Oracle’s US$30 Billion OpenAI Contract Set to Test Its AI Infrastructure Build-Out Execution

By Larbi Belkhit |

23 Jul 2025 |

IN-7886

By Larbi Belkhit |

23 Jul 2025 |

IN-7886

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

By Larbi Belkhit |

23 Jul 2025 |

IN-7886

By Larbi Belkhit |

23 Jul 2025 |

IN-7886

Oracle Captures Largest Single Cloud Contract on Record |

NEWS |

At the start of July 2025, regulatory filings disclosed that Oracle secured a cloud customer projected to spend over US$30 billion annually starting in fiscal year 2028, potentially making it the largest single cloud contract on record. A few days later, the initial news broke that OpenAI was confirmed to be the customer, a deal that is part of its Stargate initiative—a US$500 billion Artificial Intelligence (AI) infrastructure venture backed by OpenAI, SoftBank, Oracle, and others.

To meet the additional demand from OpenAI, Oracle will develop multiple data center sites across the United States with partners, with states including Texas, Michigan, Wisconsin, and Wyoming under consideration. Simultaneously, the Abilene, Texas site is set to expand from a power capacity of 1.2 Gigawatts (GW) to around 2 GW. In total, the deal includes a lease of 4.5 GW of capacity.

From Latecomer to Serious AI Infrastructure Contender |

IMPACT |

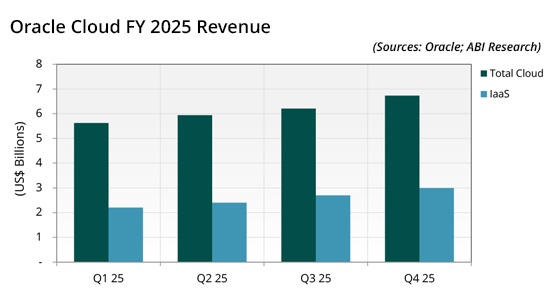

This deal with OpenAI is a landmark moment for Oracle Cloud Infrastructure (OCI), as the deal is roughly 3X the size of Oracle Cloud’s entire Infrastructure-as-a-Service (IaaS) revenue for Fiscal Year (FY) 2025, which was roughly US$10.3 billion. This positions Oracle to be a much larger threat to Tier One hyperscalers such as Microsoft, Google, and AWS in this AI era once the OpenAI revenue is realized in roughly 2 years’ time. The aforementioned hyperscalers have recently changed their infrastructure build-out strategies, cancelling or delaying their plans for infrastructure build-out due to various factors, including regional capacity oversupply and lower than anticipated compute demand growth.

Thus far, Oracle has been a serious player in the sovereign cloud market, particularly in Europe, where Oracle has made targeted investments in the United Kingdom, the Netherlands, and Germany recently. The OpenAI deal is not only positioned for Oracle as a substantial revenue generator, but as a strategic pivot to escape the “niche” of sovereign cloud and to become synonymous with AI. Furthermore, this deal is the latest in a series of recent cloud contract wins for Oracle, including deals with Chinese e-commerce company Temu and a hybrid-cloud deal with IBM. These announcements reinforce Oracle’s growing strength in this market beyond the Stargate project, and that the OpenAI announcement is not only an extension of that project, but earned on merit as its capabilities continue to be selected by various customers.

Oracle’s stock price has surged since May 2025, and the latest deal has driven the stock to an all-time high. This deal would increase the total cloud annual revenue from roughly US$10 billion to around US$40 billion a year.

To meet this AI infrastructure demand, Oracle announced in May 2025 that it will spend around US$40 billion on NVIDIA GB200 chips, potentially equating to over 400,000 chips. This may not include any orders from the Stargate project in the United Arab Emirates (UAE), which is expected to come online in 2026 and includes around 100,000 NVIDIA chips within a 5-GW facility.

From a broader perspective, this deal reflects OpenAI’s pivot to a more multi-cloud deployment, likely to strengthen its resilience and current overreliance on Microsoft, especially given the reported “tension” between the two companies. Its competition, such as Anthropic and Google, however, is unlikely to follow this strategy in the short term. Still, as more and more users begin using those platforms, it is inevitable that cloud provider diversification and/or balancing will occur. Later in July, OpenAI announced that it is also adding Google Cloud to its portfolio.

Execution Will Define Oracle's Cloud Future |

RECOMMENDATIONS |

While Oracle is clearly benefitting from its participation in the Stargate project, especially in the United States, it is still not as strong a threat to Microsoft, AWS, and Google, as it would like to be on a global scale. Furthermore, overwhelming reliance on a single customer is not a sustainable business model for its cloud business. Winning such a large contract that it cannot immediately fulfill, and must race to create capacity in time, forces Oracle to increase its spending pace, something that is reportedly putting great strain on its cash flow. Furthermore, it is unclear how much of the new capacity is being built to serve only OpenAI workloads. If the vast majority will be dedicated to OpenAI, Oracle will have to continue investing a significant amount of capital into more infrastructure in the hopes of attracting more customers in the future.

Overall, the next 24 to 36 months will be all about execution from Oracle’s perspective. With Chief Executive Officer (CEO) Safra Catz reportedly confident that Oracle’s cloud revenue will grow 70% in the coming year, and the OpenAI money not coming in for around 2 years, just how Oracle is able to scale up its capacity and serve its customers is absolutely crucial to becoming a serious and viable long-term competitor to the other Tier One hyperscalers.

The revenue growth for Oracle in the coming years will not just come from competing against hyperscalers, but more likely by competing directly with neoclouds such as Vultr and CoreWeave. Delays and other related issues could cause significant damage to Oracle’s perception in the AI infrastructure market, which is why the partnership announced with Digital Reality is a solid step to easing market concerns in this regard.

In response to Oracle’s expected growing market share in the AI cloud market, hyperscalers can:

- Develop Vertical-Specific AI Cloud Offerings: While presenting traditional generic offerings to customers has served hyperscalers well, the increasingly more competitive AI cloud market requires more vertical-specific packages to differentiate offerings, ergo better serving enterprise needs.

- Understand the Neocloud Market and Develop Strategy: The growing presence of these new Graphics Processing Unit (GPU) compute providers is a growing threat to hyperscalers, especially around enterprise AI inferencing demand. Having a clear understanding around the competitive landscape and Go-to-Market (GTM) strategies of various neocloud players can help inform hyperscalers how best to compete with them for enterprise clientele.

Written by Larbi Belkhit

Related Service

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions