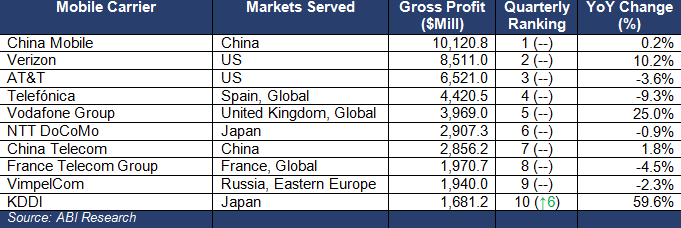

Based on 2Q-2013 year financial results, China Mobile snagged the top position for most profitable mobile carrier, followed by Verizon Wireless and AT&T respectively. The fourth and fifth positions were taken by European carriers with global operations, Telefnica and Vodafone. Remarkably the top 5 mobile carriers represent 49% of total gross profit generated by the 50 largest mobile carriers tracked by ABI Research.

While China Mobile is the most profitable mobile carrier in aggregate, quarterly gross profit per subscriber is only US$ 16.40, placing the carrier in 48th place. Verizon Wireless is 4th with US$ 71.80 and AT&T 5th with US$ 60.40. “While China Mobile’s profit per subscriber is substantially lower than Verizon Wireless’ and AT&T’s, there are signs that China Mobile will continue to extend its lead over the other carriers,” stated Marina Lu, research associate at ABI Research. As the proportion of revenue from 3G, and then 4G mobile data services increases, this will boost China Mobile’s overall profitability. Steadily rising affluence in the general economy and subscriber upgrades should boost China Mobile. In the case of Verizon and AT&T, they have been able to boost revenues by targeting not just consumer 4G services, but also enterprise and Machine-to-Machine (M2M) services. For example, Verizon is focusing on certifying new M2M solutions for use on its wireless network through partner program in healthcare IT industry, while AT&T has introduced home security and automation services.

“This is a wider phenomenon,” added Jake Saunders, VP and practice director. “Confronted with reduced voice revenue as a consequence of lower minutes of use and downward pressure on voice pricing per minute, even in Emerging Markets, mobile operators are aggressively encouraging the adoption of mobile data services. In the quarter in question, China Mobile’s quarterly gross profit grew 2.1% compared to Verizon Wireless’ 1% and AT&T’s 0.2%.”

Another effective strategy to boosting profitability is converting prepaid subscribers to postpaid. Mobile operators are beefing up their postpaid smartphone devices portfolio, introducing postpaid centric applications and offering multi-device shared plans to entice prepaid subscribers to make the conversion.

These findings are part of ABI Research’s Mobile Carrier Strategies Research Service.

ABI Research provides in-depth analysis and quantitative forecasting of trends in global connectivity and other emerging technologies. From offices in North America, Europe and Asia, ABI Research’s worldwide team of experts advises thousands of decision makers through 70+ research and advisory services. Est. 1990. For more information visit www.abiresearch.com, or call +1.516.624.2500.

About ABI Research

ABI Research is a global technology intelligence firm uniquely positioned at the intersection of technology solution providers and end-market companies. We serve as the bridge that seamlessly connects these two segments by providing exclusive research and expert guidance to drive successful technology implementations and deliver strategies proven to attract and retain customers.

ABI Research 是一家全球性的技术情报公司,拥有得天独厚的优势,充当终端市场公司和技术解决方案提供商之间的桥梁,通过提供独家研究和专业性指导,推动成功的技术实施和提供经证明可吸引和留住客户的战略,无缝连接这两大主体。

For more information about ABI Research’s services, contact us at +1.516.624.2500 in the Americas, +44.203.326.0140 in Europe, +65.6592.0290 in Asia-Pacific, or visit www.abiresearch.com.

Contact ABI Research

Media Contacts

Americas: +1.516.624.2542

Europe: +44.(0).203.326.0142

Asia: +65 6950.5670