Apple 17 Smartphone Device Launch Sparks Fear for Future Viability of the rSIM Market, but What Are the Realistic Market Takes, Risks, and Impacts?

By Phil Sealy |

01 Oct 2025 |

IN-7953

By Phil Sealy |

01 Oct 2025 |

IN-7953

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

By Phil Sealy |

01 Oct 2025 |

IN-7953

By Phil Sealy |

01 Oct 2025 |

IN-7953

Apple eSIM-Only Smartphone Expansion Sparks rSIM Market Fears |

NEWS |

Over the past 5 years, there has been a lot to unpack in terms of Subscriber Identity Module (SIM) market challenges. On top of this is the impending embedded SIM (eSIM) impact. Despite beginning with a market impact in 2022, aligned with Apple’s launch of eSIM-only smartphone devices in the United States, the eSIM hasn’t really had the massive impact on a global scale that would spark the end of the removable SIM (rSIM) card.

Fast forward to 2025 and Apple announced its 17 range of smartphone devices, consisting of a global eSIM-only device, in its Air variant, alongside an extension of eSIM-only smartphones across its entire 17 device portfolio to eight additional countries. This sparked some doom and gloom analysis related to the rSIM market and its impending demise.

This ABI Insight provides some realistic analysis, outlining how quickly the rSIM market will likely decline and pinpointing how ecosystem players should be looking at the market.

Looking at the rSIM Market in a Silo |

IMPACT |

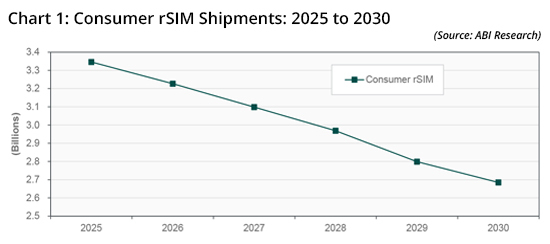

When looking at the market trajectory from an rSIM market alone, the outlook is extremely bleak, with Consumer Electronic (CE) device rSIM card shipments forecast to decrease from 3.35 billion in 2025 to 2.68 billion by 2030, marking an overall reduction of -661 million units or -20%.

However, it is important to note that prior to the eSIM impact, the market for removable CE device SIM cards was already in decline, driven by the macroeconomic climates, increasing cost of living, inflation, and subsequent impact on smartphone shipments.

Despite the fact that eSIM integration into smartphones and other CE devices has been happening for years, the eSIM impact only really began in 2022, when Apple launched its eSIM-only range of smartphone devices into the United States.

Although the impact was immediate and clear, the large reduction in rSIM shipments has largely been limited to the United States alone. Within North America, the impact in the first 3 months of launch was a reduction of rSIM card shipments of –43 million, and in 2023, the first full year of Apple eSIM-only shipments, recording an increased reduction of -102 million.

Now a similar impact is expected across Canada, Japan, Mexico, Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates (UAE), and Guam, thanks to Apple extending its eSIM-only smartphone range to those countries. This will begin to have a market impact in 4Q 2025, with a greater impact expected in 2026, aligned with its first full year of extended eSIM-only device shipments.

This Is How Ecosystem Players Should Be Looking at the Market |

RECOMMENDATIONS |

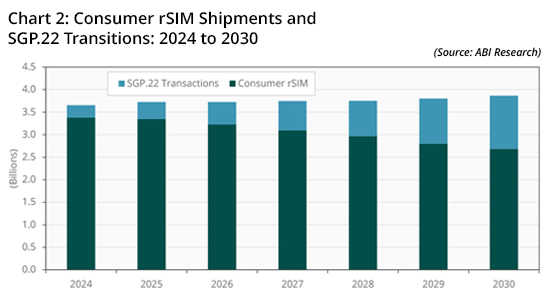

Of course, when looking at the rSIM market, it must form an integral part of any mid- to longer-term strategic planning, but the market is broader than rSIM alone, with eSIM and the Remote SIM Provisioning (RSP) component often looked at individually, rather than as a collective. If looking at the consumer rSIM market in a silo, the trajectory looks bleak; a market of extreme decline that many ecosystem players will be carefully monitoring, considering the mid- to longer-term market viability. However, when combining rSIM shipments with SGP.22 transitions, a new market perspective can be drawn, one that demonstrates overall market growth where the digital side of the business and new use cases are growing quicker than the decline in rSIM shipments.

This is the clearest indication that the business transition from physical to digital SGP.22 profile downloads is in full swing and the push toward digital could help bring the consumer market back to growth.

The reason for the expected growth is the fact that 1 single SGP.22 transaction does not equate to 1 rSIM. The ratio per device was in the 1:0.68 range for 2024, meaning that every eSIM-enabled smartphone averaged 0.68 SGP.22 transactions, an impressive rate given the fact that not all smartphone eSIMs are currently in use today. This ratio is forecast to increase to 1:1.4 by 2030, driven by increased use of eSIM over rSIM, higher levels of convenience for profile switching, higher likelihood of secondary profile download and continued expansion of eSIM-only devices.

The market for RSP downloads is not just supported by domestic connections, but additionally by eSIM travel applications, bringing a new source of downloads and, thus, opportunity. Already the eSIM travel market is experiencing exponential growth, particularly within the last 18 months, with 66 million travel-related RSP transactions taking place, representing just over 24% of all SGP.22 transactions. Repeat usage and an increase in eSIM-only devices over the forecast period will translate into a growing market and one that will outpace any rSIM decline.

Although rSIM is in decline, it will remain a significant market pillar within the SIM cards market, at least in the short to mid-term. Adoption and support of eSIM remains fragmented and it will take time for operators to fully switch away from rSIM to eSIM. In addition, and as this is a clear business transition from the physical to the digital, SIM card suppliers must remain active on the rSIM market, not only to supply short to mid-term opportunity, but more importantly to ensure they remain part of the discussion and when addressing the customer shift toward eSIM.

Written by Phil Sealy

Related Service

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions