What Is Driving the Next Wave of Industrial Automation?

Industrial automation is entering a new phase driven by software-defined systems, workforce challenges, and increasing demands for efficiency and resilience. Manufacturers are moving away from rigid, hardware-bound architectures toward flexible, IT-friendly platforms that support AI, sustainability, and stronger security. As a result, automation strategies are shifting from isolated upgrades to broader ecosystem transformation.

These research findings from ABI Research identify the factors behind the next stage of industrial automation, list short-term expectations, and provide strategic implications for technology vendors.

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

Industrial automation is being rapidly redefined by new technologies, increasing labor challenges, and growing pressure to improve manufacturing efficiency. At the center of this transformation is Software-Defined Automation (SDA), which is opening the door to faster, more adaptable, and Information Technology (IT)-friendly systems. The implications are broad, affecting how smart factories operate, how software and hardware interact, and how industrial vendors approach the market.

ABI Research’s Industrial Automation Semiannual Update: 2H 2025 presentation assesses the catalysts for the next phase of industrial automation and outlines the short-term priorities for tech vendors.

Key Takeaways:

- Software-defined automation is changing how factories are built and run. By separating software from hardware, SDA makes industrial automation systems more flexible, easier to scale, and simpler to update over time.

- Open architectures are becoming a priority for manufacturers. Companies want automation platforms that work across vendors, reduce lock-in, and support interoperability through open standards like IEC 61499.

- Labor shortages are accelerating automation modernization. Retiring Operational Technology (OT) experts and IT-trained graduates are pushing manufacturers toward IT-friendly systems that are easier to manage and more attractive to new talent.

- AI, sustainability, and security are now core industrial automation drivers. Artificial Intelligence (AI) improves productivity and diagnostics, modern platforms support energy optimization, and software-defined systems strengthen cybersecurity through faster updates and visibility.

What Are Industrial Automation Technologies?

When referencing industrial automation technologies, ABI Research primarily alludes to the following:

- Supervisory Control and Data Acquisition (SCADA)/Human-Machine Interface (HMI)

- Distributed Control System (DCS) software

- Soft/virtual controllers

- Programmable Logic Controller (PLC)

- Industrial Personal Computer (IPC)

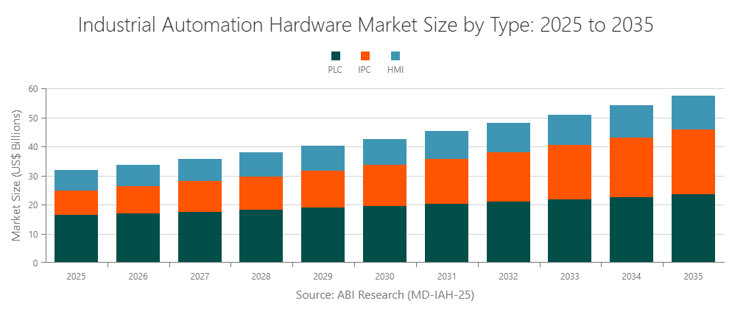

Our analysts forecast respectable to substantial growth rates across these technologies. SCADA revenue will grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2025 and 2030, HMI at 5.3%, soft-virtual controllers at 28.2%, PLC at 3.7%, and IPC at 10.1%.

Next-Generation Industrial Automation Market Drivers

A Shift in the Architecture of Automation

SDA marks a major departure from legacy industrial automation systems. Traditional automation solutions often tied hardware and software together, creating rigid systems that were difficult to update and expensive to maintain.

SDA breaks that model. It decouples the hardware and software, shifting intelligence to the software layer and enabling centralized management.

This transformation brings benefits such as easier system scaling, hardware independence, stronger IT and operational alignment, and lower costs. It also makes it simpler to reuse code, visualize processes, and build more resilient architectures.

Vendors are still early in building out full SDA portfolios. Leading examples include Bosch Rexroth’s ctrlX OS, Schneider Electric’s EcoStruxure Automation Expert, Siemens’ SIMATIC S7 1500V, and SUPCON’s Uniform Control System (UCS).

Beyond SDA: The Push Toward Open Architectures

While SDA brings significant benefits, the market is already pushing toward a more ambitious goal: Open Software-Defined Automation (OSDA). SDA may still lock customers into vendor ecosystems, which manufacturers do not prefer.

OSDA, on the other hand, promotes openness through shared standards and interoperability across vendors. ABI Research Senior Analyst James Prestwood says, “The automation market is already pushing beyond the SDA, highlighting that a core value of next-generation automation systems should be openness. He continues, “OSDA goes beyond the current SDA narrative, looking to not just break down the barriers between automation hardware and software, but ensure a fundamentally open ecosystem through completely open standards and solutions.”

OSDA is about ecosystem transformation, not just product transformation. Key advocates include Schneider Electric, Phoenix Contact, and the standards body UniversalAutomation.org, which champions IEC 61499 as the foundational model.

The Workforce Challenge

Workforce shortages across the industrial space are creating obstacles to automation. Skilled professionals familiar with older OT systems are retiring, taking decades of domain knowledge with them. At the same time, most new engineering graduates are trained in IT systems, not legacy industrial logic.

Companies that want to attract top talent will need to modernize their automation systems. IT-friendly platforms that support modern workflows are now a recruitment advantage. Continuing to rely on ladder logic and proprietary architectures will grow more expensive and less sustainable.

The Sustainability Driver

Sustainability continues to be a driver for industrial automation innovation in regions like Europe and an emerging trend in global operations. Corporate commitments and regulatory targets are pushing companies to reduce emissions, lower energy consumption, and improve visibility across the value chain.

Modern automation systems help by enabling real-time data sharing across OT and IT layers. This supports better control of energy use and faster system adjustments. Legacy systems struggle in these areas, lacking the adaptability and integration capabilities needed to support ongoing optimization efforts.

Reshoring and the Need for Automation

Reshoring is gaining traction as companies and governments look to strengthen local supply chains. But bringing manufacturing back to high-cost regions such as North America or Western Europe requires automation.

To remain competitive, manufacturers must replace low-cost labor with highly efficient automated systems (e.g., robotics). SDA offers the scalability, flexibility, and cost savings needed to make reshoring projects viable. For example, in the wake of U.S. tariffs, domestic manufacturers can use SDA at a time when automation hardware has become more difficult to acquire.

AI and Analytics Take Center Stage

Artificial Intelligence (AI) is becoming a key part of industrial automation. Vendors are integrating AI for tasks such as code generation, diagnostics, real-time monitoring, and predictive analytics. Generative AI (Gen AI) is also helping with documentation and design.

Leading firms such as Siemens, Copia Automation, Software Defined Automation, and SUPCON are building these features into their platforms. AI improves operator productivity, accelerates time to resolution, and can even help close skills gaps.

Cybersecurity Pressure Is Growing

As factories become more connected, cybersecurity becomes a bigger concern. ABI Research’s Industrial and Manufacturing Survey 2H 2024/1Q 2025: State of Play for Digital Transformation found that manufacturers list cybersecurity as their second most critical challenge. Legacy automation systems are particularly vulnerable, as they were not built for today’s security threats.

Software-defined systems allow for faster patching, better traceability, and centralized visibility. These capabilities are becoming essential as cyberattacks grow in frequency and sophistication.

Short-Term Expectations for New Industrial Automation Solutions Adoption

Market adoption of SDA is gaining momentum. According to ABI Research’s short-term transformation expectations, within 6 to 12 months, we can expect:

- Increased use of virtual or soft controllers to complement traditional systems

- Growing adoption of industrial DevOps tools

- Broader deployment of SDA-based systems at greenfield sites

- Market resonance with open SDA principles

In the 18 to 24-month time frame:

- Market adoption of IT-styled automation tools will accelerate

- SDA solutions will reach pilot scale in hybrid manufacturing environments

- Expanding workforce acceptance of AI tools will grow

- SDA-based Distributed Control System (DCS) pilots will emerge

- Virtual control tools will become common across new and retrofit operations

Guidance for Automation Vendors

This evolution requires a new approach from industrial automation vendors. ABI Research places importance on the following three priorities:

Product Innovation as a Differentiator

SDA gives customers more flexibility in choosing technology vendors. As a result, innovation will matter more than long-standing relationships. Vendors must focus on building differentiated features and providing strong software capabilities.

Build Open Ecosystems

Industrial automation vendors should actively contribute to open, standards-driven initiatives. Working in isolation will become harder as customers seek interoperability and flexibility. Participating in initiatives like UniversalAutomation.org and supporting standards such as IEC 61499 will be key to future competitiveness.

Focus on Education and Enablement

SDA is still a new concept for many manufacturers. Vendors that invest in education, training, and real-world case studies will gain credibility. These efforts are particularly important in highly regulated industries, where customer trust and maturity of deployment are a must.

Final Thoughts

Industrial automation is undergoing a fundamental transformation. Software-defined approaches are bringing new levels of flexibility, scalability, and intelligence to the equation. While challenges remain, particularly in integrating legacy systems and managing workforce transitions, the momentum is clear. Vendors that invest in openness, customer education, and real innovation will be best positioned to attract and retain manufacturing customers.

Download the report, Industrial Automation Semiannual Update: 2H 2025, for a deeper understanding of what technology vendors need to do to align their automation product portfolios with manufacturers’ evolving expectations.

Frequently Asked Questions

What is industrial automation?

Industrial automation refers to the use of software- and technology-driven systems to improve efficiency, resilience, and operational performance in manufacturing. Today, it increasingly emphasizes flexible, IT-friendly platforms rather than rigid, hardware-bound architectures.

How is industrial automation evolving?

Industrial automation is evolving toward software-defined systems that integrate more easily with IT environments. Manufacturers are shifting away from isolated, hardware-centric upgrades and instead focusing on open platforms that support AI, sustainability goals, and stronger security.

What is driving the next wave of industrial automation?

The next wave is driven by workforce challenges, increasing efficiency demands, and the need for more resilient operations. These pressures are pushing manufacturers to adopt flexible automation strategies that enable broader ecosystem transformation rather than incremental fixes.

Related Research

Presentation | 4Q 2025 | PT-3891

Related Service

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions