By Phil Sealy | 1Q 2023 | IN-6879

Registered users can unlock up to five pieces of premium content each month.

Apple 14 eSIM-Only Devices Make Their Debut in the United States |

NEWS |

The year 2023 will mark the first full one of Embedded Subscriber Identity Module (eSIM)-only Apple 14 smartphone devices in the U.S. market. As U.S. operators embrace consumer eSIM in its entirety, questions are being asked related to the impacts on the removable SIM card market, as well as when and where Apple might strike next with its eSIM-only smartphone variants.

Alongside eSIM, other market challenges remain, most notably macroeconomic factors and the ongoing chipset shortage, both of which are already straining the classical removable SIM cards market. This ABI Insight takes a deeper look at these ongoing market challenges and provides ABI Research’s insight and expectations regarding the future for the classical removable SIM card form factor.

The Year 2023 Will Be Challenging, Regardless of eSIM |

IMPACT |

The year 2023 looks to be another challenging one. A squeeze on consumer spending, which began impacting the latter half of 2022/beginning of 2023 is expected to have a direct knock-on effect on handset shipments as consumers cut spending, and do not renew handsets as regularly. The Consumer Electronics (CE) device markets, including smartphones, and the SIM card market are closely intertwined, so any impact or softening in the smartphone market will likely result in a similar impact on the SIM card business.

On top of this is the ongoing chipset shortage with Integrated Circuit (IC) vendors and suppliers continuing to place production emphasis on higher-margined chipsets. The removable SIM card has historically been a low Average Selling Price (ASP) and margined solution, so supply has increasingly become limited as production shifts toward higher-value chipset propositions. However, with reports on a significant softening in markets, including smartphones and other CE devices, allocation challenges may ease later in 2023 as foundries shift capacity to other end markets. ABI Research is hearing of a significant inventory buildup of CE device chip stock, which may benefit the smart card market as manufacturing capacity opens and becomes available to other markets.

For 2023, this may mean that the SIM card market will begin a new chapter, with short-term demand potentially falling in line with cellular device shipments, but growing manufacturing capacity increasing the availability of SIM cards. Although 1Q 2023 has yet to close out, the risks clearly remain. While the market may start to recover from the chip shortage crisis, significant limitations to growth could arise, driven by inflation and reduced consumer spending. The consumer market will be the worst hit area, so ABI Research has adjusted its 2023 SIM card volume expectations; previous 2023 Year-over-Year (YoY) growth expectations of +7.2% have been reduced to +0.4%, reflecting the evolving macroeconomic trends.

eSIM Adds to the Removable SIM Card Market Woes |

RECOMMENDATIONS |

Apple eSIM-only smartphones devices, first shipping in the U.S. market at the end of 2022 is a significant driver for eSIM. The year 2023 will mark the first full one of Apple eSIM-only smartphone shipments into the U.S. market, which will significantly impact the U.S. removable SIM cards market. This will make 2023 a significant milestone with ecosystem players looking at how successful the U.S. rollout will be and whether or not Apple will expand its eSIM-only smartphone use into other regions/countries.

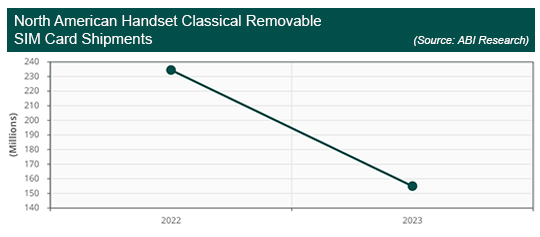

In North America, ABI Research’s current forecast assumption is that removable SIM card shipments in 2023 will decrease by approximately 78 million compared to 2022. The market will then stagnate and flatten, with no expectation (currently) of other Original Equipment Manufacturers (OEMs) launching significant volumes of eSIM-only smartphone devices in the U.S. market in the shorter term.

With eSIM usage becoming more popular in regions like Europe and Asia, it is just a matter of time before Apple extends eSIM-only sales into other countries. Outside of the United States, the continued use of eSIM and removable SIM smartphone devices will enable Apple to continue pushing eSIM, while also supporting removable SIM cards for carriers that are not ready to fully make the switch. If the U.S. launch proves successful, Apple will likely look to expand its eSIM-only range and the most notable countries for Apple’s eSIM-only smartphone devices include the United Kingdom, Germany, France, Japan, and South Korea, with assumptions that launches will commence in 4Q 2024 or 2025, which would further impact the removable SIM card market in a dramatic fashion.

Disregarding the challenges related to COVID-19, the chip shortage, and the ongoing inflation crisis, the removable SIM card market will inevitably decline over the forecast period. The rise of eSIM will be felt and removable SIM card shipments in the consumer domain are expected to continue decreasing. Prior to eSIM, the consumer SIM cards market achieved shipments well above the 5 billion range annually, but moving into 2027, removable consumer SIM card shipments are forecast to continue dropping YoY, hitting the 3.6 billion mark in 2027, which is a stark contrast from the market’s historical highs.