2Q 2020 | IN-5844

Registered users can unlock up to five pieces of premium content each month.

Version and AT&T Commencing DSS |

NEWS |

Verizon and AT&T recognize that dynamic spectrum sharing (DSS) would be key in their respective 5G deployments and are gearing up in implementing DSS in the near future. AT&T expects DSS to be introduced into their network in the second half of 2020. Similarly, Verizon is also intending to commercially deploy DSS in the second half of this year.

Why Dynamic Spectrum Sharing? |

IMPACT |

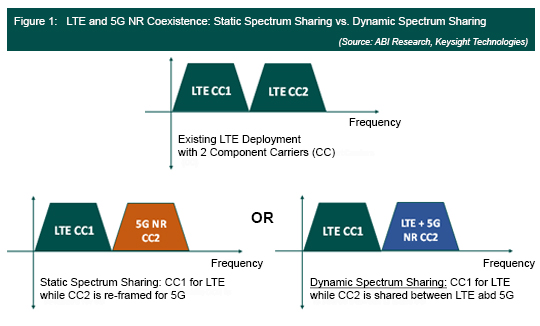

The attractiveness of DSS in 5G implementation is that it facilitates the coexistence of the operators’ LTE and 5G networks by streamlining their spectrum allocation. This sharing arrangement between the LTE and 5G networks of an operator is dictated by the mobile data usage peak schedules of the respective network generations. The importance of spectrum sharing in a scenario that involves the operator managing its current LTE network while introducing 5G NR can be summarized by the diagram below, wherein the primary difference between static spectrum sharing and DSS is highlighted:

|

Static Spectrum Sharing is Inferior to DSS in Initial 5G deployments. The main issue with static spectrum sharing, through re-farming LTE spectrum for 5G, is that the main network traffic that the operator would handle in initial deployments would still primarily come from existing LTE devices. Given this, assigning a dedicated carrier solely for 5G traffic is an inefficient utilization of an operator’s spectrum resources as the carrier is essentially cordoning off a portion of spectrum that would be underused by sparse 5G subscriptions.

DSS is therefore an attractive alternative that fully maximizes spectrum utility throughout the day. Spectrum resources can be dynamically assigned, through the use of smart scheduling algorithms, to cell sites that would need them most.

Wider Network Coverage - An underlying importance of DSS in 5G Standalone (SA) networks is that the spectrum sharing capabilities would enable wide area coverage of 5G. Current 5G NR frequency bands are in the C-band (3.5 GHz) and millimeter 26/28 GHz bands. While the millimeter bands allow for wider channels and higher capacity links, the downside of using these higher frequencies is their higher vulnerability to signal path loss, resulting in lower propagation and coverage distances. Utilizing lower frequencies is essential in providing expansive coverage; DSS would therefore allow 5G NR deployments to coexist with LTE infrastructure that is currently addressing the majority of end-users that still have LTE handsets.

Diverging Opinions on DSS Importance |

RECOMMENDATIONS |

DSS can help an operator avoid inefficient multi-year spectrum re-farming for 5G and yet still allow for rapid deployment of their 5G network. There is, however, a risk that 4G network users would experience reduced capacity. Early deployments of DSS will lead to reduced capacity because networks would still be primarily supporting 4G and 5G data consumption would still be minimal. In the early stages of 5G, carriers intended for 4G and 5G spectrum sharing would be more useful in supporting the predominantly 4G traffic of the network. This sentiment is echoed by T-Mobile’s critique of DSS reliance in an earlier earnings call this year, with T-Mobile US president of technology Neville Ray stating that DSS “.. eats away on the net capacity of the shared radio. Some of the early rollouts and workarounds and pieces that we’ve seen are pretty corrosive, and they will suck up capacity just by rolling out the feature”. However, when taking its broader circumstance into account, T-Mobile’s cynicism towards DSS can be attributed to more than just the capacity issue it is highlighting.

Firstly, T-Mobile’s dismissal of DSS might stem more from its intent on brandishing its largely unused treasure trove of exclusive 5G spectrum in 600 MHz and establishing itself as a leader in nationwide 5G coverage. T-Mobile’s low-band spectrum assets also extend to the 2.5 GHz band after their merger with sprint in April. While still important, T-Mobile has low impetus in deploying DSS soon. In T-Mobile’s opinion, operators overstating the importance of DSS for 5G is an admission of it lack low-band spectrum for coverage.

Secondly, T-Mobile’s choice of infrastructure provider might also have influence on its pessimism towards DSS. In the same earnings call, T-Mobile has commented on delays with infrastructure provers in rolling out its DSS solution. Furthermore, the success of DSS is not only its ability to adjust and allocate available spectrum but also the speed in which these processes occur. The performance reduction of DSS that T-Mobile is alluding to may also come from the additional signal management overhead traffic required by DSS. This added complexity impacts spectral efficiency as any time delay of hardware processing consumes bandwidth.

In contrast to this, Verizon’s bullishness on DSS stems from its partnership and successful trials with Ericsson and Qualcomm. Ericsson’s DSS solution has garnered industry recognition, recently winning Overall Mobile Technology and Best Mobile Technology Breakthrough at the 2020 Global Mobile Awards.