients.

- APIs: The active ingredient in drugs that produces the intended health effect, manufactured using a range of synthetic and biological raw materials.

- Excipients: Includes any substance other than the API that helps deliver the medication into the patient’s system. They are chemically inactive, allow the medicine to remain stable, and control the absorption of the drug.

After developing APIs and excipients, the pharma company moves on to the manufacturing phase. This aspect of the supply chain falls under one of the following four manufacturing categories:

- Biologics: Vaccines, blood, allergens, genes, and tissues

- Prescribed Drugs: Opioids, benzodiazepines, and stimulants

- Over-the-Counter (OTC) Medicines: Vitamins, minerals, supplements, common cough and cold drugs, and dermatology products

- Raw Materials and Bulk Pharmaceuticals: Chemical compounds and APIs

The manufacturer can apply for a patent if the medicine or drug is a new product. In the United States and European Union (EU), a drug patent lasts 20 years from the filing date. Once the patent expires, other pharma companies are free to manufacture and distribute the drug product, leading to a multitude of supply chain channels being involved.

After the drug product is manufactured, a wholesaler purchases the medications directly from the manufacturer. This then stipulates that the wholesaler pass the pharmaceutical products to a storage provider/distributor for logistics handling.

For the endpoint of the pharmaceutical supply chain, the drug product can get to the patient in three different ways:

- Hospital/clinic

- Pharmacy & retail

- Mail order

Figure 1: Pharmaceutical Supply Chain

In terms of regional trends, pharmaceutical market growth rates are high in the Asia-Pacific region, notably in countries like China, Indonesia, and India. This substantial growth, which is altering the distribution of global revenue and pharma supply chain sourcing, is the result of the following:

- More favorable drug regulatory environments

- Increased healthcare spending

- Growing middle classes

- Greater public awareness of chronic diseases

- A robust manufacturing ecosystem of raw materials and generic drugs

While the Asia-Pacific region is on an upward trend, the United States and Europe are the most prominent players in the pharmaceutical supply chain.

Accounting for 34% of the global pharmaceutical market, the United States has some favorable conditions going for it:

- Low price regulations

- Minimal barriers to market entry once the Food & Drug Administration (F&D) approves a drug product

- Americans use medicines more than people in other developed countries

Now that you better understand how the pharmaceutical supply chain works and where drug product distribution is centered, assessing the ongoing challenges disrupting the industry will be easier.

1. Cybersecurity

Pharmaceutical companies and healthcare services have fragmented supply chains, given the many divisions, facilities, research arms, and distribution partners located around the world.

With many stakeholders involved and multiple endpoint gaps between Operational Technology (OT) and Information Technology (IT) in the supply chain, it’s a major target for cybercriminals. If the supply chain becomes compromised by a bad actor, it could disrupt medical supply to patients, decrease revenue generated, and diminish the efforts to save human lives.

As a prime example of security challenges in the pharmaceutical industry, Universal Healthcare Services lost US$67 million in operating income in 2020 due to an IT disruption resulting from a ransomware attack. Moreover, the cyberattack forced its hospitals to turn away ambulances and patients in critical care.

Related Content

Pharma Cold Chain Warehouse Track & Trace Revenue

IoT and Supply Chain Visibility in the Pharmaceutical Industry: Ecosystem Assessment

2. Counterfeit Drugs

Counterfeit drugs are another huge security challenge that can disrupt pharma supply chains. Pharmaceutical companies, and authorities for that matter, are highly concerned about this issue, which can come in the form of:

- Wrong dose of APIs

- No APIs present

- Harmful ingredients

Unfortunately, fake medicine is a booming business. According to the World Health Organization (WHO), counterfeit drugs generate about US$83 billion in global sales annually.

Penetrating the pharma supply chain is a crucial strategy for counterfeiters to accomplish their goals. Criminals have their crosshairs on second-tier distribution levels, which are more vulnerable to counterfeiters. A vast bulk of this supply chain issue is concentrated in developing countries, where 1 in 10 medical products sold are counterfeit.

3. Overreliance on a Single Region

The next challenge pharmaceutical supply chains must address is the overreliance on a single region for sourcing drug products. To be manufactured, pharmaceutical products rely on specific APIs and excipients commonly sourced exclusively from one area. If world affairs are in perfect order, this may be fine, but that’s an optimistic assumption.

The problem is, what if that region you’re sourcing from gets into a military conflict? What if a catastrophic natural disaster ruins a facility? What if the region gets into a trade dispute with your country? As a result, the flow of the pharmaceutical supply chain would come to a sudden disruption, and customers won’t be happy when they don’t receive their medications on time.

U.S. Pharmacopeia (USP) highlighted this pharma supply chain issue in its recent USP Medicine Supply Vulnerability Insights Series. The organization’s findings reported that there are 114 facilities in India with more than 30 U.S.-approved API products. For the United States, that number is a measly three facilities.

Recognizing this challenge, many governments, such as the United States and Austria, have put the wheels in motion to bring pharmaceutical manufacturing facilities closer to home.

4. Cold Chain Losses

Many medicines and drug products, such as insulins, vaccines, antibiotics, eye drops, and creams, must be kept at specific temperature parameters throughout the supply chain process. If not, the product could be damaged. While most refrigerated drug products are stored and distributed between 2° Celsius (C) and 8° C, certain substances require temperatures as low as 90° C to maintain their effectiveness for the patient, sterility, or physical form. Moreover, strict regulation gives rise to greater adoption of IoT-based track and trace solutions in the pharma vertical.

Failures in temperature-controlled cold chain logistics cost the pharmaceutical industry about US$35 billion annually, according to the IQVIA Institute for Human Data Science. The challenge of promoting supply chain visibility was brought front and center in a very public way during the worldwide distribution of COVID-19 vaccinations. With millions of people relying on the timely distribution of vaccinations, a lack of information and cold chain transparency led to, in some cases, disrupted supply chain flows, poor planning, inaccurate predictions, and delayed decision-making.

As developments in advanced therapies derived from biological materials continue to grow, so will the necessity of End-to-End (E2E) pharmaceutical supply chain technologies that monitor product temperature during transport. Failing to do so could very well lead to patient mistrust.

5. Growth in Home Delivery

As more people use the Internet, online healthcare services will continue to explode. ABI Research reports that the global online pharmaceutical industry is on track to surpass US$180 billion in revenue by 2027.

This trend means more people will have virtual doctor visits, leading to a surge in e-prescriptions being issued. In terms of the pharmaceutical supply chain, this increased demand for e-prescriptions will create new challenges in delivering small-form-sized medications to the patient’s door on time.

Furthermore, many health conditions require consistent home delivery of medication to the patient. As in-person health consultations become less common, the pharmaceutical industry must focus more on these micro-fulfillment operations to maintain supply chain integrity. Local pharmacies (e.g., Walgreens and CVS), fulfillment teams, and delivery agents are significant collaborators in making all this possible.

ABI Research Can Answer All Your Pharmaceutical Supply Chain Questions

These challenges facing the pharma supply chain could all benefit from track and trace technologies to provide greater asset visibility. When tackling a lack of visibility into the supply chain, it’s critical to first gain insight into the available technological solutions, the competitive landscape, and various ways to overcome current supply chain issues.

Through exhaustive analyses and the compilation of accurate market forecasts within the pharmaceutical industry, ABI Research has published a report on the digital transformation of the pharmaceutical supply chain. To get a feel for the full report, you can check out the associated Research Highlight providing strategic guidance for supply chain managers and the technology vendors providing track and trace solutions for the pharmaceutical industry.