2Q 2020 | IN-5824

Registered users can unlock up to five pieces of premium content each month.

A Complex Telco Ecosystem |

NEWS |

The industry is going through a transformation with an eye to modernize networks and underlying supporting infrastructure. A big part of the transformation is driven by the need to both lower the cost of operations and gain agility and flexibility. For example, the impending rollout of 5G core networks ensures that Communications Service Providers (CSPs) can support the load and diversity that new (enterprise) use cases are going to introduce. Ultimately and inevitably, the transformation in question will introduce increased digitization in telco operations, in turn creating more interfaces and processes and, by extension, complexity. The continued shift to virtualized networks and containerized network elements only exacerbates that complexity.

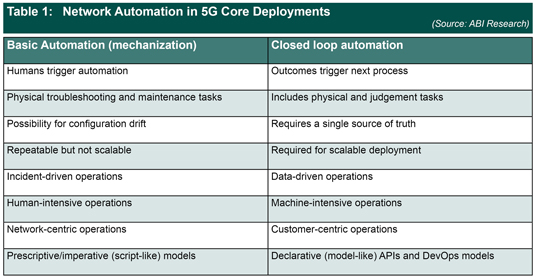

Virtualization, cloud-edges, and containerized 5G core deployments will create and require hybrid networks that cannot be managed with today’s automation solutions. The radio and core networks of today are largely supported by a basic automation model (mechanization) that is anchored on siloed and manual operational procedures. This is insufficient and unsuitable for next-generation networks expected to support a plethora of connected devices and massive network traffic passing through them. Consequently, “deep” End-to-End (E2E) closed-loop automation is set to become an industry hallmark in the coming years. This will enable CSPs to automate deployment and operational processes and pursue a high degree of configuration without impacting existing operations and software.

Out with Mechanization, in with Automation |

IMPACT |

CSPs are seeking to institute autonomous and adaptable operational processes, particularly when it comes to troubleshooting, repair, and network configuration. Today’s operations run mostly in an open-loop fashion, i.e., non-feedback procedures that provide network visibility analytics to network management personnel who are subsequently dispatched to fix failures. Such procedures are pegged to physical network appliances, have a coarse-grained component granularity, and revolve around linear processes and prescriptive/imperative (script-like) models. Furthermore, the notion of multi-vendor networks is a basic property of telecoms industry, but one that stands at the basis of fragmentation and complexity. The complexity is intensified by the arrival of 5G core, where network parameters, processing algorithms, and the number of alarms are all expected to grow.

Fragmentation and complexity introduce cost in operations. To alleviate that complexity, next-generation automation tooling will need to be predicated on fine-grained and elastic functions, declarative Application Programming Interfaces (APIs) (model-like) and cloud principles. Declarative APIs are a DevOps approach that declare an end-state and then automatically and incrementally work to achieve and sustain it, as opposed to manually running automation scripts. In other words, incremental steps are taken toward closing the loop (i.e., incorporating a feedback mechanism) in an automated fashion with little or no “human” input. For example, AT&T’s Airship is a case in point, a platform that constitutes a big piece of AT&T’s 5G plans. Airship, just like Telefonica’s UNICA, is designed to declaratively automate cloud provisioning and lifecycle management across container, VM, and bare-metal deployment options.

|

|

CSPs’ vision is to move away from “incident-driven operations” and toward proactive data-driven operations that scale across numerous business lines. This, of course, may not be without challenges, particularly when we consider that core networks are increasingly virtualized, cloudified, and distributed to edge deployments. The difficulty of automating these networks varies in line with CSP readiness, ability to leverage Artificial Intelligence (AI)/Machine Learning (ML) capabilities and maturity of automation solutions. Over time, networks will be flattened and, increasingly, infrastructure management will need to be standardized. Once a standard takes hold, solution providers will need to focus on the quality of what automation capabilities they offer as opposed to how they automate.

Focus on Existing Circumstances |

RECOMMENDATIONS |

In ABI Research’s view, the quality of automation tooling will need to encompass three imperatives: heterogeneity, interoperability/compatibility, and scale. Telecoms is anchored on a multi-vendor, heterogeneous technology landscape. This does not bode well for E2E platform observability and automation. By contrast, the notion of multi-vendor support does not exist amongst hyperscalers. The likes of Amazon, Google, and Microsoft continue to reap commercial benefits from a homogeneous technology ecosystem. Consequently, regardless of who provides the automation platform, technology providers must work on multi-vendor platform observability to automate heterogeneous operations. They must capture and subsequently factor in granular network Key Performance Indicators (KPIs), all of which will trigger outcomes and events that will self-heal and scale.

Furthermore, there are three conditions that vendors must satisfy for effective and high-quality automation capabilities, namely specifiability, verifiability and predictability. First, both the supply side and the demand side need to know what to specify—which attributes of the automation solution are core for existing network operations and which ones are complementary. Second, CSPs must be able to measure those attributes so that they can verify that modern automation capabilities meet their operations specifications. Third, solution providers must work closely with CSPs’ operations teams to avoid any poorly understood or unpredictable interdependencies across their operations. This is particularly important given that, for the foreseeable future, CSPs’ internal operations teams will work in diverse network environment where 5G Core will coexist with LTE EPC.

Lastly, telco vendors must target their products at the circumstances in which CSPs find themselves, rather than the CSPs themselves. In other words, the critical unit of analysis must be existing operations and associated commercial circumstances, not the customer. That, of course, is not to say that vendors can lose sight of impending innovation coming from cloud and cloud-native software. The automation solutions that will be predominate in the market are those that lifecycle manage incumbent’s platforms but, and this is important, integrate those platforms with operational simplicity and innovation coming from new market entrants.