20 Oct 2021 | IN-6318

Related Service

Related Insights

COVID-19 Will Upend the Robotics Market, but not Necessarily for the Worse

Insight | 2Q 2020 | IN-5777

IMHX22: Where Logistics and Automation Meet

Insight | 3Q 2022 | IN-6673

Competitive & Market Intelligence

Sharpen positioning, deliver actionable insights, and support key stakeholders.

Executive & C-Suite

Drive organizational success, capture growth, and mitigate risks with rapid access to strategic intelligence.

Marketing

Boost engagement, repurpose compelling content, and generate qualified leads with research-driven thought leadership.

Product Strategy

Accelerate product success, secure executive buy-in, gain third-party endorsement, and strengthen positioning.

Startup Leader & Founder

Validate markets, secure funding, raise awareness, and scale confidently.

Users & Implementers

Maximize ROI, streamline adoption, find the best partners, and optimize outcomes with expert guidance.

Hyperscalers

Adapt quickly, stay competitive, and meet customer demands amid AI disruption and shifting geopolitical challenges.

Industrial & Manufacturing

Accelerate digital transformation, secure operations, and turn competitive advantages into measurable revenue.

Industry & Trade Organizations

Boost membership, unify stakeholders, accelerate standards, and strengthen influence to deliver member value.

Semiconductor

Secure operations, advance digital transformation, and maintain market leadership with confidence and clarity.

Supply Chain

Build resilience, reduce risks, and streamline operations while driving digital transformation success.

Telco & Communications

Monetize 5G, capture enterprise opportunities, and accelerate cloud-native transformation for sustainable growth.

All News & Resources

Log In to unlock this content.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

Recovery of VC Activities in 2021 |

NEWS |

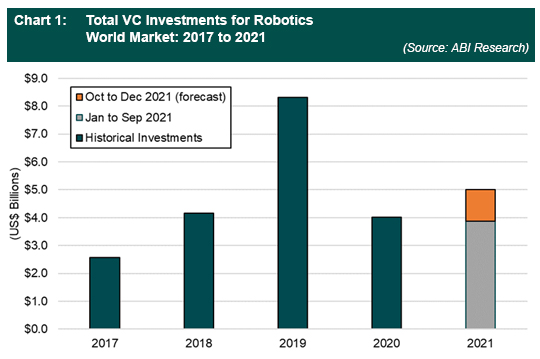

The year 2020 was a confounding year for robotics. On the one hand, the COVID-19 pandemic has dramatically accelerated the deployment of robotics solutions. As a result, Autonomous Mobile Robot (AMR) and Small Unmanned Aerial Vehicle (SUAS) vendors have reported an uptick in sales revenues due to wide-scale adoption and deployment of their products. Such products have been deployed for autonomous material handling, disinfection, crowd management, and last-mile delivery. On the other hand, Venture Capital (VC) funding dropped significantly in 2020. After hitting a historical high in 2019 with US$8.3 billion (total not inclusive of self-driving vehicles and related technologies, such as processor and mapping), total funding suffered a 52% decline, resulting in a total of only US$4 billion in 2020. This figure is even lower than the U$4.2 billion raised in 2018.

Fast forward to September 2021 where the robotics VC market is currently showing a strong sign of recovery. The total investment from January to September has reached US$3.8 billion. In comparison, US$2.7 billion VC funding was raised in the same period in 2020. ABI Research estimates that the total VC investment could reach US$5 billion by the end of 2021—not a historical high, but a clear sign of confidence.

Key Trends and Players |

IMPACT |

The year 2019 is known as the year of surgical robots, Automated Guided Vehicles (AGVs), and AMRs. Cainiao Smart Logistics, Nuro, Ocado, Postmates, and Geek+ all raised more than US$150 million each while Fetch Robotics, Locus Robotics, Gecko Robotics, and Starship Technologies were not too far behind. The market anticipated large-scale adoption of AGVs and AMRs across various sectors, with last-mile delivery being one of AMR’s most anticipated use cases.

In comparison, the VC market of 2020 and 2021 has had a slightly different focus. Surgical robots—in companies such as CMR Surgical, ZAP Surgical Systems, PROCEPT BioRobotics, and Neocis—and AMR technology—in companies such as Nuro, HAI Robotics, Seegrid, and Vecna Robotics—remain as key focus areas. Still, other startups that received VC funding have revealed other intriguing development trends that demonstrate new focal points in the robotics industry as follows:

A Growing Market with a Rich Ecosystem |

RECOMMENDATIONS |

A common trend among developed and emerging markets is to tailor products for the older population. COVID-19 has further accelerated the need for automation. What is even more critical in automation are maturing robotics hardware and software technologies. Many pure-play software startups have, in recent years, developed common platforms for robotics development, programming, fleet control and management, data analytics, deployment, and onboarding. Open Robotics has been actively supporting robotics deployment via Robot Operating System (ROS) 2 and its frequent software updates. In addition, prominent computing processor vendors like Qualcomm and Xilinx have released robotics-specific processors that feature native ROS 2 support. Intel did rock the robotics industry by announcing the retirement of its influential RealSense camera products. Still, the company walked back from the announcement and clarified that it is only retiring a selected number of products.

In addition, consolidation remains a big theme, especially as the industry saw several key acquisitions in 2020 and 2021. Larger robotics companies are eyeing prominent robotics startups to strengthen their internal capabilities. Industrial giant ABB Robotics acquired Codian Robotics and ASTI Mobile Robotics to venture into the logistics and warehousing sector. Ocado, which has developed its own warehousing system, acquired Haddington Dynamics and Kindred Systems, thereby expanding its existing product line. Locus Robotics, a successful RaaS vendor for goods-to-person robots, went in a different direction by acquiring Waypoint Robotics, an AMR vendor focusing on material handling. Not wanting to be left behind, nonrobotics solution providers Zebra Technologies and JASCI Software also acquired AMR vendors Fetch Robotics and NextShift Robotics respectively in 2021, with the aim of diversifying their product offerings further.

As 2021 comes to a close, the robotics investment market has finally become vibrant again. The robotics industry has taken another big step by moving from niche high-end solutions to become more fully integrated with regular tasks and workflows in the workspace.

Insight | 2Q 2020 | IN-5777

Insight | 3Q 2022 | IN-6673