By Leo Gergs | 3Q 2023 | IN-6999

Registered users can unlock up to five pieces of premium content each month.

BT Strikes Major Deal with the British Army for Private Networks |

NEWS |

Earlier in June 2023, British carrier BT reported having secured a major new networks contract with the British armed forces. While large parts of the project focus on delivering managed Wi-Fi services, specifically adjusted for the ministry of defense (referred to as MOD Wi-Fi), private cellular—and 5G specifically—will also play a role within this agreement, under which BT will provide connectivity to more than 600 Military of Defence (MoD) sites in the United Kingdom, Cyprus, and Germany. In addition to an already existing “smart base” at the British army base in Larkhill (in Wiltshire in southwest England) that is already equipped with fiber broadband and a private 5G network, the goal of this contract is to extend this and equip other military sites around the world with private 5G, following a careful analysis of respective requirements.

Private Networks for the Military |

IMPACT |

This announcement is interesting from a few different angles, which could easily fill hour-long discussions each. First, it shows that even telco carriers are slowly, but surely realizing that 5G connectivity is not the Holy Grail for enterprises, and other connectivity technologies like Wi-Fi will continue to exist. In response, carriers like BT begin to adjust their focus to not be fully dependent on the success of 5G for enterprises. Second, it shows that even for highly-critical environments like the military, implementers adopt a very technology-agnostic approach and look at connectivity technologies as an enabler for different use cases, rather than an end. Lastly—and this is the focus of the remainder of this discussion—it shows that there are distinct use cases for private cellular connectivity for highly-critical environments, such as the military.

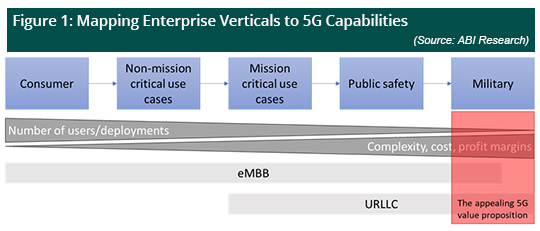

From a technology perspective, it is particularly the combination of Enhanced Mobile Broadband (eMBB) and Ultra-Reliable Low Latency Communication (URLLC) capabilities, as Figure 1 illustrates.

To understand this current development, BT’s announcement must be seen in the context of recent announcements of private network (be they cellular or non-cellular) for military/defense use cases:

- U.S. Department of Defense (DoD) 5G Testbeds: In 2020 already, the U.S. DoD announced an investment of US$600 million to install 5G testbeds at five U.S. military test sites, representing the largest full-scale 5G tests for dual-use applications in the world.

- U.K. Ministry of Defence (MoD) 5G Trials: In June 2022, the Defence business unit of BT announced working with each of the three British armed forces on 5G and Internet of Things (IoT) pilot projects, focused on improving security and efficiency.

- South Korean 5G Tactical Network: In December 2022, the South Korean army announced the deployment of a new tactical information communication network, TICN-II. The project calls for developing 5G-based tactical mobile base stations, aerial relay drone systems, and tactical communications, and is worth a total of US$40 billion.

- 5G Network Deployments for the Norwegian Army: In 2022, Telia announced the deployment of a private cellular network for the Norwegian army.

What Does This Mean for the Telecoms Industry? |

RECOMMENDATIONS |

All of this shows that the public sector (defense, in particular) is emerging as an interesting deployment environment for the telecoms industry for different reasons:

- Other highly industrial verticals (e.g., manufacturing) are governed by very close, pre-existing relationships between implementer and automation vendors, which makes it hard for new telco vendors to enter these environments on their own at scale.

- Defense environments require high degrees of network integrity and security, which perfectly suits the use of licensed or dedicated spectrum.

- As military operations are highly critical (not only for a single worker’s safety, but in realistic scenarios for an entire army or larger parts of the population), any form of connectivity needs to be highly reliable and low latency. The latter is important to be able to switch on and off the communication network if and when required quickly, to minimize the attack surface.

Therefore, it is about time for the entire telecoms industry to come together and join forces to offer appealing solutions for the public government sector, specifically defense. While interest in modernizing and automating is already high in this field, current geopolitical events and ongoing tensions will likely increase these demands and put defense investments higher on the agenda of national and international decision makers. To aid this, telcos should undertake the following steps to design appealing offerings:

- Focus on providing military solutions that use connectivity as an enabling layer, with services and applications on top.

- Develop a coherent partnership strategy for military-specific applications.

- Focus on Capital Expenditure (CAPEX) business models to begin with; particularly for defense, the military will require full ownership of all connectivity infrastructure and data. In contrast to other enterprise verticals, an Operational Expenditure (OPEX)-based business model (e.g., Everything-as-a-Service (XaaS)) is not expected to be very successful for the military.

- Be prepared to go through rigid testing and measurement circles to ensure optimal performance of the networking solution. As the military is an even more critical deployment scenario than industrial verticals like manufacturing or oil & gas, for example, a “best effort approach” will not be sufficient to realize these deployments. Furthermore, departments of defense/military decision makers will require real-life proof of the functionalities of the network. The telecoms industry needs to be prepared for a lengthy pre-sales process and might even design specific service contracts to generate some kind of value from this.