There is a 66% chance that the average global temperature will increase by 1.5°C within the next five years, according to The World Meteorological Organization (WMO). Just as alarming, the research also suggests that there’s a 98% likelihood that the planet will experience its hottest year on record by 2027. To help combat these environemental calamities, numerous software companies are offering carbon accounting solutions for enterprises. This post lists 14 of these companies, with some being household names and others being early startups.

Table of Contents

- Sphera

- Perefoni

- Watershed Technology

- Wolters Kluwer

- IBM

- Sweep

- UL Solutions

- Diligent

- Salesforce

- VelocityEHS

- Sinai Technologies

- Greenstone

- Greenly

- Microsoft Sustainability Cloud

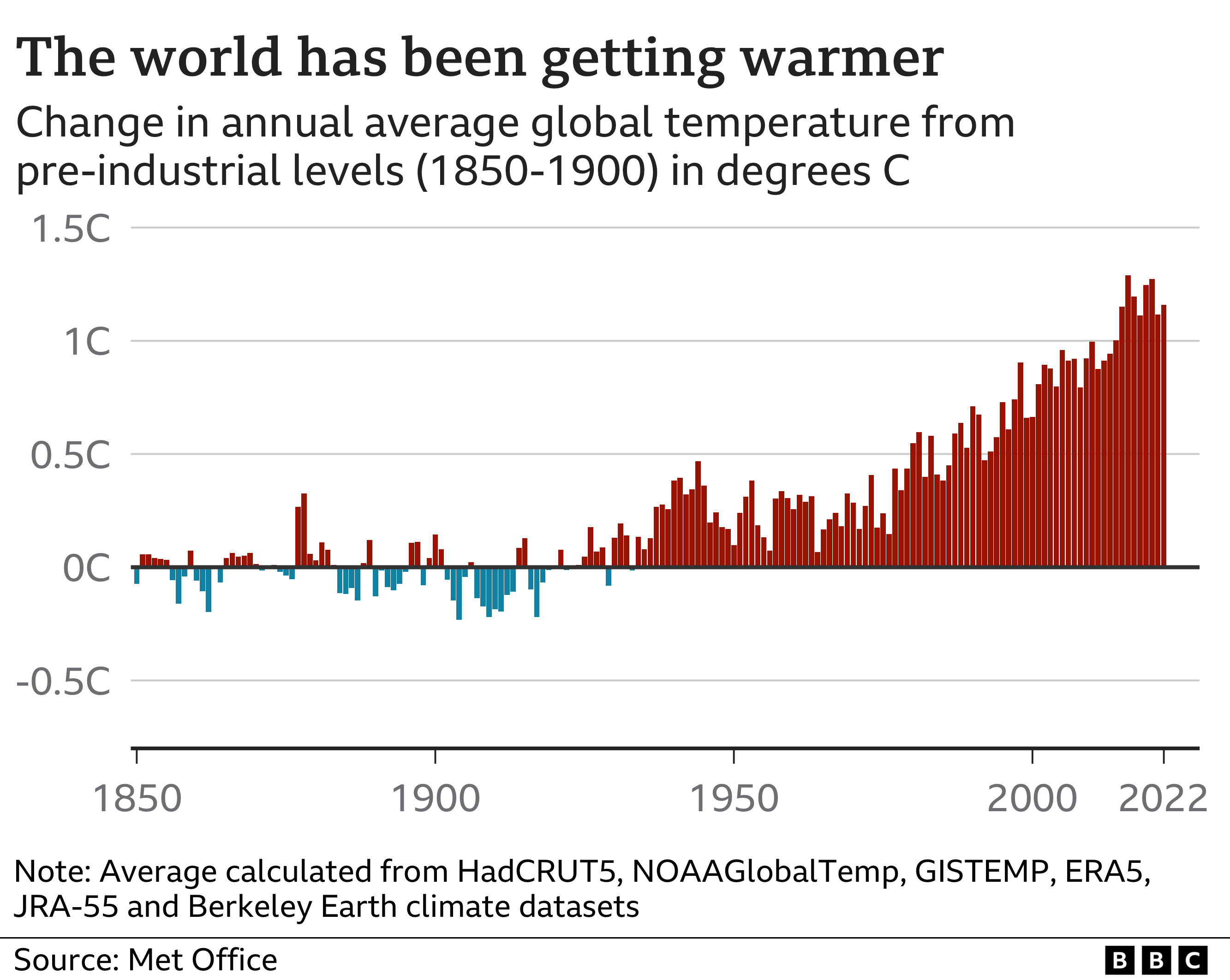

As illustrated in the chart below, overall temperatures have gotten much warmer since the pre-industrial era (1850-1900).

Chart 1: Annual Global Temperature Changes Since 1850

Climate disclosure policies are key to minimizing a firm’s carbon footprint and promoting a more sustainable future. Governments worldwide have been reacting to rapid climate change with mandatory climate disclosures approved, in process, or proposed for the United Kingdom (UK), Japan, European Union (EU), the United States, and other developed regions. The EU Corporate Sustainability Reporting Directive (CSRD) is expected to include over 50,000 EU companies and more than 3,000 US-based companies by fiscal year 2028. With these policies, most affected companies will need carbon accounting software to track their Scope 1, Scope 2, and Scope 3 emissions.

Measuring the Costs of Climate Change

Climate disclosure policies are actively aiming to curb the threat of climate change.

According to the WMO and other government agencies, if the Earth warms by just 1.5°C, the hottest days at mid-latitudes will be 3°C (5.4° Fahrenheit) hotter compared to pre-industrial levels. Consequently, sea levels will rise, polar ice will melt, and marine ecosystems will be negatively impacted. The human toll will be significant as well, raising the risk of extreme weather-related heat stroke, disease, food supply challenges, and more.

To address these issues, governments are also calculating the economic costs of climate change. The Swiss Re group has assessed that climate change will affect 48 countries and 90% of the world’s economy. The Swiss Re Climate Economics Index stress tests evaluated the following potential decreases in Global Domestic Product (GDP) by 2050, due to climate change:

- -18%, if no mitigating actions are taken (3.2° C increase)

- -14%, if some mitigating actions are taken (2.6° C increase)

- -11%, if further mitigating actions are taken (2° C increase)

- -4%, if Paris Agreement targets are met (below 2° C increase)

Asian economies will be impacted the most, with China potentially losing about 24% of its GDP in the most severe analysis. The U.S. and Europe risk losing 10% and 11%, respectively, in the same analysis.

Defining Scope Emissions for Carbon Accounting

Carbon accounting software must be capable of tracking Scope 1, Scope 2, and Scope 3 emissions. This covers the entire value chain of the reporting company.

Scope 1 emissions are defined as carbon emissions from a company’s owned or controlled sources. The fuel emissions from a company’s fleet vehicles are an example of Scope 1 emissions.

Scope 2 emissions are indirect emissions, such as the purchase of electricity, heating, cooling, etc., reported by the company. Scopes 1 and 2 emissions together consist of a company’s own emissions, and they are simpler to calculate (e.g., using invoices for fuel or utility bills for electricity).

Scope 3 emissions cover all the other carbon emissions upstream and downstream from the company’s operations that are driven by the creation and use of a company’s products. Scope 3 emissions are all the carbon emissions that occur in a company’s value chain, and they can be complex to calculate, as Scope 3 emissions are not under a company’s direct control.

Figure 1: Overview of Greenhouse Gas (GHG) Protocol scopes and emissions across the value chain

(Source: Greenhouse Gas Protocol)

Carbon Accounting Software Solutions

Gathering carbon emissions data, generating Artificial Intelligence (AI)-enabled insights from the data, and then using insights to take action on the data is perhaps the major blueprint for getting to Net Zero. Carbon accounting software can help automate the process.

This section lists fourteen of the top carbon accounting software companies on the market. As governments introduce more climate disclosure regulations, and as the phase-in of Small- to Medium- Enterprises (SMEs) occurs, ABI Research expects rapid growth in the sustainability-focused software market.

1. Sphera (acquired thinkstep)

German company Sphera, which acquired thinkstep in 2019, is a sophisticated industry leader for product sustainability, Environment, Social, and Governance (ESG) performance, and risk management software with more than 3,000+ customers, including Fortune 500 companies and SMEs. The carbon accounting software centralizes reporting for safety, ESG risks, Life Cycle Assessment (LCA), and sustainability on one platform. The platform is noteworthy for its ease of use and ability to assess a wide range of companies with varying maturities of Scope 3 reporting, though it’s likely a more expensive option.

2. Persefoni

Arizona-based Persefoni is a leader in AI-enabled climate disclosures for banks, asset managers in private equity, and large corporations. This banking-focused, sustainability-driven company has strong climate disclosure standards leadership with a focus on financed emissions and tamper-resistant features. This allows Persefoni’s carbon tracking solution to transfer data among stakeholders (Supplier Engagement/Investment Portfolio Engagement/Scope 3 data exchange). Persefoni AI uses AI and Machine Learning (ML) models, such as KNN-based clustering and Large Language Models, to analyze transactions and carbon footprint data.

3. Watershed Technology

Watershed is an enterprise climate platform provider based out of California with a large client base. Watershed specializes in Consumer-Packaged Goods (CPG) and tech company carbon footprints, carbon accounting, and sustainability Return on Investment (ROI) calculations. The company has set an ambitious 2030 goal to help reduce their customers’ emissions by 500+ megatons of carbon dioxide equivalent (CO2e) per year, or 1% of current global carbon emissions.

4. Wolters Kluwer (acquired Enablon)

Wolters Kluwer Enablon is a Dutch and U.S. headquartered company that collects and manages both environmental and Corporate Social Responsibility (CSR) data. Its wide range of sustainability solutions are used in large enterprises in more than 160 countries with a focus on integrating Environmental Health and Safety (EHS), risk, and ESG reporting. Enablon typically performs well in carbon management and EHS software ratings and analyses, as it has been developing EHS and sustainability-focused software platforms for decades.

5. IBM

The American multinational technology corporation IBM is another big player in the carbon accounting software market. The 2022 acquisition of Envizi—together with IBM AI-powered legacy offerings—analyzes large amounts of environmental data for climate risk analytics, while aiming to operationalize carbon reporting. IBM is a solid selection for companies prioritizing data management and quality control and data modeling for climate risk and sustainable decision-making capabilities.

6. Sweep

Sweep is a France-based carbon accounting software platform, with a large portion of European manufacturers, corporations, and financial institutions. The solution is marketed as a modular, cost-effective carbon management option, which is beneficial to SMEs. In addition to offering more than 30,000 emission factors that can be customized for calculations, Sweep also provides financed emissions capabilities for portfolio analysis and carbon credits and allowances solutions.

7. UL Solutions

UL Solutions is headquartered in Illinois and has a broad portfolio of sustainability software. Sustainability-focused solutions include EHS, product/regulatory, ESG reporting, material and product evaluation (LCA/Environmental Product Declarations (EPDs)), supply chain, renewable energy management, and more. UL Solutions offerings are strong in industries that have stringent regulations, compliance, and audit requirements. UL Solutions has also worked closely with helping to develop CDP’s disclosure platform.

8. Diligent (acquired Accuvio)

Diligent, based out of New York, offers a sustainability reporting solution that combines Scopes 1, 2, and 3 reporting with energy analytics, supply chain data, risk, and CSR reporting. Accuvio’s platform specialized in natural resource consumption and ESG, while Diligent’s broader platform served more than one million users from over 25,000 organizations in Governance, Risk, and Compliance (GRC).

9. Salesforce

Salesforce, an American software company better known for its Customer Relationship Management (CRM) offering, also entered the carbon accounting market with the launch of Net Zero Cloud in 2019. This climate disclosure platform is an in-house carbon footprint solution commercialized for Salesforce customers and is a strong choice for the 150,000 companies already familiar with the platform.

10. VelocityEHS

Chicago-based VelocityEHS has a software solution that tracks and reports on critical emissions, including GHG, air, water, and other waste streams. The platform is also integrated with EHS and ESG.

11. Sinai Technologies

Based out of San Francisco, Sinai Technologies’ carbon accounting software enables asset-intensive companies to measure, analyze, price, report, and reduce emissions in a cost-effective manner. Sinai Technologies also has specialized capabilities for forecasting science-based carbon reduction scenarios and renewable energy sourcing and contracts management.

12. Greenstone

Greenstone is headquartered in London and provides enterprises with a long list of environmental and social reporting features. Tracking platforms offered by Greenstone include environmental/ESG reporting, frameworks (GRI, SASB, TCFD, etc.), health and safety (Occupational Safety and Health Administration (OSHA), Reporting of Injuries, Diseases and Dangerous Occurrences Regulations (RIDDOR)), SupplierPortal (responsible supply chains, Scope 3, supplier engagement), and InvestorPortal (collects ESG data).

13. Greenly

French company Greenly is focused on carbon-tracking solutions for mid-market businesses to measure, reduce, and offset their carbon footprint. Most of the companies using Greenly’s net zero software solutions are in Europe, the United Kingdom, and the United States; however, the company is expanding with its CDP-accredited, cost-effective solution that appeals to SMEs across multiple industries.

14. Microsoft Sustainability Cloud

Microsoft Sustainability Cloud is another large-scale option for SMEs looking to monitor their carbon emissions, although, it is more expensive than Greenly and other smaller start-up and growth-level competitors. The software platform includes Microsoft’s Sustainability Manager and offers a free trial to assess its reporting and analytics capabilities.

Chart 2: Carbon Management Software Revenue: 2021 to 2032

(Source: ABI Research)

How SMEs Should Respond to Climate Disclosure Regulations

Larger companies are already providing sustainability disclosures voluntarily, but SMEs are still relatively new to climate disclosures. For example, only 28% of S&P MidCap 400 companies reported their carbon emissions in 2022. To help overcome these challenges, SMEs can take the following steps:

- Evaluate internal systems for measuring, monitoring, and validating carbon emissions data across the company and value chain.

- Educate the board of directors and all C-level executives about ESG risk management frameworks, including climate disclosures.

- Establish an ESG leadership structure and leverage financial talent in the company to help build trust around the accuracy and reliability of sustainability reporting.

- Review the Greenhouse Gas Protocol standards, which are used by about 90% of Fortune 500 companies, to guide carbon emissions reporting.

- Leverage TCFD Recommendations and consider climate risks and opportunities that affect the business.

- Consider hiring an external ESG-focused consulting partner to assist with Scopes 1, 2, and 3 carbon emissions calculations.

- Invest in digital tools like the carbon accounting software listed in this article to help automate and validate environmental data and carbon emissions measurement, management, and reporting.

To help companies understand the latest climate action trends and implementation strategies, ABI Research has launched four new sustainability research services:

- Sustainability For Industrial Markets

- Sustainability For Telco Markets

- Sustainability Software Markets

- Circularity Technologies & Programs

ABI Research’s new product, Preparing for Global Climate Disclosure Regulations, will help you learn more about the changing landscape of global sustainability regulations and their implications on enterprises. Download the research today to align your sustainability agenda with emerging government regulations and policies.