Scaleway Continues to Develop Its Software Ecosystem with the Acquisition of Saagie; How Will Other Neoclouds React?

By Reece Hayden |

23 Jul 2025 |

IN-7890

By Reece Hayden |

23 Jul 2025 |

IN-7890

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

By Reece Hayden |

23 Jul 2025 |

IN-7890

By Reece Hayden |

23 Jul 2025 |

IN-7890

Saagie Acquisition Is Another Step Toward 200 Managed Services, While Aligning with Sovereign Value Proposition |

NEWS |

Scaleway, a neocloud spun out of the Iliad group (a telco operator), has built a considerable position within the European ecosystem. Unlike pure Graphics Processing Unit (GPU) infrastructure competitors, Scaleway is pursuing a strategy that means it will end up sitting in between neoclouds and hyperscalers. Scaleway is pursuing an ambitious strategy to develop its managed service portfolio by adding a range of solutions from networking, storage, and database services through security, automation, and development to Artificial Intelligence (AI)/Machine Learning (ML) services, big data, and enterprise applications. Scaleway’s managed service development strategy blends open-source investment, integration, in-house proprietary development, and capital investment through Mergers and Acquisitions (M&A). This sensible strategy not only optimizes time-to-value and total expenditure, but aligns closely with market demand. Customers want effectively deployed, integrated, and managed services based on open-source tooling—this allows them to easily integrate into existing workflows with familiarity over the tooling. When it comes to AI hardware/software stacks, commitment to open source is one of the critical drivers of decision-making.

Scaleway’s most recent acquisition is European DataOps vendor Saagie. Saagie is a DataOps platform that supports the integration of various open-source tools to enable enterprise customers to effectively accelerate data pipelines. For enterprises, investment in the data layer is critical, given that the majority of enterprises have poor data governance, orchestration, and internal controls. Saagie’s open-source integration will provide Scaleway’s customers with a robust orchestration layer that connects key components across the data lifecycle, including data ingestion, storage, processing, ML, vector Database (DB), and visualization.

Beyond technology, Saagie further aligns with Scaleway’s core sovereignty principles, which have guided their build-out and is viewed as a Unique Selling Proposition (USP). Finding companies and building an ecosystem of European solutions is not simple—and Scaleway’s strategy will certainly resonate and deepen its relationship with European customers in regulated, critical segments, e.g., public, financial services, and industrial healthcare.

Neocloud Market Divides with Some Focusing on Infrastructure, While Others Climb the AI Software Stack |

IMPACT |

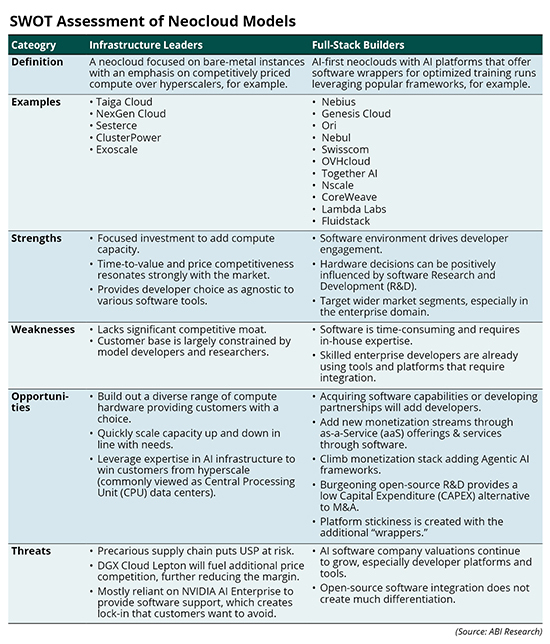

Scaleway’s acquisition of Saagie is not unique; however, not all neoclouds are actively investing across the entire AI stack. In fact, there are plenty of neoclouds pursuing “infrastructure first” strategies aiming to differentiate through price, infrastructure time-to-value, and scale. Both strategies are valid and highlight a clear divide in the neocloud market. Below, ABI Research provides analysis of these different strategies:

Software Investment Will Increasingly Be Necessary, with Most Opting for Partnerships, Rather than M&A |

RECOMMENDATIONS |

“Infrastructure leaders” have led the market globally, to date, offering a strong AI-first, fairly priced alternative to previously dominant hyperscalers. However, competitive pressures (especially price pressure) and the likely threat of neocloud consolidation (as power and capacity face ongoing constraints) will eventually force most vendors to move up the value chain aiming to build differentiation. This has already started with former infrastructure leaders like Nscale and Fluid Stack partnering with Lightning AI and Mistral/DDN, respectively, as they aim to build enterprise AI platforms. As vendors add software capabilities, they will need to make decisions around their expansion strategy—to buy, to partner, or to develop:

- M&A: Opportunity to build a tightly integrated and heavily differentiated software platform. Critical to competing with other full-stack vendors. Mostly going to be dominated by spin-out neoclouds, rather than startups, given the high AI software value multiples.

- Partnership: Mostly will be used as a first step to expand beyond hardware; however, without deep co-development and co-marketing initiatives, surface-level partnerships are unlikely to have a significant impact on neoclouds’ competitive positions in the market.

- In-House R&D: Depending on company structure (number of employees, software expertise), this could be the most cost-effective strategy to build effective differentiation within the market. Expect that neoclouds will leverage and adapt open-source tools to embed within platforms. Open-source-based developer platforms will resonate strongly with customer demands.

Given the inflated valuation multiples for leading AI software solutions, coupled with the enormous CAPEX involved in scaling AI compute infrastructure, M&A will be challenging for most players in the market. The bulk of the market is made up of startups, which, depending on maturity and internal expertise, should either look to build deep co-development partnerships or work to integrate open-source tools into their software solution. To date, Scaleway has pursued a sensible mixture of in-house R&D, co-development partnerships, and well-timed M&A.

Written by Reece Hayden

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions