The steel industry dates back to the 19th century and played a central role in the Industrial Revolution, which paved the way for the modern world. Steel continues to be a dominant iron alloy as it it’s used in construction, manufacturing, mechanical engineering, and other verticals. But steel production is both environmentally harmful and dangerous to workers. To address these two conundrums, steel producers must invest in digital transformation.

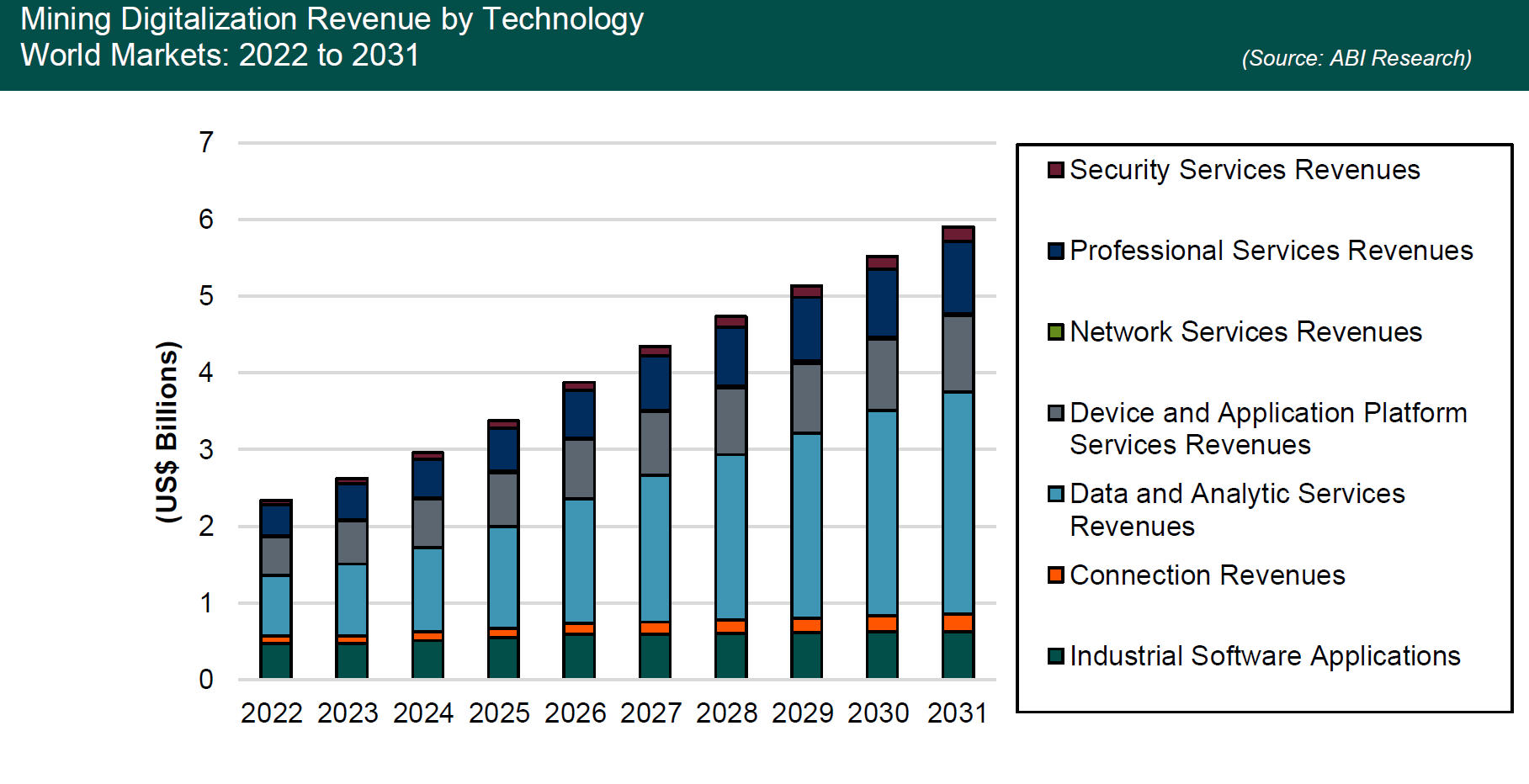

As reported in ABI Research’s Industry 4.0 in the Steel Industry research analysis report, investments in digitalization within the steel industry are forecast to reach nearly US$6 billion by 2031, growing at a Compound Annual Growth Rate (CAGR) of 10.9%.

Who Is the Largest Producer of Steel in the World?

The largest producer of steel in the world is the China Baowu Group. In 2021, the steelmaker produced 120 million metric tons of iron alloy, according to research from Statista. For perspective, Luxembourg-based ArcelorMittal is the world's second-biggest steel producer and its total production volume came out to 79 million metric tons last year.

Fortunately, China Baowu is committed to reaching decarbonization by 2050, investing 35 million yuan (US$5.5 million) annually for low-carbon research. The company’s six-point plan includes upgrading furnace technology, developing carbon capture technology, and increasing energy efficiency, which is reliant on new technology implementation.

What Technologies Are Being Adopted in the Steel Industry?

To learn what types of technologies are being used by steel producers, this section serves as a general overview of the technology investments in the steel market. All forecasts were compiled by ABI Research analysts.

As steelmakers aim to turn their facilities into “smart factories,” investment in devices and applications is expected to reach US$502 million by the end of 2022. By 2031, that number will surge to nearly US$1 billion. Devices and applications enable steelmakers to gain a deeper knowledge of equipment performance and the operational condition of the blast furnace.

The greatest amount of spending in the steel industry stems from data analytics, with US$790 million in 2022 spending and US$2.9 billion by 2031. Data analytics is a key foundation for addressing environmental concerns because it allows steelmakers to track their carbon emission output and optimize the production process. Not to mention, data analytics helps steelmakers plan for waste reduction, promote a circular economy, and reach higher quality levels.

Because implementing these technologies and using them optimally is a challenging endeavor, ABI Research expects significant investment in professional services. For example, the concept of a digital twin may be new to many steelmakers, never mind carrying out simulated "what-if" scenarios. So, a third-party consultant with expert knowledge of digital twins would prove beneficial. Spending on professional services will be a little over US$945 million by 2031.

With the ever-growing threat from hackers, as more connected devices are introduced to a steel plant, cybersecurity is of utmost importance to the steel industry. If you study the chart below, you'll see that security services will experience the greatest growth rate (14.4%) throughout the forecast period—reaching US$192 million in 2031 spending.

It should be pointed out that the Asia-Pacific region accounts for 73% of spending on digitalization in the steel industry. And this doesn’t come as surprise, because Asia produces steel at a rate that is on another scale compared to other regions.

Technology Example #1 in the Steel Industry: Everguard.ai

Sentri360, a data tracking software provided by Everguard, keeps the steel plant workplace safer. After analyzing sensor data generated by edge devices, an application of Artificial Intelligence (AI) automatically alerts staff of immediate risks in their surroundings.

Sentri360 was incredibly useful during the height of the COVID-19 pandemic because it could ensure that employees were wearing masks, restricted access to areas via geofencing, sent alerts about escalated body temperatures, and leveraged facial recognition for touchless door entry. Besides COVID-19 safety, Sentri360 also uses AI, Computer Vision (CV), and sensor fusion to prevent collisions and avoid the prevalence of cobbling.

Related Content

Generative AI Comes to U.S. Steel’s Iron Ore Facilities

Technology Example #2 in the Steel Industry: Falkonry

Falkonry is an industrial AI company that assists steel producers with process optimization by using data analytics to make informed decisions. For the steel industry, a common use case is monitoring machine health and determining the issue before rapid deterioration occurs. Much of Falkonry’s AI technologies focus on pattern recognition, so steel workers can understand where their production bottlenecks lie, realize how to get more out of existing resources, and anticipate operational failures.

Technology Example #3 in the Steel Industry: SteelTrace

SteelTrace is a Netherlands-based company that offers a digital platform promoting transparency and security in the steeling supply chain using technologies like blockchain and cloud computing. With blockchain, data are shared in a decentralized system where all partners have to approve of a decision before it’s executed. On the SteelTrace platform, security and trust can be realized when handling data about material certification, audits, test reports, inspections, and other data relevant to the steel industry because everything that can be accessed is verified by the original uploader.

SteelTrace also saves steel producers time, as the platform does away with the standard practice of data siloing, which makes retrieval of key information more time-consuming. Finally, SteelTrace will automatically check to see if compliance data hold up to international standards and specifications; this eliminates the need for manual searching.

An Environmentally Friendly and More Efficient Steel Industry

It’s no secret that manufacturers are all in on digitalization and the steel industry is no different. A pivot to a safer, zero-emissions world will require new technological investment, especially in data analytics. Technological investment is also critical for increasing operational efficiency, as edge devices automize energy outputs and can predict machine/equipment breakdown before it’s too late. As a final note, the future of the steel industry will be largely affected by the actions of industry leaders and government regulation.

To learn more about forward-looking technologies in steel production, download ABI Research’s Industry 4.0 in the Steel Industry research analysis report. This report is part of the company’s Industrial & Manufacturing Research Service.

![Heavy Industry Trends and the Key Role of Satellite Communications [Infographic and Webinar]](https://cdn2.abiresearch.com/static/blogs/trucks-at-mining-site.webp)