Telcos' Pragmatism in Sovereign AI Today Could Be Their Strength Tomorrow

By Larbi Belkhit |

08 Dec 2025 |

IN-7994

By Larbi Belkhit |

08 Dec 2025 |

IN-7994

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

By Larbi Belkhit |

08 Dec 2025 |

IN-7994

By Larbi Belkhit |

08 Dec 2025 |

IN-7994

NEWSTelcos Continue with Measured Sovereign AI Approach |

Despite the heightening fears of an Artificial Intelligence (AI) bubble dominating the news cycle the past couple of weeks, announcements of AI infrastructure build-outs have continued at pace. Neoclouds and hyperscalers continue to make significant investments in growing their available AI capacity, and telcos are continuing to enter the fray. Some recent telco-related sovereign AI announcements include:

- Deutsche Telekom: T-Systems (jointly with NVIDIA) announced its Industrial AI Cloud in Munich, consisting of 10,000 Graphical Processing Units (GPUs), which is set to go live in 1Q 2026 and is forming an ecosystem of partners such as Siemens, Wandelbots, PhysicsX, Agile Robots SE, and Perplexity. This AI factory is part of a €1 billion partnership with NVIDIA financed via its T-Capital arm. Furthermore, it has already won a contract worth tens of millions from Leibniz University Hanover for its SOOFI research project to train a new, sovereign Large Language Model (LLM) with roughly 100 billion parameters.

- TELUS: TELUS announced the opening of its sovereign AI factory with NVIDIA GPUs, HPE computing infrastructure, and powered by 99% renewable energy. The AI factory is already serving customers such as Accenture, OpenText, and League.

- SK Telecom: SK Telecom and Amazon Web Services (AWS) agreed to combine their respective capabilities to develop customized offerings for specific sectors, leveraging AWS infrastructure, as well as SK Telecom’s GPUs, to attract customers in highly regulated, sovereign verticals such as finance and manufacturing. It is also expanding its Gasan AI data center to 1 Gigawatt (GW) of capacity and building a new AWS AI zone in Ulsan.

- Turkcell: Turkcell and Google Cloud announced a strategic partnership to launch a new cloud region in Türkiye as part of a US$2 billion investment into the region. Turkcell will invest US$1 billion into data center and cloud technologies and will also act as a trusted partner to resell Google Cloud solutions to enterprises.

IMPACTTelco Pragmatism, Explained |

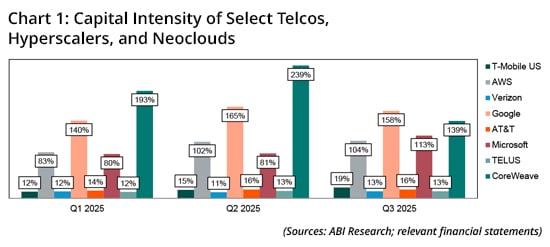

It is clear that telcos have adopted a significantly more pragmatic approach to scaling their sovereign AI compute and services capabilities compared to neoclouds and hyperscalers, and this is reflected in their relative investment levels thus far. Chart 1 illustrates the vast differences in capital intensity between hyperscalers, neoclouds, and telcos in 2025.

Unlike neoclouds and hyperscalers, telcos approach the sovereign AI opportunity with a more pragmatic, customer-first strategy. Almost every telco announcement, thus far, is backed by confirmed demand from day one, reducing the speculative risk and ensuring immediate monetization. This contrasts with neoclouds’ aggressive push to capture the AI opportunity, many of which are now also pivoting to try to capture the growing inference opportunity, too. Telcos are leveraging their strong regional presence, enterprise relationships, and alignment with national sovereignty initiatives to secure early wins, while hyperscalers have begun building their moats through a custom AI silicon strategy, alongside partnerships with NVIDIA, and the entrenched trust among global enterprises.

This approach by telcos reflects their structural realities in legacy data center portfolios, much of which may have been sold off at the beginning of the decade, not optimized for AI workloads. This makes the focus on AI inference a more natural fit for telcos. By focusing on distributed inference at the edge, telcos tap into more long-tail opportunities in regulated sectors, while partnering with governments to finance infrastructure and sovereignty initiatives. That said, some telcos have been able to capture on the sovereign AI training demand, but this is more driven by government initiatives than enterprise demand alone, meaning that this is not a universal opportunity for all telcos to capture.

RECOMMENDATIONSFocus on Inference, Acquire Training Later |

Long term, ABI Research expects that telcos will continue to focus on AI inference as the main opportunity in the sovereign AI landscape, with perhaps AI training and fine-tuning being a secondary opportunity for customers with high sovereignty requirements (i.e., beyond data residency). However, the AI training opportunity is not completely missed.

The sheer volume of neoclouds in the market in 2025 is unsustainable, and their investments in scaling infrastructure capacity remain skeptical, even with reports that some of the compute currently deployed is sitting idle and unutilized. The growing concerns around an “AI bubble” are also likely to greatly affect hyperscalers and neoclouds in the fallout, meaning that the current pragmatic approach telcos are taking could insulate them from the wider turbulence in the AI market. This will also present telcos with the opportunity to acquire the infrastructure assets from neoclouds in the long term and add said infrastructure to their portfolios.

For telcos, the market shifting to AI inference faster than they are prepared for is a much larger near-term challenge they must face. Hyperscalers and neoclouds are beginning to prepare for this market shift already, as they understand that this is the next big growth avenue after AI training. ABI Research recommends that telcos looking to address the sovereign AI opportunity thoroughly assess the neocloud landscape, as the market is dynamic. The assessment must not only consider the competitiveness of a neocloud, but also understand whether these neoclouds own their real estate assets for future acquisition exploration.

Furthermore, telcos that do not already have a direct sovereign AI offering should consider becoming resellers of hyperscaler compute offerings, owning the infrastructure. This allows telcos to educate themselves around how this market works, while having the full stack capabilities of a hyperscaler to offer to enterprises. An example of this approach is Turkcell’s recent deal with Google Cloud.

Written by Larbi Belkhit

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions