Edge AI Software Market Analysis: Key Trends and Insights

The edge Artificial Intelligence (AI) software market is gaining traction, with ABI Research projections indicating a nearly four-fold increase in size between 2025 and 2030. This market analysis breaks down key findings from the company’s study, Edge-Focused AI Chip Vendors Expand Their Software Stack to Drive Developer Engagement. Key findings include trends in edge AI software development, how chip vendors are responding, and software maturity levels for vendors.

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

Edge AI Software Market Trends

Much like the Tiny Machine Learning (TinyML) market, edge AI chip vendors are increasingly shifting focus toward developing End-to-End (E2E) software capabilities. Customers have become accustomed to the usual Software Development Kits (SDKs) and model zoos. Now, customers and channel partners seek vendors that offer a diverse range of open-source software tools designed to accelerate time-to-value for developers.

Key edge AI software market trends observed by ABI Research include:

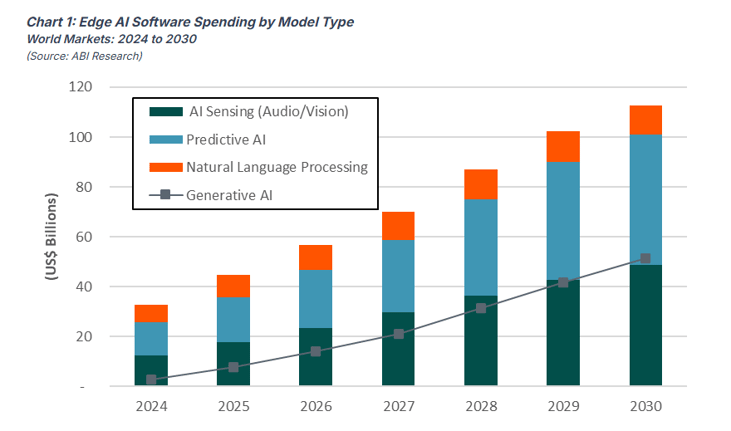

- Edge AI software market to surpass US$40 billion in 2025. According to ABI Research, the edge AI software market size is forecast to eclipse the US$40 billion mark in 2025 and reach roughly US$110 billion by 2030.

- Gen AI drives demand for new model types. Although traditional Machine Learning (ML) model deployments dominate edge AI software spending, the uptake in Gen AI tools will shake things up a bit. Demand for observability, data ingestion, data management, observability, and operations-enabling models will increase. This is being driven by the rise of Small Language Models (SLMs) capable of supporting generative applications.

- Early co-development reduces time-to-value. Edge AI chipset vendors must collaborate with software developers early in the Research and Development (R&D) process. This minimizes developer friction and optimizes hardware for new architecture on day one.

- Software partnerships bring advantages and disadvantages. Edge-focused AI chip startups have limited budgets and time constraints, making strategic partnerships the most reasonable approach to building software stacks. However, ABI Research cautions that this can risk market consolidation if brand differentiation and accessibility are not maintained.

- Turnkey solution development should be a priority. Edge AI hardware vendors should partner with vertical solutions providers to build turnkey software. These highly targeted E2E software stacks make a compelling case compared to incumbent platform providers.

Edge AI Software Maturity Projections

Edge AI chip vendors vary considerably in their software maturity. For example, a startup will be at a very different stage than a multi-billion-dollar conglomerate. To provide clarity to the edge AI market, ABI Research has mapped out how vendors are developing software capabilities across maturity levels.

- Early Maturity: Edge AI software initiatives target experienced developers, and there is no clear monetization strategy. Vendors will gradually move from generalized model zoos for perception-based applications to highly optimized models built for specific applications.

- Mid-Maturity: Development of targeted, ready-to-deploy software applications. Over time, vendors will introduce Machine Learning Operations (MLOps) and edge management & orchestration platforms.

- High Maturity: Edge AI software is monetizable and can be adopted by less experienced developers. A data fabric will be built out to support data ingestion, federated learning, data management/operations, and data generation.

How Are Edge AI Software Solutions Being Developed?

Edge AI software development is more time-consuming than hardware development. This provides the opportunity to engage with ecosystem partners and drive innovation through R&D synergies. The following strategies are being used by vendors to build out edge AI software solutions:

- Leveraging Open Source: Developers crave easy-to-use tools, making open-source software essential. Open-source software integrates more seamlessly into existing tools/workflows than proprietary solutions. It is also less expensive than tools built from scratch.

- Targeting Specific Workloads and Verticals: Most edge AI software vendors tailor solutions to specific verticals to maximize long-term value for end customers. This strategy has proven preferable to building full-blown platforms.

- Combining In-House Development with Partner Solutions: Most edge AI chip vendors are building software tools by leveraging both internal capabilities and partner solutions. This hybrid approach reduces human capital needs and helps enable applications higher up the software stack.

- Developing Multi-Tiered GTM Strategies: Customer requirements vary, given the various software skillsets among developers. Therefore, edge AI software vendors use multiple Go-to-Market (GTM) strategies targeting different developer profiles. For more mature developers, the priorities are accelerated time-to-value while accommodating low-level operations. For less experienced developers, the focus is on turnkey solutions and low/no-code tooling.

How Is the Edge AI Software Market Benefiting from Co-Development?

Chip vendors increasingly view the edge AI software ecosystem as a potential partner channel to build enterprise-grade solutions. Co-development provides the following benefits:

- Align hardware R&D with emerging edge AI workloads

- Accelerate model optimization and developer enablement

- Expand channels to market

- Seize co-marketing opportunities

- Deliver solutions optimized for specific industries/workflows

Two notable partners include model developers and vertical solution providers. As epitomized by Qualcomm’s partnership with Mistral AI, collaborating with model developers helps guide R&D around model sizes, structure, and type. This ensures that hardware and software align with prevailing trends.

Meanwhile, vertical solution providers have deep expertise in aggregating and delivering edge AI solutions to customers. The value chain exposure offered through this type of partnership is invaluable in terms of drawing customer insights and crafting long-term software roadmaps.

Grab the ABI Research Report

The edge AI software market is rapidly evolving, driven by both enterprise demands and model development. ABI Research’s analyst team took a deep dive into this topic to help product strategists:

- Understand the evolution of edge AI software

- Benchmark software ecosystem against the maturity model

- Develop winning strategies for cross-ecosystem partnerships

- Identify key companies such as Halio, Ambaraella, Axelera, and BrainChip

Download the report, Edge-Focused AI Chip Vendors Expand Their Software Stack to Drive Developer Engagement, for these expert-backed insights into the edge AI software market.

Related Research

Report | 3Q 2025 | AN-6480

Related Service

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions