Rising Stars: How Asia-Pacific Is Shaping the Future of Space Technologies

By Rachel Kong |

23 Sep 2025 |

IN-7939

By Rachel Kong |

23 Sep 2025 |

IN-7939

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

By Rachel Kong |

23 Sep 2025 |

IN-7939

By Rachel Kong |

23 Sep 2025 |

IN-7939

Igniting Asia-Pacific's Space Era: Innovation, Investments, and Ambitions |

NEWS |

In recent years, there has been much progress and innovation in the space sector in the Asia-Pacific region. This includes increased private sector investments, growth of new space startups in adjacent technologies, and the launching of national satellite constellations for Satellite Communications (SatCom), Earth Observation (EO), Positioning, Navigation, and Timing (PNT), and others.

Recent developments include:

- Japan: QZSS, the regional Global Navigation Satellite System (GNSS), will develop from a four-satellite constellation to a seven-satellite constellation. This new augmentation service will enable highly precise positioning in the Asia-Pacific region, supporting Multi-GNSS Advanced Orbit and Clock Augmentation—Precise Point Positioning (MADOCA-PPP). Additionally, over the past 2 years, five space startups (Synspective, iQPS, Astroscale, ispace, and Axelspace) have successfully pursued an Initial Public Offering (IPO) on the Tokyo Stock Exchange.

- South Korea: In 2024, South Korea launched the nation’s first domestically developed EO nanosatellite and plans to launch 10 more by 2027.

- Australia: The Australian Department of Defense (DoD) and Optus, the Australian satellite operator, have set up a public, private, and academic partnership to build and launch a sovereign Low-Earth Orbit (LEO) satellite by 2028. This consortium comprises four Australian space sector organizations—the Innovative Launch, Automation, Novel Materials, Communications, and Hypersonic Hub (iLAuNCH) Trailblazer, High Earth Orbit (HEO), Inovor Technologies, and the Defence Science and Technology Group.

- Southeast Asia (SEA): Countries in SEA, such as Singapore, Malaysia, Indonesia, and the Philippines, have been ramping up efforts in their national satellite constellation initiatives, seeking domestic and international public-private partnerships, and investing in their domestic space sector.

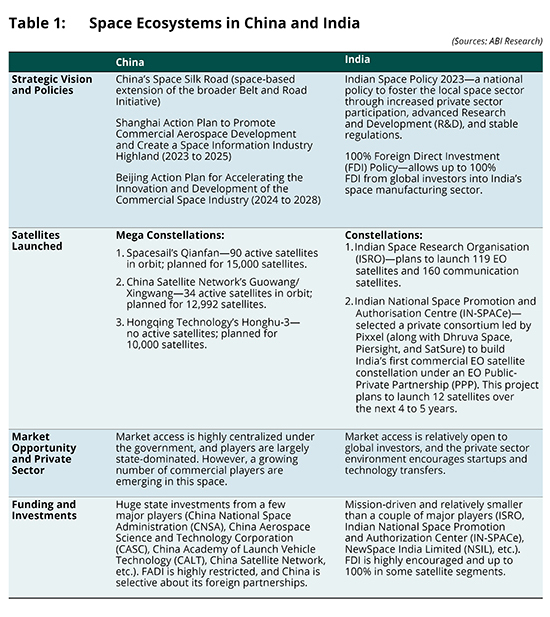

Within this diverse and fast-evolving landscape, China and India show significant potential as spacefaring nations in terms of scale, long-term vision, technological independence, and strategic models.

*Brief overview of space ecosystems in China and India. This list is non-exhaustive.

Beyond Borders: Regional and Global Impact of Asia-Pacific's Space Ecosystem |

IMPACT |

As we witness the developments and changes in the Asian technology ecosystem, with higher government emphasis on investing in the space sector, it is truly becoming a focus for commercial businesses in related markets and industries. The global space ecosystem is growing, shifting toward multipolarity as Asian countries emerge as key players in the global space economy by setting ambitious goals and roadmaps to develop their space industry.

Economic and Market Impact:

There will be increased competition and collaboration in the space sector, which includes commercial launches, manufacturing options, increased value-added services like Satellite-as-a-Service (SataaS) (allow customers to access satellite capabilities such as SatCom, data relay, or end-to-end satellite mission support without owning or operating the satellite infrastructure), Satellite Data-as-a-Service (DaaS) (allow customers to access satellite-generated data, such as EO imagery, weather, tracking on demand via cloud platforms), and more. Space technology is becoming integral to day-to-day businesses to support operational efficiencies and workflows across different industries.

- Private Investments Surge: In the last 5 years, Asia-Pacific has seen a surge in space-tech startups and venture capital activity. Money and funding are moving into the region, transforming it into a hub for commercial space innovation. For example, Singapore-based rocket propulsion and launcher company, Equatorial Space, raised US$1.5 million in funding in 2024. GalaxEye, a space technology startup from India, has secured US$10 million in funding to enhance its satellite-based EO technology.

- New Revenue Models: Traditionally, the space business was dominated by large companies with massive capital and highly specialized expertise focused on building satellites and constellations. Today, this industry has become much more accessible with lower barriers to entry in adjacent technologies such as SataaS, on-orbiting servicing, space debris removal, Artificial Intelligence (AI) application models, and more. They demand less upfront investment and do not require deep, niche knowledge, and are areas in which related technologies can complement and work adjacent to create opportunities for a wider range of sectors to get involved.

- Spillover to Technology Market: The advancements and investment flowing into the space industry have a spillover effect on the broader technology market, such as the device and electronics sector, manufacturing and robotics sector, cloud and AI sector, and others. For example, the sudden demand for space-based data for EO and satellite Internet of Things (IoT) has created new use cases for cloud infrastructure, edge computing, and AI technologies to process, analyze, and derive insights in real-time.

- Diversity of Vendors and Options: With today’s growing and increasing commercial space ecosystem, new space players are not limited to just working with vendors from their own countries. They can source pieces of their needs and operations—from satellites to launch services and software—from a mix of providers globally. While this flexibility lowers the barriers to entry, it also adds complexity as it will require organizations that want to build their own space stack to stitch together complex contracts from chosen vendors, keeping in mind that nationalism and geopolitics will likely influence stack selection.

Charting a Collaborative Future in Asian Space |

RECOMMENDATIONS |

With many emerging space powers across the region, we are witnessing a growing multipolarity in Asia-Pacific’s space landscape. How can Asia-Pacific collaborate on different fronts—policy, commercial, academic, or technical—to ensure that space remains a growth driver with continued technological advancements?

- Asia-Pacific Space Cooperation Model: The Asia-Pacific countries can work together to move from fragmented national programs to cooperative regional frameworks. Currently, there are a few organizations with different scopes and leadership models. For example, China plays the leading role in the Asia-Pacific Space Cooperation Organization (APSCO) with eight countries as full members, India leads the SAARC Satellite Initiative, and Japan leads the Asia-Pacific Regional Space Agency Forum (APRSAF). These initiatives and organizations can be extended to more countries, leading to a higher pool of shared resources, knowledge exchange, and talent pool to drive innovation. In addition, it can promote interoperability and data standardization to accelerate downstream innovation in various sectors, too.

- Shared Infrastructure and Constellations: This point extends from my previous topic on joint investment in shared constellations or ground station networks, which can be implemented from different technology angles—EO and Satcom, climate monitoring. For example, in September 2025, Blacksky, ICEYE, Aechelon Technology, and Niantic Spatial formed a partnership to create a digital twin of Earth. Blacksky high-resolution visual imagery and ICEYE Synthetic Aperture Radar (SAR) will feed into Aechelon’s 3D global database, Skybeam. Similar types of partnerships can be extended into the Asia-Pacific region.

- Encouraging Public-Private Partnerships (PPP) Across Regions: By expanding PPPs beyond national borders to include other countries and regions, this broader engagement creates more touchpoints across industries and technologies, helping to foster innovation and market opportunities in the wider ecosystem. For example, the Eagle-1 Quantum Key Distribution (QKD) mission consists of a consortium of 20 European partners led by SES. It is co-funded by the European Space Agency (ESA), the European Union (EU), the space agencies of Germany, Luxembourg, Austria, Italy, the Netherlands, Switzerland, Belgium, and the Czech Republic, as well as the industry. Similar partnership models can be applied to the Asia-Pacific region.

- Talent Exchange & Joint Research: More joint academic programs, internship exchanges, and regional research fellowships can be established in the space technology sector. These initiatives help build long-term trust and capability across emerging and mature markets, helping to bridge critical capability gaps across the region. For example, Smart Small Satellite Systems (S4TIN) is a joint venture between Nanyang Technological University (NTU) Singapore, Thales in Singapore, and Thales Alenia Space. NTU also leads a consortium project with Aliena, LightHaus Photonics, ST Engineering, and NUS Temasek Laboratories to tackle new frontiers in space.

Written by Rachel Kong

Related Service

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions