Supply Chain Planning Takes Center Stage—Vendors Must Combine Technical Prowess with Practicality

By Adhish Luitel |

04 Sep 2025 |

IN-7931

By Adhish Luitel |

04 Sep 2025 |

IN-7931

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

By Adhish Luitel |

04 Sep 2025 |

IN-7931

By Adhish Luitel |

04 Sep 2025 |

IN-7931

Myriad Supply Chain Volatilities in First Half of 2025 |

NEWS |

In July 2025, global cocoa prices spiked to multi-decade highs as El Niño-driven drought and crop disease affected West Africa, which produces nearly 70% of the world’s cocoa. This volatility caught many producers unprepared, resulting in significantly higher prices for chocolate manufacturers. Essentially, this exposed how fragile raw material planning can be when extreme weather disrupts supply.

Around the same time, North American port operations on the U.S. East and Gulf coasts faced labor unrest. A major dockworker strike representing 45,000 staff was narrowly averted in early 2025. Despite this, the threat of week-long port shutdowns highlighted dangerous choke points in supply networks. In addition to the uncertainties created by tariffs, these events revealed that many firms lack robust contingency plans for sudden bottlenecks, highlighting vulnerabilities in current supply chain planning practices.

Growing Relevance of Supply Chain Planning Solutions |

IMPACT |

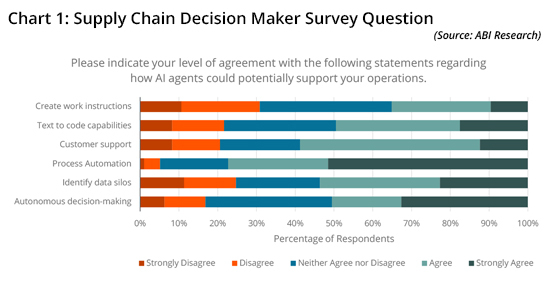

Supply chain planning is evolving into a mission-critical function for business resilience amid such disruptions. Recognizing that better foresight and agility directly mitigate operational risk to supply chains, enterprises are now elevating the planning function from a back-office process to a board-level priority. Modern planning teams must anticipate demand swings, sense external signals, and dynamically rebalance supply. This will help shrink reaction time when crises hit. Tools for demand sensing, what-if scenario modeling, and exception-based are now standard requirements. Theoretically, this means Agentic Artificial Intelligence (AI) systems that monitor live data and suggest or autonomously execute adjustments should be on the horizon. Planners are increasingly showing interest in leaning on AI assistants to coordinate decisions across silos in real-time. The proof is in the numbers, too. This year, ABI Research surveyed 490 supply chain decision makers (including C-level executives, digital transformation leads, etc.) regarding their challenges, their prompts to choose solution providers, and their appetite for different technologies. When asked a question regarding interest in AI agents in supporting operations, supply chain planning leaders responded as depicted in the chart below.

There seems to be a lot of interest in leveraging AI agents for process automation (with over 75% agreeing or strongly agreeing) and identification of data silos (over 53% agreeing or strongly agreeing). Although AI agents are a relatively new concept in the market, strong interest in these use cases and customer support as a low-hanging fruit shows promise among supply chain planners, and vendors are taking notice.

The "So What" for Vendors |

RECOMMENDATIONS |

As supply chain planning takes center stage, vendors will be judged on how well they balance AI-driven precision with industry-focused practicality. It is no longer enough to optimize plans in isolation. These plans need to be executed seamlessly and deliver tangible results. Vendors should consider fostering tighter integration across planning, execution, and finance systems so that a change in plan immediately translates into action and profit-and-loss impact tracking.

From a competitive standpoint, several market leaders each face specific areas for improvement. Netstock must confront the limits of its “one-size-fits-all” approach as it aspires to move upmarket. While it excels at framing supply chain planning in financial terms, its platform offers relatively shallow industry-specific modules. To win larger enterprises, there is a need to develop deeper integration of modules, rather than relying on generic inventory optimization algorithms. Without richer domain capabilities, Netstock risks being pigeonholed as a Small and Medium Business (SMB)-focused solution.

Blue Yonder, on the other hand, needs to reassure the market on two fronts: security and synchronization. Ignoring the ransomware attack last year that disrupted its major retail and manufacturing customers, its “tariff agent” stunt (discussed in ABI Insight, “Agentic AI Heats up the Supply Chain Software Space—Concise Market Messaging Is Imperative to Gain Momentum”) resulted in confusion in the market. Blue Yonder has boldly claimed its tariff agent “autonomously ingests policy and supply chain data and translates them into actionable sourcing and fulfillment strategies.” On the surface, it sounds similar to Resilinc’s Tariffs & Compliance Agents. Information on how exactly it classifies qualitative policy data quantitatively and how this links to execution in a seamless and resilient manner seems to be missing. Despite already offering an end-to-end supply chain software suite, it hasn’t showcased use cases where a forecast change immediately updates distribution plans or where production scheduling AI directly feeds into warehouse tasking. There is a need to showcase a much tighter plan-to-execution integration.

Meanwhile, SAP has introduced Joule, a Generative Artificial Intelligence (Gen AI) “copilot” designed to bring advanced assistance to Integrated Business Planning (IBP), among other applications. Although early results show promise, SAP’s challenge lies in agility and specificity. In today’s volatile market, planners must reforecast and re-optimize plans quickly. While SAP’s IBP is powerful, SAP’s cross-industry approach has led to generic workflow creation that may not account for the nuances of the electronics, apparel, or food & beverage supply chains. SAP should strive to make IBP more adaptive, enabling lighter-weight scenario simulation to run on the fly and a more modular vertical that can help cater to a planner’s custom needs.

Despite different strengths and weaknesses, there is a major takeaway for vendors—modern-day planners will favor vendors that can demonstrate tangible resilience and Return on Investment (ROI), not just algorithmic sophistication. The next phase of evolution will be defined by credibility in value creation. Vendors that can quantifiably prove that their AI-infused, industry-focused planning solutions can make an immediate impact will take a larger piece of the cake.

Written by Adhish Luitel

Related Service

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions