NVIDIA GTC at VivaTech Brings Hope to the European AI Ecosystem, but Some Neoclouds May Be Left Wanting

23 Jun 2025 | IN-7863

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

23 Jun 2025 | IN-7863

NVIDIA GTC in Paris Brings a Boost to the Burgeoning European Neocloud Market |

NEWS |

Wherever the NVIDIA roadshow lands, major announcements inevitably follow—and recent stops in the Middle East and Europe have been no exception. Following Chief Executive Officer (CEO) Jensen Huang’s tour through Saudi Arabia, the United Arab Emirates (UAE), and Qatar, each pledged sovereign AI investments leveraging NVIDIA infrastructure. The momentum has continued across the European continent, with a major spotlight on VivaTech in Paris and London Tech Week.

At VivaTech, NVIDIA underscored its commitment to advancing Europe’s Artificial Intelligence (AI) ambitions and boosting its competitiveness on the global stage. The standout partnership was with French AI startup Mistral, which unveiled its first venture into AI cloud infrastructure, powered by NVIDIA. This marks a strategic shift, positioning Mistral not only as a model developer, but also as an infrastructure player. Further reinforcing its European strategy, NVIDIA announced the launch of six AI technology centers across the continent. These centers aim to: advance fundamental and applied research; upskill regional workforces; and drive scientific and industrial innovation.

In parallel, NVIDIA spotlighted “neoclouds”—a new wave of emerging Graphics Processing Unit-as-a-Service (GPUaaS) providers and cloud-native telcos—which are rapidly aligning with NVIDIA’s platform to power sovereign AI capabilities. Key announcements include:

- Deutsche Telekom launched its Industrial AI Cloud initiative in Germany.

- Nscale reaffirmed its deployment of 10,000 NVIDIA Graphics Processing Units (GPUs) in the United Kingdom, backed by government support.

- NVIDIA unveiled infrastructure projects in Italy and Armenia, expanding its regional footprint.

- Orange joined the NVIDIA Cloud Partner Network, building it’s Agentic AI frameworks on top of NVIDIA infrastructure.

- Telefónica began piloting a distributed edge AI fabric across Spain, deploying hundreds of NVIDIA GPUs to deliver low-latency, privacy-preserving AI services.

- Telenor expanded Norway’s first sovereign AI cloud infrastructure, powered by renewable energy, while integrating NVIDIA AI Enterprise into its platforms.

- Swisscom launched its GenAI Studio and AI Work Hub, complementing its GPUaaS offering built on NVIDIA DGX SuperPOD.

These moves highlight a surge of sovereign AI cloud initiatives, largely led by telcos eager to monetize the growing demand for enterprise-grade AI services.

NVIDIA DGX Cloud Lepton Aims to Connect Developers and GPU Resources |

IMPACT |

At VivaTech, alongside a raft of sovereign AI and infrastructure announcements, NVIDIA introduced DGX Lepton—a free, developer-centric platform that could reshape the competitive dynamics of the neocloud market.

What Is DGX Cloud Lepton?

DGX Cloud Lepton is a unified management platform built on top of AI that enables developers and enterprises to deploy and orchestrate AI workloads across multiple clouds. Today, it supports owned or rented infrastructure, offering a single-pane-of-glass interface for managing GPU resources and deploying AI workloads. However, the roadmap indicates an evolution toward on-demand GPU access, effectively creating a multi-vendor, cross-cloud marketplace.

Contributors include European neoclouds (Mistral AI, Nscale, Firebird, Fluidstack, Hydra Host, and Scaleway); U.S. incumbents (CoreWeave, Crusoe, Lambda); and hyperscalers (Amazon Web Services (AWS) and Microsoft). NVIDIA, providing DGX Cloud Lepton provides a channel for regional GPU supply to reach global developers.

NVIDIA’s Strategic Rationale

DGX Cloud Lepton serves multiple strategic goals for NVIDIA:

- Ensures ecosystem stickiness by keeping developers anchored to the NVIDIA hardware and software stack.

- Provides a foundation for an NVIDIA infrastructure marketplace that could expand to Omniverse and build increased market hegemony.

- Drives software monetization through increased usage of revenue-generating tools like NVIDIA AI Enterprise.

- Supports hardware pull-through by stimulating demand for NVIDIA Blackwell and other architectures as more workloads are deployed.

- Enables telcos and neoclouds to participate in the AI infrastructure market, while aligning them with NVIDIA standards.

- Reinforces NVIDIA’s democratization messaging by promoting broad, equitable access to high-performance compute.

Question About Monetization

While DGX Cloud Lepton is launching as a free developer platform, it is clearly a strategic growth engine for NVIDIA. In the short term, it aims to expand the AI developer market by reducing friction in accessing compute resources. Over the medium to long term, it is designed to drive adoption of NVIDIA’s paid software offerings such as AI Enterprise, deepening integration into enterprise AI stacks. Indirectly, it supports hardware sales by increasing demand for NVIDIA GPUs. As the platform scales and becomes a central infrastructure layer, NVIDIA may introduce marketplace fees or premium features, further monetizing its position as the de facto broker of AI computing.

Lepton Announcement Will Change Competitive Dynamics in the Neocloud Market |

RECOMMENDATIONS |

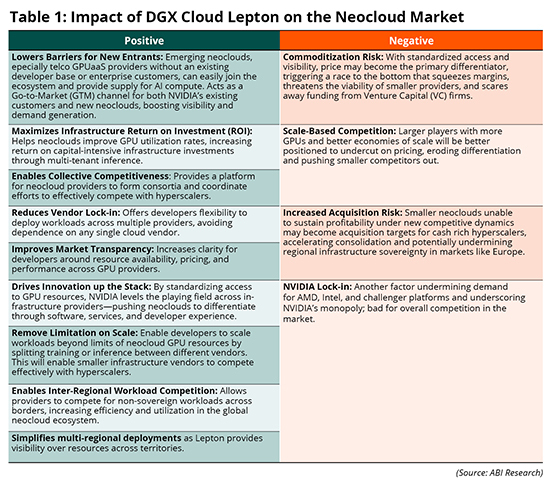

The jury is still out on NVIDIA’s exact motivations for introducing DGX Cloud Lepton, but its potential to reshape the competitive dynamics of the neocloud market is undeniable. To date, customer demand for alternatives beyond NVIDIA remains limited, with few adopting AMD or Intel GPUs, and even fewer embracing emerging players like Cerebras or SambaNova—despite a growing focus on inference workloads due to scaling reasoning models, i.e., test time compute. As a result, NVIDIA continues to hold a de facto monopoly, and support for DGX Cloud Lepton is likely to become a baseline requirement for infrastructure providers. This shift will significantly influence market competition, potentially sparking pricing pressure, commoditization, and consolidation. Table 1 highlights the key ways DGX Cloud Lepton could impact the competitive landscape.

Given the strong demand for GPU resources and the current gap in European AI infrastructure, DGX Cloud Lepton will largely have a positive impact by enabling lesser-known neoclouds and emerging players—like telcos with underutilized resources—to effectively compete for developer workloads. However, as the market matures, perfect competition for NVIDIA GPUaaS may fuel a price war, which already tends to be the primary differentiator, potentially pushing smaller players without sufficient scale out of the market. To avoid this race to the bottom, neoclouds and emerging infrastructure providers should:

- Develop Vertical-Specific Solutions: By tailoring infrastructure and services to targeted industries—similar to Deutsche Telekom’s Industrial AI Cloud—neoclouds can meet specialized Service-Level Agreements (SLA), uptime, and availability needs. This vertical focus creates stronger customer stickiness than generic, price-driven offerings. Building close relationships with governments can also offer long-term stability, given their strong investment appetite.

- Move up the Stack: Two neocloud segments are emerging: 1) pure infrastructure providers competing primarily on cost and availability; and 2) hybrid infrastructure and software players offering AI development tools, either built in-house or through partnerships. As DGX Cloud Lepton standardizes access to infrastructure, software capabilities will increasingly be the key to driving platform stickiness and differentiation.

Related Service

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions