M&A and Spectrum Deals in the United Kingdom as Operators Look to Strengthen Offerings

By Larbi Belkhit |

08 Jul 2025 |

IN-7872

By Larbi Belkhit |

08 Jul 2025 |

IN-7872

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

By Larbi Belkhit |

08 Jul 2025 |

IN-7872

By Larbi Belkhit |

08 Jul 2025 |

IN-7872

Mergers and Spectrum Deals |

NEWS |

At the start of June, Vodafone and CK Hutchinson announced that they had officially completed the merger of Vodafone UK and Three UK, forming a new operator named VodafoneThree. The new company is 51% owned by Vodafone, which will fully consolidate the business in its financial results.

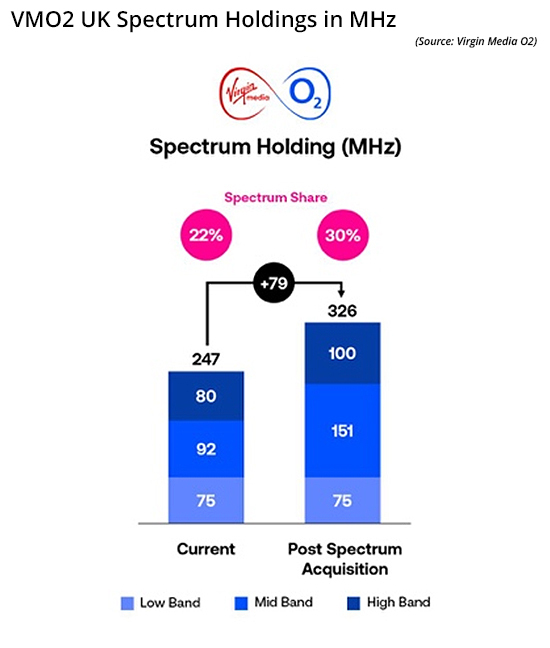

On the last day of June, Virgin Media O2 (VMO2) announced that, in exchange for £343 million (roughly US$469 million), it will receive 78.8 Megahertz (MHz) of spectrum in the following bands from Vodafone UK:

- 20 MHz of 1400 MHz Supplemental Downlink (SDL)

- 18.8 MHz of 2100 MHz Frequency Division Duplex (FDD)

- 20 MHz of 2600 MHz Time Division Duplex (TDD)

- 20 MHz of 3400 MHz TDD

This spectrum acquisition will result in VMO2 holding roughly 30% of total mobile spectrum holdings in the United Kingdom. The spectrum will be deployed gradually from this year and will be partially funded through the minority stake in Cornerstone, VMO2’s mobile infrastructure Joint Venture (JV).

A Major Signal of Further Infrastructure Investment |

IMPACT |

The merger of two of the (previously) four big operators in the United Kingdom, coupled with the spectrum portfolio rebalancing, is a major indicator that the U.K. mobile market is entering a new phase of infrastructure investment to improve the performance of cellular networks. In general, the performance of 5G networks in the United Kingdom has fallen behind many of the other European nations, so acquiring more 3.4 Gigahertz (GHz) of spectrum for VMO2 will likely help improve the performance of its 5G network, with the other bands strengthening its 4G network capacity. Furthermore, as part of its approval, VodafoneThree is committed to investing £11 billion in 5G networks over the next 10 years, while protecting customer prices for a 3-year period.

Looking at the impact within and beyond the United Kingdom’s shores, the consolidation of the two operators is a step-change in how the vast majority of the European market operates, typically favoring four major operator setups. This has been designed to help drive innovation and foster innovation. However, the incumbent telcos have been lobbying to be allowed to consolidate operations to at least a three-operator setup. Theoretically, this will allow the operators to gain scale and optimize their Capital Expenditure (CAPEX) investments, increase their Average Revenue per User (ARPU), and, therefore, increase profitability. This is likely why VodafoneThree has had to commit to protecting customers, but the impact on ARPU will not be clear for a while. In its provisional findings, the Competition & Markets Authority (CMA) found that the infrastructure investment and customer protections were necessary to remove competition concerns, especially as it pertains to Mobile Virtual Network Operators (MVNOs), and the aforementioned remedies could foster competition, rather than harm them.

Will This Be a European Case Study? |

RECOMMENDATIONS |

U.K. cellular coverage with 4G is around 96% nationwide, while 5G remains at a much lower 62%, according to Ofcom’s latest Connected Nations update (both statistics refer to coverage by at least one operator; combined, the figures are much lower). If VodafoneThree is able to fulfill its commitments to the regulators and show a positive Return on Investment (ROI) and improve the nation’s coverage, there may be a significant regulatory shift in Europe.

Many incumbent European operators will point to the United Kingdom as a case study for why operator consolidation will benefit end customers, and the European Commission may view this case study as a positive precedent, allowing for an easing of Merger & Acquisition (M&A) restrictions for regional market consolidation. However, the desire for operator consolidation across Europe is not a recent development, and the European Commission may not budge so easily, especially in the short term. Therefore, there will likely be a long-term analysis of the impact of this merger between Vodafone UK and Three UK, with more widespread regulatory shifts only coming about (if the analysis proves substantial benefits) in the next decade.

ABI Research expects that while the VodafoneThree merger may support a gradual softening of restrictions in Europe over the long term, it is unlikely to trigger a major regulatory shift. The European Commission will wait for robust evidence of unaffected/improved competition and consumer benefit before reconsidering its stance. On pricing, it remains too early to draw conclusions whether a three-operator model will lead to higher prices. Meaningful conclusions will likely emerge closer to post-2028, by which time operator focus may be on the upcoming 6G network rollout and standardization, rather than further M&A activity.

Written by Larbi Belkhit

Related Service

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions