In the latest release of its quarterly market tracker for mobile ICs, ABI Research, the leader in transformative technology innovation market intelligence, finds that despite a decent 13% year-on-year growth of mobile processor shipments in 2015, IC suppliers closed out the year with more than 30% loss in share to the top three smartphone vendors. According to report findings, the new development is directly linked to the ongoing smartphone and tablets markets verticalization.

“2015 proved to be a difficult year for mobile processor suppliers, most notably Qualcomm, as its top clients, particularly Samsung and Huawei, increase their reliance on in-house processors to power their own smartphones and tablets,” says Malik Saadi, Managing Director and Vice President at ABI Research. “Qualcomm market share in the mobile processor market dropped from 37% in 2014 to 31% in 2015 as a direct impact of the market verticalization.”

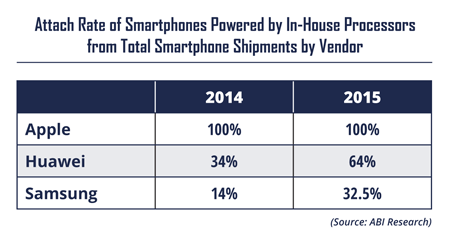

Captive vendors, such as Apple and now Samsung and Huawei, managed to collectively capture more than 30% of the total mobile processor market in 2015, up from just 23% in 2014. This was due to the aggressive verticalization strategy implemented by Samsung and Huawei in recent years, which enabled them to respectively power 32.5% and 64% of smartphones they shipped in 2015 with their own in-house processors. Looking toward the future, other vendors, such as ZTE, LG and Lenovo, may also follow this verticalization, which could lead to even further market share loss by IC vendors in the mobile processor business in the future.

“To prevent verticalization from becoming mainstream, key IC suppliers, including Qualcomm, MediaTek, and Intel, will have to push the differentiation barriers to reach the point at which their chips cannot be rivaled,” concludes Saadi. “To accomplish this, IC suppliers should quickly aim to support innovative features, such as artificial intelligence, immersive graphics, and machine vision, in their processors while offering those features at very competitive price points.”

These findings are part of ABI Research’s Mobile Device Semiconductors Service, which includes research reports, market data, insights, and competitive assessments.

# # #

About ABI Research

For more than 25 years, ABI Research has stood at the forefront of technology market intelligence, partnering with innovative business leaders to implement informed, transformative technology decisions. The company employs a global team of senior analysts to provide comprehensive research and consulting services through deep quantitative forecasts, qualitative analyses and teardown services. An industry pioneer, ABI Research is proactive in its approach, frequently uncovering ground-breaking business cycles ahead of the curve and publishing research 18 to 36 months in advance of other organizations. In all, the company covers more than 60 services, spanning 11 technology sectors. For more information, visit www.abiresearch.com.

About ABI Research

ABI Research is a global technology intelligence firm uniquely positioned at the intersection of technology solution providers and end-market companies. We serve as the bridge that seamlessly connects these two segments by providing exclusive research and expert guidance to drive successful technology implementations and deliver strategies proven to attract and retain customers.

ABI Research 是一家全球性的技术情报公司,拥有得天独厚的优势,充当终端市场公司和技术解决方案提供商之间的桥梁,通过提供独家研究和专业性指导,推动成功的技术实施和提供经证明可吸引和留住客户的战略,无缝连接这两大主体。

For more information about ABI Research’s services, contact us at +1.516.624.2500 in the Americas, +44.203.326.0140 in Europe, +65.6592.0290 in Asia-Pacific, or visit www.abiresearch.com.

Contact ABI Research

Media Contacts

Americas: +1.516.624.2542

Europe: +44.(0).203.326.0142

Asia: +65 6950.5670