Lenovo’s ODM+ in the Context of Increasing EU Supply Chain Sovereignty

By Paul Schell |

04 Nov 2025 |

IN-7972

By Paul Schell |

04 Nov 2025 |

IN-7972

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

By Paul Schell |

04 Nov 2025 |

IN-7972

By Paul Schell |

04 Nov 2025 |

IN-7972

NEWSA European Manufacturing Base for the Next Phase of Sovereignty Regulations |

Sovereignty no longer solely applies to data residency, the control over said data, and the location of compute. Individual European Union (EU) member states (and supranational initiatives) are circling in on several key aspects of the technology supply chain serving next-wave Artificial Intelligence (AI) cloud providers, or neoclouds, in Europe. This is providing more clarity on the loosely defined concept of sovereignty from a hardware perspective, in particular the supply chain for the servers that will power AI clouds. National-level initiatives include the “souveräne Cloud” in Germany and France’s “Cloud de Confiance,” and software stack mandates include Gaia-X and Sovereign Cloud Stack (SCS). Building on such initiatives, in October 2025, the European Commission (EC) released a Cloud Sovereignty Framework with a heavy emphasis on the hardware supply chain, as well as sustainability and openness.

Several key AI server OEMs have varying degrees of European manufacturing or assembly capacity. This includes HPE in partnership with Foxconn in Czechia, Supermicro in the Netherlands, Dell in Poland, and Lenovo in Hungary. The location of these facilities on European soil will impact the competitiveness of individual suppliers in the tender process for next-generation AI infrastructure to be deployed in Europe—in particular any projects relying on part funding from initiatives such as EuroHPC and the supply framework set out in the Clean Industrial Deal.

IMPACTSupply Chain Flexibility and Location Matter |

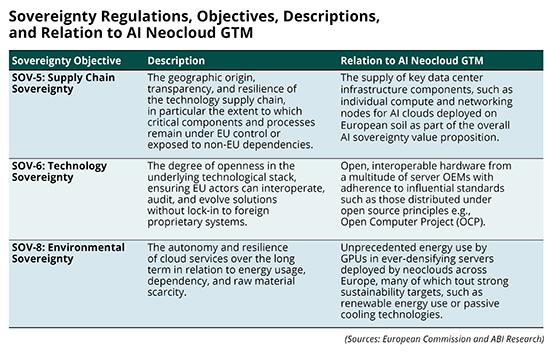

AI server OEMs seeking to capitalize on the European sovereign AI demand fulfilled by emerging neoclouds on the continent should be aware of the following relevant sovereignty objectives outlined by the EC. EU-based assembly and provenance, as well as demonstrable openness and sustainability, are essential for tomorrow’s procurement wins in the region. Relevant pillars are described in the table below.

However, European neoclouds seek further capabilities, in particular around the flexibility, customizability, and openness of server designs to fit into heterogenous environments. Lenovo’s ODM+ model goes beyond simple assembly and testing by providing an end-to-end, in-house solution that encompasses collaborative design and manufacturing, allowing neoclouds to deploy highly customized, performance-optimized hardware tailored to their power, cooling, and networking topologies in diverse data center environments.

RECOMMENDATIONSLenovo's ODM+ as a Launchpad for Next-Wave AI Clouds in Europe—but with the Right Messaging |

European neoclouds are a distinct customer segment that becomes evident when considering the sovereignty tilt essential to their value propositions. To improve the applicability to their specific needs and leverage the existing value of the ODM+ model, ABI Research recommends that Lenovo consider the following enhancements to its Go-to-Market (GTM) strategy and messaging within Europe for a sovereign, customizable solution with agile lead times and enhanced financing flexibility:

- “European” SKUs: Offer explicitly “EU-Assembled/EU Provenance” Stock Keeping Units (SKUs) with local spare pools and supply chain audit-ready documentation to adhere to strengthening hardware sovereignty regulations. This will provide clarity beyond the existing mechanisms available via Country of Origin documentation.

- Turnkey Rack-Scale AI Offerings with Commercial Flexibility: Large-scale systems with a variety of cooling technologies, including hybrid air/liquid setups to insert into diverse (primarily co-location) data center environments from a range of data center operators.

- Fine-Tune Downstream Channels: Create local and regional channel and integrator programs focused on European neoclouds’ requirements with the appropriate messaging focusing on neocloud Key Performance Indicators (KPIs): openness and interoperability, customizability, and financing flexibility.

- Partnerships and Collaborations over One-Time Vendor: The rapid scaling of some individual neoclouds and the heterogeneity of existing AI server procurement leave room for long-term relationship building that can address future expansion needs. Building deep technical sales partnerships with smaller “long-tail” neoclouds can pay dividends in the longer term as national (including U.K.) and EU-wide projects—as well as purely private sector initiatives—inject cash into regional players able to service ambitious AI data center projects.

- Flexible Financing for Smaller Customers: Expand the current reseller financing arrangements for smaller customers, or consider the expansion of Lenovo TruScale, to meet the needs of neocloud entrants that are capital-constrained and require repayment flexibility linked to utilization rates.

- Expand Co-Location Partnerships: Encompass more of the diverse co-location market in Europe to consider players beyond Digital Realty and offer turnkey solutions appropriate for each data center environment to meet neocloud KPIs such as rapid Time to Market (TTM) and numerous cooling technologies (via the Neptune portfolio). Other important data center builders include Equinix, as well as smaller regional players like Ark Data Centers, Iron Mountain, and Colt.

By adopting a more focused and strategic approach, Lenovo can augment its relationship with European neoclouds, transitioning from a hardware supplier to an indispensable partner in their expansion plans.

Written by Paul Schell

Related Service

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions