1Q 2020 | IN-5712

Registered users can unlock up to five pieces of premium content each month.

Vision-Based Perception to Hit Thousands of Deployments |

NEWS |

Most ground-based mobile robots are either Automated Guided Vehicles (AGVs) or rely on sensor fusion solutions to navigate—usually a mixture of Light Detection and Ranging (LiDAR) and cameras. Despite the benefits of LiDAR in providing greater technical redundancy, it suffers from several challenges, including confusion with uneven floors and poor indoor/outdoor transitioning, map maintenance, and performance in challenging environments. A further difficulty is their expense. While some argue that the cost reductions of recent years are making LiDAR more desirable, there is an alternative for well-lit environments. Vision-based perception, with the use of advanced machine vision, has become increasingly popularized.

Seegrid, an autonomous forklift manufacturer and early adopter for stereoscopic vision-based perception, is managing close to 1,000 unmanned forklifts and pallet stackers across the United States. Croatia-based Gideon Brothers is ramping up its own deployments with vision-based perception for material handling in industry. Perhaps most importantly, Amazon’s acquisition of Canvas Technology in 2019 will likely mean the rollout of vision-based AMRs in 2020 and onward, accelerating the popularization of mobile automation within the supply chain. As this navigation becomes more refined and develops technical redundancy,

|

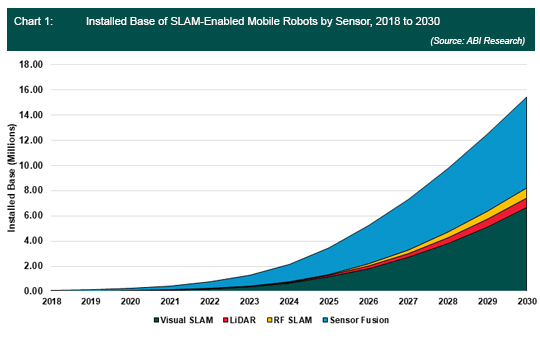

Sensor fusion between LiDAR and cameras is the current preferred method in commercial space AMRs. However, Simultaneous Localization and Mapping (SLAM) software companies are pushing for visual-only SLAM, which would reduce the price of these robots and drive scale. The environments in which such robots are deployed (supermarkets, large stores, hotels, and hospitals) are usually well-lit. Therefore, they are ideal spaces for Visual SLAM (vSLAM) deployment. When it comes to outdoor locations where lighting is an issue, there will still be a huge demand for sensor fusion. Based on Chart 1, ABI Research sees vSLAM taking up a larger chunk of the indoor mobile robotics space for closed and public use-cases.

Retail Will Be of Huge Significance |

IMPACT |

It is well known that, for mobile robotics, material handling applications in warehouse fulfilment and manufacturing will be a huge market. First-mile intralogistics is a major area of the supply-chain in significant need of productivity improvements, and companies like Amazon have already deployed at scale with hundreds of thousands of AGV’s. But what verticals outside of these highly structured and closed environments will see mobile robots deployed at scale? While there is a lot of focus on health, the consumer space, and heavy industry, Brick and Mortar (B&M) retail could well be the prime testing ground for the next generation of robots. There are already thousands of robots used to clean floors and hundreds have been deployed for security and inventory. More startups, like Coalescent Mobile Robotics in Denmark, are looking to add small-scale material handling to public spaces. This will create a demand for superior fleet management tools that can manage mixed fleets from different vendors.

|

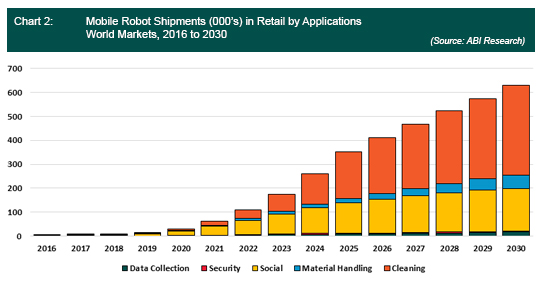

As can be seen in Chart 2, the largest single application for robotics in retail will be cleaning and maintenance. There are already 5,000 cleaning robots in retail stores in North America, and this number will grow substantially. Tuggers and pallet stackers used in storage facilities will also proliferate, while the use of social robots will continue to grow, especially in East Asia. While limited in pure shipments, data collection robots for inventory could be a hugely significant part of the market going forward. There is a huge amount wasted by B&M in low stocks and stock-outs, with some estimating a yearly waste of US$1 trillion. With mobile robots, companies can analyze shelves, develop ideal planograms for future demand, and preempt low stock to avoid shortages. Exactly how companies use robots for inventory will vary. Pensa Systems uses drones to collect information and is deployed in over 100 locations worldwide. Bossa Nova and Simbe, meanwhile, are deploying larger and more durable mobile ground robots, with Bossa Nova having deployed 350 in Walmart stores. ABI Research predicts that shipments for inventory ground robots in retail will be at over 1,000 by the end of 2020.

Quadrupeds to Make a Breakthrough? |

RECOMMENDATIONS |

Up until now, the success of quadruped robots has primarily been their marketing value as exciting pieces of futuristic hardware, as opposed to anything approaching day-to-day business value. While Boston Dynamics’ desire to commercialize its Spot Mini for verticals like construction and delivery has been clear for some time, we are far from anything beyond testing. Two key challenges are technical redundancy and cost. For the latter, British developer Zoa Robotics believes it can market a quadruped with an annual cost well below US$45,000. This would be a significant price drop from the hundreds of thousands of dollars these systems have traditionally cost. There is a big oppurtunity in the oil and gas space as large companies try to automate visual inspections of their assets, and while ground based systems will be vital to that, drones will be complimentary. The business case is certainly there in the abstract; according to the Pipeline and Hazardous Materials Safety Administration (PHMSA), US$24 billion is lost annually in downtime and accidents across the Liquified Natural Gas (LNG) sector, and cost reductions from automating the visual inspection part of maintenance could alleviate maintenance expenditure. Tens of billion dollars are spent on inspection for oil and gas each year, and a large proportion of that is visual inspections, with billions of dollars’ worth of value in automating the process with mobile robots.

More quadrupeds will be piloted in 2020, with some being certified by important regulations for operating in dangerous locations, such as the ATEX Directive. Advocates of quadrupeds argue cheaper and more reliable quadrupeds could become much more common in the service robotics space, as the flexibility and adaptability of the form factor give it advantages over wheeled robotics. For this to be considered feasible, 2020 should be the year when quadrupeds shift their value from marketing and technology demonstrations to improvements in productivity for businesses.

|

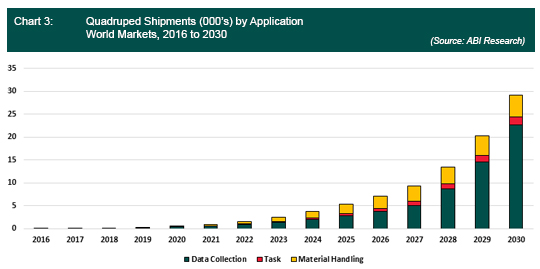

As noted in Chart 3, the big value for quadrupeds is in data collection. For this they are better than drones as they have the form factor and payload to host expensive gas sensors and sophisticated cameras, all while processing large amounts of data and having battery lives of 4-8 hours (compared to 30 minutes for most drones). They are also more valuable for task-based use cases, as they can be teleoperated to push buttons and even used for material handling, while drones are limited by their form factor and weight.

Ultimately, 2020 will remain a year in which quadrupeds remain largely on the periphery of actual mobile robotic deployments and, while they can expect long-term adoption in applications like industrial inspection, it will take longer to determine if these systems become popularized in other verticals.