Neoclouds Will Need to Partner with ISVs to Propel Enterprise AI Adoption

By Leo Gergs |

03 Feb 2026 |

IN-8048

By Leo Gergs |

03 Feb 2026 |

IN-8048

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

By Leo Gergs |

03 Feb 2026 |

IN-8048

By Leo Gergs |

03 Feb 2026 |

IN-8048

NEWSNeocloud Capacity Keeps Growing |

Looking at the build-out of Artificial Intelligence (AI) dedicated capacity within data centers, we currently see an interesting picture: across all types of Cloud Service Providers (CSPs), the amount of available capacity for AI-dedicated workloads will increase from 832 Megawatts (MW) in 2025 to 30,973 MW in 2035 (at a Compound Annual Growth Rate (CAGR) of 43.6%, overtaking legacy workloads between 2031 and 2032).

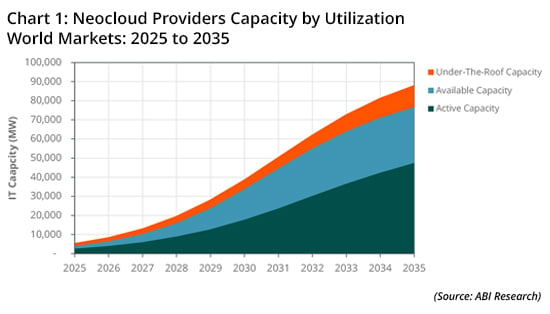

Neocloud providers have captured increased attention in the AI industry—not only because they have been able to collect impressive sums of funding through several rounds, but also due to their impressive (projected) capacity build-out. ABI Research’s recently published Cloud Service Provider Capacity Forecast market data (MD-CSPC-101) shows neoclouds expanding active capacity at a 46.3% CAGR through 2035, far outpacing Tier One & Two hyperscalers, and pure sovereign cloud providers.

Yet, if we look at the demand side of (enterprise) AI, we see that most enterprises are still experimenting with Generative Artificial Intelligence (Gen AI), while scalable uses cases that will demand this immense capacity have yet to emerge. Traditional hyperscalers have capabilities to host legacy workloads (such as Enterprise Resource Planning (ERP) systems, relational databases, and enterprise applications) with a business model that also relies on revenue from search, search, advertising, and consumer platforms, so the neocloud focus on AI workloads makes them far more dependent on the success of enterprise AI.

IMPACTWhy Are Neoclouds Reliant on the Uptake of Enterprise AI? |

To understand why neocloud providers are reliant on the success of enterprise AI, it is helpful to look at two different, but related metrics:

1) The Widening Gap Between Available and Active Capacity

Our recently published Cloud Service Capacity Forecast market data (MD-CSPC-101) shows that neocloud providers are expanding capacity at a pace that far exceeds current demand. While active capacity grows from 2.7 Gigawatts (GW) in 2025 to 47.4 GW in 2035, provisioned infrastructure climbs much faster, reaching 76.7 GW of available and 88.2 GW under-the-roof capacity. This widening gap reflects a structural dependence on a small number of large AI-training customers, rather than a broad, repeatable enterprise workload base. With the market moving from training to inference (with a focus on distributed, decentralized architectures), neocloud providers will have to adapt their business model to stay relevant.

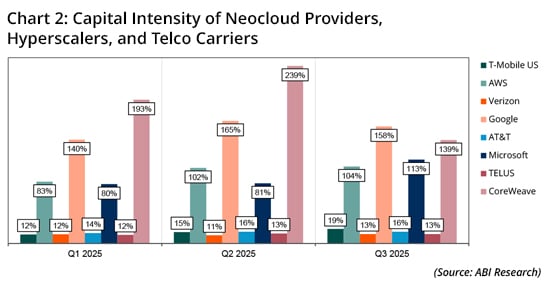

2) The Capital Intensity of Neocloud Providers

Neocloud providers (CoreWeave as an example) operate with far higher capital intensity than hyperscalers or telcos. Chart 2 shows CoreWeave running at 158% to 239% capital intensity across the period, compared with far steadier ranges for Amazon Web Services (AWS), Google, and Microsoft, and the major telcos. It should be noted that a high capital intensity is not a bad sign, per se, but it identifies a few risks associated with nascent markets: demand uncertainty that amplifies utilization risk, limited strategic flexibility due to large sunk investments, heightened exposure to forecasting errors, and the absence of diversified monetization pathways. All of this provides the economic evidence underpinning the same conclusion suggested by the capacity forecast: neoclouds are investing ahead of demand, and the enterprise AI market they rely on has not yet materialized at the scale their business model requires.

RECOMMENDATIONSNeoclouds Will Need to Broaden Their Partnership Network with ISVs |

In order to drive the adoption of enterprise AI, neocloud providers will have to continue to move out of their comfort zone and look at developing services and solutions that meet enterprise requirements. As ABI Research’s Neoclouds Aim to Build Commercial Moats by Investing in Software and Managed Services report (AN-6514) shows, providers are already trying to innovate by developing their managed services portfolio. But this will likely not be enough, as it underestimates one key point: enterprises will not adjust their buying behavior/favored solution providers to suit a technology supply chain. Other technology industries have failed because of that very assumption (look at the telco industry with private cellular, for example). Across every major digitization wave we have tracked, incumbent technology vendors with existing enterprise relationships (be it global IT integrators, cloud platforms, networking Original Equipment Manufacturers (OEMs), or Software-as-a-Server (SaaS) providers) retain a huge structural advantage in wallet share, influence, and deal velocity.

To be successful in the enterprise domain, neocloud and AI infrastructure providers need to adapt to the procurement realities of enterprises. At the core, this means understanding that enterprises are interested in buying use cases and outcomes instead of technology infrastructure. Consequently, neocloud AI-infrastructure providers will have to expand their collaboration and co-innovation networks with Independent Software Vendors (ISVs)—an area that most neocloud providers, so far, have omitted in their partnership strategy. Identifying partnerships in this field should follow these criteria:

- Market Pull & Demand Alignment: Neoclouds and other AI infrastructure providers will have to select ISVs based on their active enterprise customer base—in other words, their existing channel to the enterprise market. As a range of neoclouds position their sovereignty capabilities as a clearly distinguished unique selling point as compared to hyperscalers, neocloud providers should prioritize those ISVs with existing channels into highly regulated verticals (such as the public sector/defense, healthcare, financial services, and critical infrastructure).

- Workload & Architecture Fit: Aside from the commercial opportunity and market traction, neoclouds will have to select ISV partnerships based on a careful assessment of the necessity of neocloud infrastructure vis-a-vis hyperscalers. This will require an analysis of what kind of use cases will benefit from a neocloud infrastructure, in order to subsequently determine what players are active in this field. In addition to a heavy focus on AI applications, this should also consider requirements for performance consistency, latency, cost predictability, or data locality.

- Vertical & Use Case Specificity: Connected to the elements above, neoclouds will have to understand that ISVs in the enterprise domain are highly vertical-specific, given their heterogenous performance requirements in purchasing cycles. In manufacturing, AI-focused ISVs such as Siemens and Cognex deploy computer vision, predictive maintenance, and industrial analytics models that benefit from low-latency processing, deterministic performance, and strict control over proprietary production data. In healthcare and life sciences, AI applications from vendors such as Philips or Tempus rely on sensitive patient and genomic data, where model training, inference, and data residency must comply with stringent regulatory and audit requirements, positioning neoclouds as a trust and risk-mitigation layer.

For ISVs, such partnership can be interesting because of the AI-related domain expertise that neocloud providers bring, and their deep technology expertise in AI infrastructure provisioning and handling of AI workloads. This allows ISVs to offload performance tuning and scalability challenges, accelerate AI feature development, and reduce technical and commercial risk when bringing AI-enabled solutions to market. In addition, because of their relative size, neocloud providers are often more agile than big hyperscalers; therefore, they are willing to engage in co-innovation initiatives.

Once the selection of partners has happened, the details of each collaboration (commercial & incentive alignment, Go-to-Market (GTM) strategy, and integration roadmap) will need to be discussed. This should follow a clear ranking of use cases/enterprise AI applications to be delivered based on thorough demand-side research (like enterprise Information Technology (IT) decision maker interviews, surveys, and validated use case prioritization exercises, and Return On Investment (ROI)/Cost of Inaction (COI) models).

Written by Leo Gergs

Principal Analyst Leo Gergs leads enterprise connectivity and cloud and data center research at ABI Research. His work covers enterprise drivers, use cases, and provider strategies for technologies such as private cellular, SD WAN, and Fixed Wireless Access. He also analyzes key trends shaping the data center market, including the rise of neocloud providers, the growing importance of sovereign cloud models, and their implications for enterprise infrastructure, regulation, and workload placement.

Related Service

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions