By Andrew Cavalier | 4Q 2022 | IN-6790

Registered users can unlock up to five pieces of premium content each month.

Apple's New "Communication Terminal" Patent Unlocks New Satellite Services |

NEWS |

The launch of Apple’s 2022 flagship smartphones, the iPhone 14 and 14 Pro, introduced some of the first consumer smartphones on the market to have built-in satellite-to-mobile capabilities. In partnership with Globalstar, emergency SOS via satellite has been a recently launched feature that enables iPhone 14 models to connect to emergency services when outside of terrestrial network range. Even in a non-emergency circumstance, users can update their location via the Find My asset tracking app via satellite. In either context, once a satellite request is sent from a device, the message is received by one of Globalstar’s 24 Low Earth Orbit (LEO) satellites that then relay the message back down to custom ground stations located at key points around the world.

The current generation of satellite-enabled services on smartphones is limited by several factors. These primarily come from band licensing issues and prohibitive real estate and costs associated with introducing phased arrays into handset form factors. For Apple devices, the L-band (1610 – 1618-Megahertz (MHz)) downlink and S-band (2483 – 2495 MHz) uplink from Globalstar come with limited data rates due to a constrained link budget, which relegates them to niche emergency scenarios. However, a recent patent allocation for Apple in mid-December 2022 signals the company’s plans to bypass current form factor, cost, and performance limitations and expand out to media, voice, and Internet data services.

An Attractive Solution for Satellite-to-Cell Links |

IMPACT |

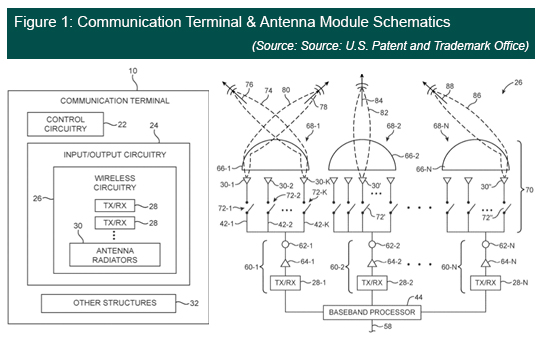

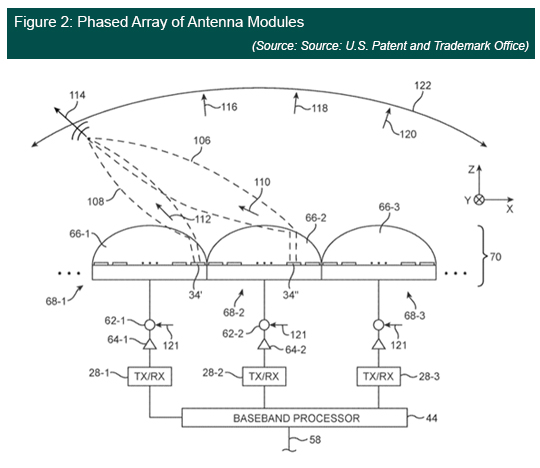

While holding a patent does not necessarily translate into the company’s strategy and product development evolution, it does provide insight into what Apple intends to do with satellite-to-cell services. As mentioned previously in ABI Insight “Phased Array and LEO Technologies: Evolving Mobile NTN,” the goal to close the link between Earth and space stations with more intent-driven and concentrated beams will be a development path driver in new wireless communication systems. Based on the terminal presented in the patent filing, which can selectively activate to direct Radio Frequency (RF) signals in both directions (see Figure 1) and be combined in a phased array of antenna modules (see Figure 2), Apple seems to agree.

In this respect, Apple plans for these new communication terminals to be integrated into a wide spectrum of electronic devices, such as satellites, ground stations, wireless access points, laptops, smartphones, tablets, and buildings. Control circuity (#22) may be used to run software and implement wireless communication processes, such as Satellite Communications (SatCom) protocols, Internet protocols, Wireless Local Area Network (WLAN) protocols, Bluetooth, cellular telephone protocols, and Multiple Input, Multiple Output (MIMO) protocols. In this way, Apple aims to support multiple concurrent short-range and wide area wireless links in a variety of deployment scenarios, with the highlight being the SatCom transceivers (#28), which are stated to transmit or receive in any desired satellite frequency band. Specifically, this includes the IEEE bands Ka-band (26.5 – 40 Gigahertz (GHz)), Ku band (12 – 18 GHz), K band (18 – 27 GHz), V band (40 – 75 GHz), W band (75 – 110 GHz), X band (8 – 12 GHz), C band (4 – 8 GHz), International Organization for Standardization (ISO) bands, such as ISO Q band (33 – 40 GHz), and/or any other desired bands. In doing so, SatCom data conveyed by transceivers (#28) and antenna radiators (#30) may include media data (e.g., streaming video, TV, radio, etc.), voice data (e.g., telephone voice data), and Internet data.

The other highlight is the terminal’s ability to support greater data throughput per antenna volume relative to flat panel phased antenna arrays by leveraging multiple different frequencies and polarizations. Beam steering between modules at one or more frequencies may be performed if desired. In this way, data throughputs can achieve a minimum of 10X the data throughput associated with a phased antenna array, while also reducing space, power consumption, and manufacturing costs. If true, Apple presents an attractive solution for improving the link between smaller handheld Earth and fast-moving LEO space stations—one of the biggest hurdles of this emerging segment.

This patent sends a clear signal that Apple intends to unlock a significant service portfolio advantage with SatCom services for its future devices. Whether the company will use only Globalstar for expanding into media, voice, and Internet data services or partner with other established LEO players like OneWeb or Starlink, or even Geostationary Orbit (GEO) players like Hughes, remains to be seen. While many industry players have been quick to join in the satellite-to-cell hype, convincing Communication Service Providers (CSPs) to adopt Mobile-Satellite Service (MSS) bands or allocate satellite-specific high band spectrum has been an area of contention. To this end, this new power-efficient “communication terminal” could end this debate and unlock satellite-to-cell services with satisfactory performance via the mid- and high-band spectrums. This development evolution sets a precedent for future flagship smartphone capabilities and expands the opportunities that CSPs and SatCom players have in the communications ecosystem.

Prepare for New Ventures |

RECOMMENDATIONS |

The market opportunity for SatCom is growing exponentially. For companies looking to enter the lucrative, yet capital-intensive market, strategic partnerships, alliances, and acquisitions represent some of their best options. In doing so, companies can tap into a slice of the trillion-dollar wireless market. There is still untapped potential that has not been fully realized by cellular, fiber, fixed wireless, or Digital Subscriber Line (DSL). ABI Research estimates that the Service Addressable Market (SAM) potential for satellite is 330 million premises, equivalent to 1.3 billion household members in 2026. Alongside this, ABI Research estimates in our recently published market research report SatCom Constellations: Deployments & Subscriptions that the wider Non-Terrestrial Network-Mobile (NTN-Mobile) service segment, which includes the growing satellite-to-cell segment, will reach 6.8 million connections by 2027. As a part of this increase, ABI Research anticipates that Apple will play a critical role in driving the growth of this segment and priming consumer’s interest for SatCom-enabled services.