3Q 2023 | IN-7055

Registered users can unlock up to five pieces of premium content each month.

Chip Supply Challenges Are Nearly Overcome |

NEWS |

The past few years have proven challenging for the government Identity (ID) market. Inflation, the fallout from COVID-19, and geopolitical tensions have presented difficulty from many angles, impacting vendors’ strategic considerations within the ID ecosystem. Not the least of these challenges are those related to chip allocation. The inability of semiconductor vendors to meet demand (beginning in 2020) has constrained the ID cards market considerably—and, by extension, the multitude of chip-reliant industries globally.

That being said, in 2023, the consensus from key industry players is that chip-related problems have ceased significantly. Moreover, the expectation surrounding chip supply in the government domain is that a complete resolution will effectively have been reached by the end of the year. This comes as a result of investment in, and qualification of, new fabs that have been made across the past few years. The Return on Investment (ROI) in chip capacity is now being felt and, moving forward, new fab construction will further increase capacity in the longer term to mitigate the likelihood of similar events in the future. This capacity increase comes alongside developments in new chip types and nodes to resolve any remaining constraints and future-proof the market.

As a result of increased capacity, 2024 should mark the first full year without shortages whatsoever for government ID documents. Additionally, a reduction in demand from chip-heavy industries like consumer electronic devices and the automotive sector has benefitted the smart card market in the shorter term. The only lingering stipulation surrounding Integrated Circuits (ICs) concerns price. Chip prices have steadily increased over the course of the shortage and are expected to remain at higher levels in the medium term, with recouping of investment cost being necessary, as well as advancing chip technology in the general sense.

2023's Significant Uptick in Shipments |

IMPACT |

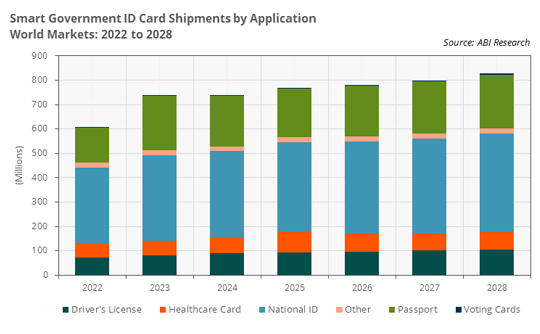

Increased chip capacity has undoubtedly played into 2023 being the first strong year of the market since an initial downfall that began in 2020. ABI Research anticipates shipments across all smart document types globally to hit highs of 739.9 million by the end of the year—a significant uptick following the dip of 2020 that only equaled 2019’s volume in 2022.

Alongside the constraint of IC allocation ceasing to inhibit the market, the rebound of passport demand as the world has moved out of the COVID-19 pandemic has played heavily into this strong year. A prioritization of passports has been clear to meet pent-up demand and fulfill expirations that occurred during the COVID-19 period. By the end of 2023, ABI Research expects ePassport shipments to reach 224.9 million, dwarfing previous years’ figures. Notably, China recommenced issuance in early 2023, after grinding to a halt during the pandemic, playing a key role in this year’s elevated figure. China acts as the major contributor to the 122.4 million passports expected to ship by the end of 2023, following 2022’s limited figure of 39.2 million. Moving ahead of 2023, as pent-up demand is catered to, the market is expected to somewhat plateau and stabilize before resuming growth. The general outlook on the market can also be viewed as somewhat simplified in comparison to numerous years of managing various challenges.

Other Noteworthy Trends in 2023 |

RECOMMENDATIONS |

Chip supply and passport dynamics have been considered the most prominent factors to monitor in recent years within the government ID market. Aside from these, government ID stakeholders should consider the following prominent trends in product planning and take a forward-facing view:

- Polycarbonate (PC) Migration: The advantages of PC are well-documented. Enhanced security features, greater tamper-resistance, and increased durability all play into the clear global trend of migration to this substrate across all credential types. While North America and, particularly, Europe see high levels of PC penetration already, ABI Research observes more and more new tenders making the step to move to a PC document, leading to an anticipated 633.6 million PC ID shipments in 2028.

- Consolidation of ID Use Cases into a Single ID: There are multiple ID programs worldwide in which a single ID credential gives a citizen access to a range of services. Japan's plans to absorb the use case of healthcare cards into its digital national ID system is indicative of a shift to this simplification. In this proposal, the issuance of Japanese healthcare cards will cease, a noteworthy example of how multiple IDs (e.g., voter and healthcare IDs) can be absorbed and consolidated into a simpler and more refined system.

- Advancement of Physical Security Features: Combatting fraud is naturally an ever-present concern. Illegal printing shops have increasing access to advanced technologies, which forces a response from ID vendors to continue to innovate and move toward more secure technologies, with a need for physical security complexity increasing.

- Continued Smart Migration: Aligning with digital transformation and increasing security demands is the continued migration globally from legacy to smart ID documents. ABI Research notes that 44.9% of all ID documents in 2022 were smart, increasing to 52.2% by 2028.