Why 2026-2027 Represents the Critical Inflection Point for Smart Glasses Market Adoption

By Malik Saadi |

09 Jun 2025 |

IN-7858

By Malik Saadi |

09 Jun 2025 |

IN-7858

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

By Malik Saadi |

09 Jun 2025 |

IN-7858

By Malik Saadi |

09 Jun 2025 |

IN-7858

The Platforms That Matter: Android XR, Meta Aria, and Apple Smart Glasses |

NEWS |

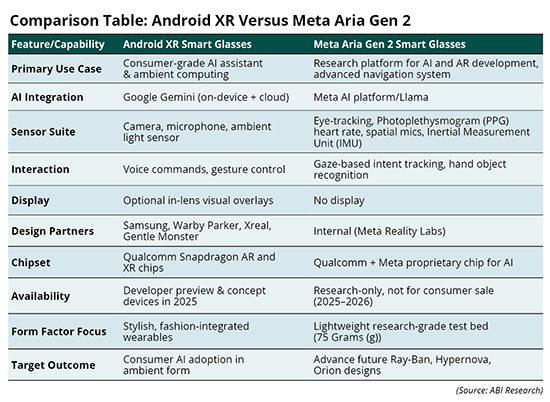

Smart glasses have generated significant momentum over the last 6 months, with multiple major announcements, signaling that the technology is finally ready for mainstream adoption. At Google I/O in May 2025, Google showcased the latest concept designs and developer features for Android XR smart glasses—an extension of the Android XR platform originally announced in December 2024 as part of its collaboration with Samsung and Qualcomm. Just months earlier, in February 2025, Meta introduced Aria Gen 2, a cutting-edge research platform aimed at pushing the boundaries of Augmented Reality (AR) perception and Artificial Intelligence (AI) interaction. Meanwhile, Apple's smart glasses project, now reportedly code-named N401, has ramped up development efforts with a targeted launch in late 2026, according to Bloomberg.

By 2026, smart glasses are gearing up to become the most disruptive wearable technology since the smartwatch. After years of failed attempts like Google Glass and Snapchat Spectacles, smart glasses are finally becoming real consumer products thanks to three key players: Google's Android XR platform, Meta's Aria Gen 2 research, and Apple's upcoming AI-powered smart glasses.

At Google I/O 2025, Google showcased new concept designs and progress updates for Android XR smart glasses, the first immersive Android platform enhanced by Gemini, Google's multimodal AI system. Designed to power both headsets and lightweight smart glasses, Android XR integrates voice, visual recognition, and hands-free interaction into a seamless experience. Through partnerships with Samsung and Xreal, Google is signaling that it wants to lead an open ecosystem that marries AI with everyday fashion. Google is also developing its own in-house smart glasses, as well as collaborating with eyewear brands like Gentle Monster and Warby Parker to create stylish smart glasses with Android XR. The glasses support contextual apps, real-time translation, navigation overlays, precision asset tracking, and ambient messaging—powered by Qualcomm's Snapdragon AR and XR chips designed for lightweight, battery-efficient smart glasses.

Meta, meanwhile, continues to iterate its AR vision through Aria Gen 2. While still research-focused, the device includes bleeding-edge sensors such as per-eye gaze tracking, Three-Dimensional (3D) object recognition, spatial audio, and even heart rate detection through a PPG sensor in the nose pad. Aria Gen 2 isn't a consumer product—yet. But the lessons Meta learns from this platform will directly shape future Ray-Ban Meta glasses and its upcoming “Hypernova” and “Orion” products. Meta's emphasis on AI-enhanced sensing could make its offerings especially valuable for accessibility, robotic control, and real-world scene understanding. Crucially, the platform features advanced memory capabilities that allow the glasses to remember past events, conversations, and user preferences, and then contextualize this information to provide more personalized and helpful assistance.

Apple's approach, by contrast, is quieter, but no less ambitious. Its smart glasses, rumored to be scheduled for release in late 2026, will focus on tightly integrated AI and privacy. The glasses will primarily act as an AI-driven interface with Siri at the center—offering contextual feedback, real-time translation, media control, and calls. While Apple Glasses may not match Meta's sensor depth or Android XR's extensibility, Apple's control over hardware, software, and services will likely result in a polished, privacy-centric user experience targeting the premium market with strong iPhone integration requirements.

2026-2027: The Tipping Point—Market Dynamics and Investment Opportunities |

IMPACT |

The strategic imperative for Original Equipment Manufacturers (OEMs) is unambiguous: establish partnerships with Google and Qualcomm immediately to secure early Android XR developer access, while cultivating distinctive form factors that resonate with specific market segments, thereby differentiating from Samsung's broad consumer approach. Simultaneously, companies should pursue strategic alliances with Meta to gain privileged access to cutting-edge sensor technologies for accessibility applications, positioning themselves within Meta's evolving market strategy.

While leaders like Google, Meta, and Qualcomm are shaping the future of smart glasses with robust ecosystems, AI integration, and custom silicon, several key players are lagging behind. Asian manufacturers, including Huawei, HONOR, vivo, and OPPO, have shown limited urgency in committing to AR, despite strengths in adjacent categories like smartphones and wearables. MediaTek, typically a strong competitor in mobile chipsets, remains absent from the AR and Extended Reality (XR) space, ceding critical ground to Qualcomm. Meanwhile, traditional eyewear brands lacking digital strategies will be increasingly marginalized as tech-savvy partnerships with design houses—such as Warby Parker, Gentle Monster, and Ray-Ban—redefine what consumers expect from next-generation smart eyewear.

According to ABI Research, the total smart glasses market will experience explosive growth from 3.3 million units in 2024 to nearly 13 million units by 2026—a fourfold increase driven by AI-enhanced ambient computing demand across enterprise and consumer sectors. Consumer smart glasses will represent 33% of total shipments in 2026, up from just 25% in 2024, while no-display form factors will dominate with 85% of consumer shipments driven by lightweight designs and AI voice assistant integration.

In terms of revenue, the smart-glasses hardware trajectory projects a compelling US$7.8 billion market opportunity by 2026—with consumer segments contributing 25% of total revenue—representing a remarkable 3.5-fold expansion from the 2024 baseline. The acceleration stems from three converging factors: 1) AI integration turning glasses into visual-aware assistants that extend, rather than replace smartphones; 2) chip maturity enabling local AI inference through Qualcomm's AR and XR processor; and 3) design evolution through collaborations with fashion brands meeting consumer expectations.

China's smart glasses hardware ecosystem faces a dual constraint: trade conflicts with the Chinese consumers prevented from accessing non-domestic cloud AI services (Gemini and Meta AI), while chipset limitations simultaneously restrict domestic cloud service providers' ability to deliver AI-assisted services for smart glasses in the region. These combined factors constrain AI feature adoption to merely 10% to 20% of Chinese smart glasses offerings. Meanwhile, Western markets wrestle with persistent privacy and data protection anxieties, compelling industry leaders Google, Meta, and Apple to pursue deliberate, controlled testing protocols prior to commercial deployment. Geographic strategy should, therefore, prioritize the United States, Japanese, South Korean, and, to a certain extent, the European markets.

Conclusion and Takeaways |

RECOMMENDATIONS |

The competitive landscape is crystallizing around market leaders: Google's expansive ecosystem orchestration, Meta's sophisticated sensor architecture coupled with AI research excellence, Qualcomm's commanding silicon supremacy, and pioneering OEMs, including Xreal and Samsung. Aspiring OEMs seeking first-mover advantages face a critical 18-month window to forge strategic platform alliances, secure essential supply chains, and cultivate developer mindshare before the market inevitably consolidates around three or four dominant ecosystems.

Smart glasses are set to become a transformative force on network infrastructure. As adoption scales, the volume of upstream data—ranging from real-time visual feeds to persistent contextual queries—will surge dramatically. This shift, driven by Agentic AI systems operating across both cloud and edge environments, will place new demands on distributed computing architectures and ultra-low-latency 5G and future 6G networks. Telco operators must prepare for a new class of ambient, always-on devices that rely on constant connectivity—not just to serve user prompts, but to support autonomous AI reasoning and interaction. Meeting this challenge will require rethinking mobile network strategies to accommodate continuous AI-driven traffic patterns. ABI Research is actively analyzing these dynamics and, in the future, will publish dedicated insights on the evolving intersection of ambient computing and network infrastructure.

Regulators face an urgent imperative to establish robust regulatory frameworks mandating camera use notification protocols with compulsory Light-Emitting Diode (LED) indicators, while establishing comprehensive guidelines for passive data acquisition and AI decision-making transparency. Smart glasses manufacturers must satisfy stringent safety certifications for vehicular and occupational environments, concurrent with implementing explicit consent protocols for biometric data collection encompassing heart rate monitoring, eye tracking, and related physiological measurements.

In the next 18 months, smart glasses will define what it means to interact with AI—not through screens, but through the world around us. The race is no longer about who builds glasses, but who builds the ecosystem that lives within them. Companies must act decisively now or risk being permanently locked out of the next computing platform as the window for strategic positioning rapidly closes.

Written by Malik Saadi

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions