Sovereign AI Tailwind and Edge AI DNA Will Help Furiosa and Axelera Make a Splash in the AI Cloud Markets by Augmenting Existing NVIDIA Position

18 Nov 2025 | IN-7985

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

18 Nov 2025 | IN-7985

NEWSChallengers Move Beyond VC-Funded R&D into Commercialization |

NVIDIA continues to dominate the Artificial Intelligence (AI) cloud market, but competitors are steadily gaining traction. AMD has seen significant adoption, with major hyperscale deployments (i.e., Oracle, Microsoft) and neocloud titans (e.g., Vultr, Crusoe) that are recognizing the significant strides they have made over the last year, and leveraging AMD to reduce reliance on the NVIDIA ecosystem, while providing greater choice for their customers. To a lesser extent, Qualcomm and Intel have started to address this market. Qualcomm announced partners/customers, including Humain, while Intel continues to innovate with the addition of a new Graphics Processing Unit (GPU) to its portfolio.

Another important segment continues to make strides. Cloud-focused inference challengers are investing heavily in their Go-to-Market (GTM) strategies, including Cerebras, SambaNova, Groq, Enflame, Tensorrent. Esperanto Technologies, and Graphcore. These vendors represent the market long-tail, but have built solid alternatives to the traditional hardware incumbents—especially for inference workloads, as highlighted by recent wins from SambaNova (SCX in Australia, Argyll in the United Kingdom, and Infercom in Europe), Cerebras (Stargate UAE Data Center), and Groq (in Norway with Earth Wind & Power).

But this market continues to expand with new players to build on their strong roots in edge AI (especially computer vision) and regional position to address the lucrative and rapidly growing AI cloud and enterprise on-premises markets:

- Axelera AI: A European vendor known for its Metis AI Processing Unit (AIPU), optimized for edge computer vision. Axelera recently launched Europa, a high-performance accelerator targeting enterprise applications, multi-user Generative Artificial Intelligence (Gen AI), robotics, and other demanding workloads, combining low-latency processing with scalability for a wide range of industries. Axelera is scaling via a global partner program, the Axelera Partner Accelerator Network, which provides training, co-marketing, and technical support to over 15 Independent Software Vendors (ISVs), Systems Integrators (SIs), and channel partners (e.g., Aetina, Arduino, Seco, Macnica). Recently, it deepened its collaboration with Advantech to integrate Metis into Advantech’s edge AI systems, enabling joint GTM channels in Industrial Internet of Things (IIoT), robotics, and smart infrastructure.

- Furiosa AI: A South Korean company that initially focused on computer vision workloads and transitioned to the data center market in 2024 with Furiosa RNGD, a programmable AI accelerator for enterprises and neoclouds. Furiosa emphasizes power efficiency and performance per watt, while heavily investing in its software stack to overcome adoption bottlenecks. Its GTM strategy includes both direct-to-customer sales and Original Equipment Manufacturer (OEM) partnerships, notably with LG AI’s Exaone model, positioning Furiosa as a sovereignty-focused solution with traction in government and other critical industries.

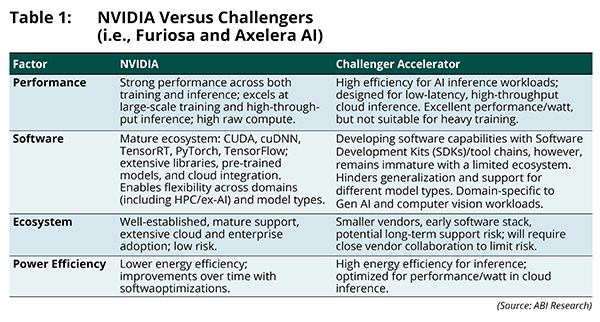

With strong roots in edge AI, these challengers are well-positioned to address power and energy efficiency concerns in AI data centers. But however compelling, they are not going to displace incumbents any time soon. Even so, it is important to understand how they stack up against the market leader—NVIDIA. Table 1 compares NVIDIA (especially A100 and H100) with these vendors.

Challengers offer highly efficient accelerators for inference workloads with alignment to critical bottlenecks (cost, power consumption). However, limited flexibility driven by the inherent programmability of GPUs (versus Application-Specific Integrated Circuits (ASICs)) and immature software (compared to NVIDIA’s CUDA) means that they are not going to displace the market leaders any time soon.

IMPACTSovereign Supply Chains Could Provide Tailwind for EU Semiconductor Vendors to Accelerate Commercialization |

Sovereignty initiatives in both Europe and Asia-Pacific are accelerating rapidly. In Europe, ecosystem stakeholders are increasingly seeking to decouple from U.S. technology dependencies. This trend goes beyond sovereign clouds to include sovereign hardware supply chains. For example, the European Union (EU) recently announced a new sovereignty evaluation framework for cloud services, which supplements existing EU controls and guides funding allocation and public service deployments. The framework incorporates a sovereignty score weighting model, assessing factors such as legal compliance, operational control, technological independence, data management, supply chain resilience, security, and environmental sustainability. Notably, supply chain sovereignty carries the highest weight, signaling its strategic importance.

Similar momentum is visible across Asia-Pacific, where governments are emphasizing technological independence and domestic capability. Furiosa AI provides a clear example: its growing traction in the South Korean government sector, driven by optimization for LG AI’s Exaone model and deep integration with local partners, reflects procurement preferences that prioritize sovereignty.

Deep alignment with these trends and requirements will be critical for challengers to benefit from these tailwinds. One particularly high-growth market segment is neoclouds. In the EU, these specialized AI cloud providers will closely monitor EU mandates, as they are heavily reliant on public funding to offset high Capital Expenditure (CAPEX). Over the next 2 to 3 years, sovereign chips, servers, and cooling equipment are expected to be in high demand. Coupled with ongoing energy constraints that continue to hinder data center buildout, this presents a clear market opportunity for challengers to grow their market share.

RECOMMENDATIONSAugmentation, Rather than Competition, Will Be the Fastest Way for Sovereign AI ASIC Vendors to Scale |

Competition with incumbents will be challenging. ABI Research advocates a more nuanced approach: rather than directly competing, challengers should augment NVIDIA to optimize performance per watt and performance per dollar across the AI data center. SiPearl exemplifies this strategy, focusing on performance per watt, security from hidden vulnerabilities (emphasizing data and hardware sovereignty), and interoperability with third-party accelerators. This approach has positioned its first-generation product, Rhea1, for deployment in Europe’s first exascale supercomputer, JUPITER.

To drive growth through augmentation of NVIDIA deployments, ABI Research recommends the following:

- Ecosystem & Development: Early co-development with NVIDIA, OEMs, and key hardware partners, leveraging open standards for interoperability and faster adoption.

- Messaging: Promote sovereign AI and hardware, emphasizing supply chain independence from U.S. dependencies.

- Workload Optimization: Focus on inference and Agentic AI, ensuring low-latency, scalable, and energy-efficient performance.

- Enterprise Market: Target high-growth enterprise segments with tailored solutions, reference architectures, and partner programs.

Related Service

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions