Decentralized Bluetooth® Networks—the Key to Smart Labels and Supply Chain Visibility?

By Tancred Taylor |

04 Feb 2026 |

IN-8044

By Tancred Taylor |

04 Feb 2026 |

IN-8044

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

By Tancred Taylor |

04 Feb 2026 |

IN-8044

By Tancred Taylor |

04 Feb 2026 |

IN-8044

NEWSBluetooth® Architectures for Supply Chains |

The year 2025 was a significant one for announcements about new smart label devices, particularly using Bluetooth® Low Energy (LE) technology. Several factors contributed to this, including more stable and scalable battery manufacturing integrated within existing Radio Frequency Identification (RFID) label printing processes, as well as the growth of InPlay, a “firmware-less” Bluetooth® System-on-Chip (SoC) supplier working with a large number of label Original Design Manufacturers (ODMs) and all the major RFID label printers. InPlay’s IN120, released in 2025, will further reduce the barrier to entry with a footprint more adapted to bonding using the same printing process as RFID. Other silicon vendors are actively working on similar projects.

With major technical and scalability—and, to a great extent, price—challenges mostly overcome on the hardware manufacturing side of this market, smart labels, particularly those using Bluetooth® LE, are on the cusp of huge volumes in 2026. The attention now turns to commercialization approaches. This involves two aspects. First, the business models, which will no doubt see trial and error in the coming years. The second important question to be solved concerns implementation architectures. Much debate on success of cellular, LoRaWAN, Bluetooth®, and RFID labels revolves around what can be achieved in and out of supply chain networks, and how frequently data can be collected from data carriers. At least partially, the success of Bluetooth® labels will be dictated by how these devices can communicate back to the cloud without imposing significant infrastructure deployment costs on adopters.

Solution providers such as Trackonomy, Chorus, Tag-N-Trac, or Wiliot all bring slightly different approaches to this point. Wiliot requires an extensive deployment of energizers to power the tags, while Trackonomy has built its own custom “gateways” that power much of the Uninterruptible Power Supply (UPS) deployment and aggregate data from multiple protocols, including RFID, Bluetooth® LE, and LoRaWAN. These approaches provide good results in closed-loop supply chains, but they are more limited in supply chains that are more open—as they frequently are, with goods and cargo passing through a large number of stakeholders. Adding new infrastructure is impractical, prohibitively expensive, and in many cases redundant because most facilities already have some kind of Internet-connected devices that can aggregate Bluetooth® data—whether dedicated Access Points (APs), enterprise mobile devices, or simply smartphones.

IMPACTDecentralized Bluetooth® Networks |

One approach that is emerging is the idea of decentralized Bluetooth® networks, enabling seamless connectivity for labels and beacons by leveraging existing networks or Internet-connected devices with Bluetooth®. Three companies, Life360, Blecon, and Nodle offer different approaches to solving this specific challenge.

Life360 comes from a consumer technology background, providing a suite of applications targeting individuals and families, focused around family and pet safety, as well as personal object finding—enhanced through its purchase of Tile in 2021. Importantly, Life360 does not target supply chain use cases directly, but through its partnership with Hubble, the developer of satellite ‘Bluetooth®’ (a proprietary protocol using 2.4 GHz, with Bluetooth® radio hardware). The benefits are designed to go both ways, with Hubble’s technology enhancing Life360 and Tile users’ ability to connect anywhere in the world, while Hubble gets access to Life360’s enormous base of around 90 million users (mid-2025) in exchange for sharing revenue from devices using this network. Hubble provides the software, Smartpin, an enterprise-facing location platform launched mid-2025, and purchases Tile hardware from Life360 to help enterprises track assets.

While an innovative idea, it is the broader commercial interest that makes this worthy of attention. In initial tests, solution providers note that they were able to receive updates every 10 minutes on trucks moving from coast-to-coast in the United States. Additionally, ABI Research is aware of several supply chain visibility solution providers that have, or are developing, partnerships with Hubble. One of these is Chorus; while the partnership has not been publicly announced, Chorus and Kuehne+Nagel shared in November 2025 that the Kuehne+Nagel visibility platform “now connects to 100 million devices”; the vast majority of these are from the Life360 network.

It is of great importance that Kuehne+Nagel, one of the largest freight forwarders globally and a company with a number of irons in the smart label fire, is experimenting with what amounts to a community network instead of purely with enterprise APs with guaranteed coverage and service agreements. There is work to be done on building out this community network, which today is primarily active in the United States, though growing in Canada, the United Kingdom, and Australia/New Zealand; but it remains an interesting proposition—maybe one that comes with its own risks. It also will have to be seen how much devices leverage the Life360 network or connect to satellites over the proprietary 2.4 GHz Hubble protocol—a distinction that will have important implications for service levels.

Blecon takes a different approach. The company is much smaller, and does not guarantee any level of coverage; instead, it offers a software package to deploy within an enterprise’s Information Technology (IT) network and on existing frontline devices—whether Internet APs, smartphones, enterprise mobile devices, laptops, Point of Sale (POS) devices, or any other device with Bluetooth®, enabling an enterprise to create a potentially dense network out of already-deployed devices. Today, a number of supply chain visibility solution providers work directly with vendors like Cisco or Juniper to allow beacons and labels to communicate through their APs; Blecon’s approach complements or enhances this approach by turning an enterprise’s broader device estate into gateways, instead of requiring multiple hardware-specific integrations. Blecon’s partnership with Molex and its InPlay-based smart labels in October 2025 highlight a clear interest in creating dense networks through which these devices can communicate.

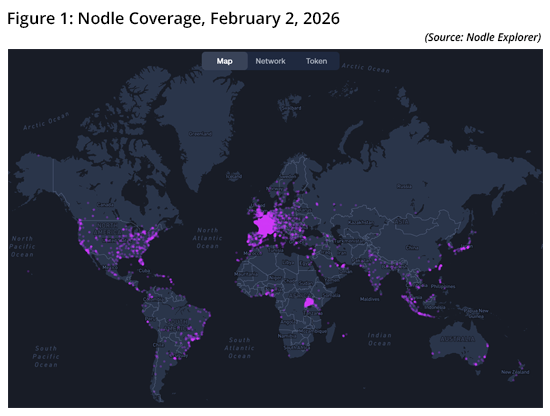

While these two are more visible currently, they are by no means the only decentralized Bluetooth® networks. Nodle offers a community network using the smartphones of those participating in the Nodle chain, who are, in turn, rewarded with varying amounts of the NODL token—reminiscent of the Helium community network approach with LoRaWAN. The system is used currently by Roole, among others, a membership club offering a range of services for car owners in France, including vehicle anti-theft protection. Bluetooth® beacons in the vehicle connect to any Nodle network member’s smartphone, with members including users of Roole’s mobile application; Roole is made up of 1.5 million members in France today, creating a dense network in the country, with sparser coverage elsewhere in Europe and the rest of the world.

Tellingly, Nodle attempted in 2022 to create a printed smart label device, the N1 Nanocomputer, which would help drive traffic through its network. While this device does not appear to have been productized, likely due to the specialization required in the manufacturing process, it is very likely to see more success working with third-party label manufacturers now that their own offerings have matured.

RECOMMENDATIONSMoving from Hardware to IT Questions |

These remain early days for Bluetooth® LE labels. Architectures and deployments today are, by nature, somewhat experimental, and they will undergo refinements and restructuring over the coming years. Decentralized networks are emerging as an option to densify coverage and deploy networks at a minimal cost, but key questions remain, including regarding security and coverage.

Security questions have long plagued the Internet of Things (IoT), and will likely redouble with initiatives allowing millions of extremely cheap devices onto IT networks. Various approaches should be considered; standards bodies like the Bluetooth Special Interest Group (SIG), IEEE, or The 3rd Generation Partnership Program (3GPP) for its upcoming Release 19 Ambient IoT (A-IoT) specification must re-architect security layers from the ground up to take into account the requirement for a pared-down protocol firmware stack—an essential requirement to make devices sufficiently low-power to create smart label devices. Additionally, “firmware-less” approaches like InPlay’s are attractive, in that complex elements like security are concentrated at the network or cloud level, essentially making smart labels “dumb” data streams with limited ability to be compromised.

Coverage and service levels are the other key question. Community networks have not seen the greatest success in the IoT—as Helium, Sidewalk, and Nodle, among others, demonstrate. Enterprise deployments require consistency, which remains one of the strong arguments that provides some encouragement to the slower market of cellular smart labels. The other strong argument is that many supply chains are highly fragmented, and visibility from shipper to recipient requires coordination and standardization of architectures across all stakeholders.

Currently, what we have are promising approaches and open questions. Now that the hardware is mostly ready for growth, the key for Bluetooth® labels to scale in the coming years will be decided by the ability to provide a low-touch and low-cost network that meets enterprises’ security and service-level requirements. The focus shifts from manufacturing what will soon be commodity hardware to the much more significant question of IT and enterprise architectures.

Written by Tancred Taylor

Related Service

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions