By Sam Gazeley | 3Q 2023 | IN-7027

Registered users can unlock up to five pieces of premium content each month.

The Current Payment Card Scenario |

NEWS |

The majority of key industry players have come to the agreement that the most significant effects of the chipset shortage are being resolved as of 2023, with investment and development likely to pay off toward the end of the year with increased chip capacity through new construction and certifying of foundries. However, the availability of chips as of 2023 has not been fully resolved. Even in 1H 2023, negative effects were still being experienced in the market, though the majority of chip vendors now advise that the availability of chip supply will improve by the time 2023 comes to an end.

There has been a concerted effort from market-leading secure Integrated Circuit (IC) vendors to best inform the payment card market (as well as other smart card verticals) on available supply, attempting to fulfill as much demand as possible. The qualification and construction of new chip foundries have been strongly prioritized (with many IC vendors seeking to shift chip production away from the Asia-Pacific region), alongside developments in new chip types and nodes to resolve any remaining constraints and future-proof the market against future uncertainties.

Given the length of time needed to upgrade and expand infrastructure and facilities, any new foundry construction is unlikely to be apparent in 2023. At the same time, declines in end markets like consumer electronics have opened up another capacity avenue, including the market for payment cards. Even though payment card ICs may be less expensive than those found in consumer electronics or automotive vehicles, they are considered essential for customers and for supporting global economic recovery in nations that have struggled as a result of global macroeconomic pressures.

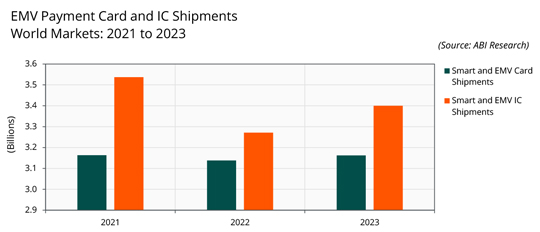

In terms of the payments IC market, shipments for the entire year of 2022 did experience a -8% Year-over-Year (YoY) loss due to general supply constraints and high demand from the consumer electronics and automotive sectors. However, the chip market is anticipated to grow by 4% in 2023, as more capacity becomes available as a result of efforts made to certify new fabricators. Additionally, this will help rebuild some inventory levels that were substantially depleted by 2022.

Payment Card and IC ASPs and Revenue |

IMPACT |

The price levels for payment card ICs is now a contested topic in the payment card market, which has become even more critical over the last few years. Transportation costs, energy prices, and material costs have all seen their prices increase, which has caused a follow-on effect in the chip price itself. All of these contributors have to be factored in when pinning down the overall card price, and it has become clear to market players that these challenges will not be completely resolved in 2023. Indeed, even if the current issues were resolved, it is not expected that card prices will return to pre-COVID-19 levels, as IC vendors look to boost revenue after the woes of the shortage, coupled with the cost of recent investment and foundry building/qualification.

As it relates to pricing specifics, ABI Research believes the average payment card Average Selling Price (ASP) increased by 11.1% through 2021, and by the end of the following year, this had increased by a further 10.4%. Due to the global shift toward dual interface and the chip allocation shortfall, the market has observed nearly 3 full years of incremental price increases, resulting in a 26% increase in average card prices from the start of 2020 to the end of 2022.

Leading IC vendors have made large investments in additional fabricator construction, new foundry qualification, and developing new chip types and nodes with the goal of increasing the supply of chips for the smart card industry, as well as other markets. Due to the time frames required to bring online and qualify more foundries, as well as higher ASPs helping to cover increasing investment expenditures, ABI Research forecasts that the first ASP drops are unlikely to be visible until the end of 2024/beginning of 2025.

Brazil, Russia, and India Experience Varied Market Dynamics |

RECOMMENDATIONS |

Brazil has demonstrated some of the most significant growth seen in the payment card market through 2022. A strong level of contactless migration has combined with expansive neo and challenger bank activity, alongside an increase in demand for credit card issuance, causing the Brazilian market to increase from 230.1 million shipments in 2021 to 251 million by the end of 2022. However, 2023 will not be a year of growth for the payment card market in Brazil; as ABI Research understands, credit agencies have issued cards to high-risk customers without performing due diligence, which has now resulted in a tightening of regulation. The consequence of this will be a decline to 238.4 million card shipments for 2023.

All ecosystem players are aligned in the fact that the Russian payment card market experienced a significant downturn in 2022. Western payment card suppliers have completely withdrawn issuance of cards into the country as a result of the ongoing conflict in Ukraine. This has pressured the central bank of Russia to perform a mass overhaul of Europay, Mastercard, Visa (EMV) cards to Mir payment cards. Russia has also been rapidly certifying Chinese-supplied products, though this process is not considered a short-term solution to the woes the market is currently experiencing.

It was originally anticipated that the Indian payment card market would see a downward trend in payment card issuance for full year 2022. However, now that 2022 has come to a close, India remained in a minor growth position. The worst of the effects of the chip shortage were navigated by the fact that India had reserved a considerable stockpile of modules, though these were heavily depleted in order to meet demand through 2022. Issuance volumes landed at 190.9 million units for 2022 and, moving into 2023, the industry expectation is that India will experience a significant level of growth, currently forecast at 12%, alongside a high level of interest in biometric payment cards. On the other hand, 2024 will introduce two developments that will reduce the Total Addressable Market (TAM) in the region for the foreseeable future. First, banks in India will no longer automatically reissue cards upon expiration and, second, newly issued cards will have an extended expiration period which will serve to lower replacement rates. These factors will lead to a lower forecast of issuance volumes in India moving forward.

The payment card market is steadily emerging from the uncertainties borne of the COVID-19 pandemic, coupled with the shortage in the supply of semiconductors. While these factors are largely resolved, in the short term, macroeconomic and geopolitical pressures, such as inflation and energy prices, will play a major role in setting the market growth trajectory. The chip shortage and COVID-19 began a shift in strategies for the payment card market, leading to issuers looking to extend card expirations, and changing card replacement strategies in order to mitigate and reduce any future supply risk, while also looking to spread the higher card cost across a longer time span.